More “coin days” than the chain trading volume indicator, more able to reflect the flow of funds

“I just noticed that the total amount of Bitcoin transferred in the past 24 hours has reached 7,149,570.84 BTC. Is this number the largest? Is there any other big transfer? Is Nakamoto active again?”

This is a post posted on the Bitcointalk forum by a user nicknamed S3052 on April 20, 2011. Subsequently, other users on the forum joined in to explore the economic activity level of Bitcoin. The amount of trading on the chain is not perfect, because you can repeatedly send the same bitcoin back and forth between your own addresses to "brush", for example, you use 100 bitcoins to revolve 20 times at your own two addresses. It will increase the Bitcoin transaction volume by 2000BTC.

Below that post, a user nicknamed ByteCoin proposed a new indicator: Bitcoin Days Destroyed.

Bitcoin Days Destroyed is the amount of money (coin) per transaction multiplied by the currency of the transaction. For example, if you spent 1BTC received 10 days ago, then the currency destroyed by this transaction is 10*1=10; if you spent 10BTC received 1 day ago, the destroyed currency days It is also 10.

- Interpretation of Libra: A revolution covering 2.7 billion people? Still a whimsical girl

- Awards for Call for Papers | Celebrating the first anniversary of the PlatON Cloud Map release!

- Twitter Featured: Connect V God, say your worship of the Ethereum application Top 3

In other words, the currency day indicator gives more weight to the bitcoin that has not been spent for a long time. When measuring the economic activity level of Bitcoin, the currency eliminates a lot of "noise" (that is, data that doesn't make much sense, such as the amount of money) compared to the amount of trading on the chain.

In addition to measuring the level of economic activity of Bitcoin, what is the use of the indicator of the currency day?

The currency day is more reflective of the market's capital flow than the transaction volume. If the daily value of the currency destroyed is rising or even peaking, and the market is in a down channel, which means that the number of “sleeping” bitcoins is being used, it is likely that many large households, “ geeks ” are throwing money; The market is on a rising channel, meaning the market may continue to strengthen.

The currency can also be applied to the credit rating. In this regard, Chang Hao often mentions. When we shop on Taobao, we often refer to the merchant's transaction volume and credit rating. Although Taobao has done a lot of measures to prevent cheating, brushing reputation and other cheating behaviors, it can not be eliminated. If these merchants are built on the Bitcoin network (or DApps on other blockchain networks), the more coins are destroyed in the transaction, the higher the weight of the credit rating, and the more effective the prevention of credit reputation.

For example, suppose a merchant's home 100BTC repeatedly trades to credit, the first transaction evaluation is valid, the accumulated currency days are destroyed, but the second and subsequent frequent brushing, due to the interval too Short, the value of the currency day will be small, and the impact on the credit rating will be small. If a large amount of small transactions are used to brush the credit, since the currency is the product of the amount of the transaction (coin) and the time remaining on the account, the transaction amount is too small, and it is difficult to affect the reputation.

In addition, the currency days will also affect the priority of your transactions being packaged. Suppose you and Zhang San transfer 10BTC at the same time, and the handling fee is the same. If your transfer is to be destroyed, the value of the currency is larger. (For example, if your 10BTC is sleeping in the address for 1 year, Zhang San’s 10BTC is The miners just received it, and the miners prioritize packing your trades.

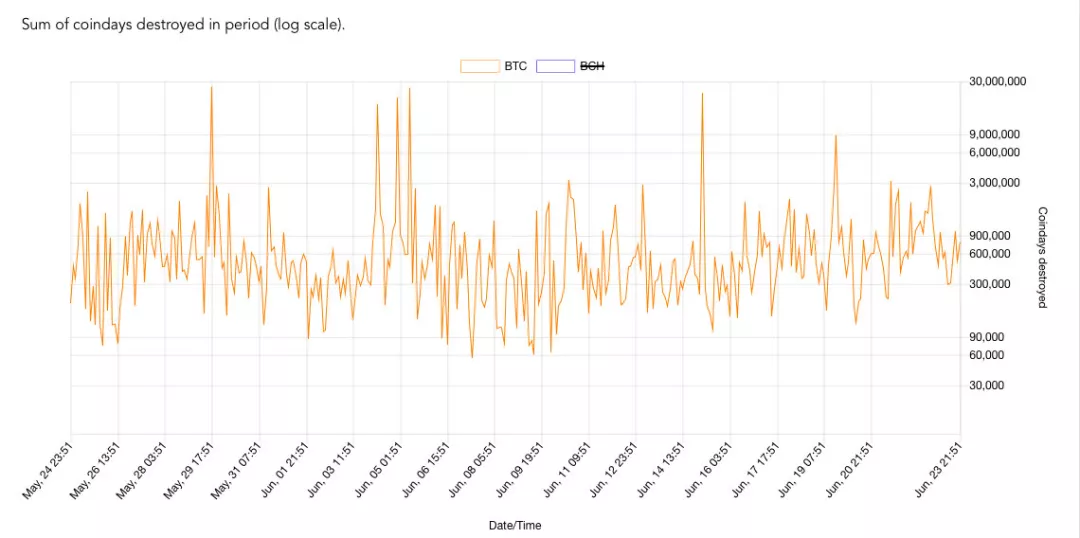

If you want to query the data destruction in the last few days, you can find it in some blockchain browsers (eg https://fork.lol/blocks/cdd).

▲ The value of the currency day destroyed by Bitcoin every day from May 25 to June 20

In addition to the currency days, trading volume, which indicators of Bitcoin will you pay attention to? Welcome to leave a message in the message area.

——End——

Author | Fangfang produced | vernacular blockchain (ID: hellobtc)

『Declaration : This series of content is only for the introduction of blockchain science, and does not constitute any investment advice or advice. If there are any errors or omissions, please leave a message. 』

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Technical Guide | Libra Technical Interpretation! Explain the move syntax, interpreter, and introducer

- “Everyone is looking for 茬”—BUG collection activities are in progress

- Jingwei Ventures: We have compiled 12 questions about Facebook and his Libra

- The next tipping point "DEFI" in the blockchain

- Zcash founder reward is about to be cancelled, the community is big due to funding problems

- Can regulations be "rolled back"? Blockchain is transforming traditional securities industry

- Like Nakamoto, the founder of Grin announced that he would leave the project temporarily.