Market Analysis: Global Opens Negative Interest Rate and Releases Water, Meeting the New Era of Digital Assets

The European Central Bank announced interest rate cuts and restarted quantitative easing. The global market was benefited better. Akong believes that under the influence of the interest rate cut, a new era of digital assets will usher in.

In the past two days, domestic RRR cuts have sparked heated debates. So far, 20 of the 26 major countries in the world have entered the trend of comprehensive interest rate cuts. European countries have entered the era of negative interest rates. When you borrow 10,000, you only need to return several thousand yuan in a few years.

The Federal Reserve and the European Central Bank have successively announced interest rate cuts. Europe is forced to start quantitative easing by employment pressure, and will start the printing press hot money will rush into the market.

On August 7, the Bank of India announced a cut in the benchmark interest rate by 35 basis points; the Bank of New Zealand announced a rate cut that exceeded the market expectations; the Bank of Thailand decided to cut the benchmark interest rate by 25 basis points. On August 8, the Philippine central bank lowered the benchmark interest rate. 25 basis points, on August 9, the Peruvian central bank cut the benchmark interest rate to 2.50%, all countries are releasing large amounts of water.

- French Finance Minister: France will prevent Libra from doing business in Europe

- Encrypted cat team shot again! Dapper Labs Receives $11 Million Investment from A16z

- Interpretation of the market | BTC was finally saved! But the cost is extremely heavy

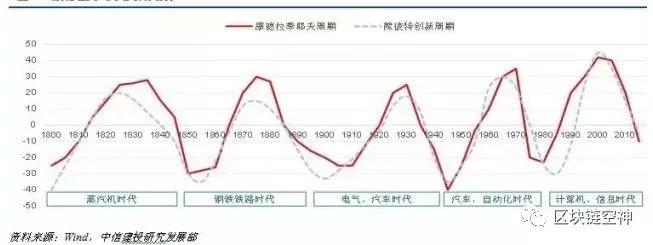

Whenever the world begins to cut interest rates and release water cycles, it will create a century opportunity, and domestic real estate giants set sail in 2008. Alibaba, Baidu, Jingdong, Tencent, the Internet giants you can name, were basically established in 1998. Gome, Suning Appliance and Haier were established in 1988. Wanda and Vanke entered real estate in 1988, corresponding to the three stages of the Federal Reserve's interest rate cut cycle. Money is the cornerstone of finance. The interest rate cut is a big release of money. The Fed uses the interest rate cut cycle to control the operation of world finance.

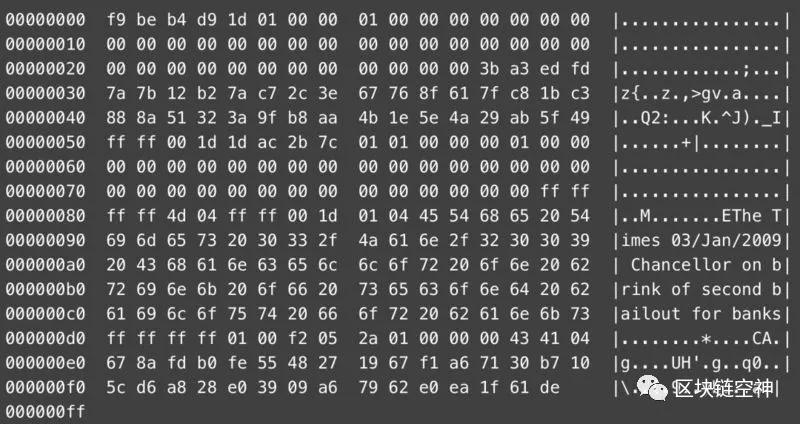

Coincidentally, Bitcoin was born in 2009. The following picture is a paragraph left by Nakamoto in the creation zone. "On January 3, 2009, the Chancellor of the Exchequer was in the process of implementing the second round of emergency assistance. edge".

Whether in Venezuela, where inflation is the most serious, or in Turkey and Argentina, where interest rates are high and currency crises have recently exploded, Bitcoin is highly sought after in the region, and there is a high premium. People are willing to spend more money on Bitcoin. Large discharges will increase the market capacity of digital assets.

Akong believes that when the world enters the era of negative interest rates, it is increasingly difficult for the market to stimulate the consumer economy. Entity enterprises are facing a new era of changes in the 100-year period. The Internet era is coming to an end and the digital asset era is coming.

Hot money has nowhere to go, it will look for high-risk, high-return assets, junk bonds are becoming more popular, and digital assets will usher in a new bull market.

Market analysis

BTC:

The EU proposes to block Libra's similar projects and to monitor the currency price. The bottom of the currency price is raised, confirming the multi-necked neckline support, the shock is higher, and the short-term multiple small pins are arranged, the quantity can continue to weaken, indicating that the currency price is still in a volatile trend. As long as the BTC does not have a volume that falls below $10,103, it will continue to rebound. The price of the coin is still at the end of the triangle convergence, and the operation is high and low, and then the BTC is shocked at $10,332.

Resistance level: 10332, 10396, 10425

Support level: 10203, 10103, 10067

EOS:

The small price of the coin is flat, and the amplitude accompanying quantity can continue to weaken, waiting for the market to change. Next EOS was sorted out with a small pin of $3.74.

Resistance levels: 3.74, 3.79, 3.82

Support level: 3.65, 3.58, 3.52

XRP:

XRP has seen a large number of large-value transfers, which have a bearish expectation of the currency price. The small price of the coin is flat and continues the trend of small shock boxes. The operation was high and low, and then the XRP was flat at $0.255.

Resistance level: 0.255, 0.257, 0.259

Support level: 0.252, 0.250, 0.248

LTC:

The bottom of the currency rebounded, forming a bottom-off trend, and the quantity continued to weaken, indicating that the bullish pull was insufficient, and it needed to be sideways to repair the decline. The operation was high and low, and then the LTC was sideways at $69.4.

Resistance level: 69.4, 70.3, 71.4

Support level: 67.8, 67.3, 66.7

ETH:

The bottom of the currency price was raised, and the trend of the small shock box continued. The volume continued to weaken, the price of the currency was shocked, and the operation was high and low, and then ETH stabilized at $181.4.

Resistance levels: 181.4, 182.7, 183.6

Support level: 178.5, 176.5, 174.5

BCH:

The price of the currency is weak, and the whole is still at the end of the triangle convergence. Waiting for the mainstream currency to change, the operation is high and low, and then the BCH is flat at a narrow range of $298.3.

Resistance level: 298.3, 300.5, 302.7

Support level: 295.2, 293.2, 290.2

Small coins:

NPXS and EGT led the market. In August, the new IE0 coins made a bottom rebound, and short-term bottoming market appeared. The model currency such as EGT also showed a heavy volume rebound, indicating that the market sentiment was gradually restored, and the spot of the coin was stable and warm, but The platform currencies such as BNB and HT are still in a weak shock, indicating that there is a lack of trend hotspots in the spot. For a long time, we have not seen Lianyang’s current currency, and the market is waiting for the mainstream currency to go out of this round. At present, it is still in the mainstream currency market. Yesterday, K network has a short-term amplitude of 50%. Many futures platforms refer to K-network to formulate futures reference prices. Combined with OK, the short-term fluctuations are further increased. The market enters the holiday market and can wait patiently for the main capital breakthrough. .

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Libra Association Leader: Libra will be launched as scheduled in the second half of 2020

- Viewpoint | Is the nature of Bitcoin a consensus?

- Babbitt column | Cai Weide: 2 development routes of blockchain and misunderstandings caused by different routes

- The market value of Bitcoin is over 70%. Han Feng: Bitcoin has a solid position and is optimistic about the new wind in the industry.

- PwC encryption investment report: Eurasian UP, US DOWN

- Russia's largest bank buys $15 million in debt through blockchain, achieving a “seamless connection” between banks and companies

- Mid-Autumn Festival surprise? Lawyers say Mt. Gox Bitcoin worth $2 billion is expected to recover