Zhang Zhenxin's pioneering department: I think that the blockchain is a life-saving straw, but it is overwhelmed by it.

Produce|Three Words of Finance Author|DorAemon

On the evening of October 5, Netcom Group issued a false statement that Zhang Zhenxin, the chairman of the Pioneer Group and the actual controller of the Netcom Group, was ineffective due to multiple organ failure, alcohol dependence, and acute pancreatitis. September 18, 2019, London time He died at the Chelsea and Westminster hospitals in London, England, at the age of 48.

- Bitcoin and cryptocurrency continue to incite the banking system, and it is expected that Bank of America will lay off 200,000 people in the next 10 years.

- Market Analysis: BTC once again broke the 8000 line, the battle of the bears took the upper hand

- Opinion: If there is a crisis in corporate credit, 2% of the funds may flow to Bitcoin

Zhang Zhenxin started in Dalian. After decades of development, Pioneer Group has developed into a huge financial empire. The main platforms of Pioneer Group are Netcom Group and Zhongxin Holdings. However, Netcom Group and Sino-Singapore are only the tip of the iceberg of Pioneer's financial landscape. After years of capital operation and investment mergers and acquisitions, Zhang Zhenxin led the Pioneer Group in banking, securities, insurance, funds, payments, microfinance, guarantees, financial leasing, foreign currency exchange, online lending, consumer finance and many other areas, including Blockchains, network cars, exchanges, and movies are all kinds of industries.

It is reported that the entire Pioneer Department has hundreds of companies, holding multiple financial licenses in the fields of banking, securities, insurance and payment, and directly managing assets up to 300 billion yuan.

The huge financial empire is ruined by "P2P" violent thunder?

From 2014 to 2018, the Pioneer Department has developed rapidly for four years. In recent years, Pioneer Group's business covers most of China; it also has branches in more than ten countries and regions such as Southeast Asia, the United Kingdom and the United States. According to the official website of the Vanguard Group, the company has its China headquarters in Beijing and its overseas headquarters in Hong Kong.

However, such rapid development momentum seems to have stopped in 2019.

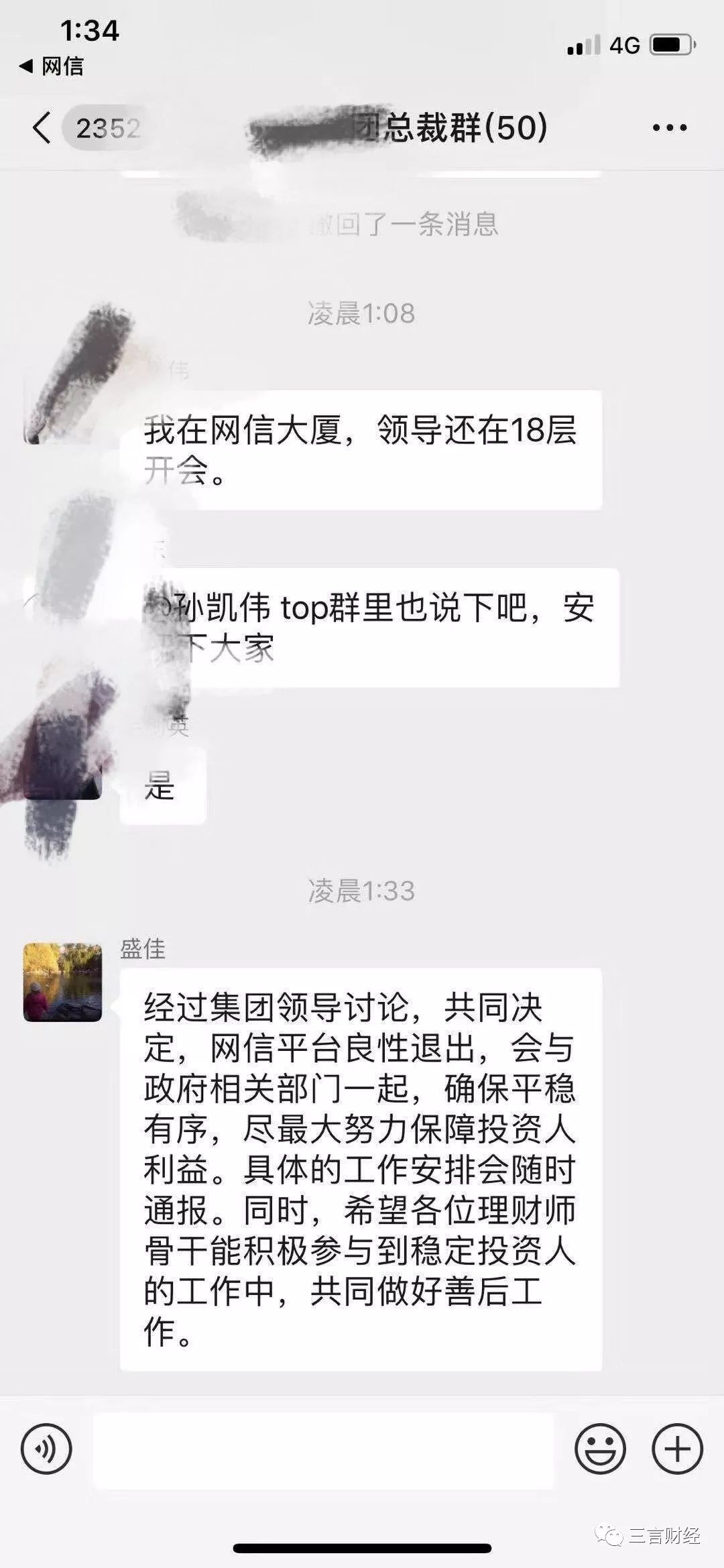

In the early morning of July 4 this year, a screenshot of the internal working group news of the network letter group was sent online. The screenshot shows that the CEO of the network letter group Sheng Jia said that the platform will be a virtuous exit and will cooperate with relevant departments to ensure a smooth and orderly process. At the same time, the backbone of each financial planner is required to actively stabilize investors and do a good job in the aftermath.

Coincidentally, according to the company's check, on June 25, the legal representative of the network letter group has changed from Shengjia to Zhao Huimin, and Shengjia has withdrawn from the board of directors of the network letter group.

At the same time, a few days before the news flowed out, investors on the Internet complained that the platform could not withdraw cash. Others have rumored that there have been investigations and financial offices in the network of the letter building.

One stone provoked a thousand waves, and the news of the benign exit of the Netcom Group immediately caused investors to panic.

For this news, on July 4th, Netcom Group responded to its official WeChat public account, “At present, there is a small overdue period for Netcom Pratt & Whitney. As an information platform, we are actively working with product management parties and related financing companies. Communicate, actively carry out remittances, and formulate strategies for deferred withdrawals and stable compression for some businesses.” However, the announcement was deleted.

The next day, Netcom responded again through the WeChat public account that some of the Group's products were overdue due to the inability to repay the loans in large amounts and the malicious borrowing of some borrowers. At the same time, the network letter indicates that the group is in normal operation, and the executives perform their duties. There are no such situations as “detained” and “taken away”.

On July 23, Zhang Zhenxin said in the form of internal letter that “the downturn of the real economy has caused a serious decline in the quality of the assets of the company’s assets, the value of collateral has shrunk, and the handling has become more difficult. At the same time, some enterprises and individuals who have maliciously escaped the debts have been encountered. The reason, Zhang Zhenxin pointed out that the company has encountered unprecedented difficulties and crises.

The official response of the Netcom Group and Zhang Zhenxin’s internal letter all attributed the reason for the overdue platform to “the reasons for the malicious escape of the debts of enterprises and individuals”. Since then, the network letter group has successively announced the progress of asset disposal, saying that the asset management working group has been established and the creditors Manage the working group and steadily promote asset disposal. And the platform has reported the information on escaped debts to the central bank's credit information system through the relevant departments, and included the malicious escape debtors into the list of untrustworthy people.

Overtime is only a small section of many crises

The overdue network information platform is only a small section of the Pioneer series of crisis.

In May of this year, due to the existence of major risks, Netcom Securities was dispatched by the Liaoning Securities Regulatory Bureau to conduct special inspections on the risk monitoring site working group. Since then, the netizen securities shareholder joint venture group has been adopted a regulatory decision to restrict shareholder rights measures. The three natural persons actually controlled more than 5% of the shares of Netcom Securities without approval, including Zhang Liqun, CEO of Pioneer Group.

According to the 2018 annual report of Netcom Securities, the revenue of Netcom Securities in 2018 was -3.244 billion yuan and the net profit was -2.88 billion yuan.

The Pioneer Department’s Sino-Singapore Group also had problems. After the 4th day of the overdue period of the Netcom Group’s platform, on July 8, Zhongxin Holdings issued a notice stating that Pioneer Payments Co., Ltd. was suspended after the on-site inspection of the relevant department on July 8, 2019. Operation; Zhongxin Holdings suspends trading from 9:00 am on July 8, 2019.

According to Zhongxin Holdings, in view of the fact that the relevant departments require Pioneer to pay severe remedial measures for certain major non-compliance matters related to their business operations, it may have a material adverse impact on the company's related business and financial position. After the company's board of directors considers the situation and the impact, the company will announce the details of the violation after the period.

The Pioneer Group is still in the quagmire because of the involvement of Huarong.

This series of problems has overwhelmed the Vanguard Group, but according to the report of the past, the last straw that overwhelmed the vanguard is Zhang Zhenxin's high hopes in the blockchain and digital currency industries.

Depending on the blockchain, it is the last straw to crush the camel.

Since 2016, due to the hot blockbuster and digital currency in the world at the time, the blockchain is like Zhang Zhenxin's grasp of “life-saving straw”, but this “life-saving straw” has crushed the pioneering system.

Media reports on Zhang Zhenxin's views on blockchain technology

Zhang Zhenxin's love for the blockchain can be seen from his views on various occasions.

Zhang Zhenxin believes that blockchain technology can be applied not only to government departments, but also to many scenarios, such as supply chain finance, digital asset management, credit data statistics, and cross-border logistics.

In an interview before, he said, “The blockchain is still in the early stages of development, both in terms of technology and economic volume. R&D of the underlying technology, promoting the integration of blockchain and industry applications, actively embracing regulation and releasing blockchain + The greater potential of the real economy is the direction of our long-term efforts."

For how the blockchain is integrated in the real economy, Zhang Zhenxin believes that the blockchain needs to meet the multi-faceted needs of performance, security, privacy and so on. The first step in the integration of the blockchain and the real economy is to create a new generation of public chains.

He also said that the blockchain is in the early stages of development in terms of technology or economic volume. Need to actively develop the underlying technology and embrace regulation. "Freeing the blockchain + the greater potential of the real economy is the direction of our long-term efforts." Zhang Zhenxin said in an interview.

It is rumored that Zhang Zhenxin gave Chen Qing an annual salary of more than 10 million, but he did not comment. Chen Qing was recruited by Zhang Zhenxin as the head of Coinsuper at the Hong Kong Blockchain Trading Center. Previously, Chen Qing was the CEO of UBS China and had no digital currency experience.

At the end of 2015, Xie Sha announced the establishment of a 10 billion Asian financial technology M&A fund in Beijing on behalf of Pioneer Group, led by China Huarong and Shanghai Xinhua Distribution Group, one of China Credit Technology shareholders. However, there is no mention of the follow-up public information of this fund, and the specific information is not known.

In 2017, bitcoin prices soared, and Pioneer Group also acquired mining projects around the world, including Shenzhen Feifeili, which is based on the Snow Leopard mining machine.

The prospective report said that Zhang Zhenxin’s direct subordinates had traveled to Kyrgyzstan on his private jet, with the intention of building a mine with the advantage of cheap local electricity prices. According to people familiar with the matter, after the person in charge and the Kyrgyz high-level officials negotiated the electricity price, they plan to report to the group at a double price to confiscate the difference. But in the end, the Kyrgyz project was not completed.

It is reported that since Zhang Zhenxin is used to delegating business and rights to trusted people, he is solely responsible for strategy. As a result, it has led to multiple cases of “public and private”.

In 2018, the bitcoin bear market came, the price of the currency plummeted, and the whole industry fell into a cold winter. The same is true of the Vanguard Group, which has faced huge losses in the past.

Under the bitcoin market, Pioneer Group had to sell the mining machine assets at a low price. However, according to the incomplete statistics of the insiders of the Pioneer Group, Zhang Zhenxin’s loss in the blockchain business needs to be calculated in billions. .

How does the blockchain business drag down China New Holdings?

The financial report data released by Zhongxin Holdings, a subsidiary of Pioneer Group, can better reflect the company's layout of the blockchain and the impact of the currency price on the company's financial status after the arrival of the bitcoin bear market.

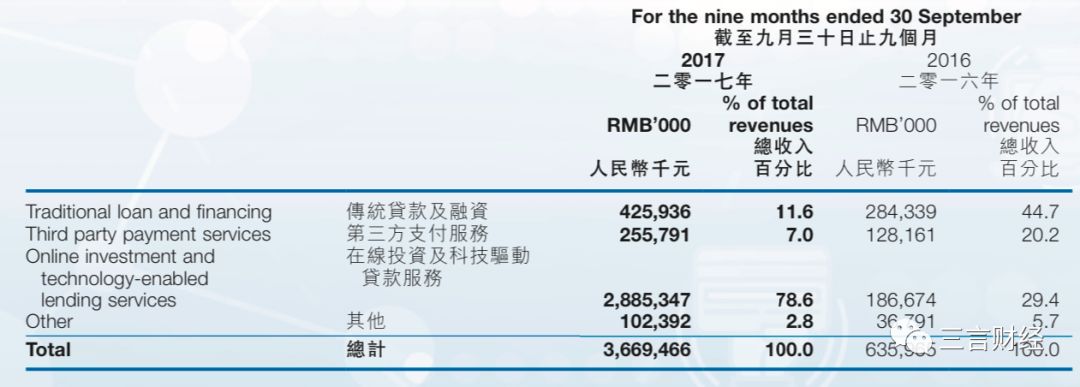

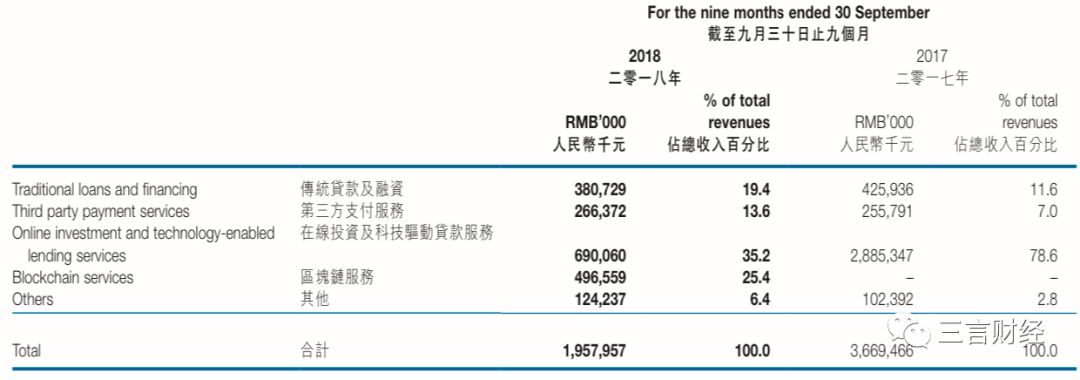

Zhongxin Holdings' third quarter 2017 financial report

First of all, in the third quarter of 2017, Zhongxin Holdings has not entered the blockchain business. At that time, the core business of the company was mainly loan business, third-party payment and wealth management, which accounted for 11.6%, 7% and 78.6% of the total revenue respectively. Among them, wealth management business accounted for nearly 80% of revenue.

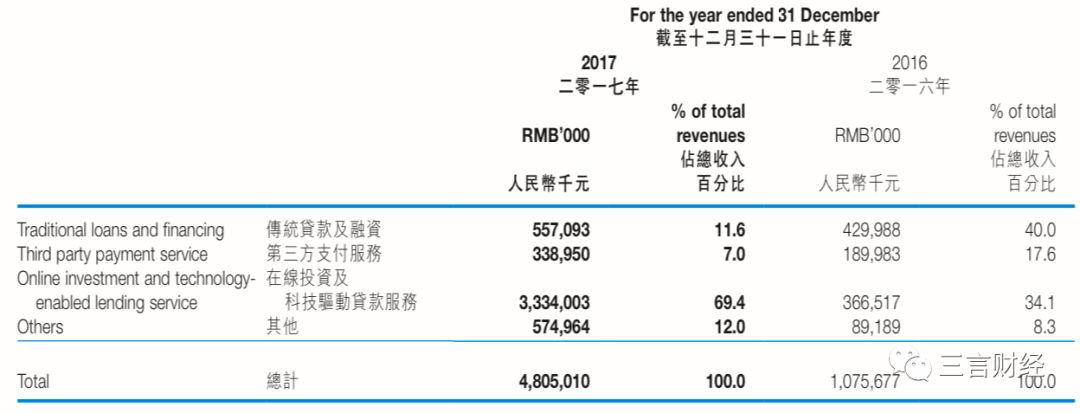

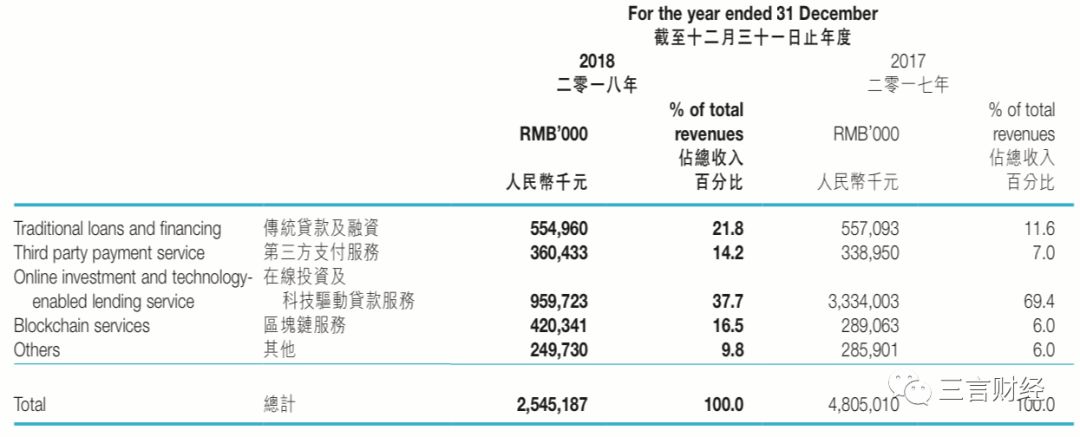

Zhongxin Holdings 2017 Annual Report

In the 2017 annual financial report, Zhongxin Holdings recorded the revenue of the blockchain business for the first time. This business is included in "Others".

Sino-Singapore Holdings 2017 Annual Report on Blockchain Business Revenue Description

According to the financial report, in the first four quarters of 2017, the revenue from the blockchain business was 289 million yuan. From the third quarter to the fourth quarter, just three months, the blockchain contributed nearly 300 million yuan to Zhongxin Holdings. At this time, Sino-Singapore Holdings began to transform the blockchain business into its core business.

According to reports, after the third quarter of 2017, Zhongxin Holdings will rank the blockchain business alongside the traditional payment business, loan business and wealth management business, which is called the company 3.0 strategy.

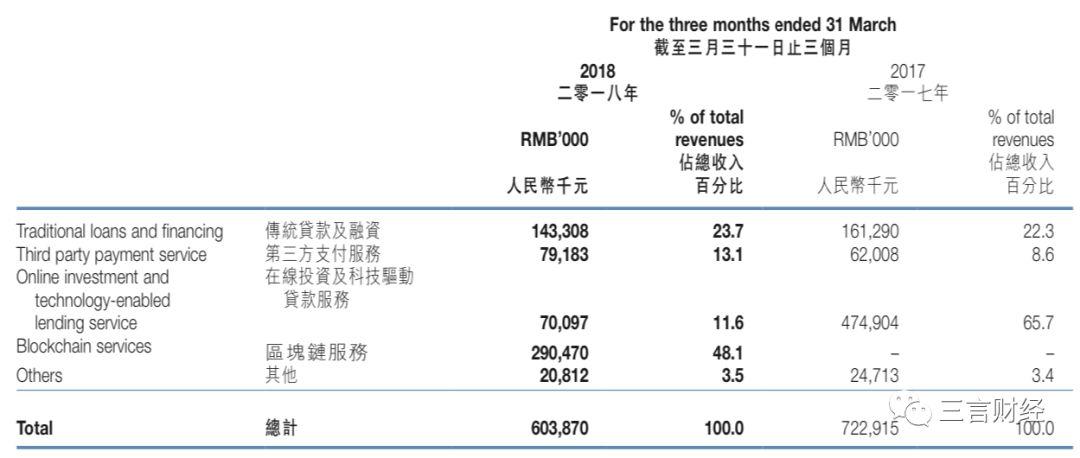

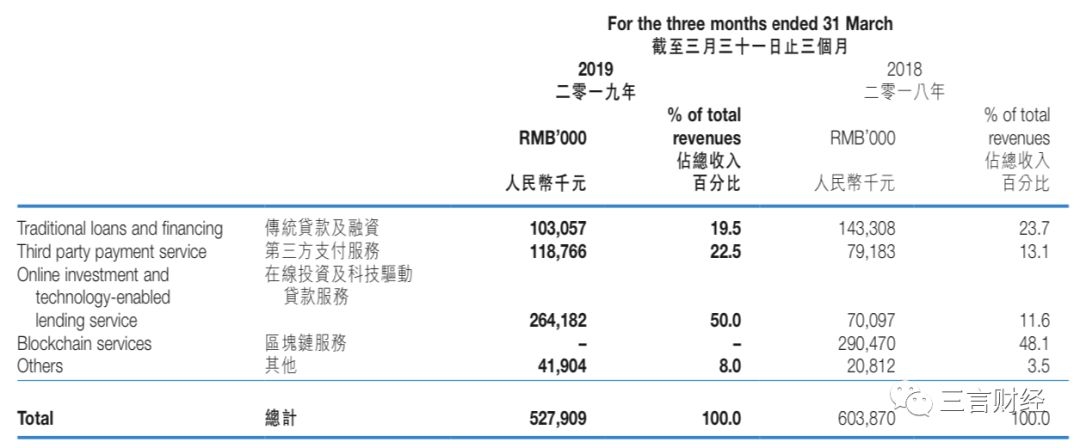

Zhongxin Holdings' first quarter earnings report for 2018

Zhongxin Holdings' own financial report for the first quarter of 2018 has separately listed the blockchain business, which has a revenue of 290 million yuan. It is worth noting that at this time, the proportion of revenues of Zhongxin Holdings' various businesses also changed significantly. The blockchain business accounted for 48.1%, followed by traditional loan business, accounting for 23.7% and third-party payment services. Compared with 13.1% and wealth management business, it accounted for 11.6%.

In the third quarter of 2017, the wealth management business accounted for nearly 80% of the total revenue of Sino-Singapore. In just half a year, the blockchain business has become the core business of the center, and its revenue share is close to 50%.

Zhongxin Holdings 2018 Interim Report

However, since then, the cryptocurrency industry has declined, and the Sino-Singapore blockchain business has declined in the first two quarters. According to the semi-annual report of China New Holdings in 2018, the revenue from the blockchain business was RMB 431 million. It can be seen that the blockchain revenue in the second quarter of 2018 was 141 million yuan, a drop of nearly 50% compared to the first quarter.

In the first half of 2018, blockchain business revenue accounted for 32.1% of Sino-Singapore's total revenue, which was a decline from the first quarter, but it is still its main source of income. Among them, the wealth management business accounted for 29.3%, the traditional loan business accounted for 20.4%, and the third-party payment business accounted for 13%.

Zhongxin Holdings' Third Quarter Financial Results for 2018

Zhongxin Holdings’ financial report for the first three quarters of 2018 showed that the company’s blockchain business revenue was 497 million yuan. Based on this calculation, Zhongxin Holdings' revenue in the blockchain business in the third quarter of 2018 was only 0.66 billion yuan. Moreover, blockchain business accounted for 25.4% of total revenue in the third quarter, which is no longer the primary source of revenue for Sino-Singapore.

In the first three quarters, Sino-Singapore's wealth management business accounted for 35.2%, traditional loan business accounted for 19.4%, and third-party payment business accounted for 13.6%.

Zhongxin Holdings 2018 Annual Report

According to the financial report, the revenue from the blockchain business was 420 million yuan. According to this calculation, in the fourth quarter of 2018, the Sino-Singapore blockchain business was essentially a loss-making state, which was -0.77 billion yuan. And the blockchain business revenue in the first four quarters accounted for 16.5% of total revenue.

At this point, wealth management business revenue accounted for 37.7%, traditional loan business income accounted for 21.8%, third-party payment business revenue accounted for 14.2%.

As bitcoin prices plummeted, blockchain business revenues were getting lower and lower, and rankings in the proportion of Sino-Singapore's revenues also declined.

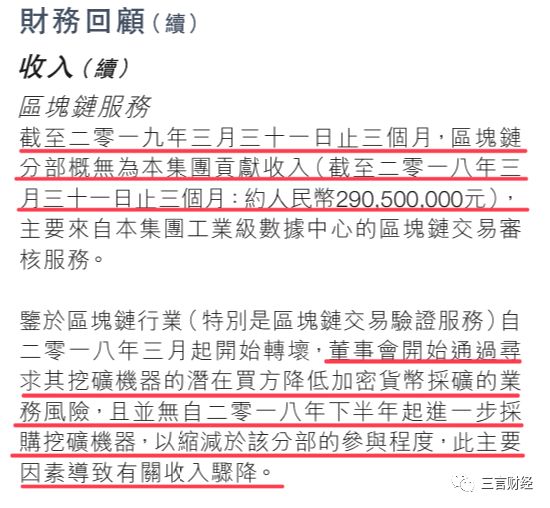

Zhongxin Holdings' first quarter financial report for 2019

In the last financial report released before the suspension of Sino-Singapore, the revenue from the blockchain business was directly shown as “none”. In the first quarter of 2019, wealth management business accounted for 50% of revenue, third-party payment business revenue accounted for 22.5%, and traditional loan business accounted for 19.5%.

Sino-Singapore's description of blockchain business income in the first quarter of 2019

Zhongxin Holdings said in its earnings report that the blockchain business in the first quarter of 2019 did not contribute revenue, and since the market fell in 2018, the company began to seek to sell minerals. The financial report also revealed that since the second half of 2018, the company stopped buying mining machines and reduced participation.

From the fourth quarter earnings report of Zhongxin Holdings to the first quarter of 2019, it is known that the blockchain business, which is mainly based on mining, was once the mainstay of Zhongxin Holdings' income source. But with the plunge in bitcoin prices in 2018, the business brought less and less revenue, and eventually lost money.

From the "embrace blockchain" to the operational burden, Zhongxin Holdings is a silhouette of the entire pioneering system. This also shows from the side that due to the blockchain and digital currency market, it is not an exaggeration for Zhang Zhenxin to lose billions or more in the blockchain business.

The blockchain project has a huge deficit, coupled with the various crises faced by the Pioneer system, which eventually led to problems in the capital chain, and its loan platform was “thunder”.

After Zhang Zhenxin’s death, what should be done with the pioneering “bad mess” left behind?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Payment System Architecture Based on Wholesale Digital Currency (W-CBDC): Interpretation of Fnality White Paper (I)

- Is Bitcoin a currency or an asset? It’s time to end this problem.

- In-depth analysis of FairWin: the money disk of the knife-edge blood loss makes the average loss of 10129 players 47%

- CTO phone is hacked, Algo Captial loses millions of cryptocurrencies

- If we are optimistic about the blockchain, we should also believe in the future of cryptocurrency.

- European Central Bank | Digital Challenges Facing International Monetary and Financial Systems

- Wal-Mart and IBM reach a partnership to track shrimp supply chain with blockchain