Can Web3 games escape the SEC’s sword dance?

Can Web3 games avoid SEC regulation?Author: Simon @IOSG Ventures

Ever since its inception, the electronic gaming industry has always been a high risk, high reward industry. The global gaming market has reached 350 billion dollars and is still growing rapidly, attracting countless practitioners. In the traditional gaming industry, the dynamic game between the industry and regulation, from the prevention of underage addiction to the definition of gambling, has always been the grass-roots development of the industry.

For web3 games, the addition of more financial elements and SEC regulatory intervention will only make the issues that practitioners need to face more complex. Facing regulation, there is only more to be done.

Starting from the point of web3 games, this article explores the points to be aware of under the US regulatory system from aspects such as product design, business model building, operation, and release:

- DeFi “cleaner” Poop: Recycle users’ worthless coins and aim to achieve “only rise and no fall”

- Can OP Stack, the competitor launched by zkSync, win the battle of L2 scaling?

- Deep | Former Harmony Employee Reveals Management Chaos Behind the Struggling Public Chain

All of the following are not financial/investment advice, but it is recommended that founders and teams discuss and research them.

What are Securities & Why Do They Matter?

Compared with other products, the R&D cost of games is high. In the traditional gaming industry, game developers commonly use financing methods such as financing from publishers, selling equity to VCs, and financing from angel investors. Web3 allows game makers to finance from the general public in addition to crowdfunding platforms: selling tokens/NFTs.

New financing methods bring new paradigms and provide new living space for small and medium-sized developers, but they also bring new troubles to financing. For example, the attitude of many crowdfunding platforms and publishing platforms towards digital assets, the applicability of various securities definitions to tokens, and various uncertainties have caused many traditional game investors to have many concerns about web3 games.

Howey Test

If a game’s token is deemed a security, it will be subject to the jurisdiction of the SEC, and who can sell these tokens and how many can be sold will be directly constrained by relevant regulations. The most direct impact on tokens is that these tokens cannot be traded on compliant centralized exchanges in the United States. Regarding the definition of securities, the Howey Test cannot be ignored.

The Howey Test is used by the SEC to determine whether a cryptocurrency should be classified as a security. Regulations will judge from three aspects: investment currency, joint venture, and expected profit. Specifically, it assigns a score to a project, and the higher the score, the more similar the nature of the token is to a security. Once it is recognized as a security, it means that the token needs to be subject to the same strict supervision as a security, the issuance threshold is much higher, and if the issuer does not meet the qualifications, it will also face serious legal risks.

Most blockchain projects, including Ethereum, are trying to avoid risks and prevent their cryptocurrencies from being classified as securities by obtaining a low score on the Howey Test.

The Howey Test is based on four factors:

1) Investment of money;

2) In a common enterprise;

3) With an expectation of profits;

4) From the efforts of others.

Note that the Howey Test has not been directly adopted by the courts and is only used for reference. When a blockchain project claims to have passed the Howey Test, it usually means that it has obtained a low score and will not be considered a security, and that the project complies with US law. Finally, the so-called “passing the Howey Test” by the project party is generally a corporate behavior of a law firm, rather than being recognized by a US court.

Game projects often establish different entities to comply with regulations. This includes establishing a coin issuer and an operator (marketing, research and development, operations, etc.) offshore in the US. However, independent entities cannot completely avoid regulatory risks. In practice, the SEC considers all active blocking participants in the securities issuance, including all third-party affiliates. Establishing different operating entities and coin issuers cannot escape the jurisdiction of the SEC. Since this kind of “block the ears and steal the bell” approach is not feasible, let us face the problem. From the perspective of the Howey Test, what are the specific risks?

#1: An Investment of Money

This is the simplest and easiest test condition to meet. If game coins, game assets, game content are sold to players, or if these things are simply airdropped/gifted to players, as long as the project party benefits directly/indirectly (such as a promotional email requiring the recipient to follow the game’s Twitter account to get a game discount code), it meets the requirement of an investment of money.

#2: In a Common Enterprise

Investing in a common enterprise means whether the interests of participants are tied together. This usually means that:

1. There is horizontal commonality of interests among investors;

2. Commonality of interests between investors and issuers (vertical)

1. Commonality of interests among investors (horizontal)

Meeting this requirement usually requires investors to put their investments in the same pool, sharing profits and losses. For games, some may say that NFTs in the game are unique assets and their ownership belongs to a single investor. The returns/losses of investors with different pairs of stepn shoes are independent of each other, which refutes the argument that NFTs in games are not securities. However, in Dapper Labs’ case, regulators said that NBA top shots NFTs were actually collected by the issuer into a collection and attracted more attention and buyers in this form. In this operation, as long as the floor price goes up, all investors in this series of NFTs benefit jointly, and vice versa. Therefore, the argument that there is no commonality among NFT investors does not hold.

2. Commonality of interests between investors and developers (vertical)

In Web3 games, there is also an alliance of interests between investors and project issuers, and the relationship between the two still exists after the purchase of NFTs. Most game NFT issuers can benefit from secondary market royalties. When the price of NFTs is hyped, the issuer’s profits will also increase, and may even be more lucrative than primary sales. Many game projects also set up their own marketplaces and take a commission from them. The NBA top shot example is also illustrative: developers not only receive royalties, but also benefit from the commission of their own marketplace. Therefore, any price increase in this collection will directly benefit Dapper Labs.

Game developers/NFT issuers will continue to benefit from the assets sold/issued.

#3: With the Expectation of Profit

This one is relatively ambiguous. Do game players expect to profit from buying assets? Has the project team clearly designed a mechanism for income? Regulators generally evaluate this based on product design, marketing information, player profiles, purchasing motivations, and input costs. It is very important whether marketing emphasizes “play-to-earn,” “p2e,” “subsequent dividend rights,” and other information. In addition, the reasonableness of the buyer’s profile and the reasonable amount of assets sold will also be taken into consideration.

“What? Someone spent a million dollars buying 80% of the skins in your game and they’re not even a player?” That’s suspicious. In the case of Telegram, many holders of Grams Tokens were not potential users (of course, how to define this is also ambiguous), but rather VC and other speculators.

It is worth noting that

1) compared with clear revenue design, the appreciation of the asset itself will not be regarded as expecting profit. For example, recently the gun skins in CS GO have skyrocketed, but owning gun skins does not generate income (such as dividends), and the profit from secondary market resale cannot be considered expecting profit.

2) If the buyer is making a profit from the asset through their own efforts, then this can also be circumvented. For example, Xiaohong rents stepn’s running shoes to Xiaoming outside the venue, which is not part of the project’s revenue design.

NFT royalties, marketplace fees, game revenue sharing, and NFT mining are all common basic operations for many gamefi projects to attract web3 users. However, many projects openly emphasize these functions during the financing stage, as if holding up a sign to announce to regulators that we are the issuer of securities.

#4: From the Efforts of Others Not directly involved in operations, relying solely on the efforts of initiators or third parties

Finally, as mentioned above, regulators will also consider the degree of dependence of buyers on the issuer if they need to profit from the asset. In other words, the more the price of the NFT depends on the issuer’s operation or the success/failure of the game, the more it will resemble a security. In the context of games, this can be said to be hitting the nail on the head.

In addition to the usual dependence of token prices on project parties, the price of game props is highly dependent on the utility provided by the game. Even many times, when tokens are issued, the game itself has not been developed/launched yet. At this time, the price of the asset can be said to be 90% dependent on the project party rather than the user’s personal efforts.

However, from this, we can think of some countermeasures that game teams can use:

Including but not limited to making users put in more personal effort before making a profit: participating in “staking” before making a profit, completing certain tasks/growth goals in the game, etc.

Or avoid issuing tokens too early and issue them when the game is mature.

Alternatively, increase the utility of assets in other cases: for example, they can be used in games of other companies. This can somewhat reduce the dependency of asset buyers on the issuers.

Off-topic: A fully on-chain game with enough decentralization is also a potential solution.

However, developers do not need to be overly cautious. The conclusion of Howey Test is based on case & event, which means that the result of Howey Test only affects the qualification of a certain token in a certain asset issuance, and has no impact on other tokens of the same type. If $GMT is judged as a security someday, it does not mean that the governance tokens of all dual-token models are securities.

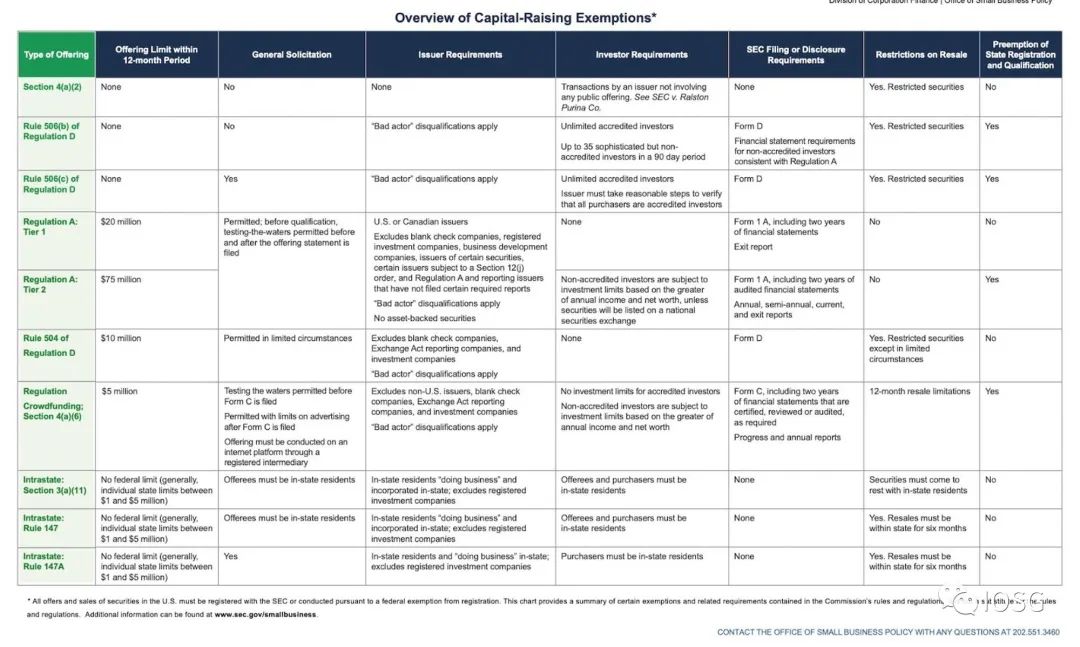

“Design compliant token models from the beginning” and “Avoid issuing tokens that may be qualified as securities” are highly cost-effective for issuers. But if you want to choose a safer financing method, you can directly design the financing structure according to the SEC’s regulations. It specifies in detail how many times a company can issue securities, how much money it can raise, who it can sell to and how much, information disclosure obligations, investor protection obligations, and so on.

Source: www.sec.gov/education/smallbusiness/exemptofferings/exemptofferingschart

Dancing on the Edge of a Knife: Pitfalls to Avoid When Designing Tokenomics

Fungible Tokens (FT)

First, let’s briefly review the common design of FT tokens in the industry: Web3 games usually adopt a single-token model or a dual-token model.

In the single-token model, the unique token has two ultilities: governance and in-game consumption.

In the dual-token model, the two ultilities of governance and in-game consumption are allocated to two tokens. The governance token generally has a fixed supply, and theoretically, its owner can participate in decision-making in the development/operation of the game to some extent. The ultility token generally does not have a fixed upper limit and is used as a circulating/pricing commodity in the game.

However, before deciding how many tokens to issue and what the supply is, developers should carefully consider the actual functions of each token/NFT and how the value capture and distribution of the project will be implemented.

Designing the token economy from the perspective of easy manipulation alone will only expose the project to more regulatory risks.

The project team needs to reassess, including but not limited to:

-What is the necessity of each token?

-Are the buyers of these tokens consumers/real players in the game?

-Although the issuers of the two tokens are the same, if the core design of the game can bypass some sensitive regulatory aspects, it may not be necessary to issue two tokens. Why add risks to the project?

Governance tokens are usually sold to retail investors through private sales/IEO and other financing activities, while utility tokens are obtained by players in the game after completing certain in-game tasks. Under the requirements of the Howey Test, the issuance method and holders of utility tokens are relatively less like securities. However, is it enough to simply design the token as a utility token?

Unfortunately, in order to regulate the lifecycle of the economy and prevent gold farmers from excessively draining the value of utility tokens, the development team often needs to step-in and adjust gameplay mechanics after the game goes live, affecting the production and consumption methods and quantity of tokens to maintain price stability – this also conflicts with the last criterion of the Howey Test, “From the Efforts of Others”.

Simply choosing or discarding past token models is not enough to face the pressure of current regulation.

Non-Fungible Tokens (NFT)

NFT applications are also very common in web3 games, from characters and skins to land and buildings that mimic real-world assets. At first glance, these digital assets are far from securities. As analyzed above, the non-fungible nature of NFTs gives them some resistance to the Howey Test. However, it should be noted that for certain series, individual NFTs are still highly fungible, such as some repetitive materials (Mahjong, Poker NFTs) that exist in large numbers in some games, which may be regarded as a common enterprise by regulators, even for a single NFT. And with the development of NFTFi and the fragmentation of NFTs, NFTs are gradually becoming more homogenized, making them more like securities.

There is another noteworthy point. In the first generation of Gamefi, many games treated NFTs as a threshold for entering the game, as well as a tool for gold farming. Players need to purchase Axies or running shoes (invest a certain amount of cost) to experience the game.

This type of upfront investment increases the investment attribute of purchasing NFTs, making the tendency of buyers to expect profit more obvious. Rather than using NFTs as a threshold, like limitbreak, it is more desirable to make the game look free-to-play/free-minted.

Another feasible design is to make the NFTs in the game have a lifespan-as time/use wears on, its value will gradually decrease, or periodically reset the game’s economic system. Like in Tarkov, Battlestate Games periodically resets the game’s economy, and in Zelda, most weapons wear out with use. These designs can reduce the tendency of buyers to expect profit.

Extended Discussion

SAFTs

SAFT is a common financing method for projects, and game projects are no exception. When combined with the situation of Howei Testing, the situation of SAFT becomes very ambiguous.

In theory, in SAFT, token purchases are divided into two steps. Investors first get an agreement that they can buy tokens in the future, and then after the TGE, investors get the tokens. Therefore, at first glance, there is reason to believe that the token itself is not a security.

However, in practice, referring to the Telegram case, the court will consider that Howei Testing needs to be applied when signing the SAFT, not at the time of the TGE. That is to say, all agreements signed around the token will be taken into consideration.

Using tokens already issued on the market

The Securities Act of 1933 and the Securities Exchange Act of 1934 regulate companies with more than $10 million in assets and 500+ shareholders. So, can Web3 game companies find a token issued by a private entity that does not meet the above requirements and use it as their own token?

Perhaps this operation can prevent Web3 companies from becoming issuers of securities. However, the cost is that game companies need to trust the compliance capabilities of third parties and relinquish some of their value capture capabilities. Therefore, it is recommended to conduct the most detailed due diligence on the token issuer.

Insights

1) Game project parties should pay attention to regulatory risks, and future dealings with regulations will be the norm in the industry. As a product with a large user base facing consumers, games will definitely be on the cutting edge. Try to leave room for maneuver in product design, rather than issuing coins for the sake of issuing coins.

2) Pay attention to decentralization of the project’s economic system and product operation. This is not just a marketing gimmick or a story to tell the community. It is also a safety cushion for the project when facing regulation.

3) From any perspective, Game-Fi seems to be a high-risk business. Game-Fi may be a validated model, but it is not suitable for the current environment. If possible, even if it is more difficult, focus on more interesting innovations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can OP Stack, the competitor launched by zkSync, win the L2 scaling battle?

- Introduction to ZK Stack by Matter-Labs – Building a modular framework for ZK-powered sovereign chains

- Application of liquidity in PoS: Examples of Berachain, Tenet, and Mangate

- Inventory of 11 Celebrity Cryptocurrency Scammers: Jake Blockingul, Floyd Mayweather, John Wall…

- Application of Liquidity in PoS: Examples from Berachain, Tenet, and Mangate

- Interpretation of How to Earn Profits with PENDLE

- Introducing two new NFTs launched this week: Ether and Azuki Elementals.