Observation | OKEx triggers "destruction war", why is absolute deflation worth learning in the currency circle?

Text | Popsicle Editing | Bi Tongtong Sources | PANews

Just now, OKEx issued the destruction announcement again, and started the destruction of the new quarter. The number of OKB repurchase destruction was 3.18 million, valued at about 17.5 million US dollars, an increase of 16.67% over the previous round of repurchase. This is the latest repo destruction after OKEx has substantially destroyed the tokens.

Just 20 days ago, on February 10th, after OKEx took the lead to destroy all 700 million OKBs that were not issued, the platform coin market was filled with smoke instantly. In one fell swoop, the "halving market" became a new growth sector.

- Industry Blockchain Weekly 丨 Baidu's financial report mentions blockchain again

- Research | How Does Blockchain Technology Promote the Transformation of Charities?

- deal! Germany officially classifies digital assets as financial instruments and does not have monetary legal status

Huobi also followed suit, issuing monthly destruction announcements, the latest destruction of 147 million HT, and the release of the public chain beta version. The two exchanges secretly competed. At present, only Binance has not had much movement for the time being.

Is destruction and repurchase a short-term market to quench thirst, or is it a long-term plan beneficial to the exchange? Looking back at the stock destruction in the US stock market for more than 30 years, we may find the answer.

U.S. stocks buy back and destroy billions of dollars a year, driving stock prices

Corporate repurchase and cancellation of shares will reduce the number of shares outstanding, which will increase earnings per share. At the same P / E valuation, the stock price will rise. The SEC has opened legal channels for stock repurchase for listed companies since 1982.

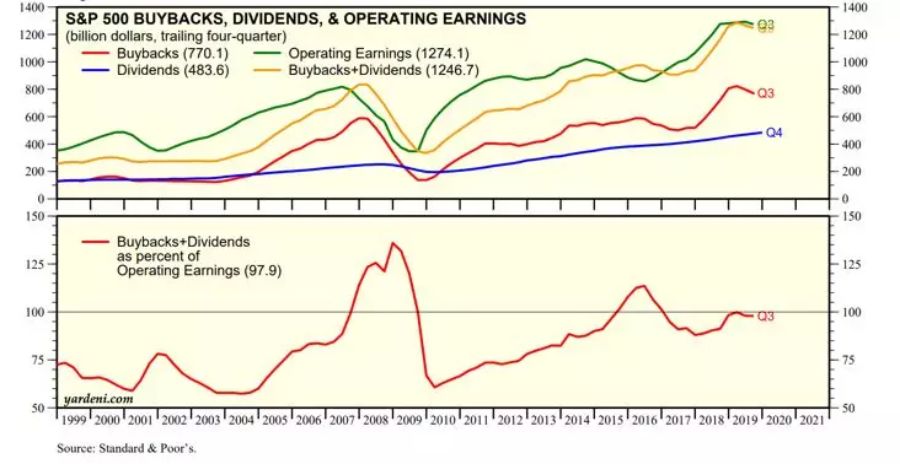

In recent years, stock repurchase in the US secondary market has reached a record high. According to a recent report released by the Tianfeng Securities Research Institute, in 2018, the share repurchase of US listed companies reached 1.085 trillion US dollars, accounting for nearly 3% of GDP and 125% of operating profit, all hitting record highs. Around 1982, US listed companies used only 4% of their profits for repurchase, and in the seven years from 2011 to 2018, this number increased to an average of 53.7%.

S & P 500 buybacks and dividends approach operating profit

Source: Standard & Poor's, Tianfeng Securities Research Institute

In the mid-1970s, IBM, which grew rapidly in the 1950s and 1960s, held a lot of cash on hand. Due to a lack of attractive projects and companies, IBM bought back IBM's stock for a total of $ 1.4 billion in 1977 and 1978. From 1986 to 1989, IBM's total repurchase of the company's stock reached US $ 5.66 billion, with an average dividend payment rate of 56%.

American auto parts maker "Auto Zone" Auto Zone, this company has not seen significant changes in business volume over the past few decades, but the earnings per share has increased by 36 times, and the stock price has been rising from 26 dollars to the highest During the period of $ 1274, the stock price rose 48 times.

Auto Strip stock price screenshot source: Sina Finance

The reason may be that the company's management generously repurchases and destroys the company's shares, and promises to repurchase a minimum of 5% of the outstanding shares every year. In some years, the repurchase rate reached 8%. Over the past 19 years, the outstanding shares have fallen from 14 million shares to 2 million shares, a 7-fold deflation, and the destruction of up to 86% of the shares, followed by a stock-like rise.

The deflation model and changes in supply and demand have a strong impact on stock prices.

OKEx sets off a wave of platform coin destruction, and exchanges follow up

There is nothing new under the sun. The rules of the traditional secondary market are also applicable and staged in the secondary market of digital currencies.

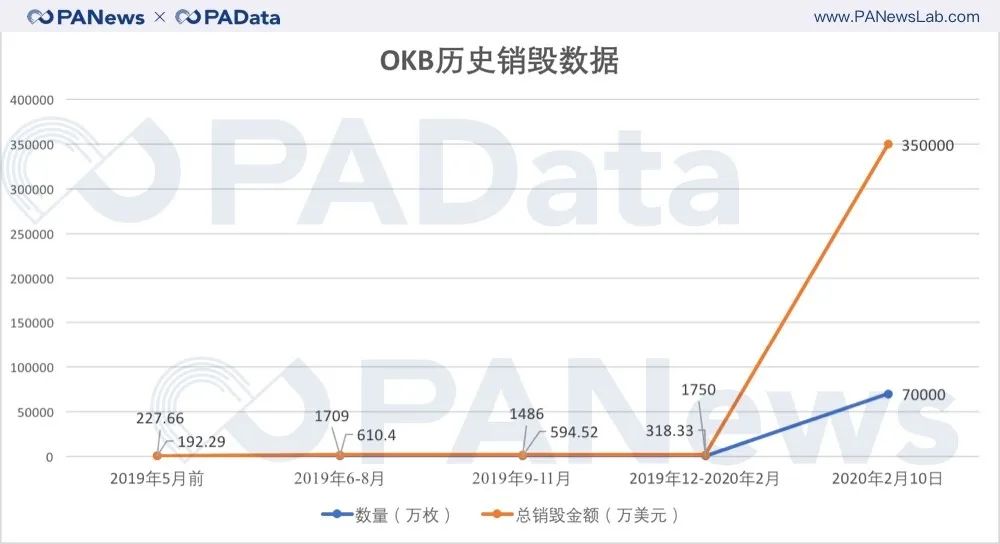

On February 10th, with the announcement of "Exchange public chain OKChain test online" by OKEx Exchange, the long-awaited platform coin section was pushed to the forefront. In addition to revealing the development direction of the OKEx public chain, the announcement also thrown a heavy message to the market that the remaining 700 million platform coins OKB that are not yet issued will be destroyed. At this point, OKB has achieved full circulation.

The news was like a deep-water bomb, and the market was suddenly noisy. According to the OKB price on the day of the announcement, the market value of the destroyed OKB was as high as 3.5 billion U.S. dollars, the largest amount of platform currency destruction. A large number of destruction caused a sharp reduction in chips, and the price of OKB rose sharply immediately. As of 11:00 on February 11, the 24-hour increase of OKB reached 46%.

OKEx's demonstration effect has attracted the attention of other trading platforms. Subsequently, ZB Exchange also issued an announcement saying that it would abandon all the 293 million ZB coins held by the team and destroy them, and at the same time, 107 million ZB of user protection funds would be destroyed.

Immediately after, FCoin issued an announcement that night, destroying all 720 million FTs held by the team. Shortly after the announcement, FCoin fell into a state of downtime. The next day, FCoin announced that it would continue to announce system maintenance time extension announcements.

It is quite dramatic that on February 17th, Zhang Jian published the "Truth Announcement" on FCoin, announcing that he could not honor the user's 7000-13,000 bitcoins, and the user began to organize rights protection, and Zhang Jian fell into a turmoil. Some investors joked that FCoin's destruction of FT is accompanied by a one-time destruction of the platform and will never be repurchased.

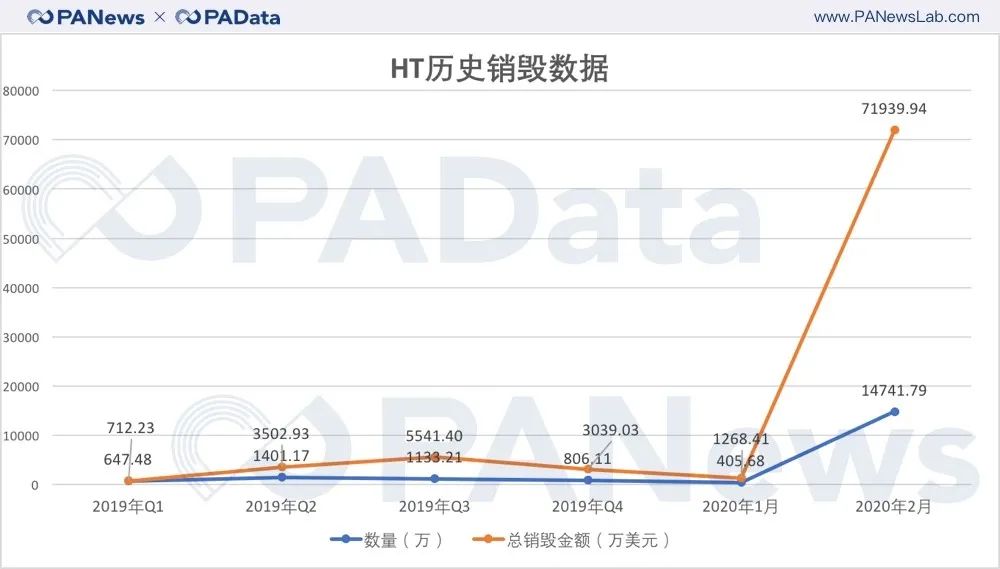

Affected by market public opinion, Huobi quickly released an announcement on February 10, "A notice about the Huobi Chain and HT's new rules coming soon." On the last day of February, the new rules were officially released. Huobi Global decided to permanently destroy the HT of all operating parts, as well as some of the HT of investor protection funds from the secondary market repurchase and other income in the first and second quarters of 2018. A total of 147 million HT were destroyed. HT has entered a new phase of "absolute deflation".

In addition, the exchanges Matcha and Gate.io have released information to follow up on the destruction. At present, only Binance is following its own route, and there is no news to modify the destruction rules.

The total destruction of the three major institutions reached US $ 4.6 billion, with OKB accounting for 76%

After Binance issued the platform currency in 2017, the era of platform currency destruction began. After Huobi and OKEx launched the platform currency in the form of points in 2018, they also joined the destruction camp in 2019. According to PANews statistics, based on the price at the time of destruction, the three exchanges destroyed a total of US $ 4.659 billion of the platform currency, of which OKEx came later, accounting for 76% of US $ 3.551 billion.

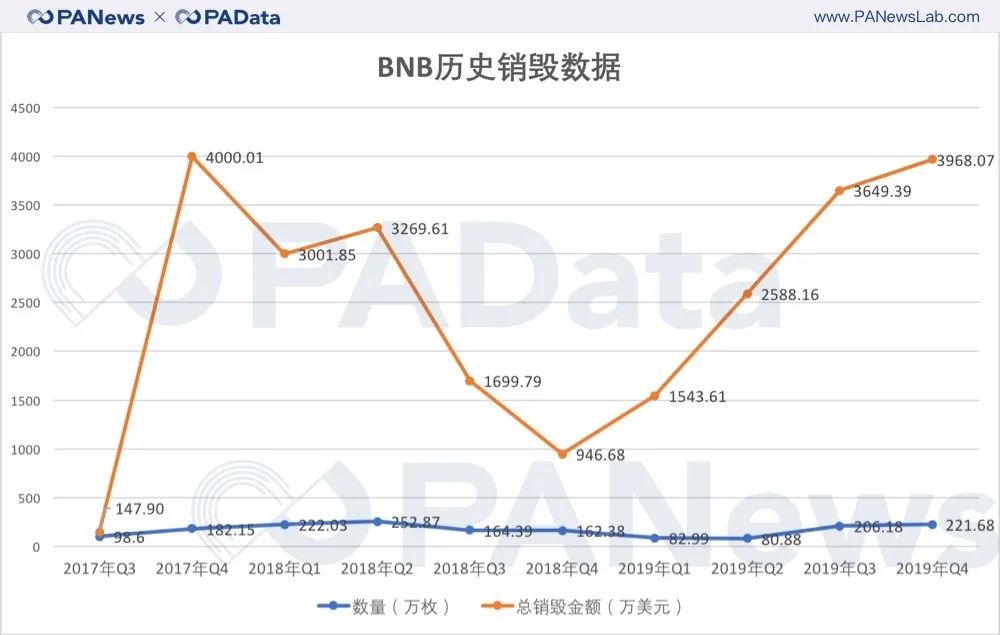

Specifically, BNB began to be destroyed in the third quarter of 2017. As of the fourth quarter of 2019, the cumulative number of destruction was 16.71415 million. Based on the BNB price at each destruction, the total destruction market value was US $ 248 million.

HT began to be destroyed in the first quarter of 2019. As of February 29, the maximum destruction was 193.544 million. The total destruction market value was 860 million US dollars based on the HT price at the time of each destruction.

OKB has been destroyed since May 2019. Currently, the total number of OKB destruction is 717 million. Based on the OKB price at each destruction, the total destruction market value is US $ 3.551 billion.

According to the indicators of total market value of total destruction, BNB is currently in a state of "behind the scenes", and the market is also looking forward to whether Binance will follow up and increase its destruction.

What cards do you keep destroying?

The passers-by are not hesitant, the followers can chase. At present, OKEx and Huobi have entered the stage of absolute deflation. The future destruction will compete against the true profitability of the platform.

At present, HT's repurchase destruction quota and BNB's destruction quota are 20% of "revenue" and "profit" respectively. This concept is a bit vague. After all, why can't I know the final profit reports of the two exchanges.

The main sources of funds for exchanges are "transaction fees" and "equity income (listing fees / discounts / new sales / UP sales)". As for the statistics of the exchange, it is temporarily unknown.

OKEx because the repurchase quota only includes the single-dimensional income of currency transaction fees, resulting in a lower amount of OKB destruction in the past single month. OKEx's products also include fiat currency transactions, leveraged transactions, delivery contracts, perpetual contracts, and options contracts. The largest part of revenue is in contract transactions.

"What we want to do is a long-term business, so we will never do things that overdraw the future value. The basic value support of OKB has not changed, and we will still use the revenue of the OKEx platform to carry out real gold and silver repurchase, and will strengthen Repurchase efforts. "OKEx Chief Strategy Officer Xu Kun said in an interview with the media, which included considering contract revenue to be included in repurchase destruction.

Including the revenue of products such as contracts into repurchases will undoubtedly be a trump card of OKEx.

Conclusion

From decades of experience and history of US stocks, it can be seen that the way of repurchase and destruction is conducive to market development and rising stock prices. Regarding the destruction of this matter, regardless of the ultimate intention of the exchange's destruction of the repurchase, it is essentially to accelerate deflation. OKEx has played a pioneering role in this matter, and Huobi is also closely followed by platform currency. Empowerment. At present, the market is waiting for the voice of Binance, but it is worth mentioning that in the second quarter of last year, Binance temporarily changed and did not repurchase from the secondary market to destroy, but instead destroyed the tokens held by the team and raised doubts.

The performance rules are regularly destroyed, absolute deflation is achieved, and services are continuously innovated and optimized. This is all the way to empower platform coins. The competition on the exchange is a "long run." In the short term, this destruction war is a major event. Looking to the future, it is the market trend.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Tokenized securities say it's easy, but CBDC is in trouble? What does the latest BIS report say

- February security incident inventory: 12 incidents lost a total of 48.23 million US dollars, bZx was attacked by hackers

- Dry Goods | Read the Taproot / Schnorr Upgrade for Bitcoin

- DeFi guardian: DeFi insurance agreement

- DeFi weekly selection 丨 Lightning attack or new normal, should I buy insurance for DeFi?

- Web3 Foundation announces funding for Second State blockchain company, introduces Ethereum virtual machine to Boca ecosystem

- Popular Science | Eth2 Beacon Chain: What You Should Know First (2)