Is the surge in zkSync Era on-chain data a bubble or a real ecosystem?

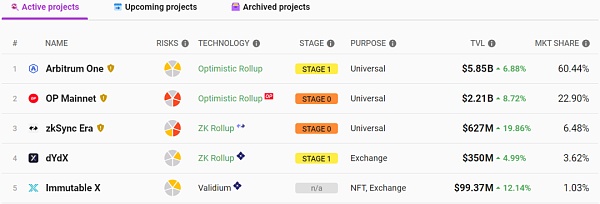

Is the zkSync Era data surge a bubble or a real ecosystem?Since the launch of zkSync Era mainnet on March 24th, the TVL has reached $627 million in just three months, accounting for 6.48% of the entire Layer2 sector, making it the third largest Layer2 network, with a weekly growth rate of nearly 20%. Currently, the number of independent addresses on zkSync Era has exceeded one million.

These data are closely related to zkSync Era’s token incentive expectations. So what is the current development of zkSync Era’s ecology? After the token incentive expectations end, can zkSync Era continue to maintain high enthusiasm and high TVL growth?

About zkSync Era

- As the staking rewards for Ether decrease, the protocol will have to seek innovative solutions.

- Exclusive new research on SUI: Distorted emissions? Dumping of non-tradable tokens?

- How to empower infrastructure and serve billions of users through account abstraction?

zkSync is an Ethereum Layer 2 Rollup blockchain, which can be seen as a Layer2 trustless protocol that provides scalable and low-cost payments on Ethereum. zkSync uses ZK Rollup technology to solve the problem of Ethereum congestion, namely scalability. zkSync is one of the ZK Rollups and one of the first applications of zero-knowledge proof technology.

The congestion and high transaction fees of the Ethereum network have made people more concerned about Layer2 expansion plans. On March 24th of this year, zkSync officially announced that the zkSync Era network was officially open to all users. As one of the most supported projects in the encryption field, zkSync Era is also favored by many capitals and has raised more than $450 million from companies such as a16z and Dragonfly.

So among many Layer 2, how does zkSync Era develop and what are its advantages?

zkEVM

zkEVM can be understood as running EVM as a smart contract engine in ZK Rollup. Its goal is to bring the Ethereum experience completely into L2 without losing the performance advantages of Rollup.

Account Abstraction

Account abstraction creates a new type of account that separates “transaction verification” and “transaction execution” by letting accounts exist as smart contracts. By making each account a smart contract with its own logic and seamless compatibility, it provides ordinary users with a secure network without sacrificing self-sovereignty and a smoother user experience.

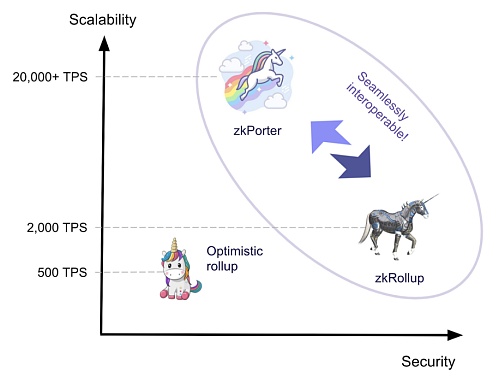

zkPorter

In order to ensure the availability of data in zkRollup expansion solutions, data needs to be published to the Ethereum base layer. However, Ethereum’s block size limits the scalability of zkRollups. zkPorter can use the availability of off-chain data to achieve the scalability we expect, regardless of the size of the Ethereum blockchain.

Overall, compared to other L2 ZK projects, zkSync stands out for its security and usability as a L2 scaling solution. Specifically, zkSync’s features and advantages are reflected in zkEVM, account abstraction, zkPorter, and Layer3 explorer, which are all narrative themes for the future of zkSync.

However, the problem with ZK Rollup is that the technical implementation is much more complex than that of Optimism Rollup. Therefore, when projects like Arbitrum and OP, which are Optimistic Rollup projects, go online on the mainnet and seize the opportunity in ecosystem construction, zkSync Era needs to invest real time and resources to overcome technical challenges.

zkSync Era Ecosystem

Whether for public chains or Layer 2 projects, ecosystem construction is extremely important. Arbitrum currently has a TVL of $5.85 billion, accounting for about 60% of all Layer 2 project TVL. There are already more than 500 DApps on Arbitrum, especially GMX, which was released in 2021 and is the native flagship project of Arbitrum’s ecosystem. The rise of Arbitrum and the development of native high-quality projects are inseparable. Even after completing token distribution incentives, Arbitrum’s TVL still ranks first.

So, what is the current state of the zkSync ecosystem? What is the development status of the project? Are there any innovative projects worth paying attention to?

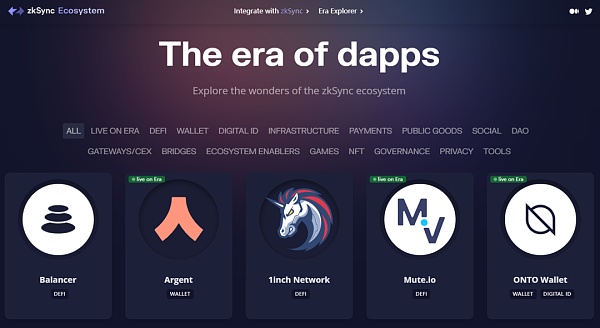

After the mainnet launch, the TVL of zkSync Era quickly rose, and its popularity is no less than that of Arbitrum when it first went online. There were nearly 200,000 independent users in the first week of the mainnet launch, and there are now over 1 million independent addresses after three months of launching, with a locked-in amount of $627 million. Since the launch in March, the development of the zkSync Era ecosystem has also been relatively rapid. According to the data on the official zkSync website, there are 302 DApps in the zkSync Era ecosystem, covering various fields such as DeFi, cross-chain bridges, and NFTs.

Among the 302 DApps deployed on zkSync Era, there are many well-known projects such as Uniswap, 1inch, and LayerZero, but currently only the projects marked with “Live on Era” have really gone online, with only 61 in total. Moreover, from the list of projects that have gone online, it is difficult to see well-known DApps. If zkSync Era wants to truly maintain a competitive advantage in the future, it still needs to rely on its native high-quality DApps on the chain.

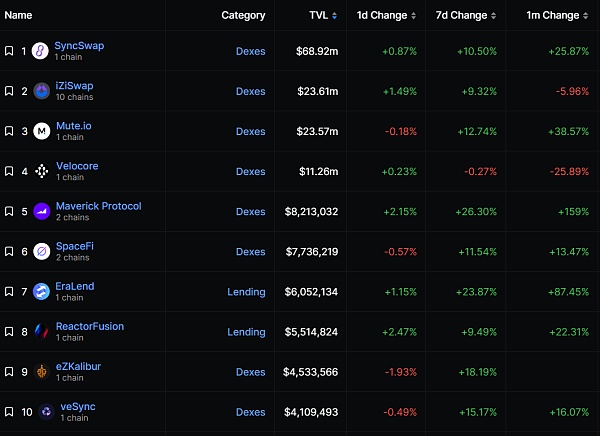

Furthermore, although the current TVL growth is fast, the number one ranked SyncSwap accounts for 40% of the DeFi TVL on the entire chain, and the top ten DApp TVL accounts for nearly 75%, with these DApps primarily being decentralized exchanges and a few lending protocols, none of which have shown unique innovative advantages yet.

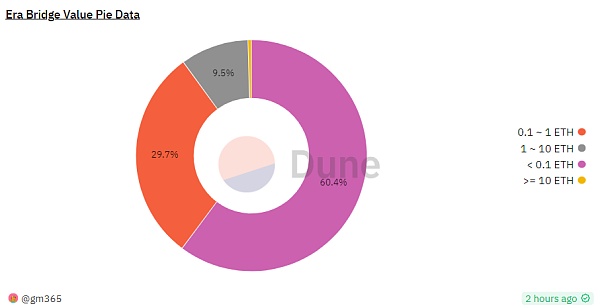

Moreover, although the number of independent addresses in the zkSync Era has grown rapidly, exceeding one million in just three months, and the number of ETH on the cross-chain bridge has also reached a new high, exceeding 530,000, from the ETH balance of each address, 60.4% of addresses have a balance lower than 0.1ETH, 29.7% of addresses have a balance between 0.1-1ETH, 9.5% of addresses have a balance between 1-10ETH, and only 0.4% have a balance exceeding 10ETH. Looking at the distribution of the independent address balances in zkSync Era, it is clear that most users are sheep attracted by the zkSync Era token incentive.

Due to the lack of star projects such as Uniswap and AAVE on zkSync Era, it is difficult to lock in large amounts of funds. The vast majority of users are here to make quick profits, especially since zkSync has clearly stated that it will release a token, which has attracted a large number of airdrop speculators and led to an explosive growth in the number of independent addresses.

Currently, there are limited projects worth participating in on zkSync Era, mainly DEX and lending projects with high TVL rankings. The Dex leader Syncswap is currently ranked first in terms of lock-in volume on the network, with a quantity of 68.92 million US dollars, and the key point is that it has not yet issued a token.

Issues with zkSync Era

As the first zkEVM project to launch on the mainnet, zkSync Era has exceeded one million independent addresses in just three months, more than all other mainstream Layer 2 projects combined, and TVL has also experienced explosive growth. However, its problems are also very obvious:

1. The project is still in its early stages, and although many cooperation projects are listed on the official website, there are not many high-quality projects that have actually gone live. Even SyncSwap, compared to GMX on Arbitrum, still has a long way to go, and the number of native projects that have gone live is not large, and the quality is also uneven, making it difficult to quickly accumulate TVL.

2. For native projects that rank high, DEX and lending are the main focus. These protocols do not have any unique competitive advantages compared to existing projects on the market. For users, there are not many reasons other than token airdrops to use them. Once the expectations disappear or are fulfilled, how to continue to maintain TVL growth is a problem that needs to be considered.

3. Compared to Optimistic Rollup projects such as Arbitrum and Optimism, ZK Rollup projects are much more difficult in terms of technical development, especially the compatibility of DApps on zkSync Era and the Ethereum mainnet. However, with the advancement of zkEVM technology, this problem may gradually be solved.

Opportunities and Future of zkSync Era

Overall, the Layer2 ZK market is still in a fiercely competitive stage. In addition to zkSync, StarkWare, Scroll, Ploygon EVM, Aztec, etc. all belong to this category. Although ZK Rollups currently face technical difficulties, when they are running on a large scale, the entire crypto ecosystem and even the world will make substantial progress based on this technology.

In the face of Ethereum’s trilemma, although many projects are trying to bring scalability to the chain, each solution and technology has its own unique trade-offs and use cases. zkSync Era chooses to maintain the compatibility of the source code (Solidity and Vyper), which brings additional security advantages. When the project is deployed on L2, EVM projects do not need to make any code changes, reducing the risk of vulnerabilities and attacks.

Currently, many projects on the zkSync network are still in the early stage, with low project quality and no high APY support, making it difficult to retain user funds. In the future, zkSync needs to continue to expand its application ecology, encourage more project parties and developers to join zkSync, and further promote the development and application of zkSync.

Summary

With the continuous development of Ethereum technology, the competition of zkEVM is becoming more and more fierce. As one of the most promising and promising public chains in the ZK track, zkSync Era needs to consider how not to let its ecology be overwhelmed by rug projects, and develop and support some background and strong projects.

zkSync Era has shown great performance and efficiency in the recent past. It will take a lot of time for zkSync Era to truly thrive. As the zkSync ecosystem continues to expand, we look forward to zkSync 3.0 bringing even more surprises in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reflections One Month After Montenegro EDCON 2023: Forward-looking Trends in Infrastructure and Applications

- Can you earn money by running a node? How to choose a public chain? We talked to a node operator about it.

- Interpreting the Narrative of HOPE’s Resurrection

- Artificial intelligence data analysis tool KyberAI

- Azuki Elementals sold out within 15 minutes and the floor price has dropped to 1.62 ETH.

- Can Reserve kickstart its growth engine with a $20 million investment in the Curve ecosystem?

- Azuki, who earned 20,000 ETH, has angered the entire community this time.