Bloomberg Thousands of Words Uncover How SBF’s Elite Parents Helped Him Build a Cryptocurrency Empire?

Bloomberg uncovers how SBF's parents helped him build a cryptocurrency empire.Author: Max Chafkin & Hannah Miller, Bloomberg

Translation: Felix & Joy, LianGuaiNews

At Sam Bankman-Fried’s (SBF) home, Larry David is a family favorite. So it’s understandable that his parents were excited when they received an email from their son Sam. SBF wrote that his company FTX will run an advertisement during the 2022 Super Bowl, with David as the star.

The irritable comedian has played a series of skeptics throughout history, essentially playing the character of David from the HBO TV show “Curb Your Enthusiasm” in a Stone Age and Elizabethan version. The video will showcase an invention – the wheel, the light bulb, the Walkman, and finally FTX. And David will reject each invention one after another. The ad will warn viewers that if they don’t invest in cryptocurrency, they will miss out on a historic opportunity to get rich. The slogan is, “Don’t be like Larry.”

- LianGuai Observation | Chain gaming track has won large-scale financing, has GameFi passed the ice age?

- How can we prevent the Twitter attacks that even Vitalik Buterin fell for?

- LianGuai Daily | Binance.US lays off one-third of its employees; Hong Kong Securities and Futures Commission warns that JPEX is an unregulated virtual trading platform.

SBF’s parents loved it. “Surreal,” wrote SBF’s mother Barbara Fried. SBF’s father Joseph Bankman expressed how happy and proud he was. A few days later, employees received some additional feedback from Sam’s brother Gabe. He asked his father if he could play a role in the ad, saying his father was too modest to ask for it himself. In a way, this request was strange. At the time, Joseph Bankman didn’t have a formal position at FTX, and neither did Gabe. Gabe runs a non-profit organization supported by FTX dedicated to epidemic prevention.

Shortly after, Joseph Bankman appeared on the set and filmed a scene where David strongly opposes the “Declaration of Independence.” When told, “The people should have the right to vote,” David incredulously responds, “Even stupid people?” Joseph Bankman, wearing a powdered wig, shouts, “Yes!” FTX spent about $20 million to produce and air this 60-second ad. Around the same time, Joseph Bankman joined the company as an employee.

Screenshot of FTX's Super Bowl ad featuring Larry David. Source: YouTube

A person familiar with the production of the ad said that in the upside-down logic of FTX, the decision to have the boss’s father play a role had a certain significance. Like most of the people interviewed for this story, the source requested anonymity to avoid being associated with the chaotic bankruptcies, numerous class-action lawsuits, and several criminal cases. To some extent, Joseph Bankman is the founder of the company.

Both parents had outstanding careers long before their son was accused of fraud. They met at Stanford University in the 1980s and taught at the law school for over thirty years, living on campus and raising two sons. Joseph Bankman is a tax expert known for his efforts to make US tax law more friendly to low-income citizens. Barbara Fried is an authority in legal ethics and enjoys a reputation in progressive politics.

At the time this advertisement aired, critics warned that FTX was attracting ignorant investors with highly risky financial instruments that are mostly prohibited in the United States. When these funds were transferred to a hedge fund owned by SBF without their knowledge, the money disappeared. FTX filed for bankruptcy in November 2022.

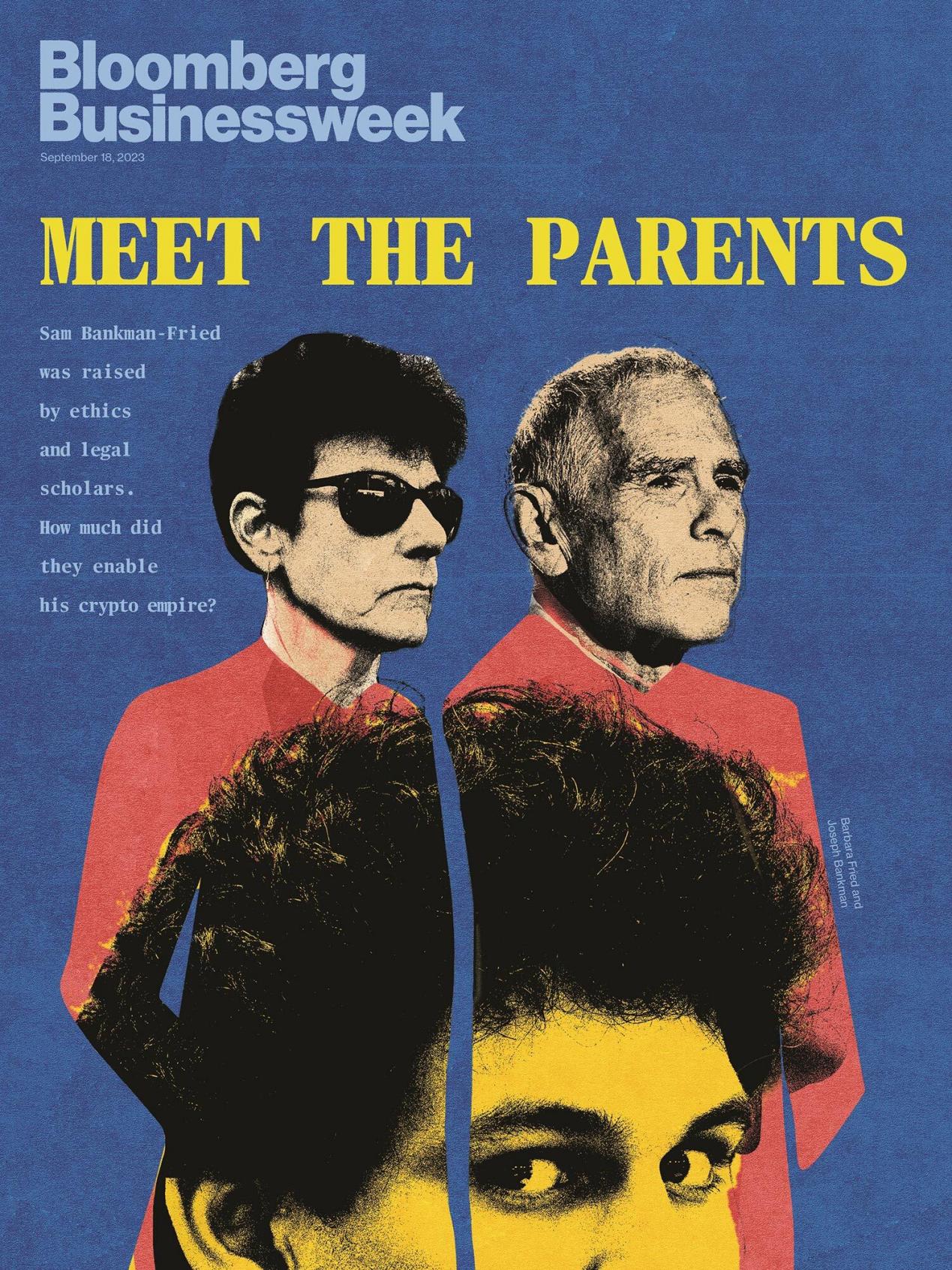

Bloomberg Businessweek Cover

Leading the bankruptcy proceedings for FTX is John Ray III, who previously handled the Enron bankruptcy case but called this case worse. SBF is accused of using customer funds for their own, their family’s, and other insiders’ benefit and is seeking to recover some of the funds. For SBF, the more ominous aspect is the criminal case, which is set to begin on October 2nd in New York City. The prosecutors have not charged SBF’s parents with any wrongdoing but have brought charges against SBF, including fraud, money laundering, and bribery. SBF’s net worth at its peak was estimated at $26 billion. This case could potentially see SBF spending the rest of their life in prison. However, they have maintained their innocence and attributed the losses to mismanagement rather than criminal activity.

Joseph Bankman and Barbara Fried have managed to avoid much scrutiny surrounding FTX. This is at least partly because they have not fully explained their role in helping their son build a vast business and political influence empire. Instead, they are often portrayed as bystanders, frequently seen shedding tears and providing emotional support to their son during his frequent court appearances. But their names are almost certain to come up during the trial. The defense team has indicated that their strategy may partly depend on advice received from lawyers, including his parents.

The couple’s spokesperson, Risa Heller, has declined interviews with Joseph Bankman and Barbara Fried. Risa Heller previously stated that, aside from being supportive parents, the two have little involvement with FTX. Heller stated that Barbara Fried has never worked for the company, and Joseph Bankman’s brief tenure was primarily focused on charitable endeavors. Last year, SBF told The New York Times that his parents “had no involvement in any relevant parts of his company.”

Former employees and business partners say that their impression at the time was not like this. Legal documents show that Joseph Bankman and Barbara Fried were crucial to their son’s transformation from a clumsy geek to a cryptocurrency tycoon. The couple made huge profits from FTX, netting $26 million in cash and real estate in 2022 alone. They were regulars at the company’s office, encouraging employees and being included in internal communications. Their reputation and connections were instrumental to FTX’s success.

As one of FTX’s largest investors, Sequoia Capital, put it in a complimentary article, their child seemed “born for the role of founder and CEO of a cryptocurrency exchange.” The article attempts to explain why one of Silicon Valley’s most respected venture capital firms chose to invest $150 million in a young man who played computer games at an investor presentation, and it provides two pieces of evidence to support its claim. First, SBF had briefly worked at a trading firm on Wall Street. Second, his parents are law professors at Stanford University.

In Silicon Valley, no one wants to believe they have privileges. Venture capital firms and entrepreneurs who read Ayn Rand’s works often get angry at the notion that their decisions are not based on calculated reasoning. However, the reflexive elitism in Silicon Valley is so apparent that it goes without saying. The majority of investors prefer companies run by white people, whose founders usually come from a small group of elite universities, while avoiding anyone who deviates from their shallow understanding of what a successful founder should look, talk, and act like. Some openly discriminate against entrepreneurs over the age of 30, those with accents, and anyone who behaves as if they are not already wealthy.

In this extremely privileged world, the most privileged place is Stanford University—the birthplace of companies like Hewlett-Packard, Sun Microsystems, Cisco, Yahoo, Google, and PayPal. Barbara Fried has a background in Harvard University, Harvard Law School, the United States Court of Appeals for the Second Circuit, and the LianGuaiul, weiss law firm. In 1987, Barbara Fried came to Harvard as a tenured professor and rented a house on campus. A year later, she met Joseph Bankman. Joseph Bankman graduated from the University of California, Berkeley and Yale Law School. After working as a tax lawyer in Los Angeles, he came to Stanford to teach trial advocacy. In Joseph Bankman’s second year as a tenured professor, Barbara and Joseph (as they were known on campus) publicly acknowledged their relationship. They moved in together, and in 1991, when Barbara Fried’s rented house was sold, they bought it.

Bankman and Fried's home on the Stanford University campus.

The house where SBF grew up and where he was “under house arrest” in the first half of 2023 is located at the end of Cooksey Lane. It is worth $3.6 million, but this is more a result of the real estate boom in Palo Alto over the past few decades than an assessment of its luxury. The house is a fairly ordinary gray Craftsman building with four bedrooms, three bathrooms, a spacious porch, and a swimming pool, all situated on a large piece of land surrounded by towering trees. Behind this property is the Lou Henry Hoover House, a modernist building that was once the home of former President Herbert Hoover and is now the residence of the President of Stanford University.

During SBF’s childhood, the surrounding area was populated by a group of young intellectuals – not just law professors and law school students, but also sociologists, engineers, AI researchers, classicists, and social scientists. On Sunday evenings, Joseph Bankman would order takeout or make something simple like spaghetti, and they would invite 15 guests to the dining room for a chat, usually about philosophy and politics. SBF and Gabe would sometimes join the conversation, even in their teenage years. Joseph Bankman and Barbara Fried were proud and staunch do-gooders. The couple, who were not married, believed that it was unfair that same-sex partners could not marry, as they told their friends. LianGuaiul Brest, former dean of Stanford Law School, said, “They felt it was wrong to withhold something from others. They are very moral people.”

Joseph Bankman at Stanford Law School in 2021.

When he was young, Joseph Bankman had thick curly hair, a trait that his son inherited but not his amiable attitude. The couple sent their children to Crystal Springs Uplands School, a prep school that costs $60,000 a year and is filled with children of Silicon Valley elites. By then, Joseph Bankman had become one of the most important experts on U.S. tax policy. He proposed a pilot program for the California government to tax them, which met strong opposition from tax preparation companies and small government advocates, making Joseph Bankman a hero of reform-minded liberals.

For other scholars, Joseph Bankman was a sympathetic and tolerant mentor. Jay Soled, a professor at Rutgers University, recalled a scene where Joseph Bankman comforted him after a failed presentation. “That’s the kind of person Joseph is,” he said. “There will be another time, and you will improve.” In 2009, while still teaching full-time, Joseph Bankman entered medical school to study clinical psychology. After completing his internship, he worked part-time as a cognitive-behavioral therapist and taught an elective course developed in collaboration with Barbara Fried to help law students manage anxiety.

Barbara Fried is an intellectual who is smarter than her husband. Although she is popular on campus, she is also famous for causing student anxiety while helping them control it. Her academic research focuses on a branch of ethics called consequentialism, which holds that the consequences of actions are more important than abstract notions of right and wrong. These ideas have become something of a family belief. The philosophy is to do good for as many people as possible, but to summarize it in a less kind way, it is “the end justifies the means.”

Barbara Fried

Barbara Fried’s most famous paper focuses on the “trolley problem,” a famous thought experiment involving a train destined for tragedy. It is primarily used by philosophers to debate moral choices: should you switch the train and kill the people standing on the next set of tracks, or do nothing and let a group of people on the main track die? Barbara Fried’s paper argues that this problem is absurd and obscures the moral choices policymakers face in real life – such as how much assistance to provide to the poor or how much healthcare to provide to the uninsured. “There are hundreds of thousands of pages on this,” said LianGuaiul Brest, former dean of Stanford Law School. “My feeling is that Barbara Fried doesn’t have much to say after solving the trolley problem.”

SBF has placed his mother’s self-righteousness at the center of FTX marketing. While his company may be formally engaged in selling cryptocurrencies, it is just one way to generate income for the cause of saving lives. In an advertising campaign featured in major fashion magazines, SBF and Brazilian supermodel Gisele Bündchen starred in an ad that quoted the FTX founder as saying, “I’m involved in cryptocurrency because I want to have the largest global impact possible forever.” Barbara Fried’s work is repeatedly mentioned in her son’s biography, often suggesting that SBF is a billionaire who is not so cynical about the world.

Barbara Fried’s second notable article is more relevant to her son’s current situation. Published as a cover story in the quarterly Boston Review in 2013, the article advocates for a more lenient attitude towards offenders. “The philosophy of personal responsibility has ruined criminal justice,” writes Barbara Fried. Her article is titled “Beyond Blame.”

SBF

In addition to the commitment to do good, operating a cryptocurrency business is always legally complex. SBF founded a hedge fund called Alameda Research in 2017, which aims to profit from price differences between cryptocurrencies traded in Asia and the United States. Soon, the fund was transferring large sums of money between continents in a manner that looks (as he boasts in podcasts) exactly like money laundering. Alameda had a hard time opening bank accounts.

SBF needs a lawyer. Fortunately, there is someone perfect for the job. In August 2022, Joseph Bankman stated on the FTX podcast, “From the beginning, I have been willing to lend a hand whenever I am needed.” He added that the company didn’t have a lawyer at the time, “and I think my role was pretty obvious.”

Former Alameda staff members said that Joseph Bankman helped draft early legal documents. Invoices from Alameda’s law firm, Fenwick & West, show that Joseph Bankman attended meetings, indicating his involvement not only in tax matters but also in the development of marketing materials for FTX and FTT.

FTX was headquartered in Hong Kong until the Hong Kong government began cracking down on cryptocurrencies in 2021. An insider familiar with FTX’s operations said that Joseph Bankman played a key role in the decision to move to the Bahamas, where there are almost no restrictions on digital currencies. The specific details were arranged by a lawyer personally hired by Joseph Bankman – Daniel Friedberg, who was a lawyer at Fenwick & West law firm and later became FTX’s general counsel.

For employees, SBF gives the impression that he frequently consults his father. A former employee said that when someone offers legal advice, SBF would often say it sounds good but wants to “call Joseph Bankman first.” This employee also said that almost all the lawyers who worked for Alameda seemed to be friendly with Joseph Bankman.

Other former employees mentioned that SBF could be difficult to communicate with and might be blunt and almost cruel when dealing with employees, while his father had a set of skills for interacting with people. Joseph Bankman’s training as a therapist made him an excellent listener, and he was also an energetic talker. Joseph Bankman would ask about employees’ personal lives, participate in cricket matches (a sport that employees were enthusiastic about), and attend company dinners. Barbara Fried also attended FTX dinners but appeared less often in the office. They both acted as mediators between the staff and their children. If SBF said something harsh or difficult to understand, his father would try to explain or simply say that he understood that his son could be difficult to get along with. Another employee recalled that Joseph Bankman was seen as a “lovable old man, someone capable but not threatening, who could prevent his son from losing control in the company.”

But the most important role played by Joseph Bankman and Barbara Fried was to gain people’s trust in their son, without which these people might not be inclined to do business with a rough and impetuous person. According to two sources, in 2021, when SBF was in talks with Sequoia Capital for a large investment, the company was interested in supporting a global cryptocurrency exchange but had concerns about potential legal and regulatory risks.

FTX is headquartered overseas and operates on the legal edge. To put it mildly, the founders of many competing companies seem to be morally flexible. Zhao Changpeng of Binance is under investigation by U.S. and other authorities. He denies any wrongdoing but refuses to disclose the exact location of his company’s headquarters. Arthur Hayes, co-founder and former CEO of BitMEX, was sued for failing to prevent money laundering activities on the platform. According to a federal criminal indictment, he boasted about setting up BitMEX’s headquarters on the small island nation of Seychelles in East Africa because bribing the regulatory authorities there “only takes a coconut.” He resigned and eventually surrendered to the authorities before pleading guilty.

The basic business of FTX is the same as Binance and BitMEX, but SBF believes that his long-term goal is to obtain approval from US regulatory agencies. In addition, he has something that other companies don’t have: recognition from a former commissioner of the US Securities and Exchange Commission (SEC). According to insiders, after a former prominent official from the US SEC called, Sequoia Capital was convinced to invest. This former official had informal discussions with the company about previous transactions and is now teaching at Stanford University. The former official spoke in support of FTX’s legal strategy, which involves conducting business overseas while striving to win approval from US regulatory agencies, and also mentioned that SBF happens to be the son of his friend.

This endorsement is one way, “Sam’s parents undoubtedly opened the door for him,” said someone involved in SBF’s efforts to get US politicians to accept his company.

At that time, Barbara Fried had already established a left-wing super political action committee called “Mind the Gap,” positioning itself as a “resistance movement” faction in Silicon Valley. The organization provided advice on where campaign donations from well-known tech donors, including former Google CEO Eric Schmidt and LinkedIn co-founder Reid Hoffman, should be used. The elite donor circle welcomed a new member in 2020: Barbara Fried’s son, who donated over $5.5 million to the Democratic Party and Democratic alliance groups, instantly making him a member of the Washington, D.C. community. In 2022, he donated about $40 million.

Barbara Fried directly provides funding to candidates recommended by Mind the Gap. Former FTX executive Nishad Singh admitted to channeling FTX client funds to support Barbara Fried’s political causes and donated $1 million to Mind the Gap in 2021, making him the biggest donor in LianGuaiC’s recent election cycle. Mind the Gap has not been accused of any misconduct.

Joseph Bankman

Meanwhile, Joseph Bankman often accompanies his son to meetings with regulatory agencies and elected officials. Joseph Bankman also appears as a spokesperson for the company’s charitable endeavors at FTX events. He still advocates for tax reform, but now he sometimes expresses a new interest: cryptocurrency.

Appearing on the FTX podcast, Joseph Bankman promoted a pilot project he runs in South Florida that provides digital currency wallets to the poor as an alternative to bank accounts. “If you’re not part of the financial system, everything becomes harder,” he said. “The cost of cashing a check is high. The cost of transferring funds is high. So it’s a national disgrace.” Joseph Bankman promises that FTX will address this issue.

In magazine profiles and TV interviews, SBF presents himself as humble. He wears worn-out sneakers, lives with roommates, drives a Toyota Corolla, and has donated all his savings to charity. In early 2022, SBF told Bloomberg reporters, “There’s no longer a truly effective way to make yourself happier by spending money. I don’t want a yacht.”

In fact, SBF and his inner circle have been enjoying a luxurious lifestyle, as described by the staff of the Super Bowl ad, with the office feeling like the Emerald City in “The Wizard of Oz”. The company has purchased luxury real estate worth hundreds of millions of dollars, including a top-floor apartment in the Bahamas’ most luxurious resort worth $30 million, where SBF and his partners reside. They have rented a private jet for themselves, and since the Amazon website does not always provide service to the island, they have also rented online packages. And – as indicated by the bankruptcy application – they have even purchased a 52-foot yacht. It was purchased by Alameda for the then company’s co-CEO Sam Trabucco.

SBF’s parents also seem to share in the “spoils”. They travel in first class, sometimes on private jets. Upon arriving in the Bahamas, they often stay in a $16 million beachfront apartment. FTX spent approximately $250 million to purchase this residence and over thirty other properties on the island. SBF’s parents have stated through their spokesperson that they consider this house to be company property, not their own.

SBF expressed similar views during an interview at The New York Times conference. “I know this is not their long-term property,” he said. “I don’t know how it was written.”

According to a sales agreement obtained through a public records request in the Bahamas, SBF’s parents signed as joint owners of the apartment on April 7, 2022, with a Bahamian notary public serving as a witness. The document does not mention FTX and refers to the property as a “vacation home”. “Joseph Bankman used the house as temporary accommodation while working in the Bahamas,” said the couple’s spokesperson in a statement. “External lawyers have confirmed to Joseph Bankman and Barbara Fried that FTX will have all beneficial ownership of the property and agreed to have this recorded in writing.”

Around the same time, Joseph Bankman received a $10 million gift from his son. FTX’s bankruptcy trustee Ray filed a lawsuit claiming that SBF obtained this money by borrowing from an account that held client funds. According to the lawsuit, he did so after consulting with his father, who at the time had become a personal and professional legal affairs senior advisor. The lawsuit alleges that this loan was never formalized – there was no loan agreement, promissory note, “or other indication that SBF took these funds from Alameda not for the benefit of his family.” His father transferred nearly $7 million into a personal bank account, while the remainder was kept on FTX.

Considering the continuous rise in cryptocurrency prices at the time, it seemed logical for Joseph Bankman to leave some of his savings on FTX, not to mention it was an opportunity to practice the values he had newly adopted. However, within a few months, market-wide selling led to him losing $1 million and ultimately endangering FTX itself. As the company teetered on the brink of bankruptcy, SBF publicly claimed that everything was fine while seeking help from his father to minimize the losses. “FTX’s assets are more than enough to cover all client assets,” he wrote on Twitter (now called X social media platform) (later deleted), “We do not invest (misappropriate) client assets.”

Behind the scenes, his father conveyed a very different but ultimately more honest message: FTX was in trouble and needed cash. A source said that on November 7th, the day after SBF released false information, he and his father went into hiding with other executives, trying to deal with what they called a run on the company. Joseph Bankman conveyed the same information to investors, including Trump White House press secretary and financier Anthony Scaramucci, who said he first heard of FTX’s troubles on November 7th.

Scaramucci said Joseph Bankman described a “liquidity mismatch” of about $1 billion in a phone call that morning. But in a second conference call later that day, Joseph Bankman said the actual number was $4.5 billion. Finally, Scaramucci learned from another FTX employee that the actual amount was $7 billion. “I think Joseph Bankman wanted to help his son, but he got caught up in what happened,” Scaramucci said. “You want to think of the absolute best for your child.”

SBF and his mother

In the following days, Bankman appeared in emails sent to the Bahamian Attorney General and the country’s top securities regulator, who had received information about possible misappropriation of funds and issued increasingly frantic messages, in short, asking what was happening. SBF copied his father, trying to delay their trip. He mentioned a “liquidity gap” and promised that the company was doing its utmost to find investors. In a subsequent email, his father also copied this email, proposing to repay Bahamian investors ahead of others – a suggestion the federal prosecutor considered essentially an attempt to “buy” influence in the country.

Just before filing for bankruptcy, Bankman urged regulators and creditors to avoid hasty judgments. Sources said his initial position was that FTX’s managers were just wayward children who had made mistakes. He explained that they would return the money and everyone could go on with their lives.

However, SBF’s parents did not attempt to return the cash. They did not explain why, but a lawsuit filed on behalf of FTX creditors by Ray suggests one reason: they need the money to fund their son’s criminal defense.

SBF was arrested in mid-December last year, subsequently extradited to the United States, and granted bail. The $250 million bail was provided by two of his parents’ colleagues at Stanford University, as well as the deed to their house as collateral. During the wait for trial, SBF was required to stay at home. The sudden turn of events shocked friends and faculty at Stanford University, who had just gotten used to the idea that the child they saw at Joe and Barb’s was a crypto billionaire. Now he was the mastermind behind one of the largest fraud cases in U.S. history. As SBF made his way home, security barriers went up, blocking the road home. Students and media gathered to watch; SBF’s parents told friends they had bought a German Shepherd because they were concerned for their safety.

“All of this is a pathological conspiracy,” said Tim Rosenberger, who graduated from law school earlier this year. “Are they going to hire a new professor? Who will teach tax law?”

In the group chat of former FTX employees, there was a heated debate about whether their parents knew about the alleged crimes. Meanwhile, friends of the couple have been struggling to understand how two individuals known for their morality could make such serious ethical mistakes. In August, prosecutors accused Ben SBF of leaking destructive information about a former employee in an attempt to intimidate a witness. His lawyer denied the allegation, but he was sent to the Brooklyn Metropolitan Detention Center.

When her son was detained, Barbara Fried tearfully tried to approach him from the audience seats. “That’s my son!” she exclaimed as a US marshal stopped her. She watched as SBF followed standard procedures to remove his jacket, loosen his tie, and untie his dress shoes. As his mother sobbed, his father wrapped his arm around her shoulder.

Friends say they are very concerned about the couple. Neither parent has taught any classes since SBF’s arrest. Joseph Bankman canceled his courses, and Barbara Fried retired from FTX two months before the collapse of the school and resigned from her political non-profit organization. “This is devastating to happen to a family that is full of wisdom and public-mindedness,” said John Donohue III, a professor at Stanford University and a long-time family friend.

“It’s hard to think, ‘How could they not know?'” said another friend who wished to remain anonymous. “The most reasonable explanation I can understand is blind faith. They didn’t have the full picture.”

That certainly makes sense. If the prosecutor’s account is accurate, SBF’s deceitful actions were antisocial—not only deceiving investors but also deceiving business partners and even his own employees. It is not an exaggeration to say that he may have exploited his parents—and their illustrious academic careers—to build an exploitative enterprise. SBF has claimed to be a billionaire multiple times. Why didn’t he buy his parents a nice house? Why couldn’t his father join Larry David at the Super Bowl shoot?

But critics say that even if they were unaware of the alleged misappropriation of funds, the parents should still bear some responsibility. Barbara Fried’s moral compass could explain how her son could overlook glaring ethical flaws in service of what he believed to be a greater good. Following this line of thinking: if the end result is billions of dollars going to charitable organizations to save the world, then what’s a little misappropriation of funds?

Meanwhile, Joseph Bankman was involved in providing legal advice, but now it seems at least somewhat unreasonable. He was involved in multiple decisions, including the launch of FTX, the creation of FTT, the company’s attempts to please politicians, and dealings with the regulatory authorities in the Bahamas, all of which have been criticized by regulators and prosecutors as potentially illegal. Joseph Bankman was also involved in the hiring of FTX’s general counsel, Friedberg, who has been accused of condoning fraudulent behavior and attempting to cover up efforts to expose the fraud, including bribing potential whistleblowers. These allegations were made in a lawsuit brought by FTX creditors, which includes a statement from Joseph Bankman to his son urging him to rely on Friedberg, “so we only have one person responsible for everything.” Friedberg denies any wrongdoing and has not been charged with a crime, but critics argue that his background is enough to give pause – including working at a Canadian online poker site that was accused of deceiving players during his tenure.

Then there’s Stanford University itself. Just a month before SBF’s arrest, Elizabeth Holmes was sentenced to 11 years in prison for fraud at medical device company Theranos Inc. She founded the company on campus during her student days and recruited prominent faculty members as employees and directors. The Holmes case, along with allegations of data manipulation in multiple academic papers by Stanford University President Marc Tessier-Lavigne, who resigned, has led some professors and students to question why the school didn’t uncover the misconduct cases sooner.

Defenders of Stanford University, including Donoho, point out that Stanford University is not the reason why SBF is suspected of criminal activity; it’s at most just their background. But background matters. Coming from a place like Stanford, with accomplished parents, changes the world’s perception of your flaws. Some behaviors that might be seen as unserious, like playing video games during meetings, become apparent evidence of talent.

Over the past 10 months, SBF has been trying to shift blame onto former employees, lawyers, and corporate competitors, insisting that his mistakes were due to carelessness rather than malice. “I messed up” is the exact quote from his congressional testimony before his arrest. It seems like he’s saying he’s just a kid far beyond his capabilities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Full Name Exploring the Path of Future On-chain Identity Layer Construction

- LianGuai Daily | LianGuai Launches Cryptocurrency to USD Exchange Service; MakerDAO Protocol RWA Total Assets Reach $2.613 Billion

- Cryptocurrency Track Weekly Report [2023/09/11] ETH Staking Rate Rises, Layer2 TVL Declines

- In-Depth Analysis of Coinbase’s Proposal for Flatcoin How to Design an Inflation-Adjusted Stablecoin?

- Why should MakerDAO choose Cosmos instead of Solana?

- An Instrument for Observation, Decision-making, and Trading – Friend Tech Tools.

- Interpreting Arweave Atomic Assets and Its Ecosystem A New NFT Paradigm Paving the Way for Creators’ Migration