Ethereum, Cosmos, Polkadot ecological inventory, or the three most prosperous public chains in the future

Original: Five fireball masters

"Teacher, the blockchain is so hot, I want to learn a programming to do development, how do you feel?"

"Not very optimistic…but if you really want to learn, there are three recommendations."

"Which three languages? C, Java, and Python?"

"No, it's Solidity, Golang, and Rust."

“Hey? Why are these three?”

“Because most of the development in the future may be carried out on ETH, Cosmos and Polkadot, the three languages above correspond to these three ecosystems.”

————Dividing line————-

- Where are the problems and prospects of EOS?

- Blockchain project operation, governance logic from the flow channel to the user community

- In order to predict the influencing factors of the encryption market price, the algorithm model for analyzing social media is increasing.

01

Ethereum (ETH)

In the blockchain industry, the market value is the first, BTC is the absolute boss; but to be ecological first, ETH is the king.

The projects built around ETH have at least three digits, so I can't introduce them one by one. I believe that all the old irons are also familiar, so simply say a few big categories:

Many people think that from the perspective of DApp, ETH is not even as good as EOS and TRON. How do you call it the "blockchain first public chain"?

As everyone knows, the ecology, especially the blockchain, is still in the budding industry. The center of ecology is not here for users, but for developers.

Otherwise, do you think EOS and TRON are the real "users" of DApp's daily users, not wool parties, robots or speculators?

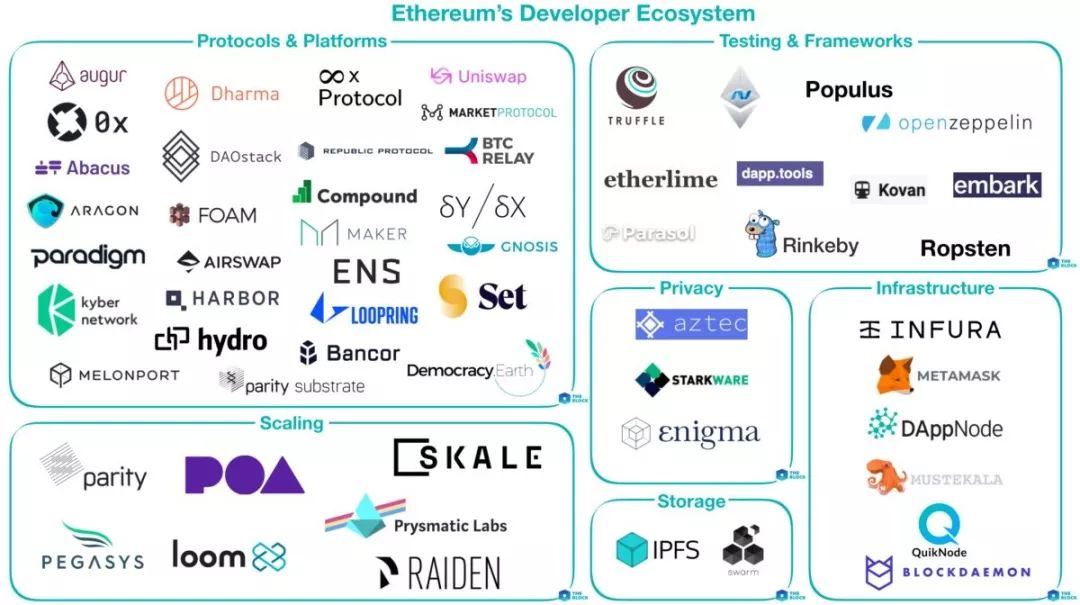

From the developer's ecology, ETH is like this:

Development Language: Solidity – The most popular language currently used for smart contract development, easy to learn, especially recommended for the zombie fun teaching of the Loom website

ETH core developer monthly: around 100 people

ETH Global Developer Community: 60,000+

Number of DApps: 2000 +

At present, no blockchain project can exceed ETH in the above aspects.

ETH began to use the new "narrative story" after the two concepts of "world computer" and "Isio local currency", namely "global settlement + DeFi", and the recent ecological development is also carried out around this narrative. .

So to understand ETH, in addition to its own, more importantly, you need to understand the several major categories of projects under its ecology.

1, wallet:

Representative: MetaMask , MyEtherwalle, imToken, Parity…

You look at the ecology of a chain. In fact, the simplest indicator is how many wallets are supporting it. There are too many wallets that support ETH. The above are the most commonly used representatives.

2, Layer 2

Representative: Raiden, Loom, Celer, Liquidy Network, Skale

Layer 2 showed a blowout situation from 2018 to 2019, because the performance of Layer 1 on ETH was really bad. Before the birth of ETH 2.0, Layer 2 was the best choice for speed increase.

Then you can see that this year's Layer 2 overall is half-dead, and there are three reasons for this:

First, in addition to Raiden and Loom, many of the Layer 2 projects are still in the development or test network phase, and the main network is not on.

Second, many DApps or projects can choose EOS, TRON, a high-performance chain, and not the Ethernet+Layer 2, which is still far from mature.

Third, the most successful Layer 2 is the BTC lightning network, and the lightning network itself does not send Token. The Layer 2 project on ETH is faced with a knack for explaining why you want to send a Token.

3, DeFi

Representative: Maker DAO, Compound, Dydx, Uniswap, Dharma

The most important stable currency item in DeFi, known as the “Chalk Chain Holy Grail”, was almost smashed by Maker DAO this year.

You may say that the most stable stable currency is not USDT. It is correct. However, the stable currency of the "traditional asset mortgage" is "very blockchain". The stable currency of the blockchain should be the zone. Blockchain assets are represented as collaterals or decentralized algorithms, while the latter have not yet seen a successful project, and there is also a view that this is most likely a pseudo-proposition.

Interestingly, these faucet DeFi projects, except Maker DAO, basically didn't send Token. Maybe this is the correct way to open the blockchain. We need so many Tokens? Is there anything that BTC and ETH can't do? Do you have to make a Token yourself?

The worrying thing is that ETH's “Global Settlement Layer” and DeFi's storytelling are a bit self-evident.

Why do you say that? Let's look at the following two sentences:

The best platform for DeFi is ETH because the market value is large enough, safe enough, decentralized and ecologically sound. The current reason for supporting ETH to continue to be the first public chain: I have DeFi!

You see, this has become a story of mutual blessing and self-explanation, a glory and a loss. A more reasonable model should have an external input, such as: ETH because it can be a world computer and the market value is large enough and safe, then DeFi chooses ETH and strengthens it again.

So before the birth of ETH 2.0, many people in the market were always cautious about DeFi.

As for the other major categories: limited to the length, just took a sentence.

Forecast class : The representative projects are Angur, Gnosis and Veil. However, a few days ago, Veil, a star institution and capital blessing, announced that it would stop operating, which slightly cast a shadow over the forecasting projects.

Decentralized transaction : The representative project is 0x. Coinbase's 0x protocol is very technical, but it also faces the need to explain why you want to send a token.

Authentication: Representative projects have Civic and Selfkey. Others believe that these are temporary falsification projects. Before the blockchain is completely popularized, before ETH dominates the world, the role of these things remains to be seen.

Smart Contract Wizard: Representative projects include Etherparty and Blockcat. Ibid. is also in a temporary falsification state, smart contracts have not yet come out of the circle, let alone smart contract fool guide. Again, the question is: Is it necessary to issue coins?

Because the ecology of ETH is too large, some other small categories are not listed.

02

Cosmos

Development language: Golang – Simple and mature, it is the preferred language for many web developments.

Compared to ETH and Boca, Cosmos is much more dependent on ecology.

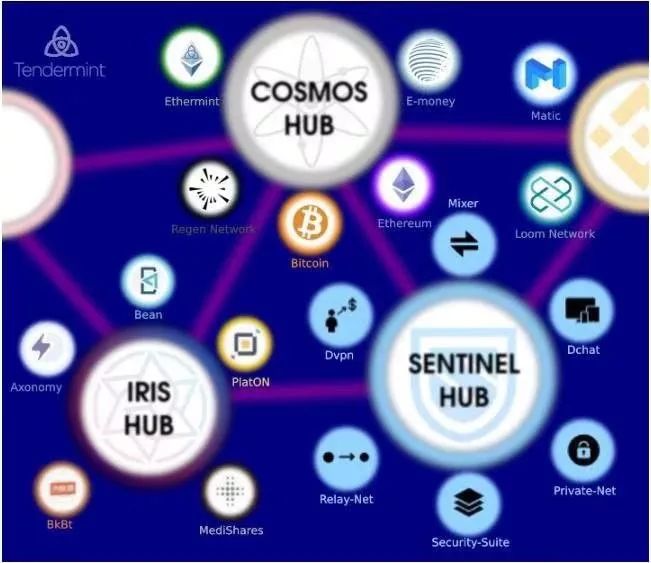

Why do you say that? Because Cosmos is essentially a hair chain and cross-chain protocol, its entire network diagram is composed of various Hubs, and Hubs can communicate with each other to form a cross-chain.

However, Cosmos's native tokens are only responsible for the security and aspects of their Cosmos Hub, and have nothing to do with other Hubs, so Cosmos's token appreciation logic is actually like this:

Cosmos is like developing an airport. When the world spreads the airport, he is equivalent to New York Airport or Tokyo Airport. As the largest airport hub, it is naturally worth the money. The Cosmos SDK is the technology for building airports. ATOM Token is the security team at Tokyo Airport. Iris, who was relatively hot in China some time ago, is the security team at Pudong Airport. The more important the airport, the higher the security, and the greater the value of Token.

Cosmos can only introduce a few current major projects because it is just on the main network and there is no such huge ecological network:

1. IRIS Network

IRIS is the eldest son of Cosmos. Except that it is the first Hub of Cosmos Hub, most people may not know what IRIS is doing. Do not believe, you ask them, I want to develop a DApp or chain, why should I access IRIS Hub instead of Cosmos Hub?

To put it simply, Cosmos is currently focusing on bridging BTC and ETH networks to enable cross-chain circulation of BTC and ETH; what IRIS wants to do is not just Token circulation, but also cross-chain services.

Ok? Isn't this always the thing that Poca wants to do? IRIS can't do it, or wait for time to verify it.

2. Coin DEX

Coin DEX is the best advertisement for Cosmos. Imagine that the world's head trading platform was developed with the Cosmos SDK.

However, DEX may not directly contribute to the market value of Cosmos, and more is to help Cosmos “make the ecological pie bigger”.

DEX is one of the important layouts of the currency security. It may be limited by the depth of the transaction and the experience of use, and may not be felt for the time being. Still the same sentence: everything is waiting for time to test.

3. Kava – DeFi

Unlike Maker DAO, which only mortgages ETH, Kava wants to use any Cosmos-supported currency as a collateral for Kava, so that the available pledge resources are much richer than the single resources on ETH.

As I said just now, if the ETH price plummets, Maker DAO, a currency that is strongly associated with ETH, also has the possibility of a crash, and if it is a cross-chain, it is equivalent to dividing the eggs into several baskets.

However, as far as the current cryptocurrency market is concerned, the overall linkage is still very strong. Even if you have divided several baskets, these baskets may all be on a truck…

03

Polkadot

Development language: Rust – more difficult, but also the most secure block and block programming language, except for Poca, Grin, Holochain, Nervos and Facebook Libra are written in Rust.

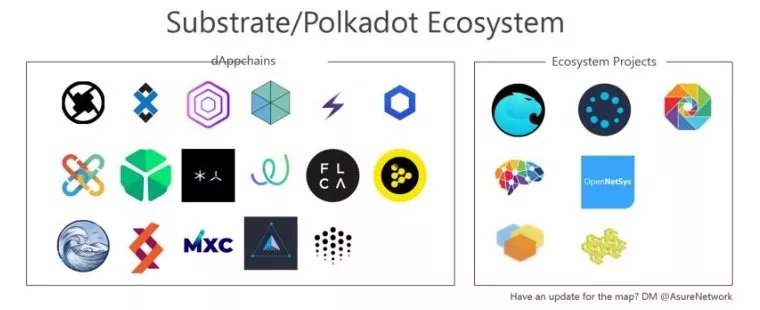

Unlike ETH and Cosmos, Polkadot is not currently online, but the ecosystem has already advanced blockchain projects.

There are several projects on Boka that are worth saying.

1. ChainX – Asset Cross-Link Project

If BTC wants to truly assume the attributes of the blockchain world's universal currency, it must be able to circulate freely between multiple chains.

There is WBTC on ETH, and there is also an asset mapping chain through ChainX on Boca. Currently, only BTC is supported, and then the public links such as ETH, EOS and BNB will be gradually supported.

2. Edgeware – Smart Contract Chain

Edgeware is the smart contract platform of Polkadot. Because of the development planning reasons, Polkadot itself does not currently have a smart contract, so a Parachain (parallel chain) is needed to perform this function, and Edgeware is the platform.

At the same time, Edgeware will also assume the functions of the Chain Management System (DAO), including identity, proposals, finances, and more. Edgeware distributes Token through LockDrop, which is the form of lock ETH. It can be said that it is the first one. For the user, it is equivalent to paying the opportunity cost of ETH. It can be obtained free of charge.

3. Akropolis – DeFi

Just two days before the project, the fire currency Prime was just introduced. The introduction of the fire currency is as follows:

Half of the world's assets are owned by pension funds, but the global pension deficit currently accounts for three times the global GDP, or $47 trillion. Therefore, Akropolis' goal is to create a distributed financial network agreement composed of all financial organizations and provide basic financial services (savings, investment, social insurance) that do not depend on banks or other traditional financial institutions. Resist the risk of global spread in the event of a financial crisis. An important task for the Akropolis team is to research and develop blockchain interoperability and support for other ecosystems, such as running verification nodes in Polkadot and building Akropolis Parachain and ChainX validator nodes.

4. Kasuma – Canary Net

Kasuma is Polkaadot's test network, but it's not just a test network, it's a test site, and it will continue to exist after the main online line.

In Gavin Wood's own words:

Kusama is not exactly a test network, but a canary net: it is an early experimental version of Boca that exists in the real economic environment. It is not as economically central as the typical "test network" and there is no central cut-off switch. As long as the community maintains it, Kusama will exist, and we envision it will cater to new, early, high-risk features and projects that are ready to be developed and deployed on Boca.

04

summary

Perhaps some people here will question: Is the Cosmos main network and the Boka, which has not been online yet, compared with the ETH that has been born for more than four years, is it somewhat biased? Indeed, Cosmos and Boca are new generations, and their ecosystem has not yet begun to be built. There is no qualification to compete with ETH as a "giant". More is just an introduction.

However, Jiangshan has talented people. After a year or two, can the ecology of Cosmos and Polkadot be as big as ETH, or even eth? We will wait and see, after all, the blockchain world is full of surprises and impossibility.

Message Mining No. 282: Ethereum, Cosmos and Polkadot Which ecology do you prefer? why? Feel free to share your opinion in the message area.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dry goods | Nick Szabo: The origin of the currency (END): the properties of the original currency

- The currency circle thousand doors and sixteen will (on)

- G7 finance minister and central bank governor reached a consensus: digital currency needs the strictest supervision

- Market Analysis: Global easing is getting closer and closer, gold bulls are like a broken bamboo, can BTC keep up with the pace

- How to classify digital currency from the perspective of IMF

- U.S. Congressional Team member Ouyang Mo’s prologue behind the scenes of the Libra hearing

- Video|"8" BTC.com CEO solemn: the trouble of the number one player