Is Enterprise Blockchain 3.0 coming? What challenges will the Bluesky project formed by the Twitter CEO face?

Source: The Startup

Compilation: First Class (First.VIP)

Editor's Note: The original title was "Enterprise Blockchain Towards the 3.0 Era, and Twitter's" Blue Sky Plan "May Lead a New Wave"

As Jack Dorsey (CEO of Twitter) announces the establishment of the Bluesky project, a new wave of enterprise-led blockchain is coming to us. Although previous attempts by large companies have failed, this time they may be able to succeed.

- Interpretation of Ethereum Proposal EIP1559: Reduce the total transaction fee and transaction fee volatility

- Science | Three Principles of Bitcoin Mining: A Brief History of Cryptography, Hardware Knowledge, and Development

- Financial Stability Board: The latest progress of large high-tech companies entering FinTech and its potential risks

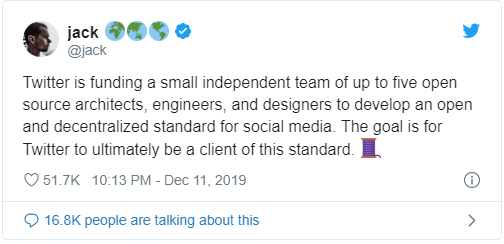

As Jack Dorsey (CEO of Twitter) announces the establishment of the Bluesky project, a new wave of enterprise-led blockchain is coming to us. Although previous attempts by large companies have failed, this time they may be able to succeed. On Wednesday, Jack and Dorsey, CEO of Twitter and Square, announced the launch of Twitter's "Blue Sky Project" to fund the development of a decentralized social media agreement (new or existing, if it is an existing agreement, it will work with Square Crypto (Similar to, and supports Bitcoin), and Twitter intends to be the first customers of the agreement.

For the past five years, we have been cooperating, investing, and co-incubating with early-stage entrepreneurs and startup teams to build open, decentralized networks and platforms and help them design and build bridges for users. But the Twitter announcement a few days ago can't help but take a step back and think: Have we seen the development of the new-type enterprise blockchain movement? What does this mean for the ecosystem? What will it look like?

On the surface, the Blue Sky project sounds similar to Square Crypto (March 2019) and Libra (June 2019), but after deep thinking, I think that Blue Sky may lead a new wave of blockchains led by enterprises. Trends ("new types")-sponsor networks and learn from past failed companies, and ultimately succeed.

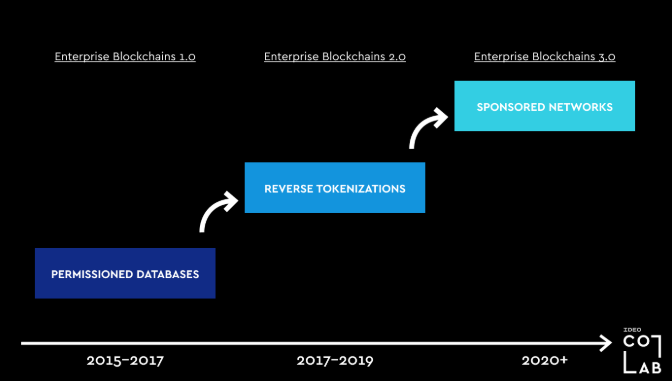

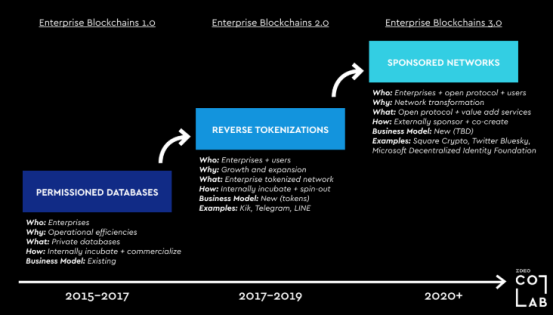

Enterprise Blockchain 1.0: License Database (through internal incubation + commercialization)

For more than six years, companies have shown little concern for blockchain. In fact, in an era where Bitcoin is unique, most companies either dismiss it or ignore it. But in 2015, when the word "blockchain" became a hot word and mentioned in the boardrooms of various companies, every company in the world suddenly wanted to implement the "blockchain strategy" and its own blockchain. Proof of concept (PoC) portfolio.

But there is another big problem: At that time, companies wanted to use the blockchain, but they did not have tokens, they were not decentralized, and they did not have a network authorized to end users.

Unfortunately, this is almost the case with the first enterprise blockchains from 2015 to 2017. They are private (or highly licensed) databases that are developed and controlled by a single company to improve the efficiency of the company's internal operations, such as reducing redundancy or simplifying internal coordination processes. Technically speaking, yes, they are blockchains, but they do not represent the invention or purpose of the blockchain. In most cases, their direct and shadow costs ultimately outweigh the expected benefits.

Some companies, such as Fidelity and Nasdaq, foreshadow the development direction of the world and have built solutions for emerging crypto ecosystems and platforms, with the intention of gradually realizing the decentralized vision. Some of these initiatives have spawned companies that are still booming today, such as Fidelity Digital Assets. But most enterprise-level blockchain 1.0 experiments and PoCs have announced miscarriage after years of hard work. The reason for the failure is simple, because they are not bold enough in ambition, thinking or design.

In the era of enterprise blockchain 1.0, most companies have misunderstood that blockchain is not mainly used to improve the efficiency of internal processes of companies or enhance existing business models. Blockchain aims to create new market infrastructure and markets, and fundamentally unlock new network-based incentives and business models.

Enterprise Blockchain 2.0: Reverse tokenization (through internal incubation + derivative)

In 2017, just as people's confidence in enterprise blockchain 1.0 began to decline, Ethereum's ERC-20 token standard began to rise, and triggered the explosive growth of new tokenized startups and ICOs based on Ethereum. .

This has attracted worldwide attention (including enterprises), especially in June 2017, when ICO financing exceeded traditional venture capital, and blockchain companies became early technology startups (though we all know that this trend is fleeting ).

As crypto startups raised billions of dollars in early 2017 to capture major news headlines, some companies around the world began asking: "For expansion and growth, how do we use blockchain to tokenize existing businesses?" Although This is only for specific companies, but it is more interesting and rich than the previous era of companies seeking internal efficiency, which is worth exploring.

Then, in 2017 and 2018, many non-crypto businesses and companies hatched and planned to spawn new tokenized networks. Kik launched Kin, Telegram launched TON, LINE launched LINK, AirAsia launched BigCoin, and even Long Island Iced Tea Company transformed into a "Long Blockchain Company" (yes, this is a fact).

The process of incubating and deriving a tokenized network by traditional enterprises in this process is called "reverse tokenization" or "reverse ICO". Many such derivatives have raised millions, sometimes billions of dollars, from investors and the public. This is largely because these companies already have millions of active users. Some projects were later suspended by the SEC, and most projects have not yet started. However, reverse tokenization represents the second big wave of enterprise blockchain from 2017 to 2019. Today, they still appear in various forms around the world in Europe and Asia, and some companies tokenize Seen as a strategic opportunity for potential expansion of businesses, platforms, regions and global networks.

The problem with reverse tokenization: neutrality

However, one of the biggest problems and limiting factors of reverse tokenization is that these platforms are mostly developed by one company and mainly serve the same company, so they lack neutrality and cannot achieve the expected widespread landing, including developers or companies. Peers and direct competitors. For some companies, this may not matter (or they are willing to make trade-offs). But if the network is designed to achieve large-scale landing (and / or its network effects), but the network was not started, constructed, and designed in this way, it will be much more difficult to achieve this goal.

Interestingly, although the tokenized network solves the core problem that the private enterprise blockchain (enterprise blockchain 1.0) cannot bring a disruptive new business model to the market, if the reverse tokenization process leads to tokenization The network becomes the focus of a single company (in terms of value capture or just potential external partners such as developers, peers and competitors), then tokenizing the network is necessary, but it is still insufficient.

Facebook Libra

In this framework, although in the eyes of the public, lawmakers, developers, collaborators and their competitors, Facebook's Libra (announced in June 2019) has always intended to become Facebook's independent platform, it is still operated by the Libra Association 100 of the expected members are co-managed (currently about 21, 7 fewer than the original 28), and it is still considered a Facebook platform, so it is more like a neutral, completely independent platform Reverse tokenization (at least for now) is partly because the world is involved in the launch, structure, design, construction, and exchange of Libra. Although it has suffered a lot of setbacks in recent months, Libra still has a chance, and it needs to do a lot of work to get rid of or accept the prejudice that people think of it as Facebook's centralized platform.

Enterprise Blockchain 3.0: Sponsor Network (created through external sponsorship + collaboration)

Now talking back to the announcement made by Twitter a few days ago, I believe that it shows the world a new method of enterprise-led blockchain: a network of sponsors, sponsored by established corporate sponsors (but not owned or controlled) External independent teams to develop or build existing open source protocols and public networks for companies and general use.

It can be said that Microsoft's support for Ethereum and the Decentralized Identity Foundation, Square Crypto's support for Bitcoin, and Twitter's Blue Sky plan are all possible examples of the sponsor network, how it will develop, and the ultimate success story.

What matters is not only who / how the sponsor network is funded, but also how a sponsor network like Blue Sky manages, supports, and empowers a company's brand, reputation, relationships, distribution capabilities, resources, and openness to millions of users Clear access (while wishing to maintain their independence and autonomy). Assuming sponsored company values are consistent (this assumption is extremely difficult to implement and may require a rare CEO like Jack Dorsey because he is convinced of the principles and commitment of decentralized technology), Blue Sky projects and other future sponsorships Commercial networks may have an advantage over existing companies and startup teams in the same market, users and use cases.

Of course, the biggest challenge of these cooperations will be to manage the tension between integration and independence, and to maintain a consistent incentive mechanism, and strive to make everyone (now and in the future) share the cake instead of falling into the death of a zero-sum game swirl. In order for the sponsor network to work, sponsors may not get too much tokenization incentives, but need to focus on high-value stack value-added experiences, services, products and relationships, such as Twitter and protocols / networks Wait for customers to gain value fairly.

Although this will become very complicated, the good news is that the next wave of sponsor networks will have the opportunity to learn and improve past structures and incentive models. With the emergence of the next wave of sponsor networks, I look forward to (and hope) that we will see businesses engage, interact and collaborate with existing open source communities and developers in an unprecedented collaborative way.

I would like to know how Twitter ultimately handles the Blue Sky project, but if Square Crypto (under Steve Lee's) has any results, I can be optimistic that the Blue Sky project may also have a positive impact, and in the future several In the months and years, a new wave of sponsorship networks was triggered in a wide range of fields such as computing, storage, gaming, digital media, credit, payment, exchange, communication, collaboration, and governance.

So this raises an interesting question: Can the sponsor network become one of the next major driving forces for mainstream crypto / blockchain development and landing in the world?

We have no way of knowing the answer to this question, but if you are equally curious and eager to try, let's find the answer together.

Perhaps this third iteration is also attractive.

Reprinted please retain copyright information, thanks for reading.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Director of Research Bureau of the People's Bank of China: Currency Competition in the Digital Age

- Could this report be the culprit behind the overnight plunge in the crypto market?

- Hong Kong Monetary Authority: Eight virtual banking licenses have been issued, Hong Kong's first virtual bank is expected to open for trial by the end of the year

- Li Lihui, Former President of Bank of China: We should step up efforts to improve the technical standards and security specifications of blockchain finance

- Behind the growth of 3.5 times a year, can the unstoppable DeFi fulfill the vision of "decentralization"?

- Babbitt Column | What is the "occupation of occupation" that the mining industry is concerned about?

- Pan Gongsheng, deputy governor of the central bank, talks about the crackdown on virtual currencies: avoiding the risk of a large-scale virtual asset bubble