Research Report | How does the developing blockchain affect emerging markets?

Continue with Chapter 1 "Blockchains – a new trust machine? After this article, this article continues to focus on the potential and barriers of blockchain, providing clearer guidance for the direction of companies in emerging markets. How should companies in emerging markets operate in the context of the enormous potential of blockchain technology and the need to overcome potential barriers to technology, regulation and organization? How can the huge potential of the blockchain system be released while overcoming its shortcomings? Therefore, they need to adopt an experimental method that enables them to develop different options to learn cognition, understand their strategies and increase their value proposition in the process.

It is difficult to predict all of its functions in the early stages of blockchain development. However, it is undeniable that it may have the greatest impact on the development of emerging market economies.

In 2016, Christian Catalini, Assistant Professor of Technology Innovation, Entrepreneurship, and Strategic Management at the Massachusetts Institute of Technology's Sloan School of Management, and Joshua Professor of Strategic Management at the Rotman School of Management at the University of Toronto. Joshua Gans proposed an economic framework to evaluate blockchain technology and its capabilities to assess the potential impact of current blockchain systems on the market by reducing verification and network costs.

Their papers concluded that when blockchains are combined with cryptographic assets, they can “self-guide” market operations without the need for traditional “trustees”, thus significantly reducing the network costs of participants.

- How to understand the layer 2 data availability solution ZK Rollup?

- 6 pictures tell you about the development status of the Asian cryptocurrency market

- Attract more people to buy Bitcoin, is it useful to change units?

The paper also found that open blockchains can have the most serious impact on market structure, which will challenge the market power of existing members and reduce the cost of joining new members. However, most early applications of blockchains may appear as follows:

(1) Value-added applications built on top of existing blockchains (such as Bitcoin);

(2) The efficiency of the financial service process is embodied as: a private or semi-private blockchain model;

(3) Provide a broader margin application process for empowering new markets.

The difference between the use of the public and private chains depends primarily on the type of service and the nature of the industry in which they are applied. Given the current lack of competitive market structures and high validation costs, it can provide a persuasive business case for blockchain technology in today's neglected or underserved markets. In design and implementation of relatively simple use cases, coupled with tested technical solutions (such as cryptographic assets), blockchain technology is likely to be adopted early (for example, adding digital asset payment options for wallets and cross-border payments) ). In addition, reducing the complexity of the organization and coordinating the form of projects within multiple database organizations will be another possibility.

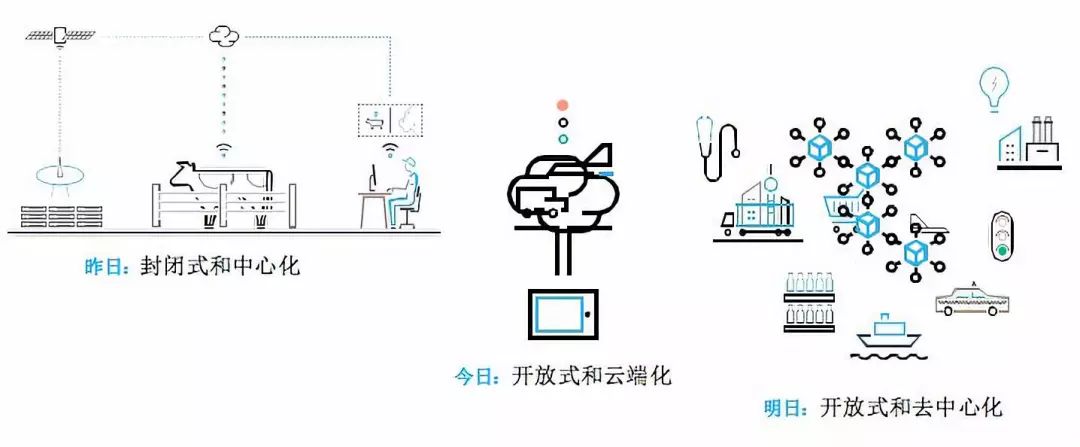

Image Information: IoT Blockchain Source: HP Enterprise Financial Services is expanding this collaboration to trusted counterparties to reduce costs through private blockchains. The traditional way of transcending traditional business and truly revolutionary blockchain solutions carry huge growth potential in the future, but its higher complexity and need to collaborate with stakeholders (such as well-designed financial instruments and smart contracts) ) may delay its adoption. Based on this assumption, many conditions that emerging markets need to meet, including high verification costs, people who are hard to reach, and in many cases can effectively prevent traditional new members from joining important markets, etc., mainly enable traditional industries to Faster blockchain technology.

Image Information: IoT Blockchain Source: HP Enterprise Financial Services is expanding this collaboration to trusted counterparties to reduce costs through private blockchains. The traditional way of transcending traditional business and truly revolutionary blockchain solutions carry huge growth potential in the future, but its higher complexity and need to collaborate with stakeholders (such as well-designed financial instruments and smart contracts) ) may delay its adoption. Based on this assumption, many conditions that emerging markets need to meet, including high verification costs, people who are hard to reach, and in many cases can effectively prevent traditional new members from joining important markets, etc., mainly enable traditional industries to Faster blockchain technology.

For example, in financial services, the infrastructure of almost all low-income countries is weak, and many of them have suffered from the crisis after the financial crisis. Fortunately, this barrier may accelerate the adoption of blockchains, as the lack of financial infrastructure also means less institutional resistance to new technologies and lower transition costs from traditional systems to new systems. Therefore, under the condition that the blockchain revolution will not destroy the existing market rules on a large scale, the regulatory agencies and existing financial institutions in emerging markets will not become the resistance of blockchain technology application.

Global payments and trade finance are examples of industry leaders and newcomers. Both have higher transaction and verification costs, and the blockchain can reduce transaction and verification costs by increasing speed, transparency, and processes. Especially in financial and banking services, the cost of customer acquisition is very high.

In addition, because of the widespread use of mobile services, especially in Africa and Asia, it provides a way for blockchain-based systems to extend other service offerings. Even in low-income countries, mobile penetration is very high, reaching 83% in the 16 to 65 age group. If the blockchain can manage to provide viable business models and proof of concept for payment methods for mobile banks and other financial participants, it will serve unprofitable customers and small and medium-sized businesses, generating up to 380 billion The extra income of the dollar has even contributed to the long-term development of financial inclusion.

As a result, blockchain may provide opportunities for emerging markets to go beyond traditional technologies, just like the mobile technologies of many emerging market regions, especially in sub-Saharan Africa.

1. Financial services

In the financial services sector, blockchain programs can be divided into two main categories. The first category is the principle of process efficiency, which occurs in countries with mature financial market leaders (usually in OECD countries). In this case, the blockchain project focuses on the gradual application of technology, and the consortium within the organization or R3, Hyperledger, and Digital Asset Holdings utilizes private or semi-private blockchains to improve process efficiency in existing business models.  The second category is the fundamentals of new market creation, where new market participants break through existing inefficient business models to create value in emerging markets. These can be start-ups from developed or emerging market economies, or large non-financial participants that seize opportunities to expand service value. Global payment or remittances and digital wallets are examples.

The second category is the fundamentals of new market creation, where new market participants break through existing inefficient business models to create value in emerging markets. These can be start-ups from developed or emerging market economies, or large non-financial participants that seize opportunities to expand service value. Global payment or remittances and digital wallets are examples.

Due to various factors, blockchain technology has formed an open network in this field and is supported by cryptographic assets (usually bitcoin), but it tends to be localized.

Such start-ups include BitPesa (Kenya), Bitso (Mexico), Remit.ug (Uganda), Satoshi Tango (Argentina), BitSpark (Hong Kong), OkCoin (China), OkLink / Coinsensure (India), CoiNnect (Mexico/Argentina) ), Rebit and Coin.ph (Philippines). There are also large players in this area, including MPesa, a mobile money transfer service launched by telecom giant Vodafone in Kenya, and an e-commerce company including Ali Pay, a subsidiary of China's Alibaba.

In this category, China is a notable participant, with companies with active operations in both segments (startups and established large players) located in Asia.

Reduce the institutional gap. The positive impact of blockchains in emerging markets can be not only technology but also institutions. From the perspective of governance and sociology, the transparency of the blockchain can also serve to bridge the “trust deficit” and urge the government to improve citizen services and force them to assume greater responsibilities.

For example, the Dubai government established the Global Blockchain Committee in 2016 to assist governments and industry to better utilize the technology to serve citizens.

2. Recent developments

According to data provided by research firm CB Insights, although there are no clear conclusions yet, some trends in capital and investment flows in the blockchain industry in 2016 indicate that larger companies and venture capitalists are targeting more complex financial applications and The growing focus on global diversification indicates that the industry is moving beyond the hype to a turning point:

1. While investment in the industry has remained stable ($550 million) compared to 2015, it is still impressive ($5 million in 2012) and its capital is concentrated in fewer transactions, which may mark investment The end of the bubble. 2. Corporate venture capitalists have actively entered the market. In 2016, their investment increased by 24% to US$52 million, indicating that the industry is moving forward with blockchain technology.

3. Financial services institutions remain the most active corporate investors, and major banks are also involved in investment.

4. Although the US still dominates the industry with a 54% market share, its share has declined as Asia's share has tripled (to 23%); Asia has become a global venture capital investment in major transactions. By.

5. As blockchain companies (including Mediachain, BitMark, Filament, SatoshiPay, and Cambridge Blockchain) expand from the financial services sector to the Internet of Things, identity management, and content distribution and supply chains, the industry has matured.

Blockchain Reform (Development): What is the next step?

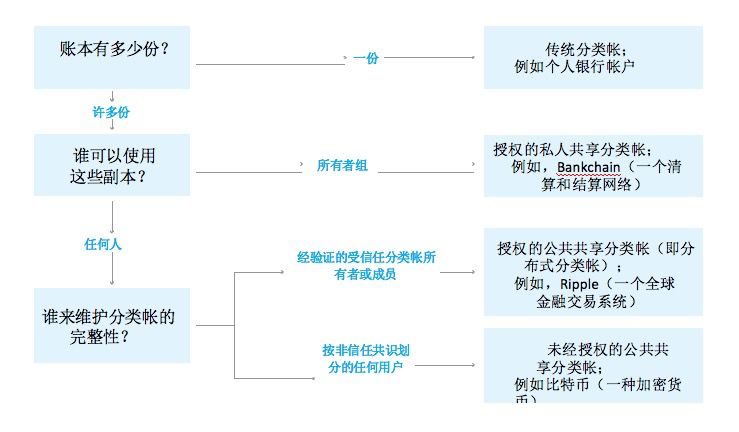

Distributed ledger technology aims to: correct certain technical limitations and promote internal forces to develop rapidly to promote the fourth industrial revolution with alternatives such as Ethereum and other destructive technologies. The combination of these innovative forces, including cognitive computing, robotics, the Internet of Things, and advanced analytics, will create the ideal conditions for changing the current economic infrastructure.  Image Information: Distributed Ledger Distribution Method Source: Consult Hyperion

Image Information: Distributed Ledger Distribution Method Source: Consult Hyperion

Smart Contract: The concept of “smart contract” introduced with the emergence of Ethereum reflects the second-generation blockchain platform that will separate the digital representation of assets on the chain from digital assets such as Bitcoin. In addition to demonstrating the high speed and efficiency of technology, smart contracts also demonstrate the ability to perform more complex and advanced tasks between parties. Unlike traditional contracts, smart contracts are embedded in code that can receive information and take action based on predefined rules. They can be used in a variety of scenarios, including transfer of property rights, settlement of financial derivatives, and copyright payments by artists. The biggest impact is expected to be a combination of smart contracts and the Internet of Things. Internet of Things (IoT): IoT platforms typically have a centralized model in which agents or hubs control the interaction between devices, which can be expensive and impractical. The blockchain can change this situation by decentralizing secure and trusted data exchanges and keeping records on the IoT platform, acting as a general ledger, maintaining a record of all messages exchanged between smart devices. As a result, it has become an important force in the interconnected world of more and more enabled devices such as sensors and smart devices.

This transactional capability between smart devices can facilitate the emergence of new business models. For example, the device can also be used as a miner to earn crypto asset rewards for the blockchain verification process. Partial subsidies are available through its mining chips by protecting the digital ledger (for example, a mobile phone plan) by calculating the idle time. The IoT with blockchain enabled can be applied to a variety of scenarios from industry to government, energy, agriculture, health, science, education, and the arts. IBM presented a compelling case in its report "Device Democracy: Rescuing the Future of the Internet of Things", favoring the use of blockchain as a catalyst for restarting the Internet of Things. It describes the blockchain as "a framework that facilitates transaction processing and coordination between interactive devices…. Devices are authorized to perform digital contracts autonomously, enabling them to act as self-maintaining, self-healing devices." In 2015, IBM partnered with Samsung. The “autonomous decentralized peer-to-peer telemetry technology” developed by combining the Internet of Things with the blockchain is a successful case. This is a distributed IoT network designed to provide a low-cost, secure way to interact with devices. Distributed autonomous organizations: Distributed autonomous organizations are actually virtual distributed companies that consist of a collection of smart contracts written on the Ethereum blockchain that collectively define the corporate governance of the organization without resorting to Traditional vertical management structure.

In general, smart contracts are equivalent to a set of charters and other founding documents that determine how all voters in an organization's constituency (including anyone in the world who owns DAO tokens purchased by Ethereum) vote, allocate resources, and theoretically Create all kinds of possible returns. Decisions are determined by collective voting.

The decentralized nature of the “management structure” of distributed autonomous organizations is revolutionary and is the core of the traditional hierarchical organization model. Since the first industrial revolution, these companies have become the foundation of our economic system. Blockchain technology blurs the line between market and business because it creates a more efficient way to achieve coordination between high transaction costs.

The emergence of blockchain technology network models can challenge the advantages of existing network platform giants and provide a basic framework for sharing economic and reconfigured economic activities.

Potential barriers

Despite the enormous potential of blockchain technology, there are technical, organizational and regulatory challenges that hinder its widespread adoption. Can the network grow? Consensus-based blockchain verification mechanisms require powerful computing power and may slow transaction speeds as data storage requirements increase. This has become a technical obstacle that the blockchain system has to overcome.

Is it safe? The cyberattack on distributed autonomous organizations in 2016 showed the vulnerability of smart contracts to attack, highlighting network security issues and indicating that the technology is not yet mature.

Can different blockchains work together? In order to benefit from a distributed system, it is critical to establish common standards for collaboration and interoperability within the industry. However, the technology is still in the experimental phase and it is unlikely to meet industry-wide standards in the short term.

Is it possible to guarantee data privacy? There are still some uncertainties and concerns about data protection in the context of blockchain applications, including the choice of applicable law and jurisdiction, the inapplicability of forgotten rights, and the availability of data, especially data protection. Despite the “anonymity” on the blockchain, there are concerns that vulnerabilities in personal data may be cross-referenced and deciphered.

Can you adapt to the regulations quickly enough? It can be said that this is the most important obstacle to prevent the rapid application of blockchain. The existing regulatory framework cannot keep up with the rapid pace of digital innovation. Unclear or hostile regulations and inadequate government understanding of digital assets can prevent the launch of any new technology, including blockchains.

In order for distributed ledger technology to be generally accepted in the financial services industry, people will need to comply with existing “know your customer/anti-money laundering” regulations. Some countries, including the United Kingdom, China and Singapore, have taken a hands-on approach to understanding new regulatory needs, appointed task forces to advise the government on their strategies or public-private partnerships, while others have adopted Some conventional business measures are waiting for the development of the industry.

How much does it cost? Another key challenge is that the financial and organizational costs associated with the implementation of blockchain technology can be high even during the pilot phase.

Companies need to weigh the potential but uncertain benefits of using blockchain technology and test current real costs. These costs include integration issues for legacy systems and shared resources to enable the limited qualified human capital required to implement blockchain projects. Financial industry companies are forming consortia to achieve cost interdependencies so that blockchain infrastructure can be used as interoperable industry utilities, but consistency and conflict of interest issues between the various players still exist.

These obstacles are not insurmountable. In the next five to ten years, the adoption rate of blockchain systems may gradually increase. In order to fully realize economies of scale and make full use of the entire network effect, it is necessary to launch new technologies extensively. The financial services industry is the first institution to mobilize in a consistent manner, and they are currently investing and are experimenting, learning and adapting to new approaches.

V. Conclusion

In the process of implementing the blockchain, two important risks should not be underestimated. The first is the legislative and regulatory environment and how it affects distributed ledger technology in relevant jurisdictions, including compliance and data privacy. This is followed by the organization's ability to transform and the talent pool that can be used to respond to organizational operations and cultural shifts. The decision-making process begins with the company's value proposition and its strategic vision and direction, then moves to analyze how the blockchain affects the space and how it provides improvements to the company's value proposition and even how to create new business markets for the company. The review of key evaluation criteria should link any investment to a value proposition and focus on improving speed, convenience, and control over the products or services involved for business partners and customers. Depending on the complexity of the process and the level of trust and compliance required by the participants, the enterprise will decide which blockchain tools to deploy (select or private, semi-private or open networks), and choose those that better serve it. Development project for external partner cooperation services.

This process should lead to the selection of one or two trials to quickly achieve the purpose and learn from it. Regardless of the method and level of participation chosen, companies must carefully consider the far-reaching impact of the blockchain by conducting their own research to determine their value propositions that may influence the market and the future, and then plan accordingly.

To this end, the company will need to strike a balance between developing internal capabilities and conducting trials while effectively managing potential risks and costs. To hedge risk, they may want to partner with their peers and start-ups to offset infrastructure construction costs.

———— end ————

Legal Notice: Intellectual Property Statement All copyrights of the manuscripts whose authors are “Zhen Chain” and “Dazhi Think Tank” are owned by the Company. No organization, organization or individual may reprint or link without the written authorization of the company. Repost or copy and publish in other ways, such as deletion, interception, etc.

Disclaimer All content contained in this report has been produced from the unique data and analytical resources of “Zhen Chain” and “Dazhi Think Tank” to provide technical reference for practitioners in the blockchain industry. The various reports produced by the company are for reference only and do not constitute investment advice. If the visitor suffers losses according to the report issued by the company for investment or trading, the company does not assume any liability for compensation. For other acts performed by visitors based on reports issued by the company, the company does not assume any form of responsibility unless there is a clear written commitment of the company.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What are the risks of encrypting asset exchanges?

- Zhang Zhenxin's pioneering department: I think that the blockchain is a life-saving straw, but it is overwhelmed by it.

- Bitcoin and cryptocurrency continue to incite the banking system, and it is expected that Bank of America will lay off 200,000 people in the next 10 years.

- Market Analysis: BTC once again broke the 8000 line, the battle of the bears took the upper hand

- Opinion: If there is a crisis in corporate credit, 2% of the funds may flow to Bitcoin

- Payment System Architecture Based on Wholesale Digital Currency (W-CBDC): Interpretation of Fnality White Paper (I)

- Is Bitcoin a currency or an asset? It’s time to end this problem.