Institutional investors boost Bitcoin to $ 7,000

Edit | Wen Dao

- Babbitt column | How to predict the extreme price of cryptocurrency? Here are a few data to help you

- QKL123 market analysis | It is obviously related to dark web activities, and the demand for Bitcoin has dropped sharply? (0402)

- Over 30% of mined BTC is inactive, and the exchange becomes the largest HODLer

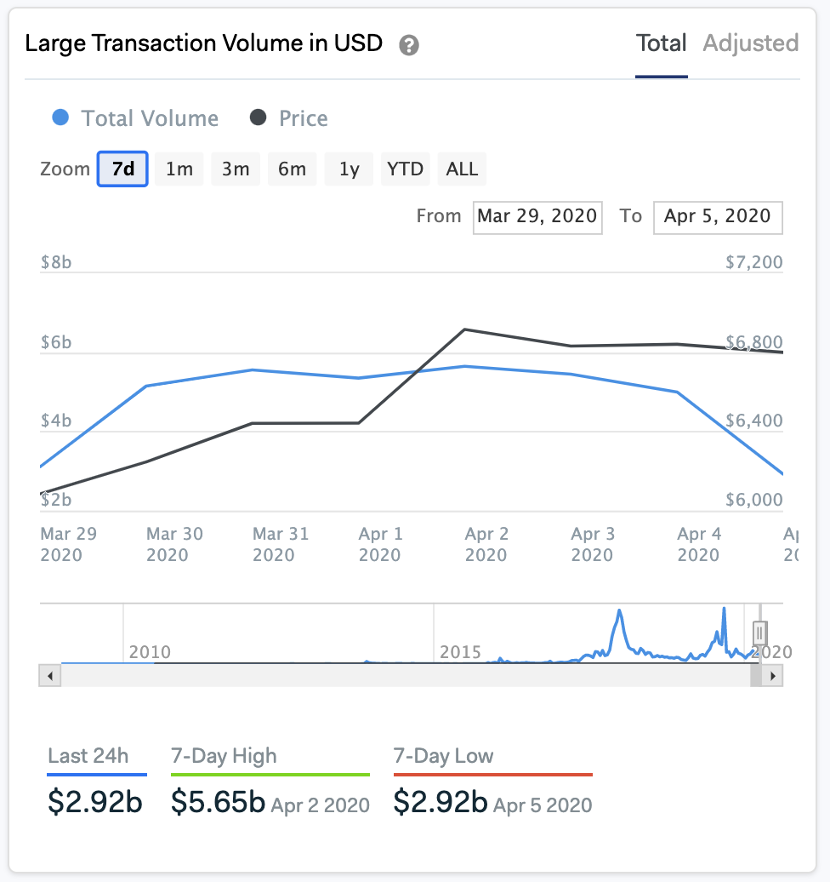

100,000 USD BTC trading volume surged in 5 days

After the collapse of the currency market on March 12, BTC's return to the $ 7,000 price mark will indeed boost market confidence. However, some analysts have warned that the downward trend still needs to be watched.

Cointelegraph analyst Keith Wareing believes that although the price is struggling to break through the key resistance of $ 7,200, it can still be seen that this breakthrough has been rejected, "I can definitely believe that Bitcoin has returned to the second half of 2019. Forming a descending channel. "

Wareing said that if Bitcoin cannot break through $ 7,200, the bears may regain control before the much-anticipated halving event. "This will allow $ 5,500 such as cheap corn to reproduce the key price before the menu."

If you also look at the trading volume of large funds, the day of the "3 · 12" plunge was also the day when BTC traded at the 100,000 USD level since March, reaching 13.03 billion USD. This year, the highest point of this level of transaction volume was 14.08 billion US dollars, which occurred on February 7, the price of BTC was 9700 US dollars. Since March 12, the BTC trading volume of large funds has occurred below 7000 USD.

The data observed by analyst Michaëlvan de Poppe also shows that BTC enthusiasts on social media still expect BTC to fall back to $ 6,400 before $ 7,600.

The analyst stated on April 5 that if the area between $ 6,966 and $ 7,217 can become a solid support, this will be a key factor in changing his original bearish position.

Wareing also values the support near $ 7,000. "Bitcoin needs to convert the resistance of 7K to support. From here, $ 8200 will look like the next level of resistance."

The Alternative display of the statistical panic and greed index shows that on April 6, the index 12 was the same as the previous day, and the degree of panic was still "extreme panic." The power of bears should not be underestimated.

When buying and selling BTC, do you have the experience of "eating meat" with Zhuang?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- For a story after a thousand years-Github bitcoin source code freezes Norway

- Max Kaiser: Gold is the “toilet paper” of the rich and Bitcoin is the “toilet paper” of the poor

- Bitcoin broke through $ 7,200 in the early morning, and the surge in US unemployment applications made Bitcoin a safe-haven asset?

- Introducing 7 million users, Revolut, a digital bank valued at US $ 5.5 billion, announced that it will provide users with bitcoin trading services in advance

- Institutional investors continue to lurking, it will take time for bitcoin futures trading volume to recover

- Application of a Class of Trading Ideas in the Design of Quantitative Strategy for Bitcoin Futures

- Unlimited printing of the Federal Reserve will increase public trust in Bitcoin