Pan Chao: 4 Common Mistakes in DeFi Governance

Finishing: Ruby

Source: DAOStep

This time at DAOFest Shanghai, we were fortunate to have Pan Chao, the head of MakerDAO China, share his knowledge of Defi governance. He shared with us from a macro perspective the four false allegations of Defi governance in his eyes, many from practitioners. The viewpoints and speculations are of great reference value to the design of the governance mechanism and the trade-offs between the goals.

- R3 has completed the largest on-chain trade finance pilot project to date, with more than 70 organizations from 25 countries participating together

- Babbitt Column | The market lacks a stable income stablecoin

- Gavin Wood: Zuckerberg's Libra has fundamental problems, or is included in historical footnotes

Below is a summary of the shared text.

Understanding DAO

DAO arises because regulatory costs> organization costs + transaction costs

Coase once mentioned in "The Essence of the Enterprise" that the enterprise is generated because the organizational cost is less than the transaction cost. In the DAO collaboration process, participants often need to pay both organizational costs and transaction costs. In the face of such costs, DAO can still be generated and developed, largely because we need to pay high regulatory costs in the current collaboration across regions and borders. When this regulatory cost is greater than the organizational and transaction costs, we will seek to organize and collaborate on DAOs built on the blockchain.

4 false allegations about Defi governance

Charge 1: Too few things to make decisions on the chain

Fact: Maker ’s interest rate is determined by the votes of mkr holders : The target audience and scope of on- chain governance? Viewpoint: On- chain governance is a very expensive matter. Only things that require global consensus need on-chain governance. Reason: On-chain governance requires the collection of complex information and signals to make global optimal decisions based on signals and feedback. This is a costly thing in itself. For a system, decisions need to be made in accordance with "cost-benefit" feedback. Regardless of cost, "on-chain governance" without discrimination is a very uneconomical decision on the system

Charge 2: Low participation in voting

Fact: Maker ’s interest rate adjustment voting participation rate is about 1%. Even if voting on the DAO event in Ethereum, the voting participation rate does not exceed 10%. Thinking: Is it a bad thing to have low voting participation rate? Point of view: The voting results of everyone's participation are not good. Reason: Not everyone has the ability and motivation to make the best decision globally. Voters need to have the expertise to make decisions, understand the process of the entire event, and be motivated to make decisions that are globally optimal. These processes have costs. It is difficult to require everyone to get more benefits in this process than they need to pay. The system should pursue global optimal results, not the most "democratic" results.

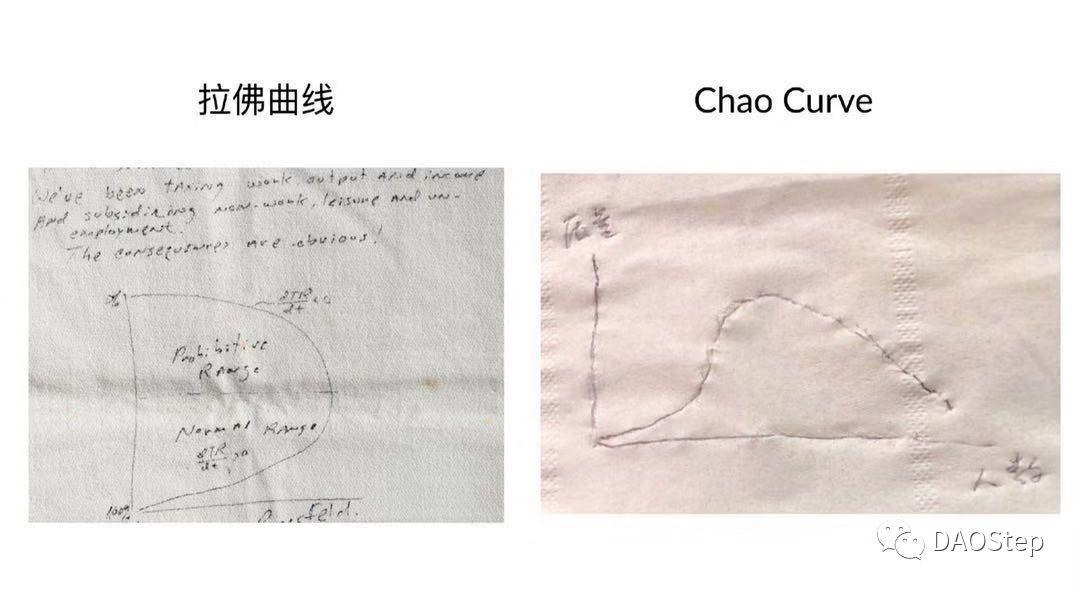

Laffer curve vs Chao curve: the relationship between the number of voters and the quality of voting

Laffer curve vs Chao curve: the relationship between the number of voters and the quality of voting

Charge 3: Poor liquidity of governance tokens

Fact : MKR's liquidity is not dominant among the Top20 tokens. Thinking: What does poor governance token liquidity represent? Opinion : Low-flow tokens allow token holders to make decisions that are in the long-term interest of the system. Reasons: For early governance systems, it was hoped that decisions would be made by actors with long-term interest in the system. Decisions based on short-term economic incentives are not necessarily beneficial to the long-term development of the system.

Charge four: artificially set rules and apply algorithms to automatically adjust

Fact : Maker's interest rate governance with "artificial" voting participation has proven effective. Thinking : Algorithm = Fantacy? Opinion: You should not rely entirely on algorithmic automated governance. "Algorithmic governance" has not been more decentralized. It is essentially a fixed and discontinuous artificial governance. Reason: DAO's vision is to achieve the "self-organizing" operating state by operating smart contracts, but the current state of smart contracts requires artificially set "responsive" rules rather than automatic adjustments through algorithms. The current algorithm is more of a fixed rule, and it does not have the ability to automate machine learning, automatic adjustment and enhancement. In the process of setting algorithm parameters, developers often do not pass the global consensus of the network. The essence is to manually adjust the parameter settings. This process is essentially a discontinuous artificial governance.

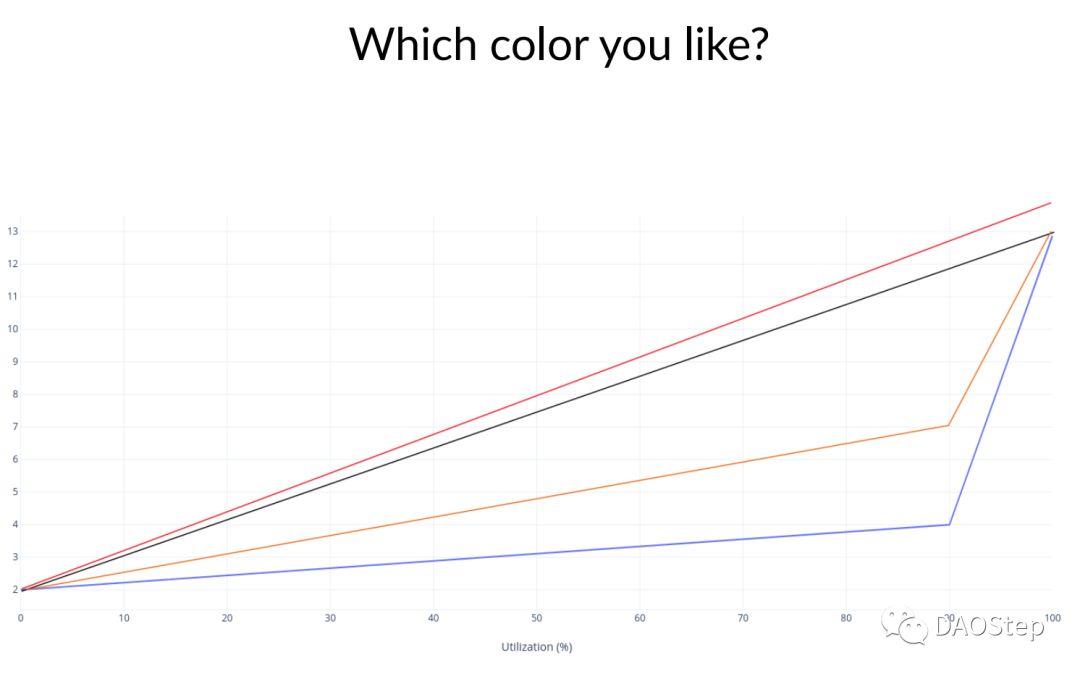

Algorithmic curve: which color do you like

Algorithmic curve: which color do you like

Step Voices

From Pan Chao's sharing, I can strongly feel a kind of pragmatic rational realism thinking and feedback from practitioners.

For the Defi project, in addition to the governance of its own token circulation rules, it also involves the governance of risk control and decision-making mechanisms in business scenarios. This not only needs to balance the participation and efficiency of decision-making in the entire network, but also to ensure that high-quality risk management can be achieved under a decentralized framework, and that it has the ability to respond and respond to sudden risks in a timely manner. This is a challenging subject .

What impressed me most about the MakerDAO governance framework is:

- A decision process designed to separate responsive governance and proactive governance based on different governance goals and events, based on the expectations and expectations of different levels of participation and decision sources

- An enhanced interactive decision-making model between MRT and MTH headed by an internal risk control team: a group discussion and decision-making based on a template proposed by a "professional team", and a further reinforcement learning-like governance process based on feedback

- Proposal time element and design of governance security module

The intuitive feeling is that MakerDAO did not deliberately pursue the so-called "decentralization" or "fairness" in the process of governance, nor did it pursue absolute "on-chain governance". I can feel that MakerDAO, as a project that is essentially engaged in "financial business", is striving to balance the "fairness" of decentralized equity governance and the "effectiveness" of risk management in the business field.

As MakerDAO states in its risk governance framework layer: " A decentralized risk management needs to ensure that strict and fact-based theories are higher than individual opinions or group biases. "

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis: Behind the Real Prosperity of German Blockchain Ecology

- After Bitcoin aimed at Ethereum, how did Fidelity lay out the crypto market?

- What are you sure and uncertain about this year? Ling listening to 2020 New Year's Eve speech concept video debut

- 30 days "water injection" 500 billion US dollars! This move by the Federal Reserve may help Bitcoin take off again

- What does incubator mean for crypto startups?

- Forbes: Trump decides Bitcoin price trend in 2020

- 26 industrial parks, 30 billion funds, the most comprehensive summary of blockchain policies across the country