FTX Latest Debt and Asset Summary How much money is owed and how much debt can be repaid?

FTX Debt & Asset Summary Owed money and repayable debt?Wu Shuo Author | Cat Brother

This issue’s editor | Colin Wu

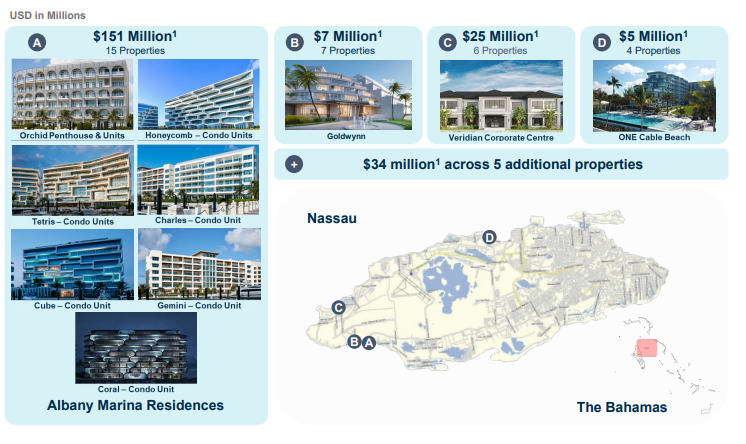

According to the latest court documents on September 10th, FTX holds a total of $3.4 billion in cryptocurrency assets as of August 31st, including $1.16 billion in SOL, $560 million in BTC, $192 million in ETH, $137 million in APT, $120 million in USDT, $119 million in XRP, $49 million in BIT, $46 million in STG, $41 million in WBTC, and $37 million in WETH. These ten main assets account for 72% of the cryptocurrency assets compiled by FTX. The document also provides details of the $2.2 billion in cash, cryptocurrency, equity, and real estate received by SBF and other executives (Nishad Singh, Zixiao “Gary” Wang, and Caroline Ellison) in the months leading up to FTX’s bankruptcy. This could be significant as US law allows for the recovery of these funds and includes them in the asset pool available to creditors. The document also reports on 38 apartments, top-floor luxury apartments, and other properties in the Bahamas, estimated to be worth about $200 million; as well as attempts to recover funds donated to politicians and charities such as the Metropolitan Museum of Art in New York.

The total amount of claims is currently about $16 billion+X; compiled assets amount to $7 billion+X; and lawyer fees for the first year are estimated to be $500-600 million. The proportion of assets that can be compensated by the final clients is still unclear due to the unknown X.

- FTX’s approval for liquidating $3.4 billion worth of tokens this week, what impact will it have on the market?

- FTX may be approved to liquidate $3.4 billion worth of tokens this week. What impact will it have on the market?

- August DeFi Market Review and Outlook Which Protocols and Airdrops to Focus on?

Below is the main content of the court documents compiled by Wu Shuo, original link:

https://drive.google.com/file/d/1Y4jMmyEQq-qOoHL2blXhVjRMMi06X9HB/view?usp=sharing

Overview of Non-Client Claims

Since the deadline for non-client claims on June 30, 2023, over 2,300 non-client claims have been submitted, totaling over $379 billion. After removing $313 billion in duplicates, the remaining non-client claims amount to $65 billion, including:

● $43.5 billion from the US Internal Revenue Service (IRS) (subordinated);

● $9.2 billion from FDM (FTX Digital Markets Ltd) (considered invalid/duplicate);

● $4.1 billion in lawsuits and priority claims from Genesis;

● $2 billion in litigation claims from Celsius;

● $2.4 billion in miscellaneous fraud claims;

● $1.4 billion in contract/503(b)(9) claims;

● $1.1 billion in accounts payable claims;

● $600 million in contract claims from Voyager;

● $400 million in equity claims;

Current Client Claims

As of August 24th, approximately 36,075 client claims have been submitted, totaling $16 billion.

● At FTX.com and FTX US, the total customer claims against the debtor amount to $10.9 billion.

● The holders of approximately $7.9 billion (72%) of the claims have not yet agreed to or disputed their proposed claims.

● The holders of approximately $1.2 billion (10%) of the claims have agreed to their proposed claims.

● The holders of approximately $1.9 billion (18%) of the claims have raised objections to their proposed claim amounts. Mediation for disputed claims is currently underway.

● If customers have disputes regarding their proposed claims, they can submit proof of claim by September 29, 2023 (customer claims deadline).

Assets Recovered

● Government-recovered assets: $800 million (assets seized by SDNY, including cash and public equity investments);

● Brokerage assets: $500 million (risk brokerage assets guaranteed and managed by the debtor);

● Class A crypto assets: $3.4 billion;

● Identified and secured post-bankruptcy cash: $1.5 billion;

● Cash balances identified, secured, and managed by the debtor as of the petition date: $1.1 billion;

● Potential additional asset value, including venture capital, Class B crypto assets, receivables, counterclaims, potential avoidance/preference actions, FTX 2.0, and investments in subsidiaries.

Class A Crypto Assets

As of August 31, FTX holds a total of $3.4 billion in crypto assets, with major crypto assets including $1.16 billion SOL, $560 million BTC, $192 million ETH, $137 million APT, $120 million USDT, $119 million XRP, $49 million BIT, $46 million STG, $41 million WBTC, and $37 million WETH. These top ten assets account for 72% of the crypto assets identified by FTX.

Brokerage Investments

The debtor’s brokerage accounts hold $529 million in securities, including:

● $417 million in Grayscale Bitcoin Trust;

● $70 million in Grayscale Ethereum Trust;

● $36 million in Bitwise 10 Crypto Index Fund;

● $6 million in Grayscale ETC, LTC Trust, and Digital Large Cap;

● Less than $100,000 in BlackRock stocks.

Venture Capital Portfolio

As of the filing date, the venture capital portfolio consists of 438 investments with a total capital investment of approximately $4.5 billion. (Note: The invested value does not necessarily represent the potential recoverable value.)

$506 million token investment

● Tokens after the ICO are being planned for delivery and are considered to have lower risks. Once received, they become assets in the debtor’s encrypted asset portfolio.

● Tokens before the ICO are early-stage tokens and are considered to have higher risks because they have not been minted yet, so their value is uncertain.

Bahamian properties

38 properties in the Bahamas with a book value of $222 million and an assessed value of $199 million.

Recovering potential assets

$588 million realized and $16.6 billion potential assets identified

Investments: Over 430 potential investments

$588 million realized and approximately $5.3 billion additional investments under investigation (partially reflected in venture capital analysis).

Non-debtor affiliates: Over 7 potential actions

$3.2 billion received from FTX Digital Markets Limited and six other non-debtor affiliate companies.

Insiders: Over 50 potential actions

Cash, cryptocurrencies, equity, and real estate with a total value of $2.2 billion received from SBF, Nishad Singh, Zixiao “Gary” Wang, and 46 other individuals.

Lenders: Over 37 potential actions

An amount of $5 billion received or settled by BlockFi, Genesis, and Voyager Digital; debtor evaluating claims related to other lenders.

Political and charitable donations totaling $86.6 million paid to third parties (SOFA 9 items).

Suppliers: Over 884 potential actions

During the priority period, suppliers collectively received $190.3 million.

Cryptocurrency and venture capital

BTC+ETH

As part of the ongoing asset tracking and recovery process, the debtor has identified approximately $833 million worth of BTC and ETH assets (token value as of August 31, 2023), excluding $487 million in securities priced in BTC/ETH.

Class B cryptocurrencies

The debtor’s cryptocurrency holdings include certain tokens that have not met liquidity thresholds and/or are mostly controlled by bankrupt entities. For reporting purposes, these tokens are classified as Class B. Over 1,300 types of Class B tokens in total.

Venture capital summary

As of the application date, the venture capital portfolio includes 438 investments with a total funded asset of approximately $4.5 billion.

(Translated using Deepl)

Risk investment of $673 million has been realized as $588 million (87% of the invested amount), and an additional commitment of $137 million that has not been invested has been cancelled.

Remaining entrepreneurial investment portfolio

The top 10 investments account for 66% of the remaining token, equity, fund, and loan investments.

(Translated using Deepl)

Equity Investment Overview

Equity investments account for 73% of the remaining risk investments, with a total of 202 investments. The main ones include $1.152 billion in Genesis Digital; $500 million in Anthropic; $111 million in Voyager Digital, etc.

LP/Fund Investment Overview

The debtor has sold certain LPs and reduced $137 million of uninvested capital. Ongoing sales will release debt related to approximately $8 million of uninvested capital. The remaining LP holdings, excluding those already sold, total $167 million, accounting for 4% of the risk investment portfolio.

Token Investment Overview

Token investments account for 13% of the remaining risk investments, with a total of 171 investments and an average investment size of $3 million. The main ones include $137 million in Solana; $80 million in NEAR; $68 million in Hole, etc.

Loan Investment Overview

Loan investments account for 10% of the remaining risk investments, with a total of 11 investments and an average investment size of $33 million. The main ones include $100 million in Dave, and $75 million in Voyager Digital, etc.

Non-Debtor Investment Overview

The total financing amount for non-debtor investments is $782 million, including 9 investments with an average investment size of $87 million. The main ones include $400 million in Mount Olympus Capital and $300 million in K5 Global Holdings, etc.

FTX 2.0 Progress Update

The debtor initiated a marketing process for FTX.com and FTX US exchange in May 2023.

● This process aims to consider different potential structures, including acquisitions, mergers, reorganizations, or other transactions, to relaunch FTX.com and/or FTX US exchange.

● The debtor is also considering offering management and operational services.

The timing of the transaction will depend on the nature of the transaction, the preparedness of bidders, and other considerations.

(Translated using Deepl)

Issues still under discussion in the draft plan

● Estimation of the size of expected claim categories, recovery fund, and creditor recovery

● Amount of assets to be allocated to claims that are insufficient for full payment compared to the total asset pool

● Decision and method of selling or restructuring FTX.com exchange

● Process of transferring claims after the effective date of the plan (recovery right tokens or cryptographic assets)

● Governance of the confirmed entity and future management

● Any revisions needed to be made to the plan to ensure that these revisions are in the best interest of all creditors

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Against the Wind How to Use Web3 to Ignite the Market and Drive Growth?

- Detailed Explanation of New Changes in US Cryptocurrency Accounting Rules What Impact Does It Have on MicroStrategy, Coinbase, and Others

- Nigeria Second Largest Bitcoin Adopting Country, the Cradle of Cryptocurrency Growth

- Overseas Web3 Employment Report Remote Work in High Demand, US as the Main Job Market

- Wu’s Weekly Selection Tether becomes the 22nd largest holder of US Treasury bonds globally, Grab adds Web3 wallet and News Top10 (0902-0908).

- Block Earner will launch a loan product backed by Bitcoin as collateral.

- Bitcoin Price Prediction BTC Falls by 6%, Is the Worst Yet to Come?