India’s regulation is counterproductive, with a local BTC premium of over $800

Recently, the currency circle has been screened by Bitcoin, and even the non-coin-directed Weibo hot search has a place for the news. It seems that BTC has gradually been accepted by more people. But at the same time, there is a place where the suppression and supervision of BTC has intensified, and even a situation of crazy premium has emerged.

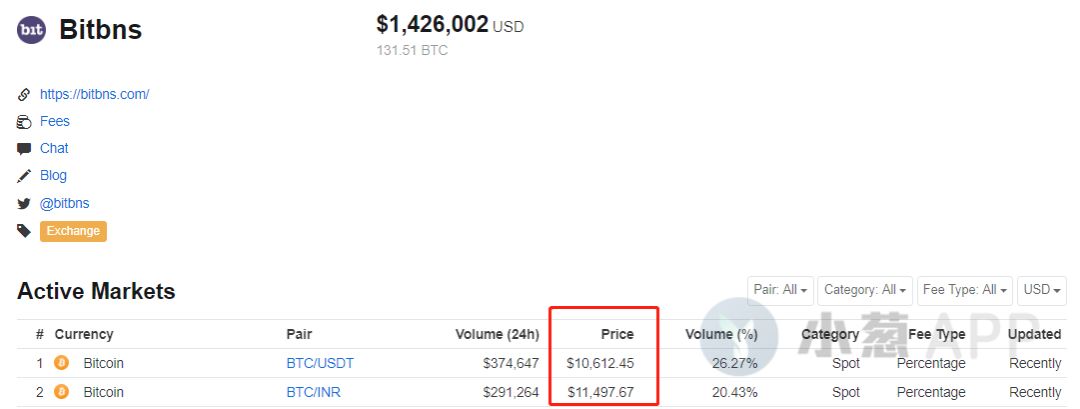

As of now, Bitcoin's premium on the Indian exchange has exceeded $800, which is quite amazing.

(Image from Scallion APP)

(Image from Scallion APP) Counterproductive suppression

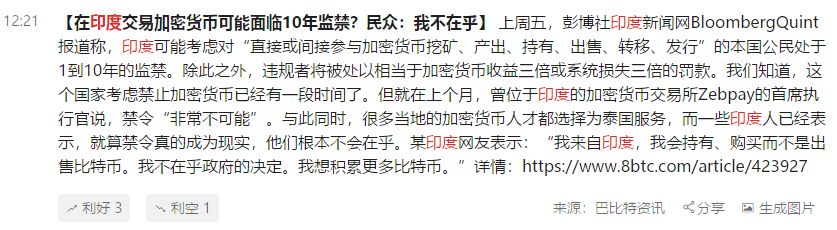

It has been well known that India has not supported the development of Bitcoin in the country. It has been said that bitcoin traders and miners in India will face 10 years in prison and will not accept bail, although the proposal has not yet landed.

- How to catch the big bull market? Demystifying the 3 rules of BTC bull and bear cycle

- Why at this stage of the bull market, most altcoins do not run bitcoin

- Global Times English: China cannot be absent from the digital currency era

This incident has made the Indian dollar circle community raging, but the possibility of passing it through is not too big. Imprisonment for 10 years is considered a criminal law. Since it is law, it is necessary to consider enforceability. However, how to judge whether a person holds bitcoin or not is a big problem. Is it a search for the key that has been printed in his home and then verify or check his mobile app? Execution is too low.

Having said that, India’s explicit ban on Bitcoin is indeed much stricter than in other countries.

Chan Chang’s CEO Zhao Changpeng also sent a comment on the incident: “The more prohibited things, the more people want to try.”

As it is expected, India's high intensity has even reached a mandatory regulatory system, which has not allowed Indian investors to give up Bitcoin. After the ban on cryptocurrency transactions and even the imprisonment news in the Indian currency circle, many investors even said that even if the news is true, I don't care.

Quite simply, strong supervision can squeeze out a part of the bubble, but it just needs to be banned by the system. The demand has not been reduced because of the reduction of the supply area. It is explained by the most primitive supply and demand relationship, and the supply is in short supply. Therefore, the high premium situation is now present, because it is easy for human beings to buy good things by default.

The right to be challenged

As a country with one-fifth of the world's population, India is often regarded as one of the most promising consumer markets, and many leaders in the encryption industry are also staring at the fat. However, because Indian Prime Minister Modi has never had a good face in the cryptocurrency industry, the encryption industry has been in a state of stagnation or even withdrawal in India.

Modi had introduced a financial policy to abolish large denominations in order to crack down on tax evasion. The second is to agree that the economy and the population are a common market, that is, to replace the original dozens of federal and state taxes with goods and services tax. The essence of these two policies is to strengthen the central government's rights and weaken the local and rich economic real power.

The essence of cryptocurrence decentralization is exactly the opposite of what Modi wants. In order to prevent the centralization of the rights from being challenged, and to prevent tax evasion by cryptocurrency or the transfer of assets overseas, Modi chose to ban the encryption industry from continuing to derivate in the country.

In fact, India's current financial situation is not good, the inflation rate is expanding, imports are greater than exports, and debts of $125 million are continuing to grow. In the face of statutory currency that depreciates at any time, between instability and instability, people are naturally more willing to choose unstable but investable bitcoin as a safe haven for value storage .

Regulatory development under supervision

It is a pity that as a low-cost technology, cryptocurrency can actually drive economic development. The so-called existence is reasonable, and the forcible prohibition can not only improve the economic situation, but will push some investors to a more regulated market.

Perhaps the high premium of Bitcoin in India seems crazy, but the madness is not the data but the astounding policy.

For the cryptocurrency industry, each country has different perceptions and attitudes, but the development of blockchain technology by virtual currency led by Bitcoin is indeed a fact, which proves that the industry has merit. Of course, it does not rule out that some virtual currencies have a phenomenon of returning to the water. In recent years, some trading platforms have gradually adopted the C2C trading model to improve the situation, meeting the needs of some investors restricted by the policy.

Since the comprehensive ban is difficult to implement, the cryptocurrency industry is not completely useless, and there is still a large amount of development potential to be developed. It is completely unrealistic to enforce a one-size-fits-all approach. Regulatory development under supervision may be the right way.

Author: Cross-country rabbit

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Zhu Jiaming: Don't ignore the capital behind Facebook, and don't underestimate Libra's technology.

- Oracle Announces Support for More Than 50 Startups Accessing Chainlink Predictor for Data Realization

- Market Analysis: BTC continues to break through the new high, and the right side will appear to accelerate the market?

- Beyond Bakkt? LedgerX approved to launch physical bitcoin futures contract

- JPMorgan Chase: It is expected to start testing JPM Coin at the end of this year

- Getting started with blockchain | Do you know the 50 blockchain terms? (on)

- Babbitt Column | Cash Pump: Libra