Breaking through the field of lending, China and the West jointly explore the future and possibilities of DeFi

The DeFi.WTF Meetup was held in Osaka as scheduled today. The WTF is a series of ancient Greek conference-style exchange debates. This is an open and inclusive exchange of ideas for practicing the ideas of ancient art: asking the right questions and gaining knowledge. Stay away from all the noise associated with hype and FOMO.

DeFi.WTF | Where will decentralization finance go?

DeFi.WTF is the first in a series of WTF conferences to track the emerging DeFi stack and explore the future and possibilities of DeFi through in-depth communication with key players in the DeFi space.

The following is a discussion of the topic of "Medium and West DeFi Meet". This is one of the topics of DeFi.WTF, and Zhenben will continue to follow up on other exciting issues.

- The electronic version of the euro is coming out! Germany once again stressed the hope that Facebook will be far from the currency issue.

- Opinion | ETH is a reserve asset with a final value of several tens of trillion dollars

- Getting Started | Why Bitcoin is worth investing in

The two guests were Camila Russo, founder of Defiant, and Diane Daisei, founder of CypherJump. Defiant is a weekly newspaper in the Defi field (not updated regularly). Diane is a specialist in the field of DeFi in China. It has compiled many foreign classics of DeFi.

The following is a dialogue compilation for two people.

When the Chinese and Western DeFi meet, Camila is on the left and Diane is on the right.

The DeFi group in the East and the DeFi group in the West seem to have great cultural differences.

These differences are reflected in the following aspects:

It seems that most DeFi happen in the West, but maybe there are DeFi projects in the East that we don't know; most DeFi users come from Western countries, while DeFi's Oriental users are more focused on centralized DeFi products; few Asians Investors focus on DeFi; for projects: large-scale adoption is more important than full decentralization; for users, how they make money through DeFi is the most important.

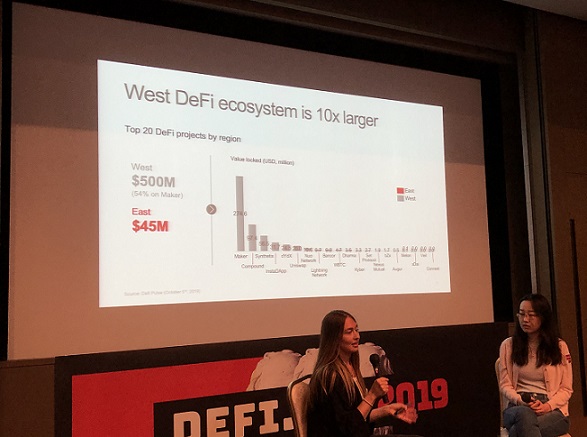

DeFi from the West is ten times more ecological than the East

In the Western DeFi ecosystem, the locked USD is worth $500 million, and 54% of the DeFi applications are based on the MakerDAO project. The USD value of the Eastern DeFi Eco is locked to only $45 million, and the list is only three: InstaDApp, Nuo network and Kyber. Among them, InstaDApp recently announced that it has received $2.4 million in seed round financing, including Pantera Capital, Naval Ravikant, former CIO of Coinbase, Balaji Srinivasan, Coinbase Ventures, IDEO Colab, Robot Ventures, Loi Luu, etc.

InstaDApp is an entry-level platform that aggregates other mainstream DeFi protocols to help users decide which types of assets or protocols to invest in on the platform. InstaDApp claims to have experienced explosive growth after the release of the agreement, locking in its smart contracts by nine times its value, from $4 million to more than $35 million, and is now locked in value rankings following MakerDAO and Compound. The third platform.

The unmanaged lending agreement Nuo Network platform currently has more than $2 million in crypto assets. If ranked according to the DeFi project counted on DeFi Pulse, Nuo Network has become the top five DeFi project in the US dollar, and is currently the largest lending agreement in Asia.

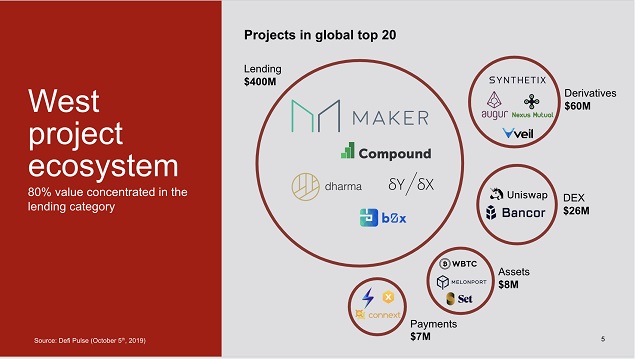

Western DeFi Eco Project focuses 80% of its value on lending

Most of the DeFi ecological projects in the East are issued.

You can link the above two figures to see the current DeFi in China and the West have certain problems. The main problem with the Western DeFi project is that too many projects focus on the field of lending, and many experts in the DeFi field are already worried about this, and there will be a subprime crisis similar to the encryption field. DeFi is more than just borrowing. In addition to borrowing, there are many things to explore and innovate.

The main problem with China's DeFi project is that it has sent too many useless tokens. The DeFi project has been proven through a large number of real-life cases: it works well without the need to issue coins. Joining the token economy model will have a negative effect, allowing users to pay more attention to speculation rather than Adoption.

The main investors in the global Top20 DeFi products come from Western countries

In the world of cryptocurrency, it is always strong and strong. You can see that the investment organization's coincidence is very high, whether it is the head project with a token model or the head project without a token model. From the above chart, we can see that there are several Western institutions that have the most power and wealth in the world of encryption and the most talkative rights: Polychain Capital, Coinbase, Andreessen Horowitz. For institutions, equity-based investments are sometimes better than the possibility of token-based investments and the ease of exit.

Eastern emerging Defi investment institutions

Investment from the Eastern investment institutions in the DeFi sector is catching up. A few projects worthy of your attention: Kava, the cross-chain DeFi project in the Cosmos ecosystem. The project's three top investment institutions in China, Hashkey Capital, SNZ and IOSG Venture, have invested. In addition, DForce, a stable currency project, is also worthy of attention. It is known as the MakerDAO of the East in the encryption of China.

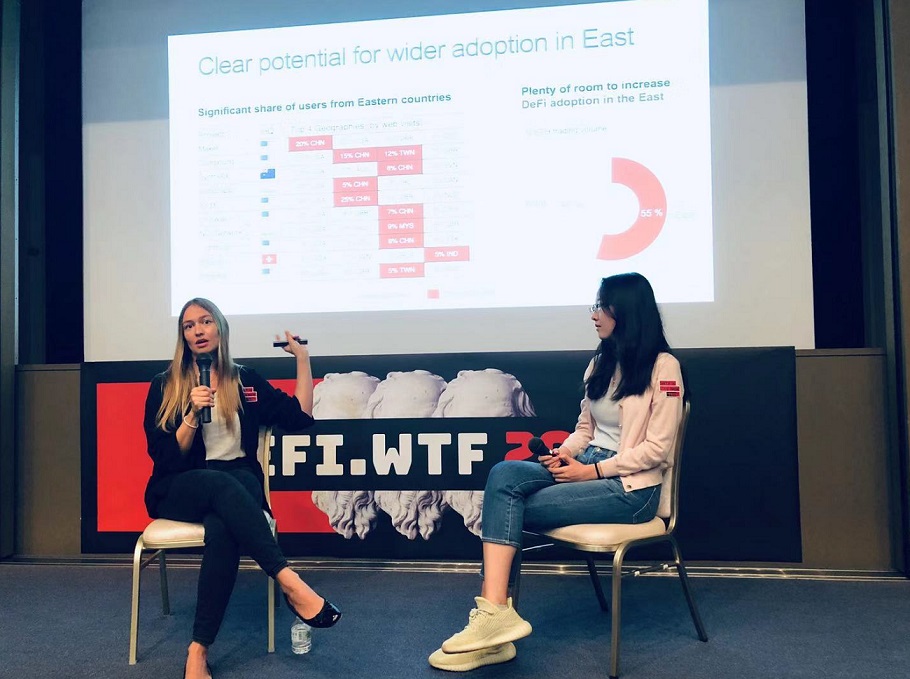

The East has significant potential for the adoption of DeFi

The East has significant potential for the adoption of DeFi

Defi still has a lot of room for development in the field of encryption. Looking forward to the joint efforts of China and the West, the entire DeFi ecosystem is becoming more and more abundant.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Popular Science | Nine Questions Take You to Know the Past and Present of the Central Bank's Digital Currency

- Samsung Payments works with RippleNet member Finablr to provide cross-border payment services to users

- Notes | 2019 cryptocurrency field most influential 100 people list released

- Research Report | How does the developing blockchain affect emerging markets?

- How to understand the layer 2 data availability solution ZK Rollup?

- 6 pictures tell you about the development status of the Asian cryptocurrency market

- Attract more people to buy Bitcoin, is it useful to change units?