Marshall SOV is about to open a global pre-sale, see how the first French currency cryptocurrency is designed

With tremendous pressure from the United States, the French currency cryptocurrency of the Republic of the Marshall Islands is finally coming soon.

Yesterday, according to Coindesk, the Republic of the Marshall Islands Minister David Paul said that the Republic of the Marshall Islands cryptocurrency SOV will open pre-sales.

According to David Paul, the actual pre-sale of SOV – users buy TRMI, and then can exchange one-to-one with SOV – has not yet started, still "in progress." But David Paul estimates that once launched, a true SOV will take 18 to 24 months, or even less, to be open to the public. In the pre-sale process, anyone (regardless of location) can register for pre-sales on the new website of the SOV Development Foundation.

Marshall Islands with SOV

- 20 million US dollars! Banking giant Santander became the first institution to issue bonds on the Ethereum public blockchain

- Senior crypto trader: "Bitcoin is digital gold" has not been confirmed, prefer band trading

- Ripple CEO: No one can control the price of XRP, the community can fork XRP

Similar to the Venezuelan oil coin, SOV is also issued by the government. However, compared with the oil coin, it is only a subsidiary currency. When the Marshallese government plans to start developing SOV, it publicly announces that SOV will be the legal currency of the country.

Moreover, unlike Venezuela, which resorted to the cryptocurrency due to its own monetary policy collapse, in fact, the Marshall government has been using the US dollar, and the introduction of SOV is to use cryptocurrency to complete its attempt to issue sovereign currency.

According to its official website, there are three main reasons for launching legal cryptocurrencies:

1. The currency system is incomplete.

Currently, the Republic of the Marshall Islands is facing problems such as inefficient cross-border financing, complex financing processes and expensive financing. It believes that the hodgepodge of international regulation is dense, opaque, and easy to circumvent.

2. The government and banks can create new currencies at will.

It believes that criminals can easily cross-border money laundering and finance terrorism by using traditional government currency and cryptocurrency. Worst of all, billions of people don't even get access to basic financial services because they are too costly or unavailable.

3. A sustainable, safe, and fair approach to capital management is needed.

Previously, according to Barak Ben Ezer, CEO of the Israeli company Neema (which partnered with Marshall to launch SOV):

1. SOV will be the legal tender as the US dollar and Japanese yen. It is different from Venezuela's digital currency Petro. Petro is not actually recognized as the national legal currency;

2. The original intention of SOV is to solve the tax problem. SOV as a digital asset can be used to repay all the debts of the Marshall Islands public and private.

3. SOV will have a blockchain similar to Bitcoin, with scalability and mining improvements, but the biggest advantage of SOV is that it will be considered a true "money."

It can be seen that although the Republic of the Marshall Islands is only a small country with a sneak peek, the influence of its cryptocurrency may not be obvious. But for the cryptocurrency world, this is undoubtedly the first to create "the cryptocurrency as a legal currency", and this has also caused a series of questions, such as how cryptocurrency functions as a legal currency, how to maintain stability, and how to design.

With these questions, the reporter browsed the white paper on SOV. The following is a highlight of the white paper:

Government issued cryptocurrency

SOV (short for “sovereign”) is a decentralized, blockchain-based currency that is the new legal currency of the Republic of the Marshall Islands (RMI).

Using the latest innovations in cryptography and distributed computing, as well as the established economic and legal principles of government currency issuance, SOV has introduced a new sovereign digital currency that is sustainable, fair and secure.

The blockchain currency issued by the government is the legal currency for all RMI debt, public fees, taxes and dues. SOV is the currency, just like the US dollar or the euro. This sovereign currency is issued by RMI in a blockchain, but unlike Bitcoin and other cryptocurrencies, it has the same legal and tax status as most national currencies, making it easy to exchange and consume.

The value concept of SOV

1. Sustainability: According to the algorithm, the supply of SOV will grow at a fixed rate of 4% per year, so the growth is slow, sustainable and unmanageable.

2. Fairness: Anyone can use SOV, and the newly created SOV is distributed proportionally to SOV holders and service providers that ensure network security.

3. Security: The SOV agreement ensures that it complies with international regulatory guidelines, but user details are kept confidential and will not be posted to the blockchain.

4. Simplicity: For individuals and businesses, SOV is easy to use and it is easy for organizations to get security and supervision.

SOV trust network

All users must be verified before trading with SOV.

After being authenticated and filtered, users can obtain SOV IDs from the authentication nodes they choose and allow transactions on the blockchain.

Factors that influence their choice may include which authentication nodes they trust will keep their identity information secret and will not use the information to make a profit.

This verification process is entrusted by the SOV management organization to a network of verification nodes called the SOV trust network, whose task is to supervise the SOV trust network.

The verification nodes that make up the SOV trust network are financial institutions such as exchanges and are decentralized entities. In addition, SOV administrative privileges can also grant the verifier the ability to approve secondary verifiers. (The mechanism for using multiple organizations to act as nodes is somewhat similar to Libra's association member governance model)

The verification node obtains incentives for participation through block rewards.

privacy protection

Personally identifiable information is not centralized or published to the SOV blockchain. SOV users can choose authenticated authentication nodes and can choose the authentication node they trust the most.

The verification node issues a cryptographically signed SOV ID to the approved user, which is provided by the user but does not display personally identifiable information and transactional data.

In order to further increase the privacy of the user, the user may choose to operate multiple verification accounts, which may be approved by different verification nodes. Since each account must be verified and each authentication node must be authenticated, this increases the user's choice without compromising the security of the entire system.

consensus

The block producer (verification node) is a decentralized entity that proposes and validates SOV blockchain blocks, which are approved and licensed by the SOV management.

Once there are more than 21 approved nodes in total, anyone with a network license can choose to participate in the selection node in the continuous voting system.

The node obtains the block reward by the number of blockchains generated.

Monetary Policy

There is no traditional central bank to decide monetary policy, and the supply of money is determined by the code written into the SOV blockchain.

At the initial release, 24 million SOVs will be issued. Each SOV is worth 100 cents. The total amount is 240 million SOVs (the total amount is known), and each SOV can be divisible by four decimal places to ensure that it maintains its usefulness as its value grows.

The SOV money supply follows the k-% rule designed by economist Milton Friedman. According to Friedman, “money stocks should grow at a fixed rate year after year, and should not change growth rates as they meet cyclical demands.

Therefore, the supply of sovereign countries will grow at a fixed rate of 4% per year, which is roughly in line with the estimated growth of world GDP. This rate is immutable and is encoded directly into the blockchain.

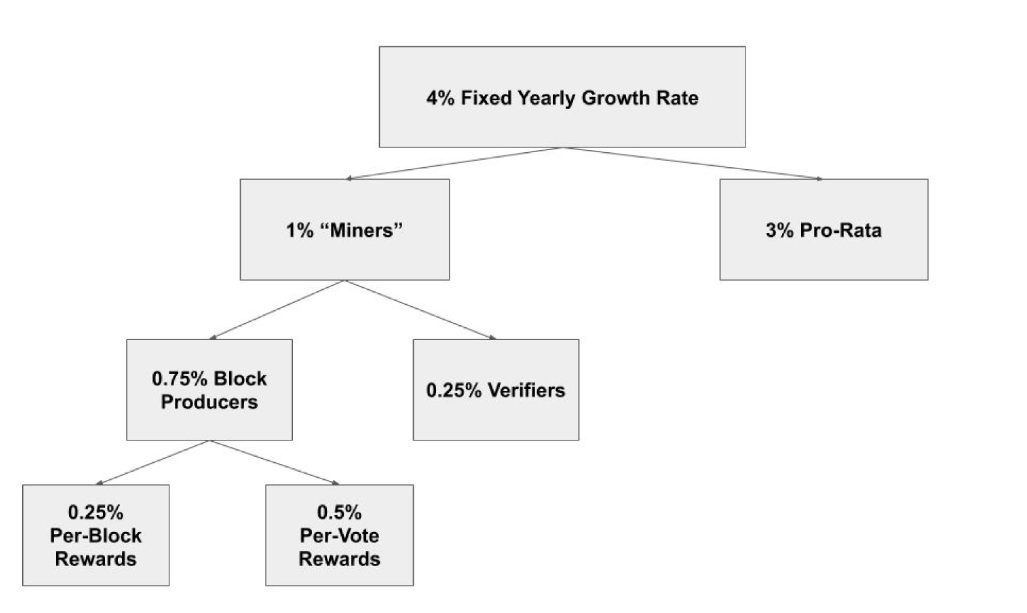

The 4% annual growth rate is divided as follows :

0.75% assigned to the node

The nodes selected in each round of elections are assigned a 0.25% bonus for each block based on the ratio of production per block.

All node candidates will also allocate a 0.5% bonus budget per vote based on the total number of votes they receive.

0.25% assigned to auditors

3% paid to the currency holder

It is worth mentioning that although the annual growth rate of 4% is immutable, the 4% distribution ratio is variable.

Initial distribution and sales

As shown in the figure, in the initial release of 24 million SOVs, the government retained 50% of SOVs, which were divided into four trust funds (all established annuities over five years).

The SOV Development Foundation accounts for 30% of SOV.

Early investors accounted for 10% of SOV.

Appoints organizers to account for 10% of SOV.

Public sale

In order to speed up the popularity of SOV, understand the liquidity level and market interest of SOV cryptocurrency. The Marshall authorities decided to let users introduce SOV by purchasing TRMI (timed Release Monetary issuance). This is equivalent to the predecessor of SOV.

After the official release of SOV, TRMI can be converted to SOV. TRMI is continuously released at an equal price through auction.

Main advantage

In the SOV white paper, it presents the following advantages:

International ease of use : SOV can be used like the legal currency of a sovereign country. This will include the elimination of capital gains tax minimums in many countries (such as the US and Canada), allowing for easy day-to-day transactions.

Low transaction costs: Because blockchain technology allows for fast, secure digital transmission, eliminating the need for financial institutions to settle in other currencies, SOV does not have to pay high credit card payment settlement fees, nor does it have to comply with the centralized policies of large credit card providers.

Convenient transactions : Lack of clear regulation and protection of cryptocurrencies such as Bitcoin makes it difficult for banks and currency exchanges to confidently revolve around these assets. Because SOVs have inherent protection against money laundering and other illegal uses, banks and currency exchanges can use SOV like traditional fiat currencies.

Serving people without a bank account : SOV can bring a portion of the 1 billion people without a bank account into the global economy.

Verify identity : All SOV users must first authenticate themselves with a trusted “KYC” solution that not only allows them to trade with SOV, but also prove their identity to third parties.

In summary, it can be seen that in terms of the design mechanism of SOV, it is more like the collection of hundreds of households, using elements such as token distribution, node mining, block incentives, community elections, etc. in the field of cryptocurrency. At the same time, in order to ensure decentralization, it also cites a model similar to the common governance of Libra Association members, that is, by introducing traditional financial institutions to ensure that SOV networks are not too concentrated.

But unlike Libra, because SOV positioning is a legal currency, SOV does not have anchors, relying solely on national credit. At the same time, the Marshall authorities gave the legal currency functions such as SOV mandatory circulation and value storage. However, the risk of SOV is that it cannot afford the stable nature of the legal currency.

In this regard, the attitude of the Marshall authorities is that “any form of convertible currency is not stable. For example, every time the exchange rate of the euro against the US dollar rises, it is no longer an effective means of value storage. What is important is that SOV can immediately play a value storage role in the Marshall Islands."

At present, it is still unclear what effect the legal cryptocurrency of the Republic of the Marshall Islands will bring. However, from the unrecognized virtual to the national credit, the Marshall authorities have undoubtedly made the cryptocurrency a new one. stage.

Original: Sharing Finance Neo

Source: Sharing Finance

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Getting started with blockchain | Blockchain and the past and present of the "big pie"

- 5G: Catalyst for blockchain and IoT development

- Babbitt column | Why study the "cottage" coins?

- After Bitcoin is stable, other currencies are ready to move.

- Hong Kong Stock Exchange with cross-border marriage: will enter digital asset trading within three years

- Babbitt column | 10 years of grinding a sword: how to better sustainable development of blockchain projects?

- PoW is efficient and saves the world $100 billion annually!