Over 43% of Ethereum addresses are profitable, and researchers are optimistic that Ethereum will become a new hedge

Source: Shallot Blockchain

According to data from cryptocurrency analysis company IntoTheBlock, with the explosive growth of the Ethereum spot and derivatives market, 43% of ETH addresses are profitable. In the first two months of 2020, Ethereum rose nearly 110% against the US dollar, and a market value injection of US $ 15 billion made Ethereum's share in the cryptocurrency market expand rapidly. Against the background of Ethereum's multi-month rise, the spot ETH trading volume has soared in recent weeks.

The rise in prices at the beginning of this year has brought huge changes in wealth to Ethereum holders. Just 4 months ago, only a tiny 0.01% of Ethereum addresses were profitable. At that time, Bitcoin's profitable address accounted for 55. %.

- Comprehensive interpretation: What is the impact and value of the US SEC Commissioner's "Token Safe Harbor Proposal"?

- Why is FileCoin delayed again?

- Winklevoss brothers support Filecoin, how long will it take us to raise $ 257 million?

Since the beginning of this year, Ethereum has also demonstrated similar strengths as Bitcoin. The ETH / BTC trading pair is up 68%, which is in its biggest upward trend since December 2018. Since July last year, ETH has never seen such a high price or market share. At the time, ETH fell into the beginning of a six-month bear market and fell to one of the lowest cryptocurrency market shares ever.

Futures traders seem to have confidence in the uptrend of Ethereum-positions in all ETH derivatives trading venues have steadily increased in recent months, with total positions approaching $ 1 billion, up about 100% since late January . In U.S. dollars, Bitcoin's open positions have grown even more, reaching $ 2 billion.

Grayscale Ethereum Trust may be a more trustworthy indicator. Since the beginning of this year, Grayscale's ETH Trust's assets under management have increased by 170%, and Bitcoin Trust's assets under management have increased by 50% during the same period.

Data show: Ethereum is becoming a hedge against traditional asset fluctuations

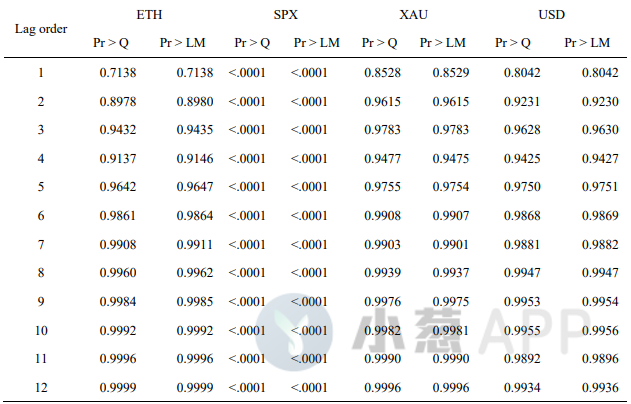

In a recent report from San Jose State University Artem Meshcheryakov and Stoyu Ivanov, the two researchers used a data-driven approach to analyze whether Ethereum can be classified as a hedge or hedging asset in response to fluctuations across multiple markets. The report's various details surrounding the price behavior of Ethereum, compared with the prices of the U.S. stock market, gold and the US dollar, found that Ethereum is quickly becoming a safe haven and diversified trader in these markets. Ethereum's role as a hedge against global economic turmoil can increase its attractiveness to investors.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | At the tip of the iceberg of crypto assets, Hurun's wealth list ranks sixth (0226)

- Babbitt original 丨 Ethereum miners' life and death situation: 4G graphics card mining machine may annihilate the entire army in the fourth quarter!

- Swiss exchange SIX announces investment in cryptocurrency trading platform Omniex, exact amount not disclosed

- New Zealand: IRD proposes to waive taxes on some cryptocurrencies to boost industry development

- Filecoin Interoperability Network is coming online. Do you know it?

- Guide to secure deposits: How to better hide the Bitcoin in your hands?

- Simultaneously addressing the pressing issues of DEX and CEX, the company received a $ 40 million investment from Sequoia and Intel