Global NFT Tax Regulation Policies Overview, Comparison, and Outlook

Overview, Comparison, and Outlook of Global NFT Tax Regulation PoliciesAuthor: TaxDAO

NFT (Non-Fungible Token) is a token that represents digital ownership using blockchain technology. NFTs can be bound to various virtual or digital assets, such as images, artwork, videos, music, game items, etc., giving them a unique identity and value. NFTs can be freely traded online, and traders usually use cryptocurrencies as a payment method.

In recent years, the NFT market has rapidly developed, attracting the attention of many creators, collectors, investors, and consumers. Statista predicts that the total transaction volume of NFTs in various fields will reach $16 billion in 2023, an increase of about 33% compared to 2022. According to data from Influencer Marketing Hub, the total transaction volume of NFTs in the art field is expected to reach $450 million in 2023, an increase of about 25% compared to 2022. The innovation and diversity of NFTs have brought new possibilities and opportunities to the digital economy. However, investing in NFTs may involve complex tax issues, as different countries or regions have different regulations or guidance on encrypted assets and digital ownership, and some countries do not have clear regulations or guidance. Therefore, it is necessary for investors to understand the rules for taxing NFTs in their own jurisdiction or the jurisdiction of the trading object and comply with them. This article will provide an overview and comparison of the tax regulatory policies of major countries and international organizations on NFTs and analyze their future development trends to provide information and references for NFT investors.

- “Responsible Financial Innovation Act” to be submitted. What’s new about the new bill?

- Comprehensive interpretation of the Metaverse industry policy: Who are the leaders of the policies?

- Hong Kong sets up Web3 development task force, will it become the next Crypto hub?

1. Countries and regions that tax or plan to tax NFTs

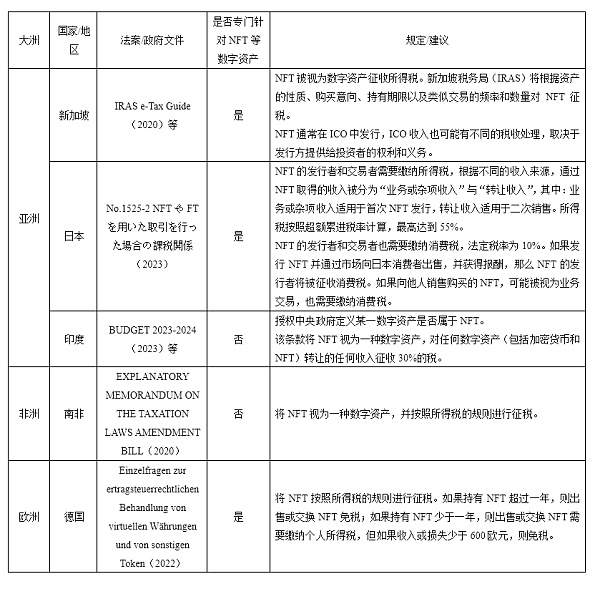

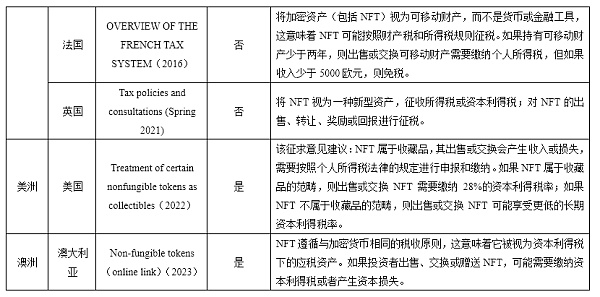

Currently, the tax regulations for NFTs are not unified worldwide. Some countries and regions have issued specific tax guidelines for NFTs; some countries include NFTs in the tax scope of cryptocurrencies or other digital assets; while most countries do not have specific tax policies for NFTs. This article first briefly summarizes the countries and regions that tax or plan to tax NFTs, as shown in Table 1.

Table 1: Countries and regions that tax or plan to tax NFTs

In addition to the countries and regions mentioned above that explicitly tax or plan to tax NFTs, most countries do not have specific tax treatment for NFTs. Generally speaking, if a country or region has issued tax rules for cryptocurrencies/cryptocurrency assets and has not issued specific rules for NFTs, it can be reasonably inferred that NFTs follow the same tax principles as cryptocurrencies, i.e., cryptocurrencies are often considered taxable assets under capital gains tax. If investors sell, exchange, or gift NFTs, they may be required to pay capital gains tax or incur capital losses. If investors obtain NFTs through mining, staking, or other methods, they may also be required to pay income tax.

2. International frameworks for taxing NFTs

Currently, there is no specific legal document or tax guide internationally for the taxation of NFTs or plans for taxation. However, some existing international tax and regulatory agreements also apply to NFTs, such as regulations or regulatory documents issued by the European Union and the OECD. Among them, the most representative document is the Market in Crypto-assets Regulation (MiCA) proposed by the European Union in September 2020. This regulation includes some rules that may apply to NFTs.

MiCA defines crypto-assets as “digital representations of value or rights that are transferred and stored electronically using distributed ledger technology or similar technology”. Its aim is to comprehensively regulate crypto-assets that are not currently covered by EU financial law, in order to standardize the regulation of distributed ledger technology and virtual assets within the European Union. The regulation is currently in the first stage of the legislative process and will be approved or modified by the European Parliament and the Council. The European Commission expects the regulation to be implemented within 2024. As an EU regulation, it will directly bind all EU member states without the need for approval by national legislative bodies.

According to the classification of MiCA, NFTs are generally classified as “crypto-assets other than asset-referenced tokens or e-money tokens”. Under this category, NFTs do not need to provide a white paper when issued, but they need to comply with MiCA’s rules on marketing communication, marketing information publication, marketing information modification, etc. In addition, service providers (CASP) that provide this type of NFT service need to obtain authorization from the EU regulatory authority and comply with MiCA’s operational compliance requirements. However, depending on the nature of the NFT, it may also be classified as utility tokens or security tokens. Such NFTs need to provide a white paper when issued and be subject to stricter regulation.

In addition to the European Union, other international organizations are also closely monitoring the compliant development of NFTs. Michelle Harding, Head of the Tax Data and Statistical Analysis Division of the OECD, stated in a webinar that the OECD is studying some key issues related to NFTs, such as ownership, taxation rights, and tax avoidance risks, and plans to release a report on the NFT market. In broader international cooperation, the United Nations’ 2019 report “Tax Issues related to the Digitalization of the Economy” mentioned the challenges and opportunities brought by emerging technologies such as crypto-assets and distributed ledger technology. The report pointed out the shortcomings of BESP2.0 and recommended that countries strengthen cooperation and coordination to cope with the impact of the digital economy on existing tax rules and principles. However, overall, there is still no unified system framework for the global tax management of NFTs.

3. Global NFT Tax Policies from a Comparative Perspective

As mentioned earlier, most countries consider NFTs as digital assets rather than currencies or financial instruments, which means that NFTs may be subject to property tax and income tax rules; however, different countries have different regulations regarding specific tax rates, tax exemptions, holding periods, issuance methods, etc. In terms of NFT tax regulation, almost all taxed countries rely on self-declaration by traders as the main regulatory method, requiring NFT traders and creators to report and pay taxes, as well as keep relevant transaction records and evidence.

Among major economies, the European Union may become one of the most strictly regulated regions in terms of NFT taxation. Its proposed MiCA is able to classify and regulate NFTs, and will also require NFT issuers and service providers to obtain authorization from EU regulatory authorities and comply with MiCA’s operational compliance requirements. In addition, the European Union has a comprehensive intellectual property protection system for NFTs, including copyright, trademarks, patents, and more. In comparison, the United States may currently be one of the most loosely regulated countries in terms of NFTs. On the one hand, the United States does not have specific regulations or guidelines for NFT issuance, but treats NFTs as digital assets or collectibles and taxes them according to existing tax rules. On the other hand, the United States does not classify and regulate NFTs, but determines whether NFTs are commodities, securities, or intellectual property based on different circumstances, and there is currently no unified court precedent.

4 directions for the development of NFT tax policies

Clear and unified regulatory framework. As the NFT market continues to grow and expand, governments and tax authorities around the world may introduce clearer and more unified NFT tax policies to reduce tax uncertainty for NFT traders and creators, as well as differences and conflicts in taxation with other countries or regions. For example, the United States is currently seeking opinions on NFT regulation. In the future, the U.S. Congress may pass new bills or amendments to regulate the definition, classification, taxation methods, and tax rates of NFTs.

More flexible tax policies. With the continuous innovation of NFT technology, governments and tax authorities around the world may adopt more flexible and innovative NFT tax policies to adapt to the diversified needs and changing trends of the NFT market, as well as to promote fair competition and sustainable development in the NFT field. Governments may differentially tax NFTs based on factors such as types, uses, sources, and purposes, or provide tax incentives or exemptions to encourage NFT creation, trading, and usage activities.

Towards international cooperation. With the continuous expansion and globalization of the NFT market, governments and tax authorities around the world may strengthen coordination and cooperation in NFT tax policies to avoid the risk of double taxation or tax evasion for NFT traders and creators, as well as to maintain order and security in the NFT market. In the future, bilateral or multilateral tax agreements and management mechanisms for NFTs will continue to develop to regulate the taxation principles of cross-border NFT transactions and establish international information sharing and dispute resolution mechanisms.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting the digital asset bill that may be introduced before the 24th US presidential election

- Hong Kong VASP License Exam: Who Will Be the Lucky One to Obtain the License?

- CEO of Hong Kong Securities and Futures Commission: Cryptocurrency trading is an important component of the virtual asset ecosystem.

- Hong Kong banks refuse to open accounts despite new cryptocurrency regulations? How are regulatory agencies responding to these concerns?

- Commonwealth Bank of Australia suspends some cryptocurrency payments to ensure investor asset security

- Comparison of Cryptocurrency Policies between Hong Kong and Singapore

- Hong Kong Monetary Authority and Central Bank of the UAE Strengthen Cooperation on Virtual Asset Regulation and Development