Indian crypto exchange lifts ban: trading volume soars 6-fold, is it global buy?

The Indian exchange Koinex, which failed to survive the cold winter, fell in the harsh summer of June last year, and the Supreme Court trial, like a "Spring Thunder," brought several times the trading volume of the surviving exchanges overnight. increase.

On March 4, local time, three Indian Supreme Court judges jointly ruled that a two-year resolution made by the Reserve Bank of India (RBI) was unconstitutional.

In 2018, RBI issued circulars to Indian banks and financial institutions, barring them from providing any services to virtual currencies, and cutting off the channel between the local crypto world and the fiat currency world. The Indian Supreme Law ruling means that local cryptocurrency exchanges and traders in India can reopen the cryptocurrency / fiat currency channel smoothly.

- Equity and debt double kills, the Fed cut interest rates sharply, can Bitcoin take over the "hot money" that escaped Wall Street?

- South Korea officially legalizes cryptocurrency transactions, Bitcoin stands at $ 9,000

- Only less than 10,000 blocks left! Will the Bitcoin halving effect come as expected?

Bloomberg quoted L & L law firm partner Valbhav Kakkar as saying that

"With this Supreme Court ruling, regulation in the areas of cryptocurrencies and fintech may become more mature and balanced."

The Supreme Court's ruling has encouraged the crypto community, and the market's vigorous response has confirmed people's optimistic expectations of this verdict. The heads of many crypto exchanges also responded to the community's enthusiasm with practical actions. But its impact on global markets remains to be seen.

01 "The World" Suffering Ban for a Long Time

In April 2018, the Bank of India's circular was undoubtedly a thunderstorm on the local trading platform. It lost the bridge of fiat currencies, the local cryptocurrency transaction volume dropped sharply, and multiple exchanges closed.

In June 2019, Koinex, one of the local exchange giants, announced that it would shut down operations due to the lack of bank support and regulatory uncertainty.

"Due to the cut-off of banking channels, operating a digital currency exchange in India has become extremely difficult over the past 14 months," Koinex co-founder Rahul Raj wrote at the time on Medium.

Koinex began to provide digital asset trading services on August 25, 2017. Four months later, it became the largest and most popular digital asset exchange in India, with a transaction volume of 265 million U.S. dollars. the company". Koinex's growth has stalled with a ban from the RBI.

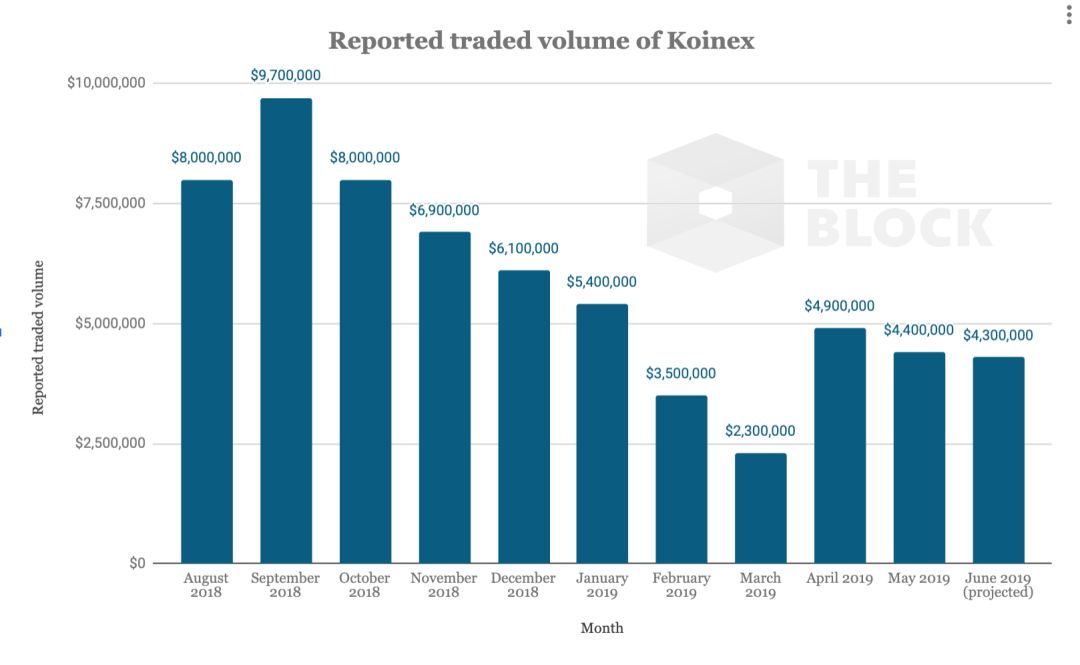

According to The Block, Koinex stated that it recorded a transaction value of 265 million U.S. dollars in December 2017. Later, as the market environment changed and the regulatory situation adjusted, its trading volume fluctuated. The total is less than $ 25 million. On the eve of shutdown, the exchange had less than 24 bitcoins in a day.

Koinex Monthly Trading Volume from August 2018 to June 2019 | Source: The Block

Prior to Koniex, cryptocurrency exchanges such as Coindelta, Coinome, and Zebpay (though the exchange has resumed operations in India since March 2), were closed due to the same predicament.

The inconvenience of trading channels and the uncertainty of the regulatory environment have also caused a significant premium for local cryptocurrencies in India.

Crypto asset analyst Joseph Young wrote in a June 2019 note that the premium between the Iranian and Indian bitcoin markets is usually between 5% and 30%. Taking the price on June 22, 2019 as an example, the average price of Bitcoin on that day was $ 11,200, while the price in India was $ 11,700.

02 Indian community enthusiasm soars, 24 hours trading volume increases 6 times

Although there is still a lot of regulatory uncertainty, this Supreme Court ruling has greatly boosted the confidence of the local crypto industry.

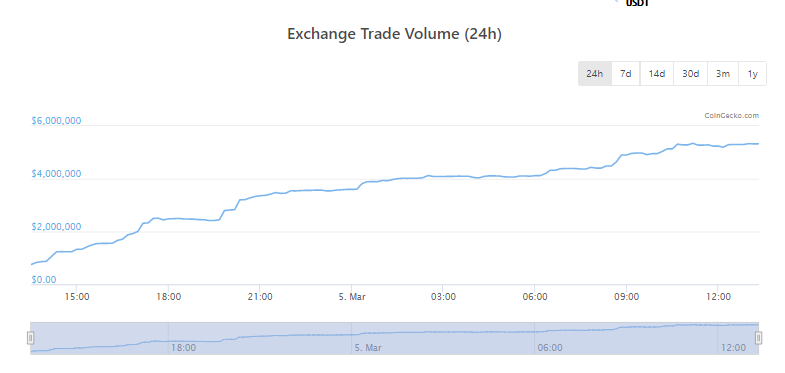

Take WazirX, one of India's largest local exchanges acquired by Binance, as an example. In the past 24 hours, its transaction volume has shown a surge, rising from about 750,000 US dollars to nearly 5.33 million US dollars, an increase of 6 times. However, it should also be noted that the lifting of the legal currency deposits and withdrawals did not immediately stimulate the skyrocketing of the legal currency trading pair.

Wazirx trading volume in the past 24 hours (as of 13:20, March 5, Beijing time) | Source: Coingecko

At the time of writing, the trading volume of fiat currencies in the WazirX exchange accounted for only 0.1% of the total trading volume. The trading volume of Zebpay, another major exchange, has also more than doubled in the past 24 hours. As of 13:20 on March 5, Beijing time, a transaction volume of approximately 130,000 USD was recorded.

Another Indian cryptocurrency exchange, CoinDCX, integrated the fiat currency deposit and withdrawal function 6 hours after the ruling was confirmed. The founder of the firm, Sumit Gupta, said in a statement that the verdict may be a catalyst for the "transition" of the Indian cryptocurrency industry. The integration of fiat currency deposits and withdrawals is the firm's first priority. Citizens can once again invest in digital assets.

OKEx, which cut into the Indian market at the beginning of the year, also expressed its views on the changes in the Indian market. OKEx Chief Strategy Officer Xu Kun said that the Indian market has a huge Internet demographic dividend, with netizens approaching 600 million, and Indian rupee inflation is severe. The demand for cryptocurrencies with both payment and value storage functions has been strong. Previously, due to policy reasons, on-site trading was limited, but the enthusiasm for buying bitcoin off-market has been very high, with daily trading volume of millions of dollars, which is a market that is worth expanding.

WazirX CEO Nischal Shetty told the media that this ruling will open the door to large-scale use of encryption technology in India, which proves that India can innovate and that the entire country can participate in the blockchain revolution.

The scale of the Indian market after the lifting of the ban on fiat currency has also a lot of room for imagination. According to the CEO of the exchange CoinSwitch, CoinDesk said that before the RBI ban was issued, India ’s daily cryptocurrency trading volume was between about $ 50 million and $ 60 million.

03 The court dealt with it prudently, the government's attitude has not been completely changed

The advent of the ruling is full of twists and turns, and the results that have uplifted the crypto industry have nothing to do with the court's prudent attitude.

This court hearing was originally planned to be held in mid-October 2019, and was first postponed to November of the same year, and then due to time conflicts in the RBI, it was postponed to January 14, 2020. After tortuous twists and turns, the results were finally announced yesterday.

Local Indian media Crypto Kanoon says the Supreme Court of India attaches great importance to the case | Source: Twitter @ cryptokanoon

According to Crypto Kanoon, a local blockchain media in India, the court stated that the postponement of the hearing several times was to consider that crypto-related matters may occupy the court's entire week's agenda. In other words, the Indian Supreme Law actually took the case very seriously and did not choose to ignore the case or directly favor the RBI.

In the court's ruling, the court stated that "the RBI at least needs to show that the financial institution under its supervision has suffered (cryptocurrency) damage, but it has not."

In response to the Supreme Court's decision, the country's finance minister, Nirmala, said the government would study the decision to decide what to do next.

Outside the central bank, the Indian federal government has imposed even stricter regulations on the local crypto industry. According to the Indian Economic Times, the federal government has been preparing a draft since April 2019, which intends to ban any cryptocurrency and related industries across India. Once the draft formally becomes law, mining, holding coins, buying and selling coins (whether direct or indirect) will become illegal activities in India. He even suggested that "the use of cryptocurrencies can be punished by up to 10 years."

Fortunately, the draft was not passed in Parliament last winter. This gives the crypto community some breathing room. But it is also important to be aware that although the federal government has been silent on the bill since the winter meeting, this does not mean that it has not been brought back on the agenda.

Ikigai law firm founder Anirudh Rastogi told the New York Times that it still fears that the government may pass the draft. Obviously, the final direction of this draft will be one of the biggest variables of the Indian cryptocurrency market.

Although the Indian High Court lifted the ban on deposits and withdrawals of fiat currencies, the market is full of optimism, but at the same time, it needs to be seen that whether the growth of the local settlement of fiat currencies in India or the price change of Bitcoin shows Global investors have not yet "buy in" India's policy changes.

In the future, whether it will bring billions of funds to the cryptocurrency market to enter the market, and the global market still remains to be seen how Indian authorities will regulate the cryptocurrency market in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Amazon, Tesla and Bitcoin

- Can't you have both privacy and utility? Privacy protection opens up new horizons for business

- Million-sold hardware wallet, can Ledger NanoX shake the throne of the previous "machine emperor"

- South Korea officially passes amendments to the special financial law! Cryptocurrency Institutionalization Goes Next

- LingTing · Blockchain General Knowledge Lecture 70: Make the blockchain "understand"

- QKL123 market analysis | What is Bitcoin? Risk assets or hedge assets (0305)

- Intensive Reading | BIS: From the Flower of Money to the CBDDC Pyramid