Opinion | Can blockchain technology eliminate your distrust and fear of ETC consumption?

Source: Weiyang Network, original title "Improving ETC Trusted Consumption Environment with Blockchain Technology"

Author: Wu Shi children

In June 2019, the Ministry of Transport issued the Implementation Plan for Accelerating the Promotion of Electronic Non-Parking Express Toll (ETC) Application Services on Expressways, and proposed that by the end of this year, the two data of ETC installation rate and utilization rate should be increased to 80 respectively. Above 90% and above 90%. At the end of 2019, news about ETC's surprise installation of ETC and the addition of ETC entrances to various toll stations around the country, and the reduction or cancellation of manual entrances continued to emerge. Indeed, many plans for ETC installations in various places did appear to be strange and even suspected of breaking the law. Forced action. This compulsory installation and use of ETC regulations has also provoked some big rebounds in society. For example, in the CCTV news column, Bai Yansong said: "No matter how much ETC is helpful to improve traffic efficiency, we must not use coercive means. The rights of a few people who do not want to use ETC should be guaranteed, not only What the higher authority clearly stated was also a sign of social progress. "

- Iran's attack on U.S. military bases, BTC surged by $ 500, can the "hedging" attribute actually be hammered?

- Watch | What exactly is the appeal of the MAS Digital Banking License?

- The market value increased by more than 20 billion US dollars a week. Is Bitcoin a "real cow" or a "fake cow"?

Of course, today we are not discussing such a social debate as to whether ETC should be compulsorily installed and used. Instead, we are using a technical perspective and consumer psychological analysis to observe why some people do not catch ETC. Since this is a tripartite profit for improving ordinary people's traffic efficiency, saving highway management costs, and saving energy and reducing emissions, why are there so many different voices? At the same time, we will focus on using blockchain technology to improve such social governance relationships and build a multi-party credible operating environment.

First of all, let's understand what ETC is. ETC (Electronic Toll Collection) The electronic toll collection system is based on the on-board electronic tag (OBU) installed on the windshield of the vehicle and the microwave antenna (RSU) on the ETC lane of the toll station. The special short-range communication between them uses computer networking technology to perform background settlement processing with the bank, so as to achieve the purpose of vehicles to pay highway or bridge fees through the highway or bridge toll station without stopping.

ETC is a non-parking toll technology that has been widely adopted by countries all over the world since the late 1980s. China's first use of ETC technology on the Capital Expressway in 1996 has been more than 20 years ago, but the development of ETC has been relatively slow. . Straight through some interviews and psychological analysis of consumers, the following sections summarize the concerns of some people about the installation and use of ETC, some of which are problems of ETC business and technology itself, and some of which are people's concepts, but in fact, more Still multi-party trust.

1. One car (OBU), one card, and one account do not meet mobile payment habits

ETC has been in existence for more than 30 years. Since its inception, the charging object has mainly been vehicle-centric rather than individuals. It can be said that the vehicle-based charging account system is innate, and at that time there was no personal mobile payment technology. . In the current daily vehicle consumption, there are indeed two types of accounting processing requirements that are separated by vehicles (enterprise vehicles) and individuals (individuals, vehicle sharers, car borrowers, etc.). At present, there are three types of cards issued by ETC. The first is a two-in-one ETC co-branded card jointly issued by the transportation industry and a bank, which also has ETC access and financial functions; the second is a debit card, which has no financial function only for the debit function Function, the debit is tied to a bank credit card or a savings card; the third is a stored-value card, which requires pre-stored value to be used. The first type has certain security risks and has been discontinued. Currently, the last two types of cards are mainly on the market. However, no matter what kind of card, the vehicle and the payment account are all bound to one vehicle (OBU), one card, and one account, and it is not possible to implement a way that one OBU can be adapted to multiple payment cards. For example: A friend borrows a car from himself to travel, and the ETC fee generated is recorded on the vehicle's pre-bound ETC debit card. The friend will not directly pay the toll, which brings some to the relationship between friends. trouble. The current ETC accounting consumption model is slightly rigid and inflexible in terms of account model processing.

Analysis conclusion: Not as convenient as mobile payment.

2. Consumption reconciliation difficulties

There are two main bills for ETC services, one is the billing statement of ETC, and the other is the bank debiting statement. The two bills are not necessarily the same for the following reasons: 1. ETC bookkeeping and fund settlement are not completed in real time and the two books will be inconsistent. 2. The clearing and settlement center has ETC deduction preferential accounts, and banks can also discount separately. Such a realistic problem makes it impossible for consumers to know simply and transparently. In the process of ETC consumption, whether there are mischarges or random deductions in the tolls of highways, ETC clearing and settlement centers, banks, etc., this is consumption. One of the main reasons why investors do not trust ETC. By the way, I would like to remind everyone that ETC bills can be used to check the relevant bill details through the provincial ETC public account or APP. However, because the ETC public account or other related ETC applications are Internet low-frequency APPs, it is often difficult to provide consumers with a unified and effective one. Sexual bill inquiry. This is very different from the consumer experience of actively checking with paper notes after paying tolls in cash.

Analysis conclusion: The problem is relatively large.

3. Account security issues

Previously, it was frequently reported that the security of funds and accounts for stolen swipes of ETC cards is another issue that affects consumers' confidence in ETC security. However, this problem mainly occurred in the early days of the promotion of ETC. Scenario, and the consumer opened a bank card small-secret and non-secret payment service, the swiper used a mobile POS machine to use the flash payment function of the two-in-one card inserted in the windshield to steal the user's account funds. This is essentially not related to the system security of ETC, but a security issue of bank card consumption. At present, if you have this bookkeeping and consumption two-in-one ETC card, you need to replace it with the current bookkeeping and payment separation model. ETC debit card or usually remove your ETC card from the OBU (windshield equipment), and turn off the card's small and secret-free payment function.

As for the ETC system's own account security issues, the author has made a detailed understanding of ETC's security mechanism. At present, ETC's data encryption and authentication uses 3DES symmetric encryption technology, and the centralization is hierarchical and hierarchical (department and provincial) decentralized ( Business and user) key generation and management systems rely on a centralized encryption machine and transaction authentication system to ensure data security for ETC transaction processing. The ETC system does not use the current more secure and flexible asymmetric encryption system. Instead, it uses the old 3DES centralized symmetric encryption technology. Although 3DES is far inferior to the asymmetric encryption technology in terms of cracking difficulty and password management security, In the current application scenario of ETC, the author believes that it is also sufficient to ensure the data security of the ETC system, and the risk of systematically cracking a centralized encryption system is extremely low. But it is this 3DES and centralized layered (department and province) decentralized (business and user) key management system that has indeed buried the biggest technical obstacles in the popularity of ETC and other consumer scenarios. I will put it to the last point. set forth.

Analysis conclusion: It is a misunderstanding.

4. Privacy Security Issues

With the recent popularization of ETC charging models in various parking lots such as commercial supermarkets, hospitals, parks, and residential areas, the privacy of ETC's privacy data has become a topic of concern for consumers. For example: Some people worry that if they go to a nightclub to party, if they use ETC to pay for parking, they will leave the risk of personal privacy leakage. In fact, at the time when e-commerce and mobile payment are widely popular, the issue of personal consumption privacy and security is not only an issue of ETC, but is a common topic of the entire mobile Internet. It is only because the accounting entity of ETC is a vehicle rather than an individual. Privacy, individuals do not have absolute control and custody of vehicles like mobile phones. (Currently, consumers can check vehicle consumption details through the ETC public number or APP of each province. They only need to enter the debit card number and license plate number inserted on the windshield. And does not require personal authorization). It can be imagined that if most parking lots use ETC to pay, there is indeed a risk of privacy leakage.

Analysis conclusion: It is a potential risk.

5. Trouble obtaining tickets

Indeed, compared to traditional cash payment models, the process of invoicing ETC electronic bills is more complicated. Although there are entrances to obtain invoices on the public account or APP of various operating platforms of ETC, consumers can also obtain ETC invoices through the official "Toll Road Toll Electronic Invoicing Service Platform"-www.txffp.com. The user needs to choose an invoice platform, register an account, bind an ETC card, invoice, download electronic bills and other processes. This is not a problem for corporate invoicing and truck invoicing. After all, there is a strong demand for corporate financial reimbursement, but for the individual consumer group, the process is a bit cumbersome, because most ordinary consumers have ETC invoicing needs. It is not a strong demand for corporate financial reimbursement, but a weak individual demand to verify whether fees are compliant and consumption is correct. However, this weak demand is enough to affect consumers' confidence in the use of ETC. After all, manual billing is simpler and more straightforward.

Analysis conclusion: inconvenient.

6. Aversion to financial services derivatives

Bank financial derivatives are a malformed product of the domestic ETC promotion process. In fact, commercial banks in the ETC industry are only the account processing role of fee payment and deduction. There is no difference in paying utility bills on the essence, but due to the rapid promotion of domestic ETC A large number of installation outlets are required, and the cost of OBU installation fees is reduced, and ETC fees are discounted. As a result, commercial banks have acted as operating entities in this activity. Of course, the money of commercial banks will not be spent in vain, they will pass on the cost to bank cardholders, various financial management and small consumer loan products. So everyone understands that part of the reason why ETC is scary is that consumers originally only installed a terminal for a non-parking toll system, but for this they did have to install a bunch of financial products. Here we talk about the issue of ETC small consumer loans. Some banks will use the ETC debit card + debit card mode. The small consumer loan function is enabled by default, that is, when your debit card balance is insufficient, a small amount will be issued by default. Consumer loans. If the overdue loan will affect personal credit, do you think the routine is a bit deep? At the same time, because ETC deduction is not a real-time synchronous deduction, no matter the ETC debit card + savings card, or the ETC debit card + credit card model, the balance is insufficient to be deducted. At this time, the highway blacklist will be triggered. Is the concept terrible? In short, although the debits are automated, the personal financial risks that may occur are not transparent, and the boundaries are not obvious. Whether the risks cross the boundaries, individuals are not sure. I don't know if the ETC blacklist is included in the data collection of the central bank credit center, but this unpredictability of potential risks has deepened people's fear of ETC.

Analysis conclusion: The problem is relatively large.

summary of the issue:

The above is the author's analysis of ETC consumer psychology and technology, and summarizes some doubts or concerns about ETC installation and use. In my opinion, the core is that it is difficult for consumers to verify low-cost ETC deduction accounts. Confirmation and the tedious process of ETC application and installation. First, the opaque multi-party account processing of ETC, the inconsistent bills, and the systemic trust issues brought about by the protection of personal privacy have caused consumers to distrust ETC consumption; second, the cumbersome installation and the financial derivatives brought by the installation of bank agents Products are consumers' fear of ETC consumption. These two core problems are not resolved, and it is difficult for consumers to install and use ETC with confidence.

I. Use the distributed ledger of the blockchain to establish a heterogeneous multi-party consistent ledger to improve the credibility of the system

The change of the highway toll mode from manual mode to ETC automatic mode has the biggest impact on consumers. The process of bookkeeping and reconciliation has essentially changed. Although ETC has saved the vehicle's travel time, personal account processing Time and cost have indeed increased. This change is actually a change from "distributed bookkeeping to centralized bookkeeping". Yes, you are not mistaken. The manual charging method is actually a distributed bookkeeping process. The witnesses of the bookkeeping and reconciliation are the toll collector and Consumers, because they are cash transactions, verify the accuracy of transactions in person and settle fees and bills. Consumers no longer need to worry about the safety and accuracy of cash balance books. The ETC automatic charging mode is quite different. This method first separates consumption into two parts: bookkeeping and fund deduction, which creates the problem of witnessing the accuracy of billing and the accuracy of debit.

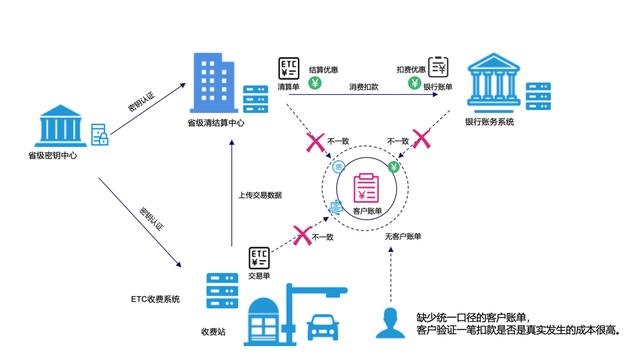

In the process of accounting for ETC toll settlement, it is actually a heterogeneous multi-party transaction process. According to the different business participants, it can be simply divided into: ETC toll system (different road owners), ETC provincial clearing and settlement center ( There are national clearing and settlement centers across provinces), three parties of the bank account system (various accounts-opening banks) (actually multiple parties, the three parties are simply understood), the ETC charging system is responsible for consumer accounting, the clearing and settlement center is responsible for clearing, settlement, and bank accounts The service system is responsible for the actual deduction. All three parties have their own heterogeneous ledger. It is actually a troublesome and high-cost matter for consumers to determine whether the consumption is accurate. First, consumers need to log in to the public account of the ETC Clearing and Settlement Center of the province. Or use the APP to query the ETC consumption records, and then log into the personal banking system of the bound bank to query the bank fund transaction records, so as to check whether the funds are consistent, and then check whether these transaction records do exist by virtue of memory. I think few people are willing to check the accuracy of ETC's consumption in this way, of course, it is impossible to build a chain of trust for ETC by consumer groups. This is the most core question about questioning the accuracy of ETC's accounting, and it is also the reason why consumers are worried about mistaken deductions, theft, miscalculations, etc.

Have you ever had such an experience? It is today that mobile payments and non-secret micropayments are very developed. We open up to hundreds of various e-commerce order records, third-party payment records and bank credit card bill records every month. If we go to check the fund transactions one by one Accuracy is actually a difficult task. So we can only passively believe that this payment process is not problematic and error-free. And with the promotion of ETC in various parking lots such as commercial supermarkets, hospitals, parks, and residential areas, the original closed ETC fee settlement network will become an open transaction environment. It is more difficult for various types of fee owners and systems to join here. Reliable on the accuracy and consistency of these accounts.

ETC clearing process in the province

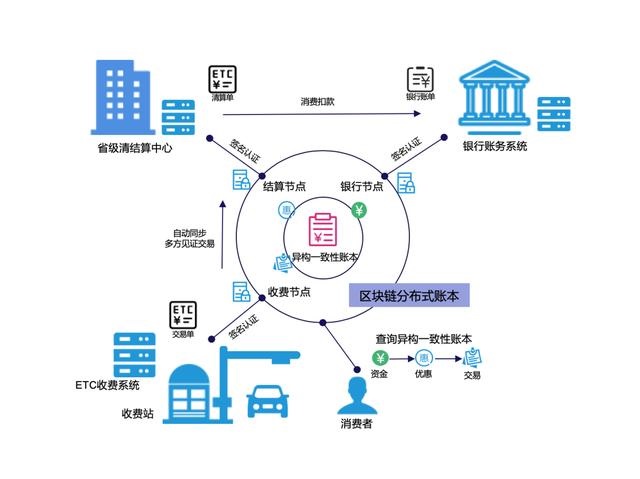

The use of blockchain distributed ledger technology can effectively solve the problem of bill consistency for heterogeneous multi-party bookkeeping. ETC distributed bookkeeping nodes are deployed in ETC charging systems, clearing and settlement centers, and bank accounting systems, and the node ledger is used to automate the synchronization mechanism. Guarantee the consistency of heterogeneous ledgers of all parties, use the tamper-proof advantage of blockchain to improve the convincing power of accounts, and use account traceability technology to build heterogeneous multi-party consistent ledgers to achieve automatic verification of funds debited from banks to clearing preferences to transactions Functions to help consumers reduce the verification cost of accounting processing and provide the credibility of the overall ETC consumer network.

ETC transaction settlement process based on blockchain distributed ledger

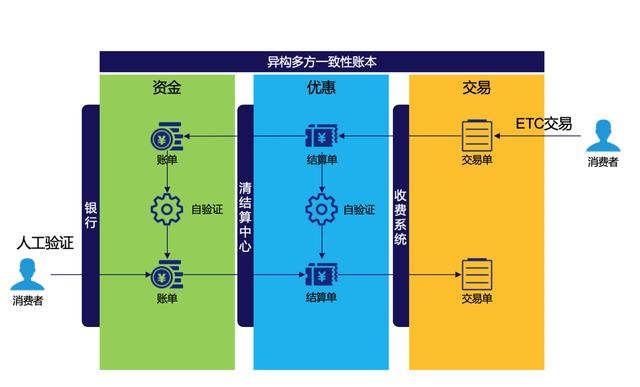

A trustworthy heterogeneous multi-party consistent ledger needs to have self-checking and traceability functions in terms of capital flow, multi-party concessions, and transaction accuracy. It is necessary to build a multi-party consistent ledger model based on mathematical self-conformity, which can allow consumers to convert bank statements Automatically correlate and compare clearing orders and transaction orders, thereby eliminating consumer's bookkeeping costs and returning to the distributed bookkeeping system.

Heterogeneous multi-party consistent ledger

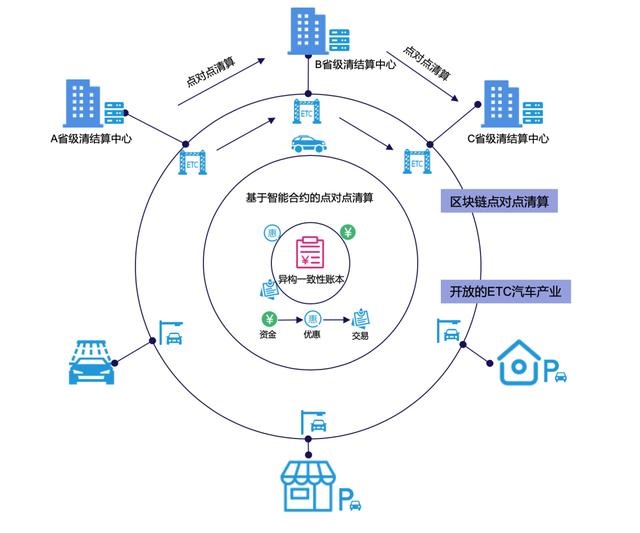

The ETC toll settlement network based on the distributed ledger of the blockchain has a more secure, open and flexible settlement account processing capability. By connecting various provincial settlement centers to the ETC transaction network, it will realize the cross-provincial traffic differentiation and point-to-point of the expressway. Settlement strategy; it can realize inter-provincial settlement without the need for a national-level settlement center. Under the security guarantee of distributed digital certificates, the entire network can open the charging and settlement interfaces to achieve a variety of consumer scenarios such as commercial supermarkets, hospitals, parks and residential communities, such as various parking lot charges, automated car wash charges, and other consumer scenarios.

Open ETC blockchain network

Second, use the blockchain distributed digital identity authentication and asymmetric encryption technology to improve the application and installation procedures of ETC cards and OBUs

The tedious application and installation procedures for ETC cards and OBUs are a headache for every user who has installed ETC. For example: ETC cards are divided into four stages: card production, primary issuance (provincial center), secondary issuance (outlets), and user use, and OBU has ESAM (module manufacturer), ITS center, OBU manufacturer, and center one issue ( Provincial Center), two outlets, installation activation, and user use. There are 7 stages. As for the meaning of each stage, I will not repeat them here due to space limitations.

The author mainly wants to talk about the issuance of ETC cards and OBUs due to encryption and security requirements. It is carried out in a closed and centralized distribution network and key management network. The distribution needs to be performed at the provincial centralized encryption machine, certification center and Fixed outlets are developed, so the application and installation of ETC cards and OBUs are troublesome, and fixed outlets such as banks need to bear certain promotion costs. The cost of the bank's investment will naturally recover its investment in financial derivatives, which is also a historical problem.

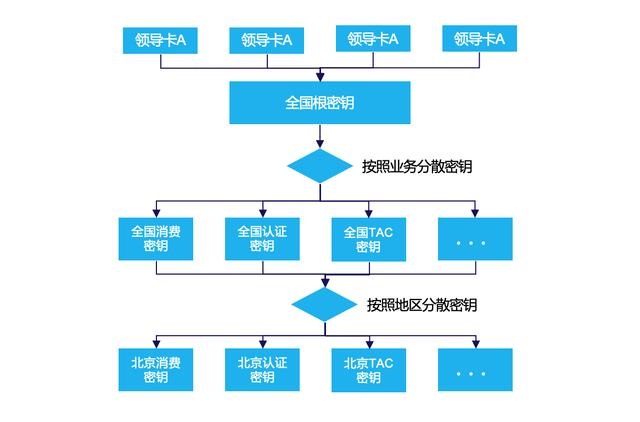

The encryption algorithm used by ETC is mainly 3DES, a symmetric encryption algorithm, and uses a national and provincial two-level key management system, and uses service coding and area coding as key dispersion factors to ensure the security of the root key. However, this centralized and hierarchical (department and province) decentralized (business and user) key generation and management system has brought serious restrictions to the openness and flexibility of the ETC industry. In the consumer problem we mentioned above, : One car (OBU), one card, one binding bank account, privacy security and financial derivatives issues are the indirect effects of this symmetric encryption system.

ETC National Key System

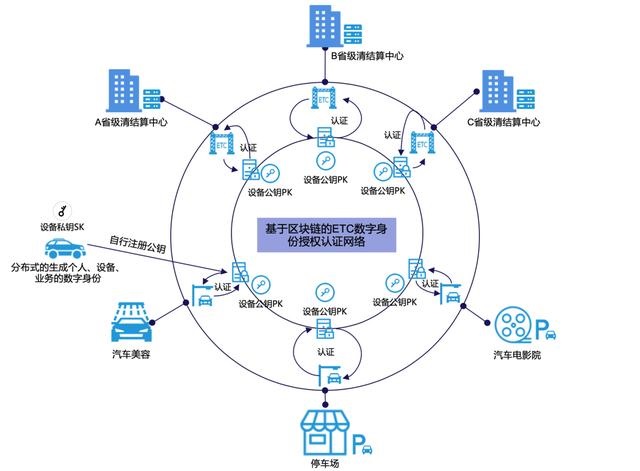

The national and provincial issuance strategies of ETC cards and OBUs, the 3DES symmetric encryption algorithm and the blockchain's distributed issuance strategy and asymmetric encryption algorithm are just two completely different ways, representing the degree of openness of the issuance and operation network. huge difference. In order to protect the security of a single key, a symmetric encryption algorithm must be secured by a closed network and a strengthened encryption machine. Asymmetric encryption algorithms (with public and private key systems) can provide ETC participants with an open operating network and flexible encryption strategies. . Using blockchain distributed digital identity authentication network and asymmetric encryption algorithms, such as: RSA and ECC can flatten the ETC card and OBU issue levels, and use the natural distributed deployment conditions of each provincial center to establish decentralized key signing and authentication security Guarantee, consumer ETC application and installation can be downloaded and updated on the open Internet, which can be as convenient as e-commerce. The ETC distribution network using the blockchain network can be more flexibly extended in the automotive industry to other owners and entities, such as: car beauty, parking lots, car cinemas, etc. can more effectively promote car culture.

Distributed digital identity authentication network

Important note: At present, car beauty, parking lots, car cinemas and highways belong to different owners entities, so it is difficult to directly access the current ETC consumer settlement network under the protection of data security, which is also difficult for ETC to promote in other industries. problem lies in.

to sum up:

The widespread use of ETC has indeed brought great convenience to driving, saving transit time, reducing highway management costs, reducing pollution emissions, etc., but we have really ignored the consumer experience brought by automated deductions for a long time. problem. In the traditional multi-party transaction model, funds, offers, and transactions lack self-inspection and self-justification proofs. They can only manually check the consistency of deductions for consumption. They do not have the business traceability of consumption, and it is difficult to establish customers' Confidence in the security and accuracy of transactions. The traditional ETC symmetric encryption guarantee system is essentially a closed encryption and authentication network, which greatly limits the expansion and promotion of ETC in other automotive cultural industries. This article attempts to explore the use of blockchain technology to solve the problem of heterogeneous multi-party consistent ledger and distributed digital identity authentication in ETC consumption. Using the blockchain's distributed ledger and distributed network operation capabilities, it helps ETC to quickly promote to other and more convenient Automotive manufacturing and consumer industries.

Due to the author's knowledge and space, there are still many details that please readers to understand.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain Weekly Report | Central Bank steadily advances fiat digital currency R & D in 2020; Zhanke sends open letter against Bitmain layoffs

- Digging the "foot of the wall" in Zhongguancun, 100 million yuan to grab academicians, local governments set off a battle for blockchain talent

- US-Israel conflict bitcoin gets attention again, "hedging" will become the main theme of the bull market?

- Annual Report | Verification in 2019: ICO, IEO, STO three cryptocurrency issuance models have all failed

- Where is the wind blowing in 2020? 20 domestic and overseas institutions and big coffee forecasts in 13 dimensions

- What will happen to the crypto market under the control of "whale"?

- U.S. SEC compliance office's 2020 inspection focus includes digital assets