Blockchain Weekly | US SEC approves first token sales, blockchain promotes regulatory progress

Reg A+ or blockchain tokens are standard on the market. On July 10th and 11th, local time, the US blockchain project BlockStack and Props Network (the video streaming application YouNow) successively announced that they were exempted from the US Securities and Exchange Commission (SEC) under the terms of the RegA+ of the Securities Act. Can be publicly issued to non-qualified investors. Blockstack is a blockchain-based decentralized computing power network that wants to create an application ecosystem that enables users to truly master their identity and data. This is the first time the SEC has approved the listing of blockchain tokens (referring to cryptocurrencies based on blockchain issues), marking a new phase in the regulation of blockchain projects in the United States. The SEC said that most of the blockchain tokens except Bitcoin and Ethereum are securities.

The US regulatory system for blockchain and digital assets is becoming more sophisticated. In general, the attitude of the US regulatory system to the blockchain and its digital assets is to be incorporated into the existing regulatory system as much as possible, and the relevant businesses are subject to licensing supervision. The SEC approved the application for the listing of the two blockchain projects on behalf of the blockchain tokens beyond the previous definition of tokens. It is the actual implementation of the blockchain project in the SEC-regulated capital market financing, and has a strong demonstration effect, which has important reference significance for future blockchain projects.

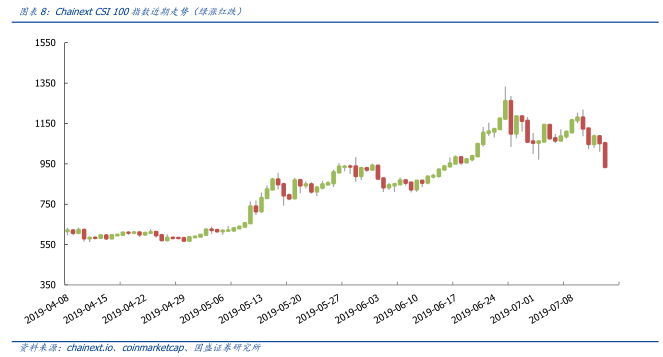

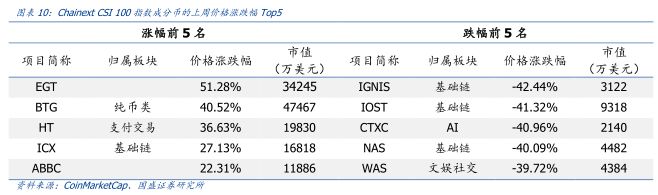

Last week's market review : Chainext CSI 100 dropped 15.66%, and the payment transaction category in the segment was the best. From the breakdown of the segment, the payment transaction, AI, and pure currency sectors performed slightly better than the Chainext CSI 100 average, which were -0.20%, -11.85%, and -15.11%, respectively, basic chain, entertainment social, commercial finance, and foundation. The Enhanced, Storage & Computing, IoT & Traceability segments underperformed the Chainext CSI 100 average of -26.11%, -25.14%, -19.99%, -23.51%, -18.73%, and -23.54%.

- A picture proves that there are a large number of cleaning transactions on the exchange

- Meng Yan: Analysis of the Difficulties in the Design of the Economic Model of Double-passed Cards

- With a Reg A+ license, is Blockstack's compliant token in the last exchange?

Risk warning: regulatory policy uncertainty, project technology progress and application landings are not as expected, and cryptocurrency-related risk events occur.

Reg A+ or blockchain tokens are standard on the market. On July 10th and 11th, local time, the US blockchain project BlockStack and Props Network (the video streaming application YouNow) successively announced that they were exempted from the US Securities and Exchange Commission (SEC) under the terms of the RegA+ of the Securities Act. Can be publicly issued to non-qualified investors. Blockstack is a blockchain-based decentralized computing power network that wants to create an application ecosystem that enables users to truly master their identity and data. There are currently more than 165 apps on the platform. Prior to the SEC approval, the company raised $50 million from investors such as Union Square Ventures, Blockchain Capital, and Compound. Props is based on the Ethereum blockchain, and its tokens are used to integrate streaming media platforms (such as YouNow and Xplit) to motivate users and content producers. Prior to the SEC approval, the company sold blockchain tokens worth approximately $22 million to investors such as Union Square Ventures, Comcast, and Venrock. This is the first time the SEC has approved the listing of blockchain tokens (referring to cryptocurrencies based on blockchain issues), marking a new phase in the regulation of blockchain projects in the United States. The SEC said that most of the blockchain tokens except Bitcoin and Ethereum are securities. According to the Securities Act of 1933 issued by the United States, securities are required to be registered with the SEC unless exempted under the regulations of D, S, A, etc. ("Reg D", "Reg S", "Reg A"). For a long period of time, blockchain tokens did not have a precedent for successful registration or exemption at the SEC. In addition, through the history of ICO financing, the average financing amount of ICO projects in 2014, 2015, 2016, 2017, and 2018 was 4 million US dollars, 1 million US dollars, 6 million US dollars, 16 million US dollars, and 26 million US dollars. There are also few issuers financing more than $50 million (Reg A+ capped fund limit), which makes it suitable for public release using the Reg A+ exemption clause. As of October 31, 2018, the blockchain project received a total of approximately US$22.5 billion in financing through ICO. RegA+ will be the key bridge for the market to be accepted by traditional capital markets.

The US regulatory system for blockchain and digital assets is becoming more sophisticated. In general, the attitude of the US regulatory system to the blockchain and its digital assets is to be incorporated into the existing regulatory system as much as possible, and the relevant businesses are subject to licensing supervision. The SEC's approval of the two-block chain token project listing application is an important step in the US's blockchain and digital asset regulation. It goes beyond the previous "qualitative" and fines for blockchain tokens. The suspension of issuance and other enforcement actions against issuers have further clarified the US regulatory system for blockchain and digital assets. It is the actual implementation of the blockchain project in the SEC-regulated capital market financing, and has a strong demonstration effect, which has important reference significance for future blockchain projects.

On the eve of the Libra hearing, US lawmakers submitted to the House of Representatives a draft discussion on “letting big technology companies stay away from the financial bill”, which aims to prevent technology giants from becoming financial institutions; Whether it is Faceboo's Libra-based attempt or BlockStack's breakthrough in the issuance of tokens, the blockchain industry has become the dominant driving force in the long-term game with regulation.

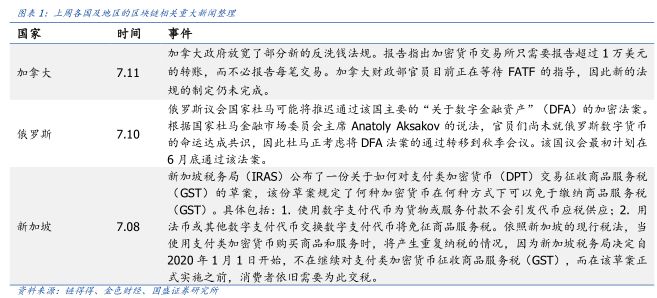

The Singapore Revenue Agency announced a draft of a Goods and Services Tax (GST) on payment-type cryptocurrency (DPT) transactions. The draft stipulates which cryptocurrency is exempt from paying Goods and Services Tax (GST). These include: 1. Payment of goods or services using digital payment tokens will not trigger a taxable supply of tokens; 2. Coin or other digital payment token exchange digital payment tokens will be exempt from GST.

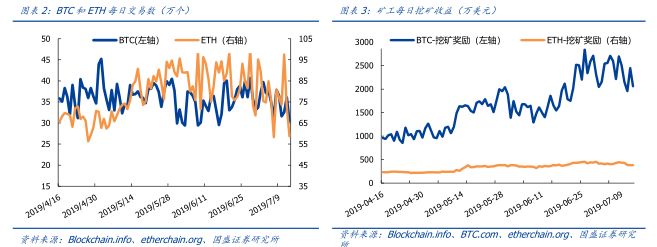

Last week, BTC added 2.36 million new transactions, a decrease of 6.8% from the previous month; ETH added 5.19 million new transactions, a decrease of 7.9% from the previous month. Last week, the average daily income of BTC miners was 22.92 million US dollars, a decrease of 5.2% from the previous month; the average daily income of ETH miners was 4.14 million US dollars, a decrease of 0.9% from the previous month.

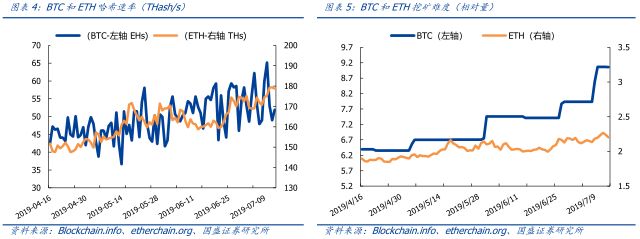

Last week, BTC's average daily computing power reached 64.8EH/s, down 0.8% from the previous month; ETH's daily average computing power reached 175.7TH/s, up 2.2% from the previous month. Last week, the difficulty of mining the whole network of BTC was 9.06T, an increase of 9.3% from the previous month; the next difficulty adjustment day was on July 23, the estimated difficulty value was 10.01T, and the difficulty increased by 3.72%; last week, the average mining difficulty of ETH whole network was 2.2T, an increase of 2.1% from the previous month.

From the breakdown of the segment, the payment transaction, AI, and pure currency sectors performed slightly better than the Chainext CSI 100 average, which were -0.20%, -11.85%, and -15.11%, respectively, basic chain, entertainment social, commercial finance, and foundation. Enhancement, Storage & Computing, Internet of Things & Traceability are underperforming

The average level of ChainextCSI 100 is -26.11%, -25.14%, -19.99%, -23.51%, -18.73%, -23.54%

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Noah's wealth of 3.4 billion big thunder detonated, DeFi has come!

- QKL123 market analysis | The market is long and short, and it is expected to see the bottom in the near future (0716)

- Siemens plans to integrate blockchain technology into shared cars and has demonstrated a blockchain-based smart parking solution

- Twitter Featured | US Treasury Secretary: "It can be used to speculate in bitcoin, and it is never allowed to do illegal things."

- Libra project leader: Libra project will not be launched until the supervision

- USDT Final Judgment: "Doomsday" is coming? What do you think about the short-term and long-term?

- Crypto.com Chain (CRO) welcomes the first settlement agents and stable currency partners