Old-timers Leaving the Crypto Circle Some Get Married and Have Children, Some Start New Businesses

Old-timers leaving the crypto circle marriage, children, and new businesses

Author: 0xmin & Freya

Editor: 0xmin

In the crypto world, people come and go. Have you ever wondered where the people who left the crypto circle went?

- What are the global regulations on the supervision of encrypted assets that the SEC is committed to adopting?

- HashKey Investment Manager The likelihood of the market mainly fluctuating is relatively high, and the market sentiment remains poor.

- From top mining companies to top crypto funds, Fidelity Mafia is becoming a talent incubator for Crypto.

With this question in mind, we interviewed many former industry professionals and received various answers: studying abroad, getting married and having children, lying flat, starting AI businesses, selling insurance, technology agriculture…

Leaving here does not mean not holding crypto assets, but not working in the crypto industry. Some people earn enough to retire and live a laid-back life; some people leave because of the bear market; some people are still unemployed…

When the gears of the crypto cycle start to turn, everyone is swept along and has no choice.

What are the old-timers in the crypto circle doing?

In 2011, there was a major event that affected the development of Chinese cryptocurrency. The community “8btc” was founded.

The two founders of 8btc, Chang Jian and QQagent (Wu Jihan), are well-known in the industry. But there is actually another founder – financial writer Lao Duan.

In 2011, Lao Duan wrote several articles about Bitcoin, such as “What Can Appreciate 3000 Times in a Year” and “Bitcoin: Great Innovation or Giant Bubble?”. In July 2012, Lao Duan established the Bitcoin fund “Lao Duan Bitcoin Fund”, which was the first Bitcoin fund in China.

A few months later, the Cyprus banking crisis broke out, and Bitcoin skyrocketed more than ten times in eight months. However, the skyrocketing price brought immense “psychological pressure” to Lao Duan. Under the pressure of cashing out, in April 2013, Lao Duan chose to liquidate the Bitcoin fund, believing that the rise of Bitcoin had come to an end.

In November 2013, after liquidating the Bitcoin fund for five months, to everyone’s surprise, Bitcoin soared again. But at this time, Lao Duan, who had “missed the boat”, gradually transformed from a Bitcoin evangelist to a Bitcoin critic.

“The biggest value of Bitcoin now is that it fulfills the fantasy of ‘getting rich overnight’ for Chinese people.”

From then on, Lao Duan and the Bitcoin world went their separate ways. He later rooted himself in the stock market and became a stock commentator. He has also published books such as “Investment Magic Book,” “Positive Energy Investment Study,” and “Actually, You Still Don’t Understand Women.”

In March 2021, Lao Duan mentioned “Bitcoin” again.

Lao Duan said that at one point he owned four-digit Bitcoin, which is now worth billions of RMB. However, most of them were sold after making tens of times the profit. Now he only has three-digit “leftovers”, but all of these Bitcoin are in an exchange that has already gone bankrupt – Mt. Gox.

Both are about Bitcoin. After Wu Jihan and Lao Duan left, Zhang Jie found new partners: Song Huanping, Chen Yurong, and Lang Yu.

Song Huanping’s previous title was “Co-founder of Bitcoin.” Now, the identity tag of Song Huanping appearing in the media is Founder of Joy Tiger Capital, the first angel investor in the catering industry, invested in Lele Tea, Chen Xianggui, Hu Tou Ju, Jasmine Milk Tea, and Hu Zi Da Chu.

In 2013, Song Huanping learned about Bitcoin in a QQ group and then, through a friend’s introduction, met Zhang Jie and joined Bitcoin to participate in its commercialization process. However, this journey only lasted for 4 months.

In early 2015, with the first bucket of money earned from the cryptocurrency circle, Song Huanping chose to leave the cryptocurrency circle and turned to the investment circle, targeting the catering industry, and established Joy Tiger Capital.

In 2017, when interviewed by the media, Song Huanping expressed some dissatisfaction with the cryptocurrency circle, even saying, “I am a little sad”:

“A round of skyrocketing, followed by a new round of attention, and then quickly cooled down, until the next time it breaks through a price that was considered crazy before, it attracts even greater attention.”

“Bitcoin is a good thing, but the cryptocurrency circle is too dirty.“

Since the birth of Bitcoin, it has changed the destiny of many grassroots people in more than ten years. The old people in the cryptocurrency circle have all “retired” and faded out of the public eye.

A “veteran” who entered the Bitcoin community in 2013 told DeepTechFlow that the old people in the cryptocurrency circle either went abroad or returned to their families, taking care of their children every day, and some became obsessed with “immortality” and invested in peptide-related industries.

Once known as the “richest man in Bitcoin,” Li Xiaolai was regarded as the spokesperson of the cryptocurrency circle until he gradually faded out of the encryption industry after the recording incident in 2018. Besides continuing to write books, the most important thing for Li Xiaolai, who left the cryptocurrency circle, is to “have a bunch of children”. As a father, Li Xiaolai now has a new identity – educator.

After 2022, Li Xiaolai launched the “Family Growth Yearly Community” (1999/year) and in 2023, he launched a new course “Li Xiaolai Talks about Family Education in the AI Era” on the platform “De Dao,” which received widespread praise.

The Lying-Down Miners

Once, miners were seen as standing at the top of the cryptocurrency food chain. With a “prohibition order,” Bitcoin mining completely broke up with China. So, where did the miners who no longer mine go?

The former miners interviewed by DeepTechFlow told us that the mining community is also extremely complex, with different decisions and ideas between large miners and small miners.

Some large miners choose to continue mining by using mining machines and physical resources, while others choose to transform into AI and provide computing power support to other enterprises.

Most of the interviewees mentioned the same words – “lying flat”, having savings, not wanting to work, so they eat, drink, play, travel, and pursue a healthy lifestyle.

The miner Wang Lei is now in a state of “lying flat”. Having suffered losses in the cryptocurrency circle, he has become unusually cautious. He does not engage in risky investments, does not interact with people in the cryptocurrency circle, and holds ETH to obtain nearly 4% risk-free annualized returns through Satking. The annual income of nearly 80 ETH is enough to cover his daily expenses.

This is already a good “outcome”, as countless small and medium-sized miners have gone bankrupt after a bull market.

“Many small miners floated away during the last market surge. Some people who didn’t cash out in time went from driving a Porsche to having to take a Didi (ride-hailing service),” said former miner Li Xiaoming.

Many miners blindly invested during the bull market and got trapped in various first and second-level projects. At the same time, they encountered the collapse of FTX/PayPal, making miners also become members of the rights protection movement.

In Yunnan, a female miner named Liang You, who entered the Bitcoin community in 2012, chose to engage in organic technology agriculture after the “mining ban”.

Raising shrimp, other sea products, and orchards… she is also enjoying it.

Shrimp raised by Liang You

After conducting some research and thinking, Liang You believes that agriculture is relatively stable and long-term business under the current economic environment in China. In addition to technological agriculture, Liang You will also invest in other physical industries.

Although Liang You and other former miners are no longer “mining”, they still pay attention to the trends in the cryptocurrency market. They have a common goal – to accumulate coins.

After leaving as an entrepreneur

Before entering the cryptocurrency circle, Saul had been involved in internet investment.

In the summer of 2021, the emergence of STEPN made Saul realize that blockchain gaming could be a direction for the future development of the gaming industry.

This time, instead of directly investing in a company, he chose to start his own business. Compared to young entrepreneurs who have been in the cryptocurrency industry from the beginning, he believes that his advantage lies in having experienced a complete cycle and having richer product and user experience.

Therefore, based on STEPN, Saul launched a similar “to earn” project and obtained investments from multiple industry venture capitals.

In the hot “x-to-earn” trend, Saul’s project gained widespread attention in the early stages due to various operational activities and collaborations with some public chain ecosystems. NFT prop sales were impressive. However, like a momentary firework, the beauty is always short-lived. The collapse of STEPN running shoes plunged the entire “x-to-earn” track into a winter season.

Saul’s project failed to survive in the crypto winter, and after a year of persistence, Saul disbanded the team.

Saul attributed part of the failure to the “cycle”. He said, “Web3 entrepreneurship has obvious cyclical characteristics, shorter than traditional finance. Web3 is a more retail-oriented and irrational market. The more important problem is that Web3 is difficult to acquire and retain real users, especially when the market is unstable, user growth is slower than imagined.”

After liquidating the project, Saul left the cryptocurrency industry and chose to venture into the booming AI wave to continue his entrepreneurship.

In Saul’s view, the crypto industry and AI are completely different industries with different underlying logics. The AI industry is more technology-driven, while the crypto industry is still mainly driven by funding. Blockchain products have not yet effectively solved practical problems in daily life.

However, he will continue to pay attention to the crypto industry in the future because he believes that there are many possibilities for the combination of AI and the crypto industry, especially in the gaming industry. He may even return to the crypto circle in the future with a new identity and posture.

“Life is an experience, and if I were to start over again, I would definitely choose to start a business in the crypto industry.“

Saul is just a microcosm of the “Web3 to AI” trend in the crypto bear market. Will Wang, a partner at Generative Ventures, said, “So far, all the mobile internet portfolios I previously invested in and then turned to the so-called Web3 direction have now all returned to AI.“

In June 2023, the oldest domestic crypto media, 8btc, announced a comprehensive shift to the AI track, and the founder of 8btc, Chang Jia, also transformed into the founder of Unbounded AI, similar to the Chinese version of Midjourney.

A new question arises: “When the next crypto bull market arrives, will the departed entrepreneurs return?“

Transient Practitioners

The flow of personnel in the crypto industry often fluctuates with the cyclical rise and fall of the market. When the bull market comes, they all come back, and when the bear market arrives, they scatter.

Xiao Jun used to work in a well-known industry VC doing post-investment work. Unexpectedly, she received a “layoff notice” at the beginning of this year. After considering it carefully, Xiao Jun did not continue to look for a job in the industry. Instead, she resolutely left the crypto circle and joined a local medical industry.

For Xiao Jun, who comes from a financially well-off family, work itself is not that important. At present, she has a more important mission – to find a partner and get married. The work in the crypto industry seems to cause her some trouble in dating.

There are quite a few people like Xiao Jun who have been laid off and changed careers or are unemployed. The crypto bear market from 2022 to 2023 not only severely impacted investors’ wallets but also triggered a wave of layoffs in the crypto circle. Exchanges, VCs, and project teams all chose to “lay off” to reduce costs and survive the bear market.

Antoniayly operates a Web3 job-seeking and recruitment community, and she has a clear perception of the unemployment wave in the bear market of the cryptocurrency industry.

“The talent pool for job seekers grows by about a dozen every week, but it’s considered good if there is a new position available each week. I browse overseas job websites every week, but there are not many companies hiring. Most of them are job postings from large European and American companies, but it’s hard to say how many of them have actual hiring plans.”

Leo, an entrepreneur who has posted job listings before, told Deep Tide TechFlow, “As soon as I post a job listing, I receive a large number of resumes, and some of the applicants have excellent backgrounds.” In his opinion, this is not a problem unique to the crypto industry, but rather a result of the overall unfavorable environment. He also received resumes from a large number of people with backgrounds in internet giants. Many of them want to join Web3 because the internet industry is more tiring and demanding.

Whether it’s Web2 or Web3, under the wave of layoffs, everyone is looking for a way out.

Small V, who has a background in journalism, used to write reports on financial technology for a leading technology media company and joined a blockchain media company as a chief editor in 2018 out of pure interest in the new field.

At the end of 2019, Small V chose to “exit” the crypto industry and “change the environment” by joining an internet company to work in brand marketing. Small V quickly felt the unfriendly working environment of the internet industry, both due to the overall downward trend and the age crisis at 35.

“In a large company, I feel like a screw inside a machine. There is not much room for personal development and a sense of value, and it’s not as free as working in the media.”

In mid-2023, amidst the wave of layoffs in large companies, Small V voluntarily accepted the “optimization package” and began embracing a new field – insurance brokerage.

“From my observation, I feel that this is a very promising industry. The insurance industry’s depth will increase after a country’s per capita GDP reaches a turning point. The views of some young people in China towards insurance are completely different from before.”

Another reason for choosing to be an insurance broker, Small V believes that the experience accumulated in the insurance industry itself is of great help to career development. The current insurance products are complex, involving not only knowledge about the products themselves but also legal and medical knowledge. This profession is also not as age-discriminatory as the internet industry, and many successful insurance brokers consider insurance as a lifelong career.

Recently, Small V will join another internet giant as the main job and continue to pursue insurance brokerage as a side business.

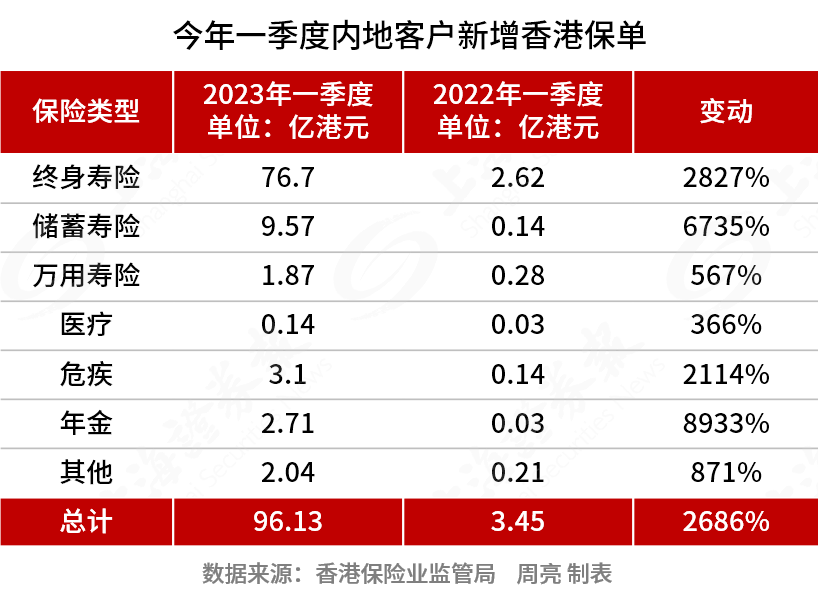

Similarly, the author has noticed that many Hong Kong friends who used to work in the crypto industry have entered 2023, and they have started the “Hong Kong insurance” sales model in their social circles, either joining insurance companies full-time or becoming licensed managers.

In 2023, with the resumption of customs clearance, the new Web3 policy in Hong Kong, and the relaxation of the high-level and high-talent program, a large number of mainland personnel and funds have poured into Hong Kong. Obtaining Hong Kong identity, starting a business in Hong Kong, and purchasing Hong Kong insurance have become the “To Do List” for many cryptocurrency practitioners in 2023, also giving rise to a wave of wealth opportunities.

At the end of the interview, we usually ask one question, “Would you still want to return to the cryptocurrency industry?“

Almost everyone answered yes, mostly mentioning the most attractive aspect of the cryptocurrency industry, the status of distributed remote work, which provides individuals with more freedom.

Coco left the cryptocurrency industry and joined a major internet company in 2019, but returned in 2022. In her opinion, compared to working in internet companies, the cryptocurrency industry is still much easier, to the point where she has spare time to engage in side businesses. In addition, the cryptocurrency industry can also change a person’s mindset and expectations.

“Losing money is not important. Once you make some quick money, it’s hard to completely leave,” Coco said.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reflections on the Game Marketplace, Asset Valuation Dimensions, Metaverse Interactions, and AI Games Triggered by the Treasure Trove

- Are cryptocurrencies, as legal assets, subject to taxation in mainland China?

- Can Bitcoin miners successfully transition to artificial intelligence and perfectly catch the next wave?

- August Cryptocurrency Market Summary Most indicators further corrected, and the total on-chain transaction volume decreased by 6.3% after adjustment.

- LianGuai Daily | The US SEC has postponed its decision on the Bitcoin spot ETF; UK cryptocurrency travel rules come into effect today.

- Steady profit from rebound? An article lists 4 volatile tokens with the best performance.

- Binance Research Emerging Stablecoins and an Overview of Market Competition