Jianan Yunzhi's performance has increased, or is missing the best time for "mining shift"

On the evening of April 9, Jia Nan Yunzhi, who landed on Nasdaq less than half a year, issued his first "transcript."

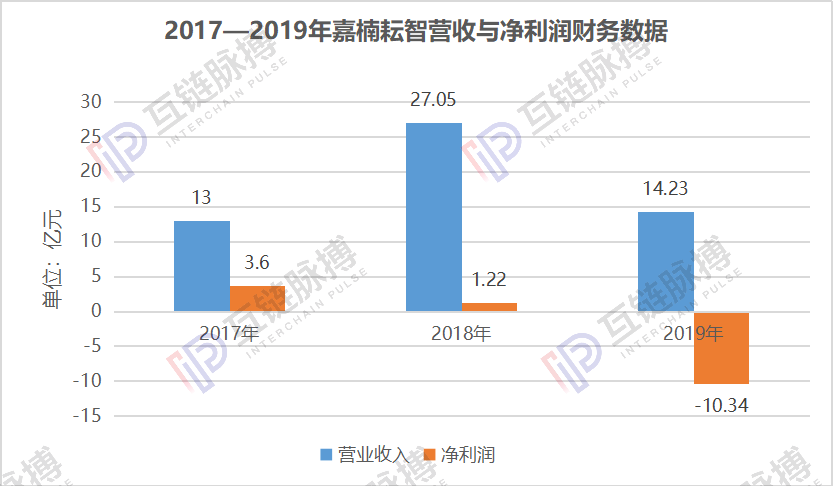

According to the 2019 financial performance report (unaudited) released by Jianan Yunzhi, the company's annual operating income is about US $ 204 million (about RMB1.423 billion), a year-on-year decrease of 47.41%, and a net loss of about 1.49 in 2019 100 million US dollars (approximately RMB 1.034 billion).

Judging from the performance of last year, Kanan Yunzhi's revenue not only fell back to the 2017 level, but the net loss was a record high.

Although Jianan Yunzhi explained in the financial report, the main reason for the company's full-year revenue decline in 2019 is the decline in the price of mining machines caused by the decline in Bitcoin prices.

- Onion model of blockchain security: additional security is added at each layer

- A picture of the central bank's digital currency DCEP "Past Life and Life"

- Financial decentralization: Can DeFi replace traditional finance?

But in fact, the impact of currency price fluctuations is not the root cause of its loss. The larger bottleneck currently faced by Jianan Yunzhi is that competitors such as the Shenma mining machine will come up later, and because the 7nm chip mining machine has been unable to mass produce, 8nm chips With insufficient supply of production capacity, Jianan Yunzhi is missing the best time for "mining shift".

The performance change face intensified, Jianan "lagging behind"

In the 2019 prospectus, Jianan Yunzhi's performance once showed signs of recovery.

The prospectus shows that in the first three quarters of 2019, Jianan Yunzhi's operating income was 47.218 million yuan, 240 million yuan, and 670 million yuan respectively; the first three quarters of net profit were -678.57 million yuan, -263 million yuan, and 94.625 million yuan, respectively. Yuan, by the third quarter has already achieved quarterly turnaround.

But in the fourth quarter, performance losses began to intensify again. The financial report shows that in the fourth quarter of 2019, Jianan Yunzhi achieved operating income of 463 million yuan, a decrease of 30.9% from the previous quarter; not only that, its net loss in the fourth quarter was as high as 798 million yuan. Among the net losses in 2019, The proportion in the fourth quarter was 77.2%.

Why did Jianan Yunzhi's "performance change face" so quickly after going public?

In the financial report, Jianan Yunzhi gave two explanations: One is the substantial increase in revenue costs in the fourth quarter of 2019. The increase was mainly due to a write-down of 729 million yuan in inventories and advances. This is due to the fact that the price of bitcoin has fallen sharply throughout the issuance of financial statements, leading to a decline in the demand for mining machines and the price of mining machines.

This means that in the fourth quarter of last year, Jianan Yunzhi cleaned up a large number of products at low prices. In fact, since the beginning of 2019, Jianan Yunzhi has been destocking. According to Wu said that the blockchain previously reported that the inventory of Jianan Yunzhi at the end of 2018 was 585 million yuan, and the inventory at the end of 2019 had dropped to 196 million yuan. Analysts believe that a large amount of dumping inventory is one of the main reasons for its revenue level decline.

In addition, in terms of supplier prepayments, upstream chip suppliers' fabs generally give priority to customers who pay in advance. After the chip supplier of Jianan Yunzhi changed in the fourth quarter of last year, in order to speed up greater computing power. For mass production of machines, Jianan Yunzhi needs to pay more advances to the new upstream fab, which further increases quarterly operating costs.

In addition to the increase in operating costs, another explanation given by Jianan Yunzhi is that in 2019, Jianan Yunzhi spent an additional RMB 247 million in equity incentive fees.

However, the inter-chain pulse noticed that in addition to the above two internal factors, in terms of external competition, the challenge that Jianan Yunzhi had to face was that in 2019, the rapid rise of Bit Weishen Ma mining machine robbed many mines. Market share.

The sales director of Shenma Mining Machine Zhang Wencheng revealed at the event hosted by the Yinyin mining pool earlier this year that the company's flagship product WhatsMiner M20 series sold about 600,000 units in 2019. Computing power.

The current computing power of the entire Bitcoin network is about 116EH / s. According to this calculation, 600,000 Shenma mining machines contributed more than 30EH / S to the Bitcoin network in 2019, accounting for about 25.9% of the computing power of the entire network %.

According to the financial report data, the total computing power sold by Jianan Yunzhi in 2019 is 10.5 million Thash / s. According to this calculation, the total computing power sold in 2019 accounts for only 9.1% of the total network computing power, and almost only Shenma Mine One third of the machine.

In addition, according to Wu said that the blockchain reported at the end of last year, in 2019 Jianan Yunzhi's revenue was only a quarter of the Shenma mining machine, and about one tenth of Bitmain. If the reported revenue data is true, Jianan Yunzhi ranks second among the world's three largest mining machine giants and will probably be shaken.

Mass production of 7nm chips is blocked, missed the best time for "mining shift"

However, the greater challenge facing Jianan Yunzhi is that due to the delay in launching its 7nm chip mining machine and the insufficient supply of 8nm chip production capacity, Jianan Yunzhi may have missed the best time for "mining shift".

In August 2018, Jianan Yunzhi preemptively released the TSMC 7nm process mining machine chip, and said that the chip will be used in the Avalon A9 series mining machine. But until now, its mining machine products have iterated to the A11 series, and no 7nm chip mining machine has been officially released and sold.

Not only that, Jianan Yunzhi's A10 series products have returned to the 16nm process chip. According to its prospectus, its latest product, the A11 series, does not use 7nm chips, but uses 8nm chips that are suspected of Samsung.

However, due to the trade war between Japan and South Korea since the second half of last year, the photoresist has been embargoed by Japan, and Samsung's chip shipments are very limited, or it will affect its large-scale mining machine shipments. At least for now, the A11 series miners on Avalon's official website are no longer in stock.

In contrast, Bitmain's 7nm mining machine has been rapidly iterating. Since the first generation 7nm ant mining machine S15 was launched in 2018, the second generation 7nm chip mining machine S17 was launched in 2019. In March of this year, Bitmain iteratively launched the S19 series mining machine with greater computing power and lower energy efficiency ratio.

More importantly, Bitmain has almost monopolized 7nm mining machine chip production capacity. According to industry sources, TSMC and Bitmain have signed a secret betting agreement on 7nm chips, and their 7nm chip production capacity is no longer available to other mining machine manufacturers. And this is the main reason for the chip supplier changes in the second half of last year.

In addition, even in the field of 8nm chip mining machine, Jianan Yunzhi still has to face the competition of Shenma mining machine M20S and M30S series mining machines. These two series of mining machine products also use 8nm process chips, and their upstream The round factory suppliers, like Jianan Yunzhi, are all current Samsung with difficult chip shipments.

For the 5nm process chip that Jianan Yunzhi has high hopes for, TSMC is currently taped out, but since the four iphone 12 series phones that Apple will launch in the second half of this year also use the TSMC 5nm process, it has already covered TSMC three Two-thirds of 5nm production capacity. In addition, some professionals said that the chip taping process is relatively long, and it may take 12 months for the chip to reach mass production. Therefore, it may be difficult for TSMC to provide sufficient 5nm chip production capacity in a short period of time.

But it is worth noting that at the moment when Bitcoin is halving for the third time and the Sichuan flood season is coming, the entire mining industry is also entering an inflection point. The era of depleted mining machines is coming.

For Jianan Yunzhi, if the chip technology research and development capabilities and large computing power mining machine shipment capacity can not keep up with competitors, it may miss this round of "mining shift" the best time.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- See how this 80-year-old coffee brand has fun with blockchain

- Popular Science | Use the overlay to change the format of the Ethereum state tree

- One article to understand the latest research and development progress of Ethereum, zero knowledge proof, sharding and other topics

- Topaz, the first testnet with Eth2.0 Phase 0 mainnet configuration, has been released

- The central bank's digital currency is ready: the wallet is undergoing internal testing, and related concept stocks have risen collectively

- The central bank's DC / EP beta is out, and we guessed about these functions …

- Observation | A picture to understand the Ministry of Industry and Information Technology's blockchain standard commission