Looking at the blockchain from Ripple for ten years: How will the phased revolution of digital finance begin?

Recently, foreign media reported that the US blockchain startup Ripple is undergoing major brand rebranding. The company removed almost all of its application cases for its three major cross-border payment products, xCurrent, xRapid and xVia, from its website.

Some commentators said that Ripple is gradually shifting its focus to RippleNet. RippleNet connects more than 200 companies using Ripple's cross-border payment technology, and most of these customers originally used the payment system xCurrent.

For XRapid, an XRP-based payment solution, Ripple has renamed the technology using On-Demand Mobility (ODL). Ripple's third major product, xVia, has also been removed from Ripple.com.

Ruibo Company & Ruibo Coin

Ripple and Ripple use the same Ripple name, although the relationship between the two is extremely close but also different.

- PayPal withdraws from Libra, Visa and MasterCard hesitate, and the digital currency of Facebook is yellow?

- Bitfinex and Tether are mired in litigation, and investors say they create "the biggest bubble in human history."

- Babbitt's first launch | Deng Jianpeng: The Enlightenment of the International Practice of "Regulatory Sandbox" to the Blockchain Industry

It is also based on the development of blockchain technology. Ripcoco is launched after Bitcoin. It maintains distributed ledgers by servers in the network, and servers are shared with financial institutions such as banks. Similar to Bitcoin, Ripple coins exist in the Ripple blockchain network and are a currency without counterparties.

In the second half of 2018, Ripple soared in a short period of time, and the market value jumped from the third to the second. In addition, the application of blockchain technology became popular, and the term Ripple triggered global attention.

Ripple is a blockchain startup that specializes in providing blockchain open payment network services to banks. Ripple is the base currency of the Ripple payment network and can be circulated within the network.

Ryan Fugger, a software developer in Vancouver, Canada, invented the RipplePay payment protocol for Internet payments in 2004. RipplePay allows for the transfer of various currencies or currencies such as gold and airline miles. Users can transfer instantly and without Any intermediary.

Eight years later, Ripple was formally established, initially named OpenCoin, and later changed to Ripple Lab.

In 2013, the company officially changed its name to Ruibo, and its focus became the main focus on cross-border remittances. It cooperated with banking financial institutions to integrate the Ruibo agreement into the existing financial IT system. The partners include American Express, Royal Bank of Canada and Accenture.

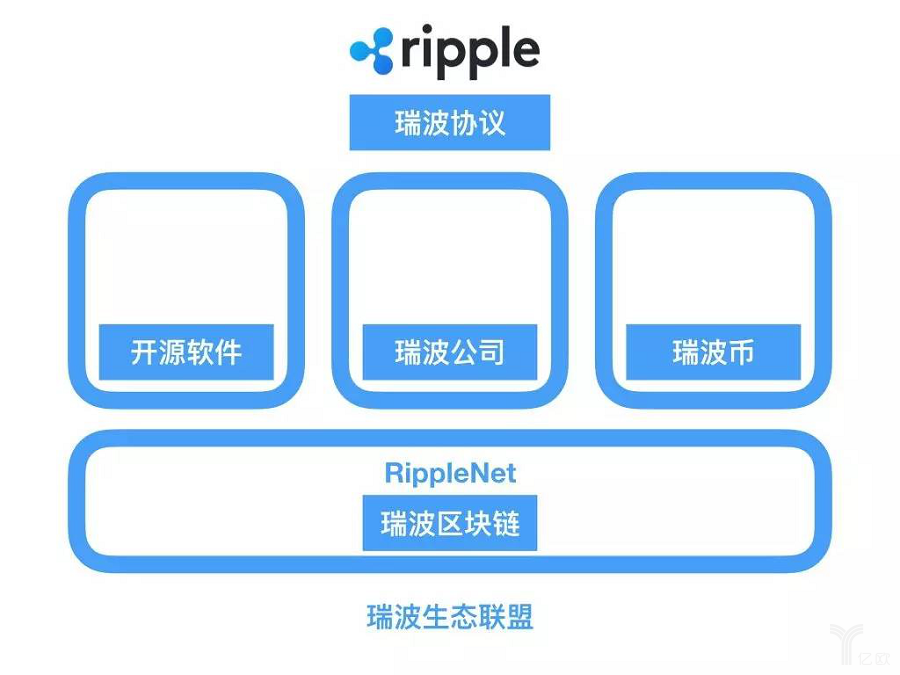

At this point, Ruibo has evolved from a payment agreement to the following ecology:

Ripple offers three solutions to help financial institutions or companies access the Ripple blockchain network:

- Assisting banks in handling xCurrent for global payments;

- Help the payment provider to provide liquidity xRapid;

- xVia for ordinary companies to access Ruibo.com for payment.

Cross-border remittances do not really involve the cross-border flow of funds, but mainly rely on the SWIFT system for information transfer, thereby liquidating, and the banks subsequently update the books and complete the settlement of funds. This leads to a long process, involving a large amount of processing costs and capital precipitation costs.

Take the xCurrent settlement system as an example, which uses SWIFT communication and real-time settlement based on blockchain to reduce the cost of cross-border remittances.

In September 2018, Ripple officially entered the Chinese blockchain payment market. The specific partners are unknown. Foreign media said that Alibaba may become its first choice. Prior to this, Ripple's blockchain network had grown to 55 financial institutions, including Japan's MUFG, Spain's BBVA and Sweden's SEB.

In September 2016, Ripple received $55 million in Series B financing with investors such as Andreessen Horowitz, IDG Capital Partners, and AME Cloud Ventures.

Andreessen Horowitz, also known as A16Z, is a Silicon Valley venture capital firm that also participated in a $250 million financing for Stripe, a payment solutions provider in the US, in September.

Stripe is an Internet company that entered the mobile payment field earlier. Its partners include Airbnb, the world's largest home-based operating platform, Lyft, one of the two largest online car companies in the US, and Shopify, an e-commerce company. Stripe has long been one of the most valued unlisted internet finance companies in the United States, and its valuation has soared to $35 billion after this round of financing.

Blockchain development has repeatedly hit the wall

In September 2019, there were 12 typical security incidents in the blockchain ecosystem, including EOSPlay suffered a new random number attack, the fund disk project FairWin smart contract rights management defect, EOS blacklist account craigspys211 using the new BP blacklist defect transfer Typical security incidents such as 19.99 million EOS.

In addition, supply chain attacks against the blockchain ecosystem are increasing. The attack on the digital currency wallet Agama build chain disclosed in July, the URL hijacking attack on the digital currency market/navigation station disclosed in August, the third-party statistics for the exchange disclosed in September, and the malicious code implant of the customer service js disclosed in September. Wait.

In the early stages of blockchain development, companies that chose low-cognitive costs and meet the bottom-level needs of humanity would be more likely to gain public recognition and participation, so exchanges, gambling, and games became the “hot potato” in the early stages of the blockchain.

Take the EOSplay event as an example. It is an online quiz platform based on the EOS public chain. Currently, four games, lottery, cattle, dice and slots are open on the platform. Although the use of blockchain technology can open up system source code, display underlying algorithms, real-time chip settlement, etc., but while improving transparency while ignoring security, many blockchain projects have been transferred by hackers through loopholes. Tokens come to get huge profits.

Take Komodo (KMD) as an example. According to CCN's June 7 report, the cryptocurrency platform Komodo found serious security holes in its wallet. Although the hacker has not broken through the security hole to steal the user's private key, the Komodo team saved a loss worth about 13 million US dollars, but it did cause Questions about the "decentralized" nature of cryptocurrencies.

Globally go to "chain governance"

Yao Qian, deputy secretary and general manager of the China Securities Depository and Clearing Corporation, pointed out in the 5th global blockchain summit on September 17 that digital assets and digital currency are the two most important aspects of the digital economy, and asset digitization will give birth. The financial retail revolution will bring more far-reaching financial changes. Any financial instruments, such as currency and securities, are “one-dimensional” on the underlying assets. The need to convert digital resources into value resources is also the key to digital assetization.

In 2019, the number of schools that opened blockchain courses and related research in the United States has risen from 3 to 52. On September 7th, at the blockchain technology innovation summit in New York, Facebook founder Mark Zuckerberg said that the US blockchain technology innovation and industrialization construction has achieved initial results, but currently in artificial intelligence, 5G industry zone The blockchain application has great potential for development. As the world's first project to invest in the 5G industry blockchain, the intelligent chain ATII will carry out in-depth cooperation with Facebook to develop the commercial application of the US blockchain in 5G.

In October 2019, CrossAngle officially launched its Xangle chain project announcement platform in South Korea . CoinNess, Korea's largest cryptocurrency investment information platform, immediately signed a cooperation agreement with Xangle. As of October 1, 353 blockchain projects have been registered on the Xangle platform. .

In the month, at the b.tokyo, the largest blockchain conference in Japan held in Tokyo, the founder of Japan’s largest exchange, Bitflyer, Ghana Yusan, gave a keynote speech on “How the Internet Value of Blockchain Changes the Future Society”, said in the block In the chain industry, Japan's development is relatively slow. 57% of Japanese companies have not started or have not yet touched the blockchain, but it is certain that Japan will continue.

In 2019, it was the tenth year of the birth of the blockchain. In the past ten years, the blockchain has only been able to realize digital currency transfer payments from the beginning, and can be developed to integrate with smart contracts, develop third-party blockchain applications, and nowadays cross-chain, sidechain, sub-chain and other technologies. Flourish.

Many commentators and scholars believe that the problem of blockchain is frequent because of the problem of the technology itself, so I hope to replace it. But no matter the emergence of any advanced technology, the most basic element that constitutes the smooth and healthy development of financial technology is still the "user." When users have a clear and rational understanding of blockchain technology, financial technology entrepreneurs can correctly explore and apply it, and at the same time impose effective supervision constraints, the existing setbacks will also become powerful boosters.

How will blockchain technology develop in the next decade? We will wait and see.

Source of this article: billion euros

Author: Guo Manqing

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The European Commission investigates Libra coins: asking for a lot of questions about financial stability to counter-terrorism

- Long text: the change of the encrypted asset exchange and the risk challenge

- Breaking through the field of lending, China and the West jointly explore the future and possibilities of DeFi

- The electronic version of the euro is coming out! Germany once again stressed the hope that Facebook will be far from the currency issue.

- Opinion | ETH is a reserve asset with a final value of several tens of trillion dollars

- Getting Started | Why Bitcoin is worth investing in

- Popular Science | Nine Questions Take You to Know the Past and Present of the Central Bank's Digital Currency