Outlook for 2020: Will US stocks, A-shares and Bitcoin be seen in the long-term and long-distance?

Author: Kay's Story

Last weekend, the three major stock indexes of the US stock market hit another record high. The Dow rose more than 220 points, surpassing the 28,000 milestone for the first time in history. At the same time, the positive prospects for progress in trade agreements in the United States have boosted market sentiment. Now, investors are waiting for a number of economic data such as US retail sales. Overnight, it seems that the world has suddenly turned positive.

US Secretary of Commerce Wilbur Ross and White House Economic Advisor Larry Kudlow have spoken positively, raising market sentiment and driving the UK, continental Europe and most Asian markets to climb.

The recovery of US bond yields has somewhat calmed the market's worries about the US economic recession. At present, the yield on the US 10-year government bond has risen by 3.4 basis points to climb to 1.846%. US Treasury yields have rebounded from historical lows touched two months ago, and it seems that the market is telling every investor that there is no need to worry about the recession.

- Subverting the dominant position of the dollar, all countries are in love with the central bank digital currency

- Russian Federal Savings Bank receives blockchain patents to reduce counterparty risk in the repo process

- Twitter selection | The first SEC compliance ICO still breaks 50%, retail investors are bruised

Federal Reserve Chairman Powell reiterated in his congressional testimony on Wednesday that the current US economic growth appears to be sustainable, with few indications that the economy will immediately decline.

Yes, Federal Reserve Chairman Ben Bernanke said the same thing in early 2007. On March 28, 2007, Federal Reserve Chairman Ben Bernanke issued a statement that the impact of subprime mortgages on the market has been controlled. “There is almost no indication that the US economy will immediately decline.” US stocks continued to rise from April to May, hitting a record high. In mid-June, the yield on 10-year Treasury bonds hit a peak in 2002, reaching 5.3%. By mid-July, the 90-day government bond rate reached 5%.

In October, US stocks reached the highest point in history at that time, and everyone later knew the story.

What happened to the world? The riots can be seen everywhere, but the economy is singing and dancing? Today, deep inside our hearts are full of deep fear and suspicion, and huge uncertainties hang over people. It seems that at the same time, "The Great Gatsby" is showing a climax, and "The Clown" has already begun.

Last weekend, riots broke out in Tehran, the capital of Iran, and in more than a dozen cities. The demonstrators burned banking institutions and government facilities and clashed with the police. Just because the price of gasoline rises by 5,000 riels per liter (about 3 yuan). The national protests in India have been maintained for three months. Just because the price of onions is 30 rupees per catty (about 3 yuan).

A group of high school students from the Chilean capital of Santiago launched a peaceful protest and quickly evolved into a nationwide robbery, arson and mass riots, just because the subway ticket price rose by 30 pesos (about 3 cents). In the past two weeks, the US police launched a campaign against subway evasion. Hundreds of protesters believed that the police had been over-executed, and there was a subway riot, and demonstrators took to the streets to burn public facilities. Just because the New York subway unified fare is 2.75 US dollars.

Last weekend, Paris, France, again appeared in the violent demonstrations on the streets of the Yellow Horse, commemorating the first anniversary of the Yellow Horse. It rushed to the streets, forcing shops and multiple downtown subway stations to close and block the Paris ring road. There was also a Spanish strike, and the protests in Turin, Italy, evolved into riots. The turmoil in the Bolivian state has intensified, and Iraq’s Baghdad demonstrations have protested against government corruption and large-scale demonstrations have taken place in several cities in Lebanon.

Today, we have stood on the eve of 1929.

As the global economy declines, the gap between the rich and the poor further increases. Worldwide, apart from mainland China, class solidification and class contradictions have been unable to reconcile, and uneasiness and turmoil have become the main theme of all countries.

Today, we look at the Fed, and the interest rate is very close to zero. In the last recession, the Fed cut interest rates by 5 percentage points. This means that in this recession, when there are significant problems in the economy, the United States has no weapons to regulate. The FOMC has cut the policy rate three times to support economic growth and return the inflation rate to the 2% target. The current policy rate is between 1.5% and 1.75%.

In any recession, weapons are needed to regulate the market to support economic development, and now the United States has gone on a road of no return.

Trump even called on the US to go to negative interest rates last week. Powell was very wary of rejecting the proposal. I mentioned in "An article reading 2019" that in the face of the global economic environment of 2019, the most important thing for the United States is to raise interest rates. Only in this way can we have corresponding weapons to regulate the market after the economic collapse.

What Trump needs is to stimulate the economy. He will be re-elected until the 2020 US election. There are two kinds of demand for raising interest rates and cutting interest rates before the economy has collapsed: one is to control the economy, the bubble is limited, the bubble is blasted, and the energy is re-injected; the other is to accelerate the bubble. Big, squatting and eating food, the money dividend after the economic collapse is eaten before the crash. Obviously, Trump needs the latter.

Therefore, cutting interest rates in advance will become the only option. This has also become a poison of the dollar.

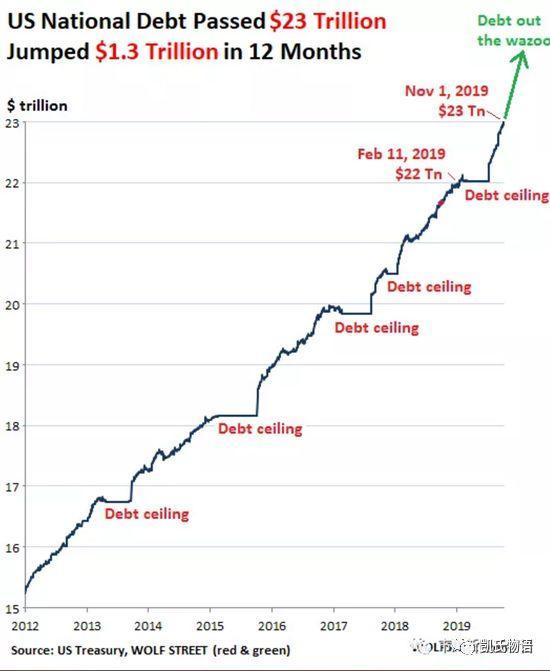

The "Sword of Damerslick" hanging over the top of the United States today is a US debt. Just a few days ago, US Treasury bonds broke through the historical mark of $23 trillion and hit a record high, equivalent to 112% of the total US GDP in 2018. In FY 2019, the US fiscal deficit actually reached 98.84 billion US dollars, the highest level in 7 years, a sharp increase of nearly 26% year-on-year, far higher than the US economic growth rate. In 2020, the United States can't even pay interest on its own national debt.

In fact, in the past year, China has sold a total of $90 billion in US debt, and Russia has sold $85 billion in US debt. Japan, which was originally the biggest buyer of US debt two months ago, suddenly sold $28.9 billion in US debt. This is the largest monthly US dollar bond sale in Japan's history, and it also makes Japan the biggest seller of US debt in September.

So who is picking up? Now look at the top three buyers in Ireland, Luxembourg and the Cayman Islands to buy US$1.6 billion, US$8 billion and US$2.4 billion in US debt respectively. There is also an increase of US$3.06 billion in Israel. This is the fourth consecutive month that Israel has increased its holdings of US debt, and its holdings of US debt reached a record high of US$46 billion. But this is obviously a drop in the bucket.

The country that really takes over the US debt is the United States itself, using the way of repurchase.

The Fed restarted the bond purchase program, and Powell stated that "do not confuse this with QE." The expansion of the balance sheet is QE. In order to quell the shortage of the US dollar capital market and inject momentum into the declining US economy, the asset purchase plan will release huge liquidity. In fact, the Fed’s balance sheet has long been unknowingly more than $300 billion.

That is to say, the United States is printing more "air coins" to fill the already precarious US debt bubble. What is even more terrifying is that the world is headed by Europe in this direction.

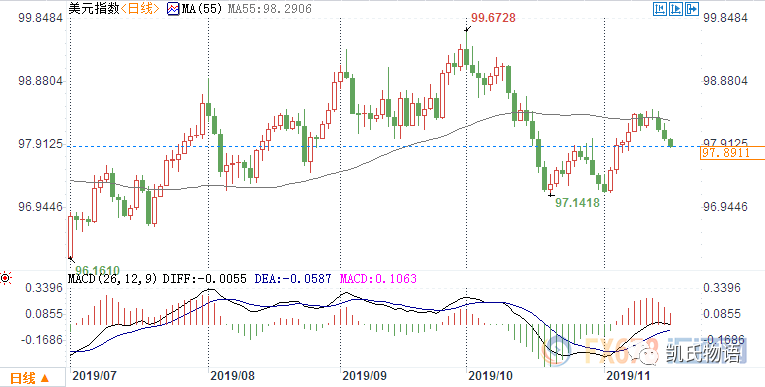

Since September, the Fed has purchased $66 billion in medium- and long-term government bonds, and plans to maintain a $60 billion monthly bond purchase by June 2020. This will increase the Fed’s government bond holdings by approximately 5,400. One hundred million U.S. dollars. In other words, the United States not only does not pay back the money, but also printed more "dollar air" to recover the US debt sold by other countries. This is the truth about the strong dollar this month.

So the question is, where is the excess dollar currency going? As I said in the previous article, in the current economic environment in the United States, the excess US dollar flows to the US stocks as if it were directed quantitative easing, that is to say:

The United States is using the ultra-selling "air" dollars to recover the US debts that countries are selling, and then squeeze these financial assets into the US stocks. This is the truth that US stocks continue to rise.

But we must know that there are three dangerous and fragile links in the entire chain: if the market cannot support the US dollar to continue to maintain a strong currency, the dollar will depreciate in name due to a large number of overshoots, which will prompt countries to expedite The dollar system is actively looking for alternatives.

Although the US Federal Reserve’s repurchase of US debt is not to lend investors to invest in any financial leveraged products, in fact, these US debts will allow banks to increase large amounts of cash in the United States, and banks will lend to financial investors in order to reduce idle funds. Do overnight interest rate funds. In a ring, if the economy deteriorates, banks will quickly de-leverage, investors will also be forced to withdraw liquidity funds, capital will escape from the stock market, US stocks will collapse, and then become a vicious circle of dominoes falling down. .

In the current US stock market, most of the robots are deeply involved in trading, not human. Many investors buy passive index investment ETFs, they don't understand, and they don't know what the stocks they buy are. This means that if there is a big crash, the stock of the head may be good, and the market has enough depth to let the robot play freely. What if most stocks are not liquid?

The robot will continue to snatch the escape door, and eventually pull the entire US stock market crazy.

For the first vulnerable link, I am unfortunate to tell you that the Fed's data shows that the US economic growth in the fourth quarter will be close to zero. The actual wage level in the United States has returned to the highest level in 1970, very similar to the state before the last round of the Kangbo cycle Great Depression. In September this year, the US unemployment rate fell to the lowest level in 50 years, only 3.5%. This sounds very good, but it is precisely the "market illusion."

The highest level of real wages means that there are two situations that may occur next. One is that US inflation has risen, nominal wages have remained the same, and real wages have fallen. The other is that unemployment has risen, nominal wages have fallen, and real wages have fallen. Of course, from the current situation, what is most likely to happen next year is that the US economic growth is close to zero, inflation is rising, unemployment is rising, nominal wages are falling, and real wages are falling.

At this time, Morgan Stanley came out with the following remarks: With the slowdown in the trade situation and the relaxation of monetary policy, global economic growth will be boosted in the first quarter of 2020. In addition, given that US economic growth is at the end of the cycle, emerging markets will drive the global economic recovery.

This sentence tells you 2020 is no problem, but actually tells you:

The final madness of the market will emerge in 2020.

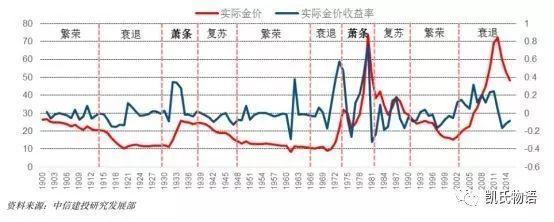

For the second fragile link, we see that the world is actively selling US debt and hoarding gold. According to data released by the People's Bank of China on November 8, the gold reserves reached 62.64 million ounces (about 1,984.32 tons). In the past 10 months, China has been increasing its holdings of gold. In addition, the top four countries are Russia, Turkey and Kazakhstan. Not to mention the game about Bitcoin, I will elaborate on it later.

Go back to the third vulnerable link. I mentioned in a previous article that the upcoming Great Depression in 2020 will be a superposition of the bursting of the Internet technology stock bubble in 2000 and the bubble burst of the 2008 subprime mortgage crisis.

In the past three decades, we have seen the Internet as the result of the core technological development of this round of the Kangbo cycle. We saw a huge burst of traffic and saw countless content appearing on the network. Technology has indeed changed the way of life, making us more convenient, and enjoying higher efficiency and various products at lower cost. Now is an era in which material and data information is extremely rich. Even children have started to own iPhones and watch all kinds of content. But is this really true?

In the past, there was a famous saying in the advertising industry that advertisers invested in advertising and could never know where half of their money had been invested, and why they did not produce benefits. Today, with Internet advertising, you can clearly tell advertisers that your ads are promoted to people who have calculated them through algorithms in various types of applications such as Facebook and Youtube. The advertiser is very happy, because he finally knows where every penny he spends and how much benefit he can make. Actually?

The New York Magazine sent this news: only slightly more than 50% of online traffic comes from real humans. The rest is that robots are creating information and reading information. Therefore, the advertiser found that although he clearly knew where his penny was used, in fact, the ratio of production was far lower than the original TV commercial.

In the first quarter of 2018, Facebook deleted 600,000 machine accounts, 750,000 in the second quarter, and 1.2 billion in the fourth quarter. What about this year? Just 2.2 million machine accounts were deleted in the spring. I even wonder if Facebook really has so many accounts. Because in September last year, Facebook had a total of 2 billion accounts.

Beginning in 2018, there is no user traffic on the Internet worldwide.

At this time, Ma Huateng also proposed that Tencent has a comprehensive view of the industrial Internet. I think this is very wise. Back to the Kangbo cycle, in fact, 2015 is the turning point of the current Kangbo cycle from the recession cycle to the depression cycle. why? Because the global government has begun to discuss supply-side reforms. The core of the industrial Internet is to go to the B-end and do the collaborative upgrade of the enterprise supply chain. That is to say, the B-side efficiency service upgrade through Internet technology is essentially the technological upgrade of the supply-side reform.

Of course, there are still many people arguing that in 2019, the turnover of Taobao Double Eleven reached a terrible RMB 268.4 billion. In the end, it can be seen that the economy is not working. In the end, where can the user traffic be seen? Referring to my Facebook example above, the story is already obvious. There is only one tipping point for "big but not down" and "big and can fall", which is why you are not allowed to fall.

Ma Yun’s abdication last year was the smartest choice in his life.

In the past, we looked at GE General Motors. In the industrial era, the offices were spread all over the world, reaching nearly 100 million users, and the market value reached 500 billion US dollars at the peak. But then, there was a series of crashes that were kicked out of the Dow Jones Industrial Average. This shows that in the era of industrialization, the result of multi-level intermediation and traditional offline methods is inefficiency and marginal cost is extremely high. Therefore, traditional consumer goods companies have reached the limit by managing means and superimposing all aspects of technology.

And this limit is 100 million users with a market value of 500 billion US dollars.

In the era of the Internet, whether it is Google, Facebook or China's WeChat, the approximate size is 1.2 billion to 1.5 billion people. Of course, it also covers the robot account. Therefore, we have seen that the Internet has achieved “big intermediation” through technical means, that is, Internet companies are the only intermediary. Only in this way can we reduce the marginal cost and increase the marginal benefits.

And this limit is about 1 billion people, and the market value reaches 1 trillion US dollars. Both Microsoft and Apple have exceeded this number today. Do you think that when the market value of the company that represents the core technology of a business cycle has exceeded the limits of the market, what is the story of this market? What about imagination? Who is going to be the next one?

This is the terrible double killing that US stocks are about to face: the false prosperity brought about by machine data obscures the fact that this round of technological innovation has exceeded the border, and the false market brought about by machine trading has made more investors sink in the hustle and bustle. The economic index is in the illusion.

When the market collapses, it is time when the machine network begins to strangle the human economy.

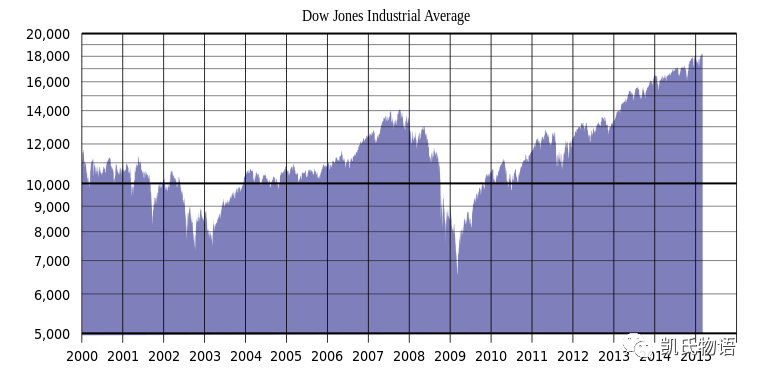

Just yesterday, the ratio of the total market capitalization of US stocks to US GDP has reached 147%. The ratio of market capitalization to GDP can be regarded as the ratio between economic expectations and actual economic growth. Investors can use this to observe whether the stock market has support from real economic growth. In the past, the highest historical data was in the 2000 technology bubble period. Only 135%.

The total market value of the US stock market is currently about 30 trillion US dollars. If we throw the repurchased 540 billion US dollars into the US stock market, it may only have a gain of about 2%. But it doesn't really need it, because the core is in the Dow Jones index, which is the 30 most important stocks in the US stock market. If only the proportion of weighted stocks is calculated, the increase will reach 7%.

In 2020, we may see US stocks reach 30,000 points, but this moment, it may become the US stock of Everest.

The divergence of the US market to the economy has gone to extremes, and the extreme bulls and the ultimate bearers are evenly matched. The hostility between the Republican Party and the Democratic Party in the United States has torn the entire United States. Do you still remember the last madness of 2007? When Bernanke, then chairman of the Federal Reserve, said that the US economy was stable, the stock market rose for another six months and then peaked in October.

The US stock market is still in the long-term bull market and is in a long-term upward trend. In the final madness, the market will break the short of all bears, and start to rise counter-cyclically in uncertainty, because only then will the first kill. When investors start to doubt their previous judgments and are attracted to the price that has risen to a very high level, the market will have a top critical point. Then there was a series of declines. The top of the market in 2020 is likely to appear between May and November, and finally complete the long and short double kill.

Historically, the top is often difficult to predict, because only the skid over the top, falling to a certain critical position, the market is once again boosted upwards, so that the peak is formed, the highest peak will be fully confirmed. Taking the 2008 subprime mortgage crisis as an example, the worst time for the market to fall was not the long and short doubles that were completed in October 2007, but the series of global financial derivative effects in 2008, which was completed in 2009. The last bottom.

I believe that the worst downturn in the global market will occur in 2021, and it will eventually happen at the end of 2023 and early 2024.

The global giant financial tsunami that has been reincarnation for nearly a hundred years has only one Noah's Ark, which is China. As of the end of August 2019, China's national debt was about 36.7 trillion yuan, which was only about 5 trillion US dollars, far lower than the United States. In my last article, "The Financial Tsunami on National and Digital Monetary Governance," I have described in detail the efforts that the state has made in response to the financial bubble in the past three years.

Everyone knows that since the second half of 2018, the outbreak of African swine fever has destroyed China's live pig stocks and triggered a series of reactions. At present, the stock of live pigs in China has dropped by about 130 million, while the stock of pigs in the entire EU is only 150 million. The resulting inflationary pressure is obvious.

Just two days ago, the central bank said it would strengthen counter-cyclical adjustments and cut the reverse repo rate, which will reduce the 7-day reverse repo rate from 2.55% to 2.5%. This means that a new round of interest rate cuts has been opened. In the past year, we have seen China's RRR cuts several times, but there is no obvious effect in the loan. This is because it takes a certain amount of time from the implementation of policies to the inflow of money into the market and then to the adjustment of the economy. So there is often a lag.

Just yesterday, the central bank stressed: insist on preventing and defusing risks in promoting high-quality development, properly responding to short-term downward pressure on the economy, and resolutely not engaging in “big flood irrigation”. Focus on expected guidance to prevent inflation expectations from diverging.

This means that China is ready to cope with the financial crisis, and long-term inflation is being suppressed and is in a downward trend. Quantitative easing will occur in the future, depending on when the global financial crisis occurs. But even quantization is directed quantization.

Why is it no longer a "big flood irrigation"? This has a very important relationship with real estate.

The US market has already matured. From the 1950s to the 1970s, the United States experienced a phase of real estate investment. With the development of the big bull market in the US stock market, it has gradually turned to the era dominated by financial assets. For today's US investors, the ratio of investment in financial products to real estate is roughly 8:2. At present, the total market capitalization of US stocks and the total market value of US real estate are both 30 trillion US dollars.

The EU is both 20 trillion US dollars, Japan is slightly different, experienced the financial and real estate bubble in 1990, the current real estate market value is roughly 10 trillion US dollars, and the stock market value is 6 trillion US dollars.

In China, the total market value of real estate now reaches 65 trillion US dollars, while financial assets are only 6 trillion US dollars. In the long run, the Chinese market will inevitably experience a situation in which the total market value of real estate is close to the total market value of financial assets. This round of the upcoming financial crisis has given China a good time to switch assets.

This is exactly the same as the overall development of the last round of the Kangbo cycle. The booming real estate market in the United States from the 1950s to the 1970s coincided with the boom cycle and the recession cycle of the Kangbo cycle. In 1973, there was a depression cycle. In the beginning of 1975, the US stock market bottomed out and then began to rebound. It took seven years to complete. Thus, in 1982, the recovery cycle of the current Kangbo cycle was opened. The United States happened to be the transition from real estate investment to financial asset investment in the depression cycle of the last round of the Kangbo cycle, thus opening up a 44-year-old US stock market.

In the recession cycle of the last round of the Kangbo cycle, from 1968 to 1972, there was a wave of speculation in the United States to grow up and consume the white horse's "beautiful 50", but the positive did not cash, and then ended in disappointment. The situation is very similar to the wave of leveraged bulls in China's A-shares from 2013 to 2015.

In the depression cycle of the last round of the Kangbo cycle, from 1973 to 1982, although the US stock market has been bottoming out, the R&D investment has risen sharply, laying a foundation for the subsequent bull market of information technology and biotechnology. Volcker raised the independence of the Fed's monetary policy, lowered inflation expectations, and laid the institutional foundation for long-term economic prosperity. From the beginning of the recovery cycle of this round of the Kangbo cycle, since 1982, the US economy has entered a period of low inflation and high growth, productivity and consumption power have recovered and released, and US stocks have also opened a super bull market for consumer and technology stocks. It continued until 2019.

China's future will also be a decade from the full transition of the real estate asset cycle to the financial asset cycle, and the Chinese A-share super bull market that opened later. The turning point is in 2020.

From the macro data of China in the past 20 years, we can see that the long-term trend of China's economic cycle is bottoming down. In fact, everyone knows that China's economy has taken off in the past 30 years, but why economic variables will be built down. What about the bottom?

There is a very simple reason for this: China has a huge infrastructure and real estate investment in the past, and it has used a lot of leverage based on such a scale. Leverage generates a lot of bubbles, and the bubbles must be controlled so as not to cause systemic risks. This will inevitably suppress the marginal return of new investment, which will reduce the return on economic development and extend the return period.

This is why China has been working hard to prevent financial risks, including the deleveraging of real estate, in the past three years.

In fact, we say that the real estate cycle is generally three years. A real estate project, starting from the acquisition of land, 3 months planning and design, 3 months formalities approval, plus 10 months of construction, 10 months of hydropower line layout and related safety approval, plus 10 Pre-sale, completion acceptance, and delivery of the house for a total of three years.

The current round of China's real estate cycle, which was launched from the end of 18, is accelerating at the end of 19th and is expected to reach its peak in 2020, and then all the way down to the end of 2021. How to judge?

Last week, the National Bureau of Statistics released statistics on house prices in 70 cities nationwide in October. Since the national property market entered the current round of the upward cycle in May 2015, the number of falling cities exceeded the number of rising cities for the first time. Although the number of new homes is still higher than that of falling cities, the first- and third-tier cities are still rising. However, the price change of second-hand housing is ahead of the price of new homes. The current cycle of cooling, the number of second-hand housing prices has changed, and it is ahead of the average price.

Injecting bubbles through the downsizing of real estate and injecting liquidity into high-tech industries and financial assets through targeted quantitative easing will be the core theme of China in the next decade.

In fact, in the past decade, the United States and China have shown some degree of synchronization, and there has been a decline in the return on investment. This is most likely caused by the fact that after China’s entry into the WTO in the past two decades, it has become a world factory and has formed a mutually reinforcing relationship with the United States.

Both China and the United States have a tendency to concentrate capital on the stock market. It is clear that the return on capital investment of small-cap stocks is much lower than that of large-cap stocks. This is partly because the market, especially the capital market, has a typical capital concentration system, and even the technology stocks use the data as a core barrier under the existing Internet paradigm. The inevitability of monopolistic enterprises.

In the past three decades, the bottom of the Chinese stock market has actually been uplifted, although the middle and the US stocks have formed a clear contrast, the US stocks are short and long. In the past, China’s A-shares were typical of short-term bears. However, judging from the MA20 moving average of the annual line, China has been in a steady rise in the financial market since the reform and opening up. But in the short term, 3200 is still a strong resistance. So I tend to think that A shares should be around 2,600 points at the bottom of 2020, while the top is still around 3,200 points.

When the global financial tsunami occurred, what would happen in China was that it was first flooded by the sea, and then the rapid direction of the Noah's Ark was the first to float in Shanghai. This is actually a strong connection with the fact that the Chinese economy has begun to gradually complete the bottoming. For the Chinese economy, the most difficult time will come out in 2021, which is the time I think it is most likely to officially introduce the property tax. The Chinese financial market will complete its bottoming out at this time.

According to the UN's forecast of China's GDP in the next year, China will quickly bottom out and start a rebound. The United States will be in a long-term process of bottoming out. The rest of the world may face a major choice, which is which side of the team. This choice will determine the future economic recovery after the financial tsunami in the country.

2020 will become the turning point of the decisive battle between the East and West. Those who do not want to choose will be abandoned by the times.

As an outpost, Hong Kong has foreshadowed the impending fall of the Western ideology represented by the United States. In the past year, the chaos we have seen is essentially a process of financial wrestling. Hong Kong dollar is the leading indicator of the renminbi and the location of the offshore renminbi. Sniping Hong Kong stocks is the essential purpose of Western ideology in this series of farce.

In the past six months, it has been Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, and JP Morgan has been shorting Hong Kong stocks. The two sides killed almost white heat, and the Soros sniper battle in this year is also the embodiment of Chinese wisdom. At this critical moment, we saw an important news: On the evening of November 13, Alibaba officially launched the Hong Kong stock IPO plan.

According to the prospectus, Alibaba plans to list on the main board of the Hong Kong Stock Exchange on November 26, and plans to issue 500 million shares worldwide. The public offering price will not exceed HK$188.00 per share, which will be confirmed on November 20. In other words, Ali will raise more than 108.1 billion Hong Kong dollars. What does this mean?

Ali is a deadly arrow.

Ali returned to Hong Kong to sit in the outpost of the East-West ideology and stabilized the Hong Kong stock market with $15 billion. At the same time, because in the US stock market, Ali's price-earnings ratio is only about 29 times, compared with Amazon's 77 times. This means that the return of Hong Kong stocks will inevitably bring the price-earnings ratio of Ali stocks up. And Ali will inevitably become an important constituent of Hong Kong stocks, which means that capital will go through Ali to do more Hong Kong stocks.

Why did it announce on the 13th and go public on the 26th? Because the delivery date of Hong Kong stock futures is on November 28th, the key point of this battle is coming to an end. It is also back to the previous article of this article: "big but not down" and "big and can down" have only one critical point, which is why you are not allowed to fall.

As I said in my previous article "On the Way Out for China and the United States and Bitcoin": The piece of cake in Hong Kong has been opened.

Just a few weeks ago, I just published an article on "Financial Tsunami on National and Digital Monetary Governance", which mentioned that the country will fully launch blockchain supervision and clear the upstream and downstream of the industrial chain. Who knows, it was verified so quickly.

Today we hear everything from the wind to the wind. In fact, a careful observation of the steps is not difficult to understand the process that takes place in the middle. From the point in time when the Biss exchange occurred and the overall situation, it is probably known that the country is starting with a typical example to understand all aspects of the transaction. The detailed level of in-depth is not simply to solve the problem of an exchange, but to do more comprehensive information. Only then do you know what to do next.

Supervision is not for destruction, but for distinguishing between good and bad.

As I mentioned in my previous article, the development of Bitcoin is divided into three phases, and 2013 is just at the stage where the exchange controls the bitcoin throat. So in 2016, the Chinese government began to study digital currency on the one hand, and on the other hand began to conduct a “bitcoin limit order” on several digital currency exchanges.

The core is mainly concerned that the digital currency exchange, like the Exchange, has mastered the rise and fall of Bitcoin. So when Bitcoin began to skyrocket, several exchanges in China were very nervous. In the end, the government found that the rise in bitcoin was not driven by the exchange at this stage, which means that the exchange did not significantly affect the behavior of the market. It also opened the market and continued to wait and see. This stage just happened to confirm the second stage of bitcoin that I said. The competition of money suppliers brought about a collection of mine pools, and there was a situation in which the mines controlled bitcoin.

Therefore, from 17 to 18 years, China has been clearing all kinds of mining pools, on the one hand, reducing power consumption, on the other hand, it hopes to solve the problems related to Bitcoin. This is also the highlight moment of the Bit continent. But as I said before, when the halving cycle of 2020 comes, the total amount of bitcoin of 21 million has been dug out of 19 million, is it still important?

The answer is obvious. This is like the gold producer we saw today. If it goes public, this company is of course worth the money, but it has gradually moved away from the center of power, but it has become a pawn in the market. After that, the third stage that Bitcoin will experience is the era when the channel is king. Whoever masters the bitcoin spot and futures legal currency deposit channel, whoever has mastered the "digital gold" of the next era.

So today we find that all kinds of news in the news about cleaning up the illegal exchanges seem to intentionally or unconsciously revolve around a core – that is, currency security. It has a large enough foreign user and a market brand with sufficient weight, and it is now outside the Chinese legal system. "Zhaoan" is the core.

For the boss of the exchange, it means turning a businessman who suddenly became rich in the past into a more important role in the market game. This is like Tehla's Elon Musk's coming to the electric car factory in China, not just knowing the technology or understanding the market, or even being a spiritual leader can solve the problem. What is more needed to go down is political wisdom.

In fact, we think carefully, what should the exchange be? The exchange is the funnel to screen the next round of blockchain revolutionary core technologies. Only by screening out the most valuable digital currency for this era will it be possible to bring systematic user variables to the exchange, and it will be possible to lead the development of users, exchanges and projects. Give up short-term benefits to go to the next era.

At the same time, the country is walking on two legs, one is to control the upstream and downstream of the blockchain industry chain, and the other is to accelerate the relevant policies of the blockchain. This is the reason why Tencent was the first to get the Hong Kong virtual currency exchange license in the past week. In fact, in the era when C-side traffic is gradually disappearing, on the one hand, the Internet giant is facing the stock market stifling and transforming the industrial end, on the other hand, it is becoming the upstream and downstream of the industrial chain in the next technological era, and is the supply-side infrastructure.

Back to Bitcoin itself, last week, we already knew that the trading volume of the Bakkt exchange had exceeded 1750 Bitcoin contracts. Many friends are scared to see the decline in Bitcoin. For the time being, although capital in the world has begun to intervene in bitcoin in 2018, bitcoin is still not a hedging tool like gold. The current logic is still a speculative variety.

Since the fall of Bitcoin triggered by the evils of futures trading on September 23, in fact, it is the process of Wall Street dealers waiting for market signals. Although in the middle we saw a surge in the bitcoin and digital currency caused by the country's clear indication of the vigorous development of the blockchain. But this is not a real signal. The real signal is that US stocks have broken through new highs, the “quantitative easing” implemented by the Fed in disguise and the next stage of Sino-US talks.

All three have emerged. We can understand that based on the fact that bitcoin is still a property of speculative products, it is obviously unrealistic to complete the digital economic growth from the human capital monetary economy to the machine network in the coming year.

Therefore, the most likely scenario for Bitcoin in 2020 is that, like the US stock market, the first move will empty the bearers, then fall, empty the bulls, and finally complete the long and short double kill.

This is why we have seen a slow decline in Bitcoin in the past month, and the market is accumulating short-selling sentiment. This is to prepare for the turning point signal and complete the killing. At the point in time when this signal appeared, I tend to be in December. But after the signal appeared, Bitcoin is unlikely to skyrocket. Because of the Christmas at the end of December, there will be “junk trading hours” in the Western trading market, and the Chinese New Year will be followed on January 25.

Therefore, it is most likely that the increase will be completed in 3-4 months. The staged high of this round will be around 16,000 points. Then if time is enough, it may once again challenge the 2017 high, but it should be noted that the high point is unlikely to challenge success once, and is more likely to fall again in close proximity. The point of rising again afterwards may challenge 22,000 points. But it all depends on the amount of energy, speed and the slope of the moving average at that time, which needs to be observed at any time.

In general, what we need to focus on is the change in the US stock market, because the frenzied rise in the end of the capital expansion of US dollar assets will drive the sentiment of the speculative market and reflect it into the bitcoin and digital currency markets. The timing of the collapse of the US stock market is likely to coincide with the halving cycle of Bitcoin, bringing about market news, market sentiment and market currency withdrawals.

If the US stock market crashes later than the BT halving cycle and then collapses at the end of 2020, it will likely rebound again after bitcoin halved the expected cashback, challenging the 2017 high or surpassing the 2017 high.

Until the collapse of the US stocks, the collapse of the US stocks, A shares, Bitcoin and other long-term double-killing situation.

No matter what kind of ending, I don't think that 2020 is the year in which Bitcoin completes the incremental conversion of human stock currency to the network. After all, this year is more likely to be the year of global financial bubble collapse. However, as the RMB has overtaken the curve of the US dollar, Bitcoin is actually more likely to start a new round of inflation at the end of 2020 and 2021 after the completion of the long and short doubles in 2020.

Only in this way will the eyes of the world be drawn from the ruins into the core of the next generation of the human wave cycle – the blockchain and the digital currency economy.

In the signal that appeared in December, the most likely occurrence was the rise of the Ethereum to drive the digital currency to rise, and finally complete the relative increase of Bitcoin. In 2020, bitcoin will reach the climax of the stage as the second key point, and the US stock will reach the apex as the most critical point to judge the whole process will be clearer. And just on December 7, Ethereum will complete the Istanbul upgrade.

As I said before. The transformation of digital currency from the human currency stock market to the incremental market of machine networks in 2020 will face four important signals.

The first point is that the Bakkt exchange's bitcoin spot and futures trading volume continues to rise to complete the control of the Bitcoin legal currency channel through the regulated channels, and this channel will face competition from China; the second point is the Ethereum to complete the POS consensus mechanism. Upgrade, the SEC also published the possibility of launching the Ethereum ETF at the end of 2020; the third point is the nationally regulated digital currency, which is more likely to occur between the end of 2020 and 2021, depending on when the financial crisis broke out. .

The last point is that the underlying application system public chain was born, using a new consensus mechanism, bringing a new smart contract standard, and the application landing, which means the official opening of the blockchain 3.0 "digital bronze "The era." This promoted the birth of the big bull market in the next round of blockchain. In the second half of 2015, Ethereum was born and led the 2017 bull market with erc20.

In the past, they are all prologues. There is a light coming in the crack.

THE END

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Getting started with blockchain | What is bitcoin? Explain with Pokémon cards

- XRP transaction analysis: illegal transactions of 400 million US dollars, accounting for only 0.2% of the total

- Singapore Monetary Authority: Proposed cryptocurrency derivatives to be listed on the Compliance Exchange

- Smart Contract Entry Series | An important part of smart contract engineering: formal verification method

- The BTC has been halved for six months, but the miners have "surrendered"?

- ShapShift, an established exchange, announced the implementation of “zero fee”, which refers to hosted exchanges such as Coinbase.

- Algorand 2.0 released, providing standardized asset creation, atomic transfer and smart contracts in Layer 1.