Introduction to Blockchain | Centralized exchanges continue to thunder, what are the advantages of DEX?

Author: Yan Wenchun

In the cryptocurrency industry, every once in a while, there are incidents of stolen coins on the trading platform. The small partners involved in the investment are really difficult. Not only must we prevent fund scams, hackers from stealing coins, but also platforms from running away … Investors are really too difficult. Today we will introduce the centralized trading and decentralized trading platforms (DEX) and their respective characteristics.

01 Centralized trading platform and DEX

A trading platform, as the name suggests, is a place or platform that provides transactions for users with trading needs. The trading platform can be divided into a centralized trading platform and a DEX based on whether or not user assets are managed.

To provide users with account service systems, real-name authentication, asset recharge, asset custody, matching transactions, asset clearing, asset exchange and other business service platforms, we call it a centralized trading platform. When buying and selling cryptocurrencies, users need to deposit cryptocurrencies or issue coins into the trading platform. The trading platform provides liquidity and conducts matching transactions and settlement processes. Currently well-known centralized trading platforms include Binance, Huobi, OKEx, Coinbase, Bitfinex, etc.

- SEC rejects Wilshire Phoenixd's Bitcoin ETF application

- Economics of halving: what will happen to the price of Bitcoin?

- Three drafters talk about the first financial blockchain specification: the central bank recognizes the blockchain, and the industry no longer grows savagely

DEX is not responsible for hosting user assets, and users have absolute control over their assets. DEX is responsible for providing liquidity. Matching transactions are completed by smart contracts, and transaction settlement and settlement are completed on the blockchain.

02 The difference between a centralized trading platform and DEX

The differences between the centralized trading platform and DEX are mainly reflected in the following aspects:

1.Different asset control rights

In a centralized trading platform, user assets are controlled by a centralized trading platform. Users need to deposit their assets into the trading platform's wallet. The asset custody function of the centralized trading platform is like a bank. Users deposit money in the bank. The bank gives the user an account to record the user's funds. The bank has absolute control over the user's funds.

In DEX, users' assets are completely under their control. DEX does not provide fund custody services, so it cannot control and transfer user funds.

2. Different funding risks

The centralized trading platform's wallet stores all users' funds. Due to the huge amount of funds, it is easy to attract hackers to attack, and it is not uncommon to stick to theft or even run the trading platform.

For example, the Bimentougou incident in February 2014 was the theft of 650,000 bitcoins from the centralized trading platform "MT.Gox", which is worth about 15 billion yuan today . This is also the largest coin theft incident in Bitcoin history. Although the suspects in this case have been apprehended, the case is still under trial.

Bitcoin has been in existence for only ten years, but the incidents of theft, attack, and running of centralized trading platforms are countless. This is also an important reason why some people choose to go to the central trading platform.

Compared with centralized trading platforms, the security risks come from hacking and platform running . Once there is a problem, almost all users will suffer losses ; the asset risk of DEX users mainly comes from the improper management of wallet private keys by users, and the private keys of a certain user. Leakage will not affect the security of other users' assets. The assets between users are completely isolated.

3.Transparency in transactions

The transactions between users of the centralized trading platform are completed by the trading platform. The transaction information is only recorded on the internal ledger of the trading platform and is not recorded on the non-tamperable blockchain. Therefore , the transactions of the centralized trading platform are also Called Off-Chain, the transparency of its transaction records is relatively low. If the trading platform is to be evil, the cost of tampering with transaction records is very low.

With DEX, transactions between users are completed on the blockchain, and their transactions are packaged by miners and broadcast on the blockchain. Therefore, DEX transactions are also called on-chain transactions. Trading information on the chain means that transaction information can be publicly queried on the blockchain and cannot be tampered with, so DEX transaction information is more secure and transparent.

4.Different trading experiences

Centralized trading platform, because the transaction data is not on the chain, as long as there is a matching counterparty, the transaction speed is extremely fast . At the same time, the centralized trading platform has simple operation steps, low thresholds for use , and can provide rich trading pairs , so more users will choose a centralized trading platform, and more users will have better transaction depth, which further promotes centralized trading The transaction speed of platform orders.

Because DEX transaction data needs to be chained, transaction confirmation needs to wait for miners to package and broadcast, so the transaction speed is slow . The operation steps of DEX are relatively complicated , and the threshold for use is higher . When it comes to different blockchain asset transactions, such as Bitcoin and Ethereum transactions, more complex cross-chain technologies are required. Many DEX trading platforms cannot be implemented, so fewer transactions are supported than centralized trading platforms.

The centralized trading platform has faster transaction speed, lower usage threshold , and better user experience than DEX .

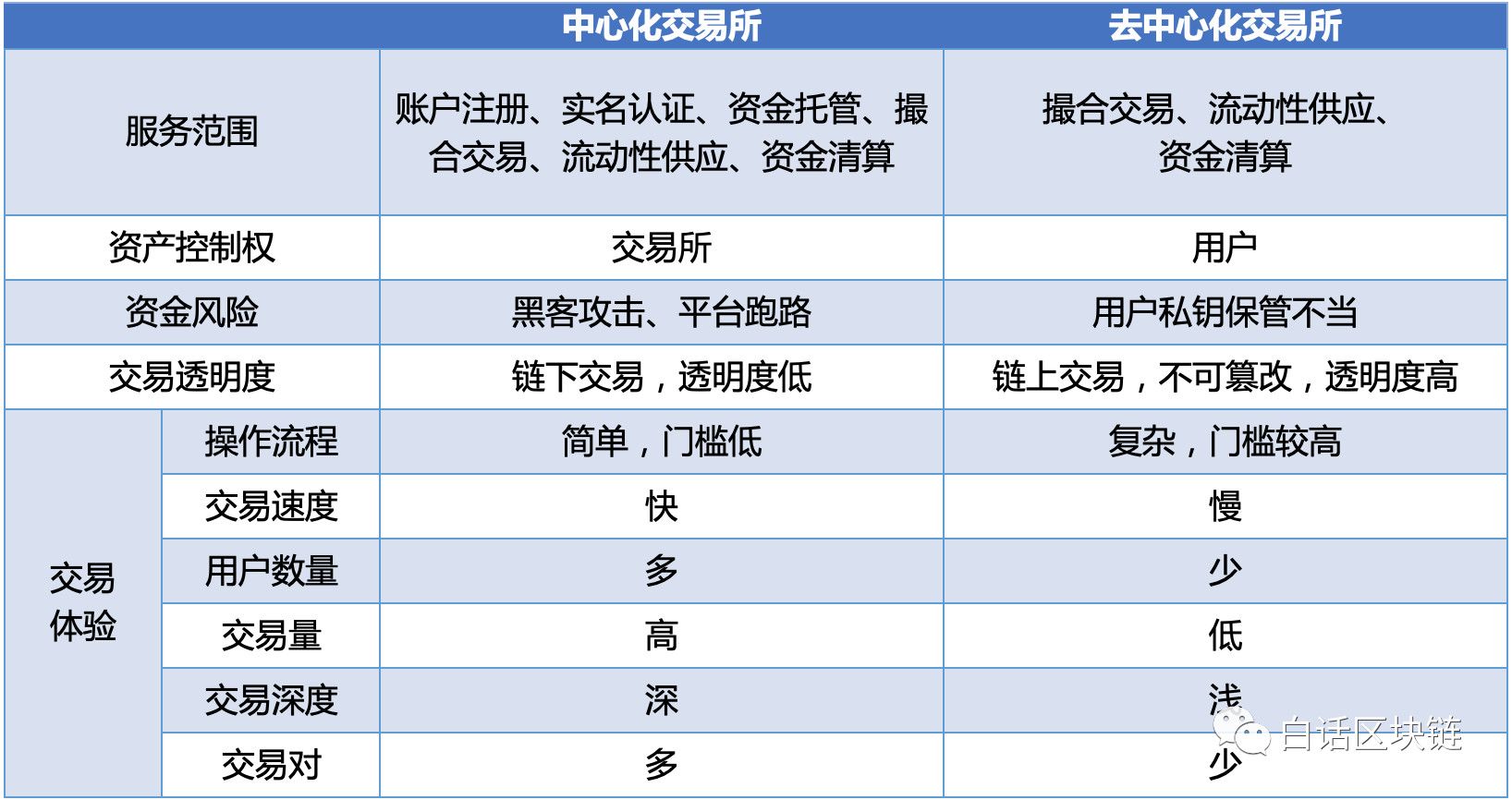

In summary, we use a table to show the difference between a centralized trading platform and DEX:

03 Conclusion

To sum up, since the centralized transaction platform is not on-chain, the customer experience is better than DEX in all aspects , which is why more users choose the centralized transaction platform . However, centralized trading platforms require users to surrender control of their assets. Once a centralized trading platform is attacked or ran away, all users will suffer losses, which is why many people choose DEX.

Currently DEX has gradually developed. Have you used it? How was the experience? Welcome to leave a message at the end of the discussion.

——End——

"Disclaimer : This series of content is only for the introduction of blockchain science popularization, and does not constitute any investment opinions or suggestions. If there are any mistakes, please leave a message to point out. The copyright of the article and the right of final interpretation belong to the vernacular blockchain. A

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Libra welcomes new members, has this company been almost acquired by Coinbase for $ 150 million?

- Bitcoin once fell below $ 8,600, and BitMEX's bitcoin settlement exceeded $ 150 million

- Blockchain applications enter the fast lane: 4 "Blockchain +" scenarios have begun to fight the epidemic

- Viewpoint | Professor of Beijing Jiaotong University: Blockchain talent reserve is extremely insufficient

- Blockchain has been shortlisted in 22 provinces, autonomous regions, and municipalities. This year's government report. Industry opportunities?

- Many mainstream project development funds are facing "burnout". Should BCH levy a miner tax?

- Anchor Coin Watch: Can Bitcoin on Ethereum Break the DeFi Ceiling?