Opinion: The non-exchange channel of the currency circle is essentially a brokerage and investment bank.

Foreword:

Recently, IEO has entered the public eye, and the IEO project has become more popular. In essence, IEO is outside the List (on the currency) of the exchange, and is also responsible for underwriting. Through the IEO, the Exchange actually made a role of the first (level 1) (second level), directly responsible for the two major sectors of the original brokerage business (broker, investment bank, asset management, self-employment).

Further assume that a large number of assets will indeed be in the chain in the future. Then, whether the brokerages in traditional markets such as A-shares, US-Hong Kong stocks, and futures brokers have no value at all?

In order to answer this question, I hope to be able to inspire others to make friends in the circle at home and abroad (friends in the primary market, such as the assets/coin department of the exchange, the wallet/self-media that has risen on behalf of the investment; the secondary market) Friends, such as the direct sales department/big customer department of the exchange, the media/quote APP/community friends who want to trade cash, and the investment institutions that want to distribute the currency) think together: the future currency circle, and even the asset chain After that, what is the player pattern in the first and second level of the currency circle? What kind of collaboration is each player?

- Public chain development combat: local environment preparation virtualbox articles

- Symbiosis of 5G, Internet of Things, and Blockchain: Record of 2019 IT Leaders Summit

- The highest rate is 5 ups! Blockchain concept stocks are the rise or fall of the bubble or the return of value?

The title is my point of view. The non-exchange side of the transaction, in essence, the business will involve brokerage (level 2) and investment bank (level 1) business.

In this article, I will discuss my point of view from three aspects: primary market, secondary market, and traffic. Although it is certainly inappropriate to use the framework of the traditional field to set the coin, it will not change. For example, the development of an exchange, the most important thing is the assets. Although the short-term chuan (xiao) can lay a foundation, if there is no good assets in the long run, it can only "see him from the Zhulou, seeing that his building has collapsed." Whether it is centralized or decentralized, any exchange model will follow the essence. Therefore, as long as we understand the essence, combined with the advancement of technology, to dig out the top-level pattern of the future first- and second-tier markets, we can find a good position for our ass.

Primary market: the head "boutique" exchange carries limited fundraising needs. The non-exchange's traffic end agencies can find a clear positioning.

In the asset-winding trend of 10-20 years, the first step must be to issue assets, so let's start with the primary market.

The bear market raises a small amount of funds, and the project is small, and the head exchange can carry it. At the same time, other potential underwriters are not ready.

Before the currency circle IEO became popular, in fact, the last round of bull market, the rhythm is imtoken, ico365, all kinds of individuals and organizations, such as Tokenclub was also a major force. In fact, these individuals/organizations have assumed the role of underwriting in the original secondary market. The underwriters completed the sale operation, and the exchange completed the operations of the currency and circulation, and they cooperated well with each other. So what is the core reason for this round of IEO, the exchange to assume the role of underwriters?

Why do exchanges and project parties do this? The basic summary is as follows:

- Exchanges need quality projects to bring traffic;

- The project side also took a fancy to the relatively large stock flow, endorsement effect, and market value management experience of the exchange;

- At the same time, from the perspective of market value management, the fewer the participants, the better, so it is a better solution to directly connect with the exchange;

- Another point to consider is that the traditional ICO model has regulatory risks; the IEO model deals with regulators through exchanges, and exchange experience is the most abundant.

But the more central reason is two things:

First, the demand for fundraising in the entire market is still small. The current market environment is a bear market. Although there are always companies that raise funds in a bear market, the relative volume is definitely small, and the project side also knows that the bear market is difficult to raise funds and will be placed in the bull market as much as possible. At the same time, after this wave of bear markets, there are fewer exchanges. Therefore, there are fewer projects, less fundraising, and fewer exchanges:

- The head exchange is willing to sacrifice the currency fee, provide PR services, create a hot market, and get traffic

- The project party is willing to sacrifice certain valuations and financing amounts to obtain eyeballs through the exchange.

Second: the comprehensive service capabilities of potential underwriting agencies are not yet ready. Regardless of the wallet, media, market APP, etc., there are potential underwriting agencies with traffic. Even if the traffic is good and the user base is large, there are the following shortcomings:

- Ability to acquire/screen assets

- Breadth of services (lack of experience in market value management)

- Grasping the scale of supervision

However, as the demand for fundraising increases and the potential underwriting institutions mature, the market cake will become very large, the primary market will be stratified, and the platform with flow can be divided into cakes.

If more companies want to raise money as the market picks up, can the head exchanges that insist on the boutique strategy be satisfied? Here, we still look at the problem through the essence. For example, everyone is familiar with Nasdaq. So if you withdraw from Nasdaq, or if you don’t meet the Nasdaq requirements, where do you go public in the US? The answer is the OTCBB and the pink sheet market. Those who have seen the "Wall of Wall Street" movie will have a certain concept, but in fact the film is extreme. In fact, there is a good company in the pink sheet market, which is a clear stratification of the US capital market.

Analogy to the currency circle, mentioning that you may not pay attention to it, "one coin" one said in July 2018, the central exchange of the currency security will be Tmall, strictly select the project; decentralized transaction Everyone will be on the line. If I tell you, the US pink sheet market does not need to announce the earnings report of listed companies, as long as there are market makers willing to provide market-making, they can go online. Do you think that the decentralized exchange of the currency is the pink market?

In fact, there is no absolute relationship between this centralization and decentralization. A centralized powder market and a decentralized boutique exchange can of course emerge. The key is that in a good market, there will be a large amount of financing needs, which will lead to insufficient digestion of the exchanges that adhere to the boutique route. At this time, a large amount of assets will be spilled into the second-tier exchanges, or the flow-side non-exchange platform.

Of course, the overall spillover rate of projects is definitely lower than the projects underwritten by big exchanges. However, due to various complicated reasons, there will be a large number of good targets that have been accidentally killed and submerged; otherwise, in Taobao, Tmall, can you still have a small red book, how much? There will still be so many good projects not listed on the A-share market, but will you go overseas? We don't know the complicated reasons, but the results are quite clear.

However, whether it is a second-tier exchange or a flow-end agency that wants to undertake these spillover projects, it must have the ability to analyze and screen the project, have a certain amount of traffic underwriting, and integrate the industry to help the project to go public and market value management.

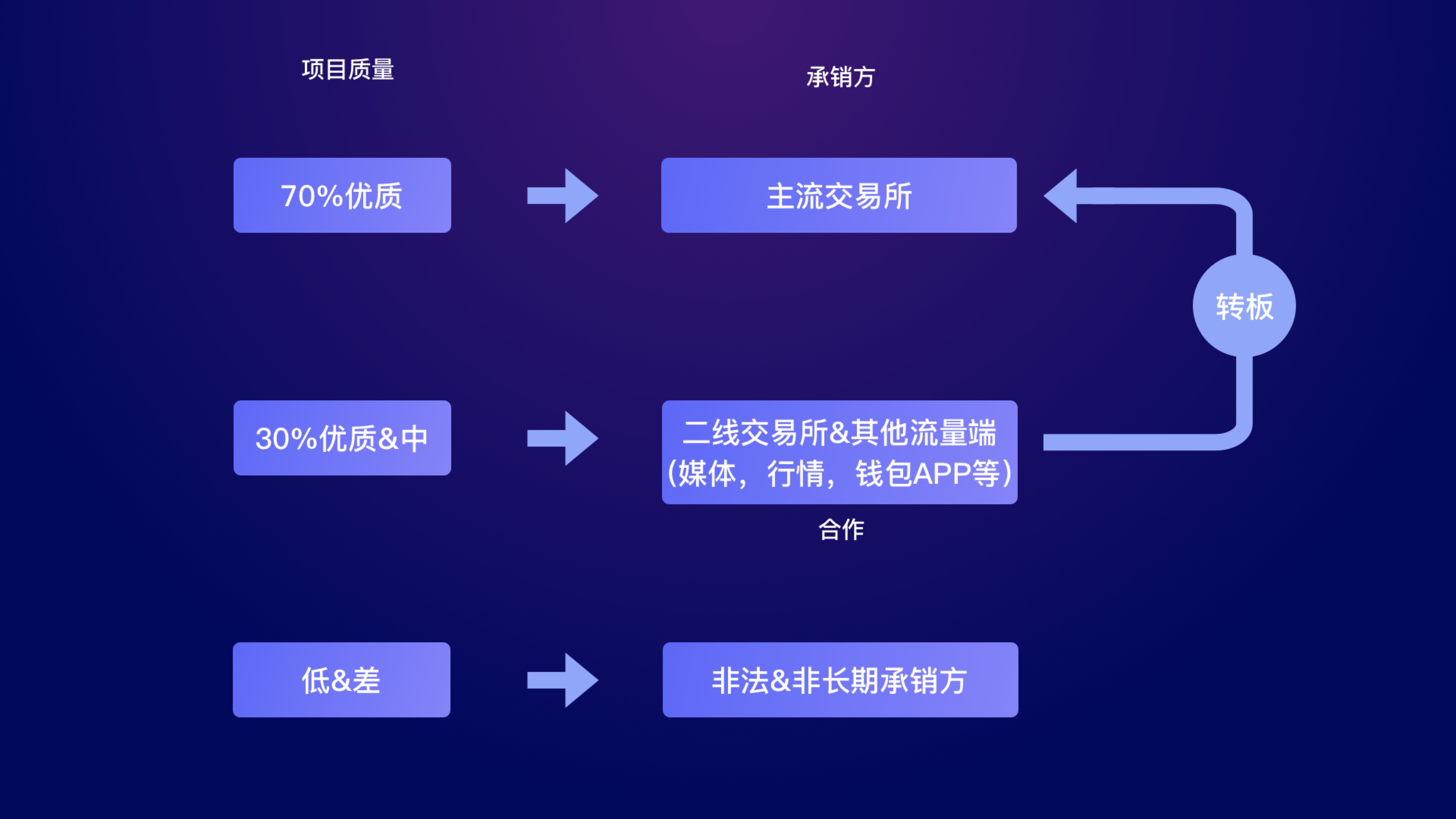

Therefore, the overall situation of the primary market can be found as follows:

- The head exchange needs to also spend a lot of energy to find "assets" around the world.

- Good projects are preferably issued on big exchanges

- Large exchanges can't cover all the targets, and a large number of targets will overflow.

- Some institutions can find a position on the "second floor" or even the "third floor" capital market, and divide it into cakes.

In one sentence, the headline is that the non-exchange's traffic end can be used in the primary market to do the underwriting business in the traditional investment bank, similar to the mode in which the imtoken sold the eos.

Secondary market: the service side of service retailers and professional traders will provide personalized services for various customers in line with the exchange global strategy.

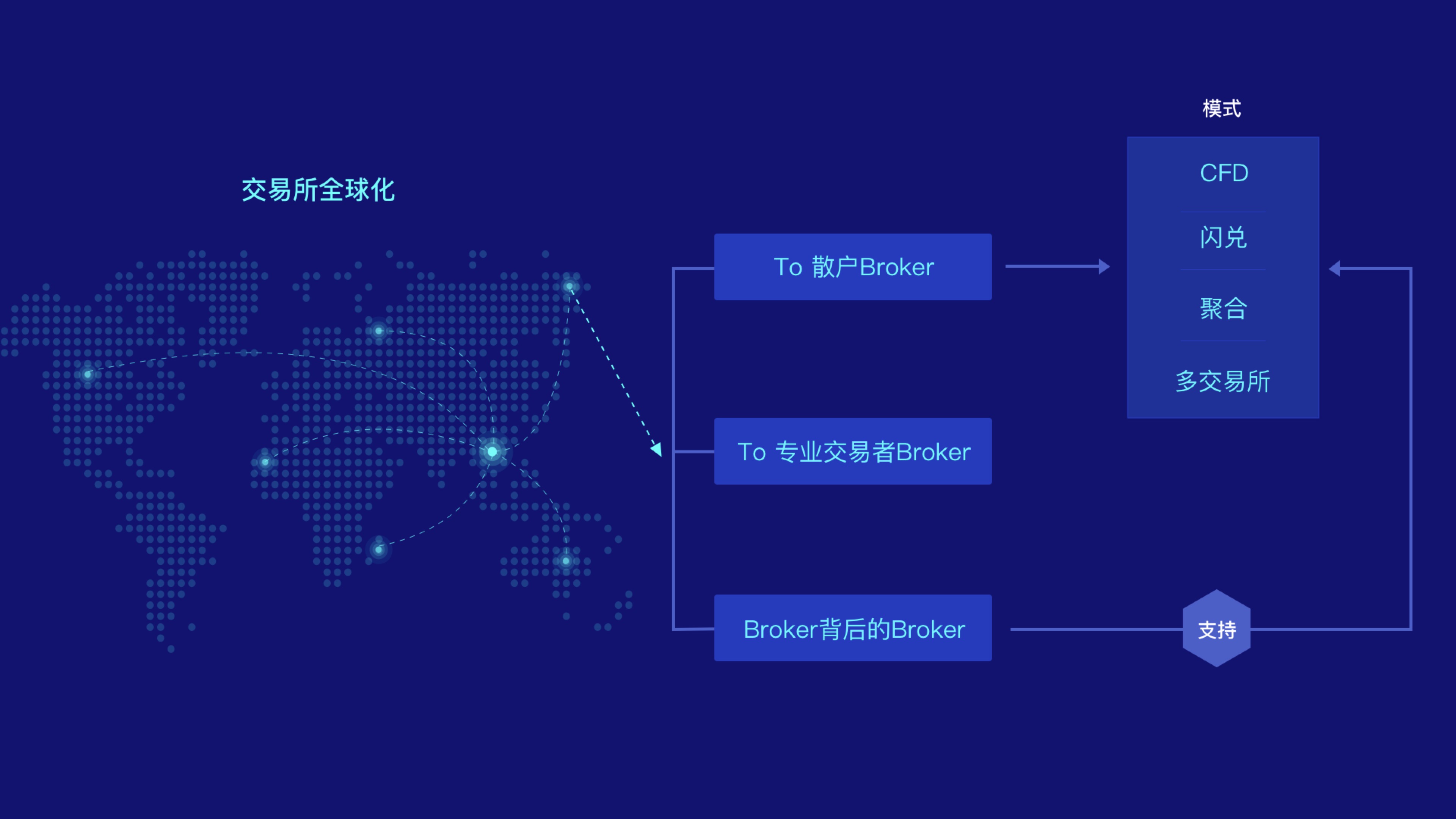

After talking about the primary market, we will talk about the secondary market and traffic. In the primary market, the core keyword of the exchange is the asset. Then in the secondary market, the exchange's keywords should be global. This year, I have heard many high-level exchanges mention the globalization strategy. I think the logic behind this has the following two points:

- Gain global mobility

- Global strategy can enhance the instability of the exchange itself against single country policy adjustments

Then, like the primary market, will the players in the secondary market of the future currency circle cooperate with the exchange to promote the development of the industry? I think the answer is still yes. Before explaining the reasons, let's talk about some objective things happening. In overseas markets, Canada's Newton platform, targeting Brokers (brokers, or popular brokers), docked the depths of global exchanges, helped retail investors get the best transaction prices in the world, and received $15 million from Canadian proprietary trading company DV Trading. Financing. Another similar American company, Voyager, was founded by Uber's former CTO and former head of the well-known American broker ETrade.

If someone refutes that the overseas market will be different from the domestic one, then look at the domestic situation. Bikan announced the April 10 online trading, the essence of which is the Broker. In addition, 5 customers who provide mid- and back-office solution system solutions by 1Token, the professional broker of the currency circle, including well-known media in the domestic currency circle, the most futures documentary/monitoring/quote APP with the largest flow rate, and the exchange rate APP with 60 million users will Different Broker forms, in April and May, have been launched "transaction function and closed-loop account system" (the name is kept secret before it goes online). In addition, more traffic ends have begun to interface with 1Token, ready to launch the online transaction function.

Under this momentum, at the end of June, the flow of non-exchanges in more than 15 currency circles will have a high probability of going online; by the third quarter, all traffic terminals will basically have their own account system and trading functions.

After talking about the phenomenon, saying the essence, the reason why the traffic end is going to go online trading & account system:

- The traffic end needs to be realized, and at the same time, it can provide customers with one-stop service.

- The traffic side hopes to build its own account system and enhance the user experience.

At present, I have seen 3-4 business models such as aggregate trading, multi-exchange trading, flash mode, and CFD mode (the latter two are similar). The first two are suitable for platforms that stand within the currency circle, and the latter two are more suitable for platforms that are newly entered from outside the currency circle. No matter which mode, there are a lot of demand inside and outside the currency circle, and the essence is the Broker. These traffic platforms will bring incremental orders to the exchanges, make bigger cakes, further promote more people to enter the currency circle, and promote asset-winding.

The traffic end generally lacks the technical ability to revolve around transactions, and the industry needs institutions such as 1Token to empower

But the big threshold for the traffic side to cut into the trading function is the technical and financial service capabilities. Unify the account system of the global exchange, stabilize the safe wallet, the trading system is the lifeline, and the support of financial services such as low rates and funds/coin pools is also essential. As a company that locates the “Dot IB”, 1Token entered the currency circle in 2014, and now orders more than 2 billion+RMB per day from the 1Token platform. 1Token has obvious advantages in empowering transactions on the traffic side:

- An account docked to the global mainstream exchange without binding API

- 2 billion + transaction volume proves that the system has high stability

- Low rate channel, and pool of funds and currency pool (supporting the best price)

- Mature product, can be quickly launched

While the traffic end wants to cut into the transaction, it also wants to save energy and do more in terms of information, content, tools and community. This is why the head institutions in various fields inside and outside the currency circle have chosen to cooperate with 1Token to open up trading functions. And 1Token will also focus on the Broker behind the Broker, analogous to IB's support for Tiger's model, helping retail brokers better serve customers.

The backbone of the secondary market is professional traders who need professional trading systems and financial services before and after trading.

Participants in the secondary market, in addition to numerous small scattered, another main force is a professional trader. In overseas markets, Tagomi, which is aimed at professional traders, is optimistic about investment institutions and receives $28 million in large-scale financing. In China, 1Token is deeply cultivating professional customers, and the transaction amount of orders placed through 1Token is stable at 2-10 billion RMB per day.

In fact, in the traditional market, from manual to automatic, from trend strategy to arbitrage strategy, from low frequency to high frequency, from pre-trade investment research to post-trade analysis, from brokerage business to asset management business, there are a large number of The IT and financial solutions are integrated into the Broker system to provide services to professional traders, but the currency is basically missing. Therefore, the platform for professional traders such as 1Token is to build a currency circle based on different scenarios for different needs, further reducing the barriers to entry for professional manual traders and quantitative traders. For example, 1Token provides the following functions to cover 30+ mainstream exchanges around the world, and will continue to enrich the supported professional strategy scenarios:

- Before the transaction, provide a unified account across the exchange, simulation transactions, historical data, quantitative backtest platform;

- In the transaction, discount rates are provided, a unified API across global exchanges, a professional manual intraday trading system, and lightning transfer across exchanges;

- After the transaction, the transaction is repeated/quote playback system.

With the global layout of the exchange, the traffic broker will provide targeted services for different types of customers and guide the exchange. However, there is a need for a platform for deep-growing infrastructure to provide a one-stop service for the technical and financial systems of the traffic broker. In addition, professional traders for the secondary market must also have professional brokers. Provide professional pre- and post-transaction systems and financial services to form a secondary market closed loop.

It can be seen from the above that in the secondary market, the non-exchange side of the transaction is actually responsible for the Broker (broker/broker) business with various types of investment services.

In summary, the currency circle and even the entire financial circle, through a single seat, a license, can lay down the fee to get more and more days, the key is the service:

- Want to cut into the traffic end of the primary market, you need to cooperate with quality assets to serve investors.

- Want to cut into the traffic end of the secondary market, need to dock the global liquidity, serve the traders

The nature of these cooperation and services determines that the actual traffic is the investment bank and the brokerage. They can provide more vitality and liquidity to the market, inspire more users to enter the currency circle, and better meet the individual needs of the entire market.

Author: coins circle of professional brokers 1Token founder door (graduated from Fudan University, worked in the US financial technology company Scivantage as head of China, after the creation of the software options "option will be", with financing platforms "cloud with" micro-Private Platform "special investment network" and other projects.)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion: "Unable Triangle" of Stabilizing Coins

- The story behind the resurgence of the venture capital Andreessen Horowitz

- What is the mission of Bitcoin? Why did Coinbase start crazy online assets? The answer is here

- Is the mine-based “guaranteed” income product really low risk?

- Bitcoin and IDG Layout Japan Exchange, Liquid Completes Series C Financing, Valuation $1 Billion

- Bitcoin returns to the 2017 bull market? No, it’s better now, there are 8 reasons here.

- Secret history of bitcoin in the dark net "Silk Road"