Monthly financing report | Global blockchain financing exceeded $1 billion in October, showing a steady upward trend

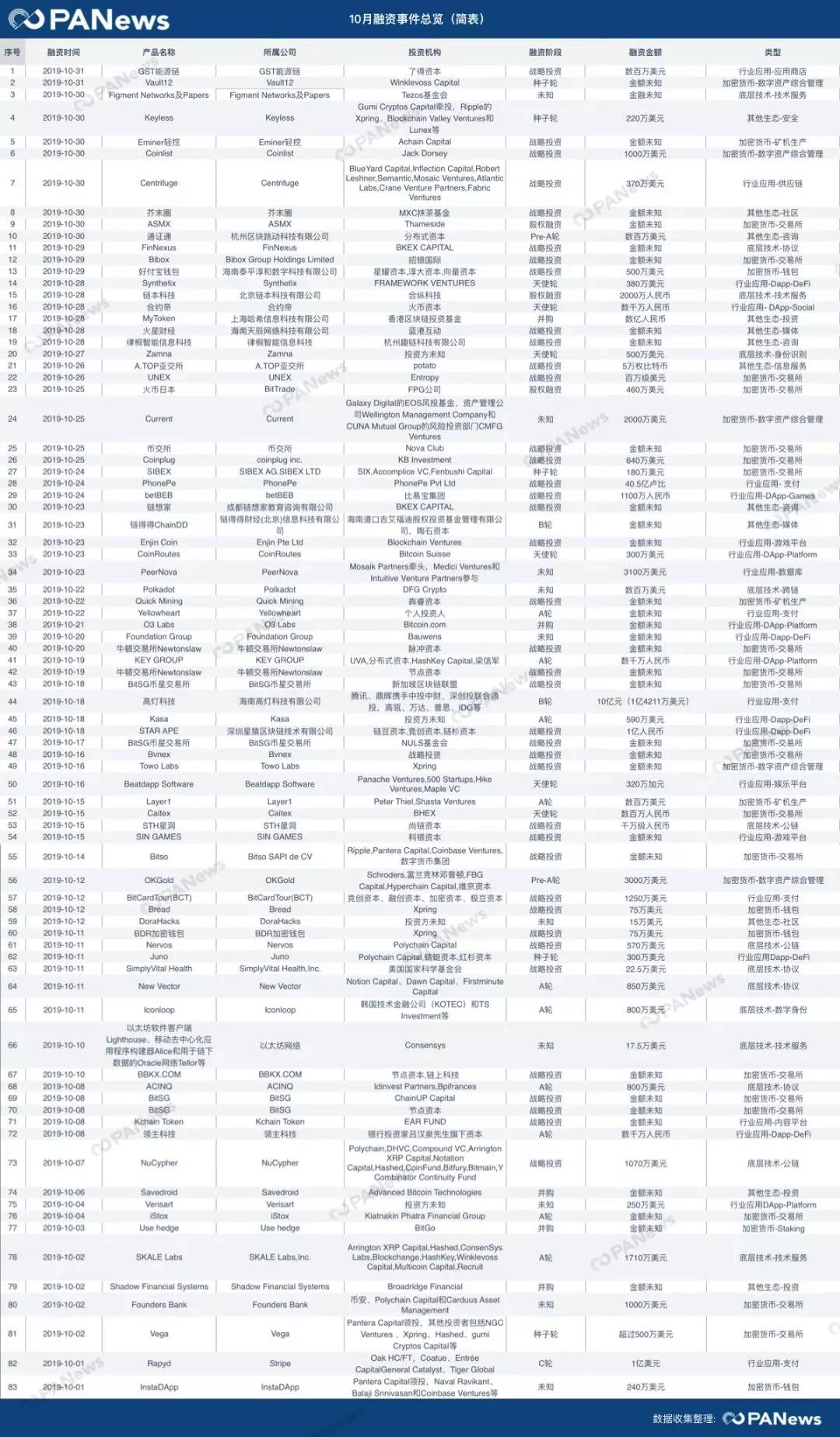

- There were more than 83 financing events in the global blockchain industry, involving a total of over US$1,022.8 million.

- The amount of financing is up to one million, and financing events of more than tens of millions have risen sharply.

- The financing phase tends to be multi-level, stepped up

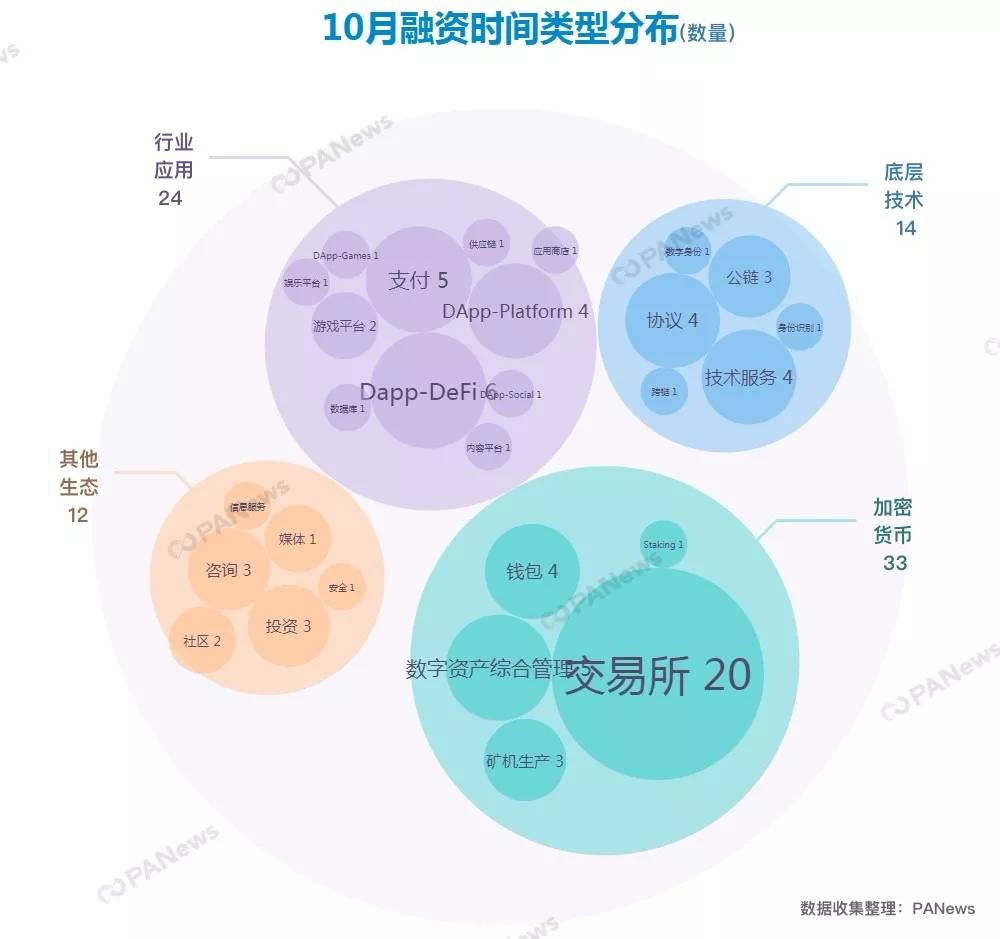

- Among the types of financing events, exchanges, payments, Dapp-DeFi are the three thrones, and the types are distributed in multiple concurrent

PANews sorted out the information on the amount, amount, and financing distribution of blockchain in October 2019 (October 1 to October 30), in order to understand the true status of current event financing. (Note: This report focuses on the amount of financing, financing amount and financing classification of blockchain investment and financing events disclosed in October 2019, in order to understand the current status of current event financing, and observe the key track and future direction of industry development. Reference sources include PA Weekly, PAData, Coin Schedule, Enterprise Check, IT Orange, PitchBook, and corporate websites.)

Report body:

- The agency said that 22,000 BitMEX users' personal information has been published online, will BitMEX face legal proceedings?

- Babbitt column | Who are we going to earn in the currency circle?

- Research Report | Seeing the "de-dollarization" from the central bank's digital currency

In October, the financing market in the blockchain sector developed steadily.

According to PANews incomplete statistics, between October 1 and October 30, 2019, there were more than 83 financing events in the global blockchain industry, involving a total of over $1,022.8 million. The Asia-Europe market continues to explode. China is supported by national policies, and the blockchain industry is eager to invest in China and the investment environment is more standardized. In addition, investment and financing events have become more diverse in terms of types, amount of levels, and financing stages, and the investment structure has become more stable, further reflecting that the development of the blockchain industry tends to be mature and stable.

Secondly, the blockchain and the traditional industry are more closely integrated. The blockchain technology is used in many industries such as entertainment, art, aviation and real estate to improve its platform. The B-side of the blockchain is becoming a consensus.

1. Distribution of investment and financing amount in the global blockchain industry in October 2019

According to PANews incomplete statistics, between October 1 and October 30, 2019, there were more than 83 financing events in the global blockchain industry, involving a total of over US$1,022.8 million.

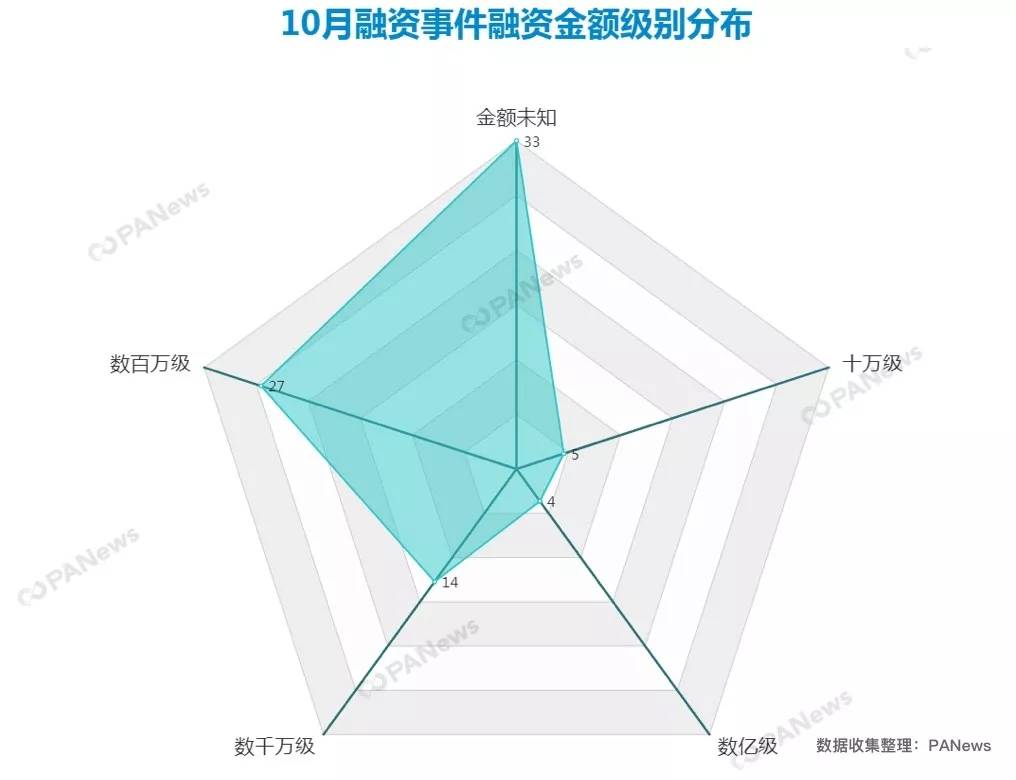

In October, excluding 33 undisclosed financing amounts, from the level of financing amount, the million-level is still the mainstream of the blockchain industry investment incident, a total of 27 cases, accounting for 32%; but compared with September The financing of more than one million has increased significantly. Among them, tens of millions of events accounted for 17%, a total of 14 cases; billions of events accounted for 5%, a total of 4 cases. In addition, there are 5 cases of 100,000-level investment events.

From the perspective of the distribution of financing amount, investors' confidence in the industry has improved. From the perspective of financing time of more than 10 million yuan, the industry application class becomes a hot track, contract emperor, PhonePe, PeerNova, KEY GROUP, high-light technology, STAR APE, lord technology, Rapyd, in Dapp-DeFi, DApp- Platform, DApp-Social, payment and other perspectives promote the commercial application of blockchain technology. Among them, India's digital payment service provider PhonePe completed a new round of financing of 4.05 billion rupees (about 57.195 million US dollars), which will be used for its payment, especially cross-border payment business. In addition, investors pay more attention to the underlying technology. Among them, taking SKALE Labs as an example, the Ethereum scalability platform SKALE Network obtained $17.1 million from ConsenSys Labs and Winklevoss Capital to start the main network. NuCypher, the privacy public chain, raised $10.7 million through the Future Token Simple Agreement (SAFT), led by Polychain Capital, and several companies including Bitcoin, Bitfury, Y Combinator Continuity Fund, CoinFund, Continue Capital, and Hashed.

In October, among the 58 investment and financing transactions, in the disclosed incidents, the financing amount was mostly in the millions of US dollars, a total of 22, accounting for 37.93% of the total number of financing; 8 of the 10 million dollars, accounting for 13.79 %; 3 dollars below the million dollars, accounting for 5.17%. Another 25 financing events have not disclosed the specific financing amount. Among them, 10 million US dollars events include Elliptic's $23 million Series B financing; CasperLabs' $14.5 million Series A financing; Dapper Labs's 11.2 million US financing; Immutable's $15 million financing, Everledger's $20 million Series A financing The financing types focus on blockchain technology and analysis, public chain, financial services, supply chain and other fields.

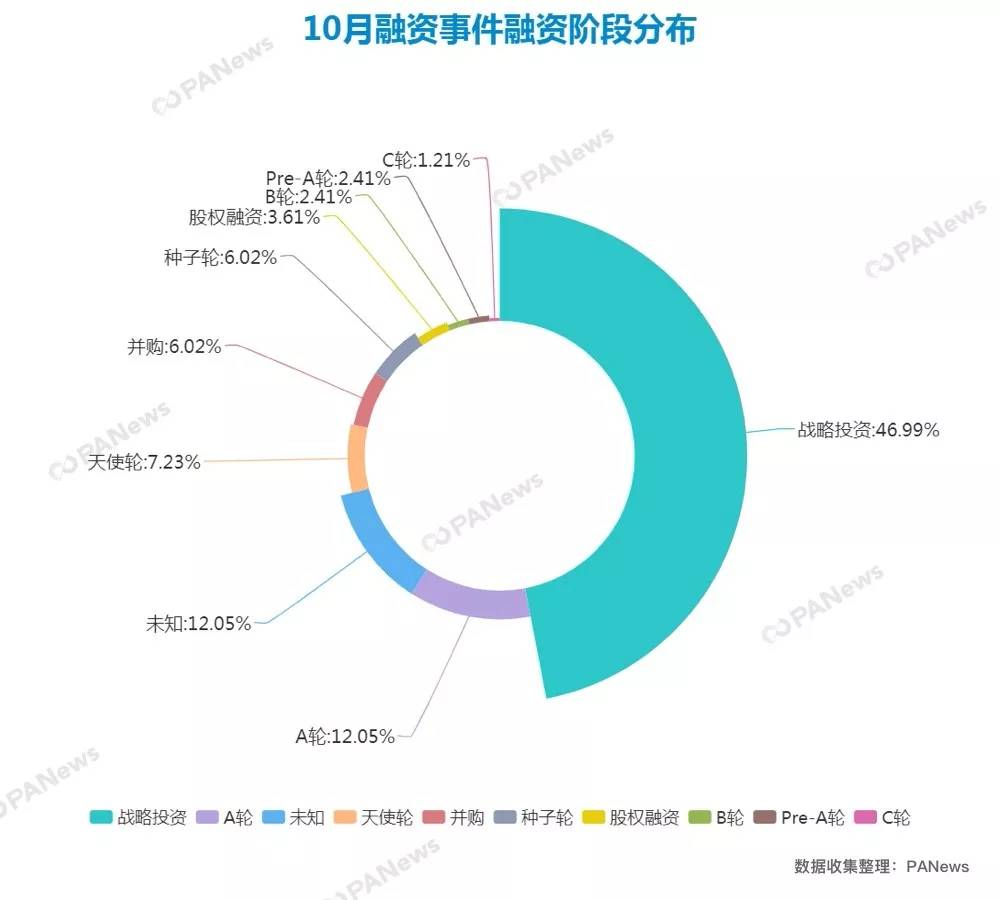

2. Distribution of investment and financing stages in the blockchain industry in October 2019

In October, strategic investment accounted for almost half of the financing incidents, reaching a total of 46.99% of financing, and the A round and above rounds increased significantly compared with September. In addition to strategic investment and unknown financing phase events, the number of financing events gradually decreases from low to high. However, the distribution of financing rounds tends to be multi-layered.

In terms of quantity, in 83 cases, strategic investment reached 39 cases, followed by A round of financing incidents, a total of 10 cases, 10 cases of unknown financing incidents; secondly, 6 cases of angel round; mergers and acquisitions There were 5 cases of incidents and seed rounds; 3 cases of equity financing; 2 cases of B and Pre-A rounds; and 1 case of C rounds.

It is worth noting that in the 2 cases of B rounds from the domestic market, one of the blockchain electronic invoicing participants of the high-light technology completed 1 billion B round of financing, led by well-known companies such as Tencent, Dinghui and other institutions. The financial chain of the blockchain has got ChainDD to complete the B round of financing. The investor is Hainan Daokou Ji'aifudi Equity Investment Fund Management Co., Ltd., Taoshi Capital. In only one case of C-round financing, Rapyd, a payment platform supported by the payment giant Stripe, raised a total of 100 million US dollars to compete with the stable currency.

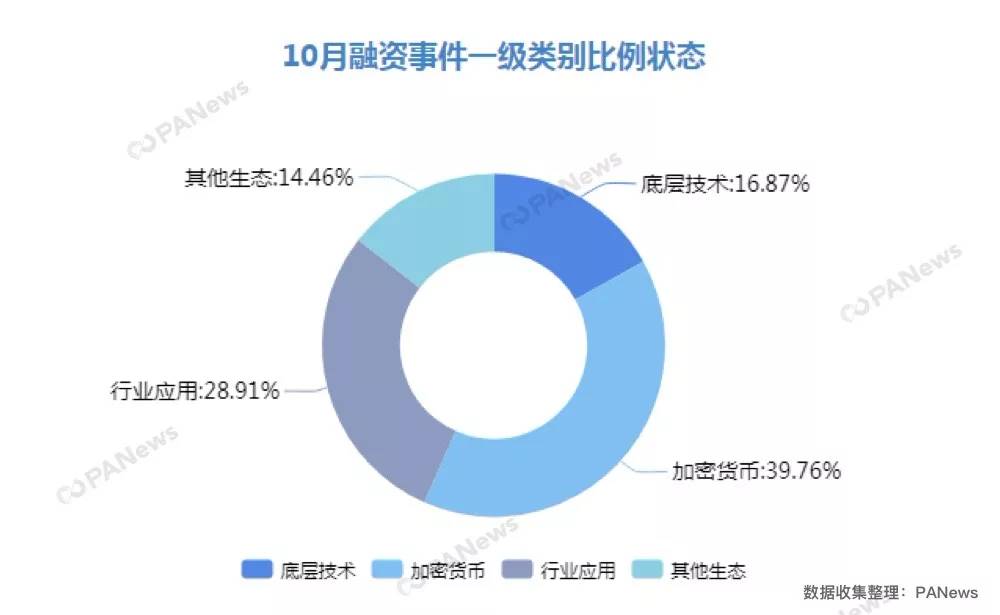

3. Distribution of investment and financing types in the global blockchain industry in October 2019

In order to observe the overall financing situation of blockchain events under the same standard, this paper will refer to the classification of PAData. The financing types are divided into four primary classifications and 40 secondary classifications. The primary classification includes: underlying technology, cryptocurrency, industry applications, and other ecosystems. The underlying technology is divided into 10 categories including public chain, alliance chain, side chain, cross-chain, fragmentation, agreement, smart contract, tools, identification and technical services; cryptocurrency is divided into 6 categories, issuers, exchanges, wallets, Mining machine production, Staking and integrated digital asset management; industry applications are divided into 14 categories, including Dapp-DeFi, DApp-Games, DApp-Platform, DApp-Social, payment, supply chain, browser, content platform, human resources platform, Databases, app stores, gaming platforms, entertainment platforms, domain name services; other ecosystems include security, incubation, media, research, rating, community, data, investment, consulting, information services.

According to the incomplete statistics of PANews, 83 financing events in the global blockchain industry in October 2019 involved multiple fields, including investment and financing events, including technical services, identification, cross-connection, public chain, agreement, Dapp-DeFi. , DApp-Games, DApp-Platform, DApp-Social, Payments, Supply Chain, Content Platform, App Store, Gaming Platform, Entertainment Platform, Exchange, Wallet, Mining Production, Staking, Integrated Digital Asset Management, Security, Media, Sub-categories such as research, community, investment, consulting, and information services.

In October, investment and financing events around the commercial finance sector dominated, but in many industries, the investment and financing situation tends to be diversified, hierarchical and vertical.

As can be seen from the figure, in the underlying technology, cryptocurrency, industry applications and other ecological categories, the cryptocurrency-related events are not hot, with 33 cases ranking the first of the four main types, accounting for 39.76%. Secondly, the industry applied to the new track, and there were 24 cases of industry application financing, accounting for 28.91%. Since then, there are 14 cases and 12 cases of the bottom layer technology and other ecology, respectively, accounting for 16.87% and 14.46% respectively.

Overall, in the October financing incident, mainstream events centered around financial services and their derivative business applications. Intersected in September, the October financing event became more diversified in the type segmentation. Among them, the exchange, payment, Dapp-DeFi ranked among the top financing events. From the perspective of large-scale subdivision, in the cryptocurrency event, the exchange has an absolute advantage, followed by digital asset management; in the industry application, the distribution is more uniform, the payment service and DApp are three-legged; in the underlying technology, the public chain event, agreement, Technical services are still the key track; in other ecosystems, ecological construction is more concurrent and still in the test stage.

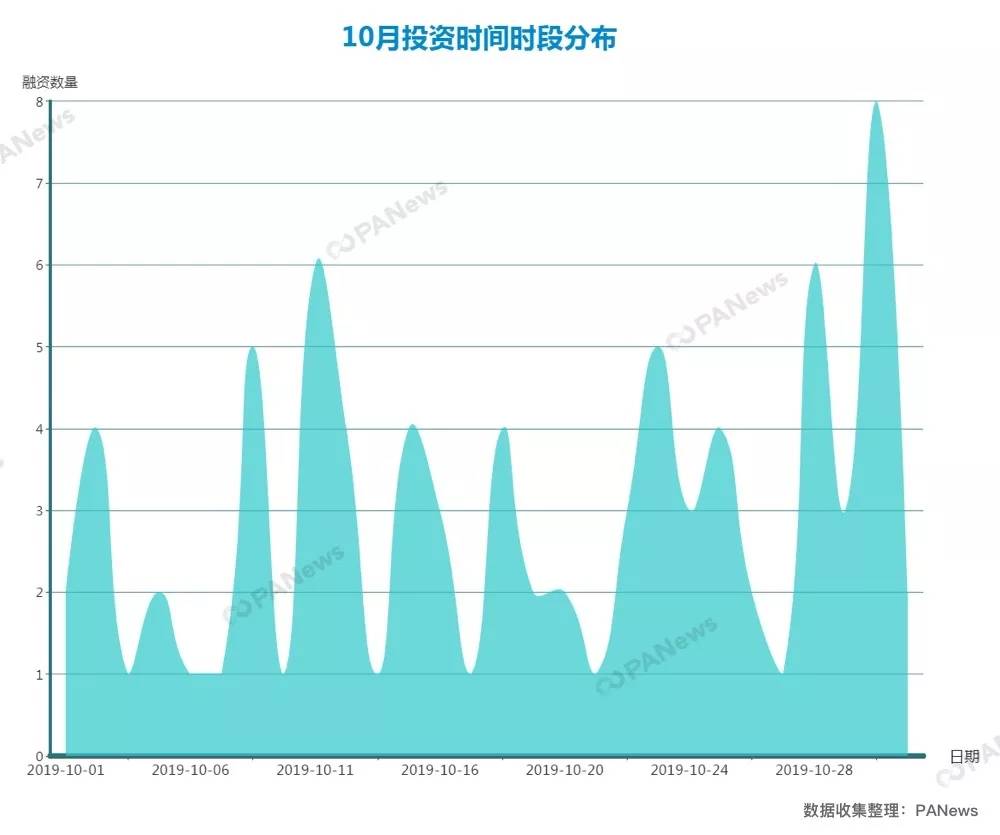

Distribution of investment and financing periods in the global blockchain industry in October 2002

In October, from the distribution of time slots, the state of investment and financing has gradually increased from the beginning of the month to the end of the month, with partial fluctuations.

In the first half of October, governments and their regulatory agencies frequently lit up the warning lights in the encryption industry. While supporting the development of blockchain technology, many countries have tightened their supervision. At the same time, hot events such as Libra were cold, and investment and financing events were relatively cautious.

Affected by domestic positive news, in late October, investor confidence increased, investment incidents increased, and reached the peak of the month on October 30. On the same day, there were 8 financing events. Among them, a number of companies including Tongzhengtong, Haofubao, Link Technology, Mars Finance, and Lawrence Technology were supported by investment institutions in the latter part of the year. At the same time, from the perspective of types, industry applications and content platforms are more popular among investors in China.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ruibo completed strategic investment in the new smart contract platform, and the XRP ecosystem became more perfect.

- Wuzhen gathers more than the original special event, and talks about the blockchain ecology and application.

- Babbitt Column | Super Jun: Miner's Spring

- The blockchain has come in the future, are you ready?

- The Ministry of Industry and Information Technology has promoted the development of blockchain, and the Hong Kong Securities Regulatory Commission issued a regulatory framework for virtual asset transactions.

- Blockchain: A step in financial innovation

- “National team” grabs the blockchain and infrastructure is preferred