Anchor Coin Watch: Can Bitcoin on Ethereum Break the DeFi Ceiling?

Source: Odaily Planet Daily (ID: o-daily)

Author: Huang Xue Jiao

On February 14, Huobi Global announced that it will issue a 1: 1 anchored Bitcoin HBTC on Ethereum.

- Demystifying the IOTA mainnet suspension, bZx and SIM being hacked, doing so can improve account security

- Sue against FB, buy spaceship tickets with BTC, bitcoin career of billionaire "Gemini" brothers

- Front Running: The Achilles heel of decentralized trading

Bitcoin-backed token, Bitcoin-backed token, is as easy to understand as its name, but why is it necessary to issue BTC anchor coins based on other public chains?

DeFi is the most popular star circuit in the crypto world in the past 2 years, but its development is deeply limited by the Ethereum market. The market value of bitcoin is US $ 160 billion, which is 6 times that of Ethereum. If thousands of ecological applications of Ethereum pry bitcoin as an asset, it will undoubtedly paint a glorious picture of its "world computer" story.

Outside of Ethereum, there are also several public chains that are gradually trying to issue Bitcoin anchor coins. In June last year, Binance launched BTCB on the Binance chain. ChainX issued xBTC based on Polkadot. In addition, Kava, a lending platform on Cosmos, also supports BTC. It can be seen that Bitcoin is brought into the home as the first "public asset" The public chain has a certain user market.

On the other hand, BTC users also have a need for public chain ecological applications. The success of Ethereum is based on smart contracts and applications. Using BTC based on it, users can experience a variety of open financial products and enjoy lower rates than centralized lending and leveraged transactions.

Just like the dollar anchor, there are more than one player who wants to split this cake. So far, there have been 3 different issuers of ERC20 BTC, with a total of nearly 2,000 bitcoins (valued at $ 20 million).

The recent entry of Huobi has been favored by many in the industry. The most important reason is that the exchange is not only the flow entrance of the blockchain world, but also a large capital pool and an ecological chain gathering place. Transfusion of DeFi by them may be one of the most ideal development methods.

For exchanges, the opportunity to issue U.S. dollar anchor coins has been lost. It is the first to issue BTC anchor coins and promote their connection to Bitcoin, Ethereum, and DeFi to create a network effect with themselves as core participants. It's an imaginative story.

Is ERC20 BTC widely used? Will there be more exchanges coming in? Maybe we will know the answer soon.

What is the use of BTC Anchor Coins?

After a month of continuous rise, on February 7, Ethereum broke through the $ 200 mark and continued to rise.

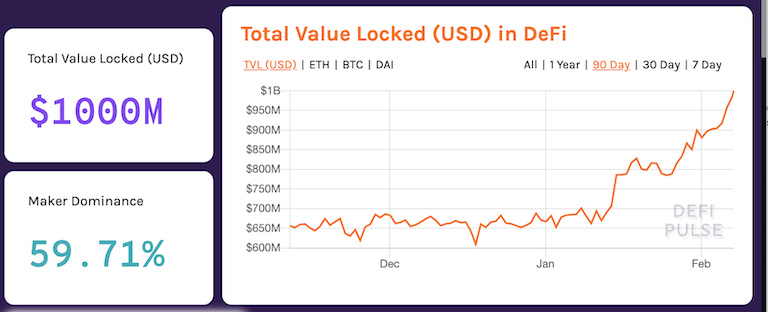

At the same time, the total value of DeFi's hedging on Ethereum reached the first $ 1 billion.

Data from: DeFipulse

This is a milestone for many practitioners of open finance.

In the two years since its birth, DeFi has been known for less than $ 10, and has attracted a lot of money and is highly sought after. Many practitioners believe that DeFi's next billion will come faster.

But where does this "faster" start? Where is the increment?

Improving contract security to ensure asset security and user confidence; improving usability are two necessary tasks.

Beyond that, some innovators have begun to look for new ways to "go global." The 1: 1 anchored BTC ERC20 token released on the Ethereum ecology is one of the directions they captured.

What's the use of ERC20 BTC?

The first is to increase the market size of DeFi (or understand market penetration) by attracting BTC holders and their assets.

This raises a question as to why DeFi on Ethereum requires BTC.

To many practitioners, the reason may be simple and rude.

"The biggest problem with DeFi right now is that it is confined to the Ethereum ecosystem." Digital currency practitioner Miao Kai told the Planet Daily. "The only valuable underlying asset in this circle is Bitcoin, so DeFi without Bitcoin will embarrass the role of open finance. Because its underlying assets (mainly Ethereum and USDT) are questionable."

We do see that Ethereum-based DeFi faces the problem of "soil infertility", and its ceiling is ETH itself.

"In DeFi lending, the lack of collateral is an unavoidable problem. People with other mainstream cryptocurrencies, especially Bitcoin users, cannot borrow European money through DeFi. The first question is whether they will configure Ethereum. Even if it does, Ethereum's market value is $ 28.7 billion, and the ceiling of the amount of lenders (collateral) that can be borrowed is obvious, so it is difficult for the market size of DeFi lending to expand horizontally. "

So what is the reason for BTC holders to attract him to exchange his real gold and silver coins for an ERC20 token?

The most straightforward, we can see two points, the transaction cost of the BTC anchor coin is lower, and it can be used in the DeFi ecosystem of Ethereum.

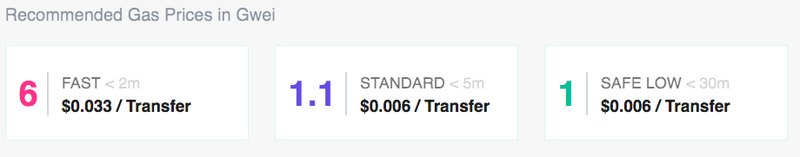

First of all, the current average transaction cost of Bitcoin is 17.9 satoshis / byte (equivalent to 0.3324 USD at the current currency price), and the Bitcoin anchor currency is an ERC20 token. The average cost of transferring money on Ethereum is 0.006 / Transfer. 2% of Bitcoin, the transfer transaction time will also be reduced from 1 hour to 5 minutes, compared to the two, who is more economical at a glance.

Ethereum transfer rate, data from: Ethgasstation.info

Secondly, until now, the main functions of Bitcoin are still transactions and stored value. However, there is no intention that BTC is the strongest consensus blockchain asset. Many people still hope that Bitcoin can complete the mission of "point-to-point electronic transfer system" and promote economic freedom.

Previously, bitcoin holders had no idea of ecological applications (most likely to be used for offline payments, but they are limited by time and space), but now they have bitcoin anchors, which may be like the slogan of the WBTC project. People can "Do more with Bitcon".

WBTC is based on the Bitcoin anchor coin issued by Ethereum. After BTC users exchange their own currency with WBTC, they can either go to MakerDAO to mortgage, loan to Compound, or open the leverage of bitcoin trading pairs on DEX such as Uniswap / Kyber. It is difficult to operate without Bitcoin or its anchor) …

Of course, if there are only the two benefits of low transfer funds & time cost and wide use, for most BTC users, there is still lack of motivation to try complex products on Ethereum.

After all, using USDT as a currency is also cheap and efficient, and the assets themselves are more stable. As for the need to use BTC to borrow or open leverage, there are also centralized exchanges and lenders who have been cultivating for many years, and have achieved good service charges and convenience Level. Unless, BTC anchor currency can further reduce costs and improve efficiency.

In some scenarios, we have already seen this potential.

Mr. Zhang, the community leader of the dForce core agreement of the DeFi project, told Odaily Planet Daily that he sees a better use case where users can use the BTC anchor currency to arbitrage between CeFi and DeFi borrowing.

At present, the rate of mortgage of stablecoins such as USDT by centralized lenders is usually around 10%, and on most decentralized lending platforms, this interest rate can be reduced by 25% or even 50%. The cost of using capital on the lending platform is significantly lower.

Cheap sources of funding allow lenders to gain an advantage by lowering lending rates. On the whole, whether the cheap capital flows to users or to peers through interbank borrowing (which will eventually reduce the overall lending rate of the market), the market size is expected to grow further.

So how can a lender holding a lot of BTC get USDT on DeFi?

It is easy to pledge and borrow on DeFi through the BTC anchor currency. According to Mr. Zhang, some lenders have started to arbitrage on the decentralized lending platform Lendf.Me (dForce sub-project) in this way.

In addition, Mr. Zhang said that through BTC anchor currency and DeFi, BTC users can also obtain cheaper leveraged transaction rates than on centralized exchanges. "Currently, BTC's borrowing interest rate on Lendf.Me is less than 1% per annum, which is much cheaper than the spot leverage of most centralized lending platforms (up to 36% per annum)."

How does BTC Anchor Coin work?

After understanding the "law" problem, let's take a look at what "shu" is.

In theory, the BTC anchor coin can be issued on any Turing-complete public chain. In the current situation, most of the BTC anchor coins with circulation and users choose Ethereum.

The operation mechanism of ERC20 BTC is roughly divided into three types, centralized (HBTC, imBTC), semi-centralized (WBTC), and decentralized (TBTC).

Semi-centralized WBTC

WBTC is the first BTC anchor coin to go live, and its many rules have been referred to by latecomers.

In October 2018, WBTC was co-sponsored by Kyber Network, BitGo and other DeFi projects, and officially launched in January 2019.

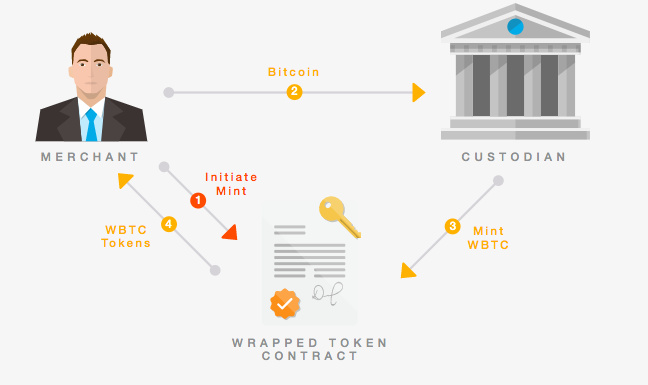

WBTC operates around one agency (WBTC DAO) and two roles (Merchant Acceptor and Custodian Custodian)

As shown in the figure below, when the user needs to change BTC to WBTC, he sends a request to the acceptor, and then the acceptor sends a Mint minting request to the WBTC smart contract, and at the same time sends the user's bitcoin to the custodian. After receiving the bitcoin, the custodian also sends a minting request to the smart contract. After this similar multi-signature process, the contract sends a WBTC to the acceptor through the request.

Picture source: WBTC official website

What should I do if I want to return WBTC from the acceptor?

Simply, the acceptor is responsible for recovering the WBTC, sending it to the contract for destruction, and then redeeming Bitcoin from the custodian.

So far, WBTC has obtained more than 20 acceptors, but there is only one escrow agency, BitGo, which is also its most centralized place.

According to Bowen, DDEX Operations Leader, one of the acceptors, in order to improve the compliance and security of the borrower, BitGo will conduct a KYC / AML audit on the newly added acceptor; in order to prevent contract vulnerabilities from over-issuing tokens, BitGo will also Manually review each minting request. Of course, WBTC stipulates that BitGo can receive two thousandths of the coinage as a service fee with these services.

Of course, BitGo announced its Bitcoin escrow address to ensure that WBTC is 100% reserved.

To obtain WBTC, users do not have to go through the acceptor, they can also buy directly through the DEX that has listed WBTC. At this time, the payment method is no longer limited to Bitcoin, as long as the exchange supports WBTC and XX currency trading pairs.

Acceptors, custodians and exchanges constitute the ecological governance organization-WBTC DAO.

According to the official introduction of WBTC, there are 16 initial members of DAO, whose task is to jointly manage all important changes of WBTC, including adding and removing acceptors and custodians. "This is an open and transparent decision-making process controlled by multi-signature contracts."

According to official WBTC data, WBTC has been in circulation in 34 dAPPs since it was issued for one year. At present, there are 887 coins minted on WBTC, which are scattered on 1700+ addresses, resulting in 10w + transfers.

Data from: WBTC official website

2. Centralized distribution of HBTC and imBTC

The biggest difference between it and WBTC is that as a "central bank", it is responsible for coin minting, destruction and escrow. Of course, its Bitcoin hosting address is also public.

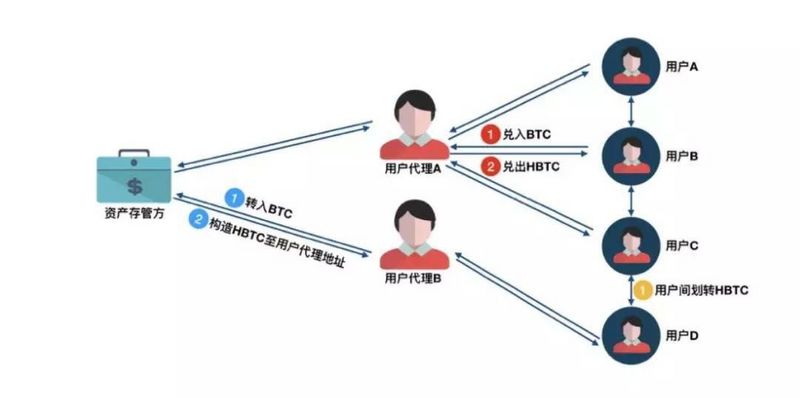

HBTC operating mode, picture from: HBTC white paper

HBTC supports multi-acceptor acceptance, and currently has access to Huobi Global, Huobi Korea, and Huobi Cloud, and plans to list MakerDAO-Oasis, DDEX, and dForce. On Huobi Global, users can choose BTC-ERC20 to exchange HBTC when withdrawing BTC.

Etherscan.io data shows that 500+ HBTC have been issued within the current HBTC contract address, with 18 distributed addresses. In comparison, the amount of coinage of imBTC issued before HBTC is also 500+, but the distribution address has reached 1000+, and the number of transfers has reached 8000+.

A person familiar with the matter said that this is likely due to the fact that the current users of HBTC are mainly acceptors and institutions, and they use these funds to deposit and lend on DeFi.

ImBTC, which is also a centralized BTC anchor coin, has its own unique features.

imBTC is issued by a decentralized exchange Tokenlon + escrow + acceptance. In other words, the endorsement of imBTC relies entirely on Tokenlon.

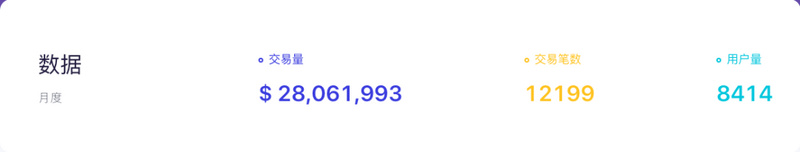

Official data shows that Tokenlon is backed by imToken, the largest Ethereum wallet, and its latest operating data shows that the platform's monthly transaction volume is $ 28 million.

Data from: Tokenlon.im

As the issuer, Tokenlon will charge users a fixed fee of 0.0005BTC, which is worth USD 4.8 based on Bitcoin 9600.

What is special about imBTC is that it divides the fee, "to make up for the liquidity loss caused by users pledged BTC. According to official data, based on the current fee, the current annualized income of imBTC users is 0.79%, which is not high. .

3. Decentralized TBTC

Finally, let's introduce the unique TBTC in this field, just like its slogan, "No KYC, no middlemen, no bullshit …"

TBTC's previous slogan has now been changed to No games, just math.

As mentioned above, the biggest feature of TBTC is decentralization. In order to realize this idea, TBTC has carefully designed a set of "self-issuance" rules, which are far more complicated to implement than a scheme based on central licensing + smart contract automation.

After nearly 10 months of boring research and development, TBTC released a white paper in August last year, and another half a year later, that is, on the 21st of this month, Matt Luongo, the TBTC project leader, announced that the project code has been completed, and the code is currently being frozen and audited. If successful, V1 mainnet will be launched next month.

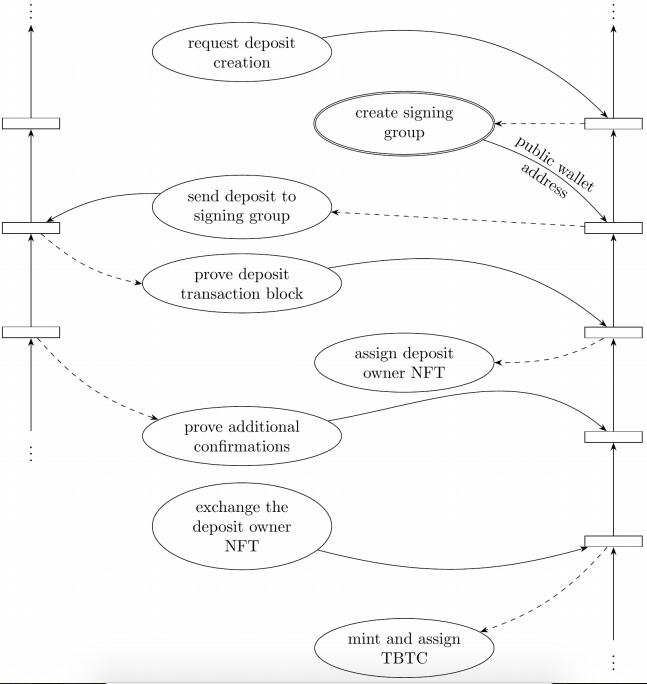

According to the TBTC white paper, the operating mechanism of TBTC is somewhat similar to the POS consensus algorithm. First of all, there will be some users in the ecology who want to obtain the coinage fee, and obtain qualifications through pledged deposits. Let us call them “nodes”; when users want to convert BTC to TBTC, the system will choose among the alternative nodes. "People" form a Signing Group and create a multi-signature co-managed address on Bitcoin for storing the bitcoin that the user intends to lock; after the user's bitcoin is locked, the signing group will generate for the user TBTC.

Of course, in order to ensure that the code controls the lockup, the signature group needs to submit the public / private key of the address to the system. Non-rule nodes, like POS, face the risk of fines being forfeited.

TBTC release rules, picture from TBTC white paper

The TBTC decentralized system's experience of no trust (only trust contracts and logic is no problem) is its biggest highlight. But at the same time, the shortcomings are also very striking.

In order to make this absolutely decentralized system work well, TBTC has set many rules, such as nodes,

Ethereum 1.5 times the mortgage verification amount / exchange amount; Second, only one bitcoin can be exchanged at a time, and there is a fixed term of 6 months after the exchange, and users cannot Exchange back Bitcoin. Furthermore, we cannot know whether this complexly designed system will be successful and practical.

Benefits and Challenges of BTC Anchor Coin Development

After reading the above, I believe that you have a comprehensive understanding of this field.

But from the fact that there are only a handful of publishers, and most of them are just online or not yet online, this field is still in its early stages of development.

But the recent admission of Huobi is undoubtedly an important event in this industry.

As Mr. Zhang said, every move of the head exchange will have a significant impact on the blockchain ecosystem.

In the Staking economy, the exchange has become the number one player with a huge pool of funds. On the BTC anchor coin, I believe that as long as the demand is real, there will be successive exchanges entering the market.

"The entry of such resource-based players will be a forcible catalyst for ERC20 BTC. If there is no exchange involved, other ERC20 BTC solutions, whether centralized or decentralized, will be difficult to develop in the short term, with insufficient incentives. There are also problems of trust, and more importantly, the lack of a participant who radiates a large number of users and has a complete ecological system. In this case, 100 BTCs can't stir up the splash, and so is 1,000. "

Mr. Zhang believes that the exchange may be part of reversing the situation. For exchanges, entering the BTC anchor currency is also very attractive.

Looking closely at the comparison chart of the above several BTC anchor coins, we can see that currently only Huobi provides this currency exchange service for free. This may be because the early minting was small, and unlike the USDT, which has already issued billions of dollars, this income may not currently make a lot of money. On the other hand, what Huobi sees more is that HBTC can help itself to access DeFi, thereby obtaining the benefits of capital flow in this field, and paving the way for its own public chain and DeFi applications.

"Just as USDT was issued by Bitfinex, the first-hand USDT will come in and out of Bitfinex. In the same way, HBTC's coinage and redemption will eventually pass through Huobi. After HBTC accesses more application scenarios, Huobi will therefore Enjoy the network effect brought by HBTC. "Mr. Zhang explained this in detail.

"Each time HBTC is used in DeFi, it is increasing the demand for HBTC coinage. In the long run, regardless of whether the acquisition mode is direct / indirect, BTC to Huobi Exchange is a net inflow."

Based on this logic, Mr. Zhang also believes that the scenario of Binance, which also releases BTC anchor currency, is not good enough.

"Issuing BTCB on Binance Chain, they should want to strengthen their ecology. This is no problem, but what Binance did not want to understand is that there is no complete DeFi ecosystem on Binance Chain, and this cycle has not turned."

In addition to being viewed by the giants, many people have another confidence that the BTC anchor currency can develop at a high speed because its asset value has been recognized by the industry, but its penetration rate in the open financial market is very low.

According to DappTotal statistics, Ethereum currently has 3.65 million locked positions (about 900 million U.S. dollars at current prices), accounting for 3.33% of the total supply. In contrast, Bitcoin, the three largest BTC anchor coins that have been issued, have a total of locked positions. With less than about 20 million US dollars, it can be seen that BTC's participation in DeFi is close to zero. Although it is still too early to let 3% of Bitcoin lock-in into DeFi, even if only 100,000 Bitcoins come in (that is, less than 1% of Bitcoin), the DeFi market can double. This imagination space is enough to make BTC anchor coin issuers and members of the DeFi ecosystem excited and continue to work for this.

Before that, as mentioned above, practitioners also need to solve the problem of insufficient incentives for early adopters of BTC anchor currency, or the selected scenarios are not enough, and at the same time, there are still many centralized parts in the current solution. Potential trust issues.

Furthermore, despite the attractiveness of low rates and other incentives, DeFi still has a threshold that cannot be ignored for general users. Just as DEX still cannot shake the status of a centralized exchange, it is unknown how many users can be converted.

However, it is optimistic to say that if the BTC anchor currency slowly realizes a 1% total lockup, some practitioners will have to worry about it. Because this will greatly benefit Ethereum's DeFi ecosystem, but it will also shake Ethereum's dominance in DeFi assets.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 18 felonies and up to 20 years in prison! Former Microsoft employee convicted of digital currency scam

- What does De in DeFi mean and what does it mean for the blockchain industry?

- Bitcoin fell below $ 9,200, and the entire network was over $ 300 million in short positions. Is the halving quotation not over yet?

- Over 43% of Ethereum addresses are profitable, and researchers are optimistic that Ethereum will become a new hedge

- Comprehensive interpretation: What is the impact and value of the US SEC Commissioner's "Token Safe Harbor Proposal"?

- Why is FileCoin delayed again?

- Winklevoss brothers support Filecoin, how long will it take us to raise $ 257 million?