Password Punk and Super Sovereignty: written on the eve of the 134 stable currency project

This article Source: NPC Source Plan (ID: gh_8f53b5712d81)

Author: Xiaohan, oranges, Leo, xy, Blake, Ryan

The birth of the encryption world stems from the geeks' pursuit of utopian vision. They hope to use a decentralized and trustworthy way to build an open society that does not have to rely on the government, enterprises, organizations or any third parties. But with the development of the encryption world, the stable currency, something that does not conform to the cryptocurrency fundamentalism, occupied most of the eyes and resources in 2019. So we began to look at the stable currency and think about its birth, status quo and future.

At this time, NPC noticed the "An overview of the current state of stablecoins" report released by BLOCKDATA. After obtaining the official authorization, in order to ensure the professionalism of the text as much as possible, we have combined Meter. Io's CEO Zhu Xiaohan, Qitao Capital's orange, Leyue Technology's Leo, LBank's xy, Capital's Blake and NPC's Ryan, expanded and deepened with BLOCKDATA's report as an entry point, now integrating the results Article, share with you. The full text is as follows:

- Interpretation of the US Economic Research Institute "Who should issue CBDC" report: ignoring the consequences of wholesale digital legal currency

- "White gloves in the dollar", Libra will meet with the central bank's digital currency

- Quote analysis: the battle against the digital frontier, the Fed is also ready to play coins

- Why do you have a stable currency?

- The status quo and case analysis of stable currency

- What is the future of stable coins under known limitations?

"What is the stable currency?"

For stable currency, it is difficult to find an authoritative and convincing definition. We try to explain it in a more understandable way from the literal point of view: the first nature of the stable currency is used to act as currency. Quoting Marx's classic definition, money is a special commodity that acts as a general equivalent. Second is stability, the so-called "stability", the industry is more considered to be relatively stable against the high volatility of Bitcoin, that is to say to maintain a relatively stable purchasing power for other commodities. In modern times, the French currency represented by the US dollar and the Renminbi serves as a special commodity that satisfies the requirement of “general equivalents”, so most of the stable currency choices are linked to the main legal currency.

But this is only the concept of a stable coin in the narrow sense. The scope of the stable currency goes far beyond this. We believe that no matter what method is used, as long as it has met:

1. Act as a medium of trading for the purchase of goods;

2. Stable value (relatively stable purchasing power, etc.);

These two qualities (or potential), we can say: This is a stable currency, not necessarily constrained by the stability of the French currency or the legal currency symbol (such as 1 US dollar). In the depths of "stability," we want to explore a system of currency issuance and recycling behind the stable currency, including monetary policy and free flow of capital. This is the thinking of stable currency.

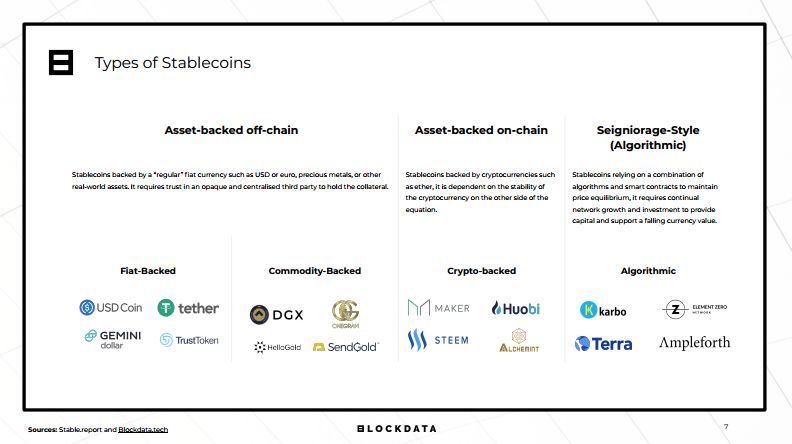

"Types of Stabilizing Coins"

BLOCKDATA's report uses the classic three-point method: under-chain asset collateral, chain-based asset-backed, and unsecured algorithmic. This classification method is widely used in the industry and will not be described here.

Source: BLOCKDATA "An overview of the current state of stablecoins" report

According to the definition of stable currency given above, the mainstream stable currency on the market is the concept of stable currency in the narrow sense, that is, the usage currency, mainly the US dollar as the valuation scale to measure the stability of the stable currency, obviously the current encryption world. Instead of successfully establishing his own currency scale, he has followed the real-world system.

"Why is there a stable coin heat?"

2019 is considered to be the first year of stable currency, why is there such a wave of outbreaks, we believe that the main reasons are as follows:

1. The cryptocurrency transaction lacks a good access channel.

In most countries in the world, including China, one of the most active countries in cryptocurrency transactions, China has cut off the direct exchange of domestic currency and cryptocurrency. At the same time, the cryptocurrency market has experienced a sharp rise, so the stable currency has become a giant. Access to funds.

Second, the cryptocurrency natural cross-border settlement advantage claims unified measurement and balance

The emergence of stable currencies (more on the dollar in the chain) is conducive to global trading and value measurement. The original legal currency and financial system are not conducive to capital flows and transactions in global markets.

Third, the blockchain, as a new value network, began to intervene in the value system of traditional finance.

In the traditional financial architecture, the French currency operates in traditional financial infrastructure such as the banking system, and the blockchain is an emerging global network that can carry value. In the process of continuous development of the blockchain industry, it is necessary to introduce a large amount of real value, and the legal currency is the best value agent at this stage (of course, other assets such as gold can also be introduced, but it is far less effective than the legal currency, so we can Seeing most of the stable coins anchoring gold did not succeed). The outbreak of stable currency is an advanced part of the blockchain paradigm than the existing financial infrastructure, which means that a large part of the stable currency moves the original French currency value from the traditional financial network to the blockchain network. The blockchain paradigm represented by Ethereum is flatter, more open, and more resistant to censorship, which is conducive to value transfer and also generates less transaction friction.

"The status quo of stable currency"

The core content of the BLOCKDATA report is the analysis of the status quo of the stable currency. The report surveyed 226 stable currency projects, of which 66 were online, 134 were under development, and 26 projects were closed (Ps: text narrative is 26 But only 25 are shown on the graph).

Source: BLOCKDATA "An overview of the current state of stablecoins" report

Of the 226 projects, 65% are based on under-chain asset collateral (for legal or commodity collateral, commodities are mainly gold).

Source: BLOCKDATA "An overview of the current state of stablecoins" report

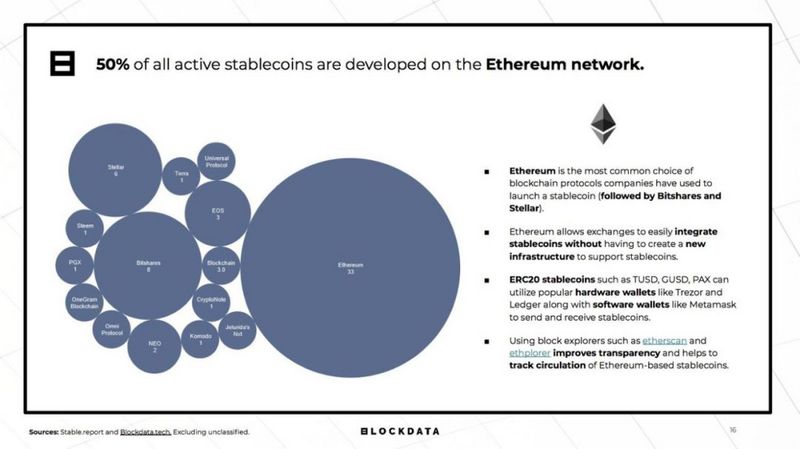

Of the 66 projects that have been launched, 50% are on the Ethereum blockchain, followed by BitShare (8) and then Stellar (6).

Source: BLOCKDATA "An overview of the current state of stablecoins" report

The reason why Ethereum can occupy half of the stable currency projects on the line is mainly because the infrastructure of Ethereum is perfect, the stable currency can be issued in the easiest way, and the hardware and software wallet is obtained by Ethereum. The support can directly store the ERC20 standard stable currency (such as TUSD, GUSD, PAX, ERC 20 USDT), and the network agglomeration effect also makes the stable currency project on Ethereum more active than other blockchains.

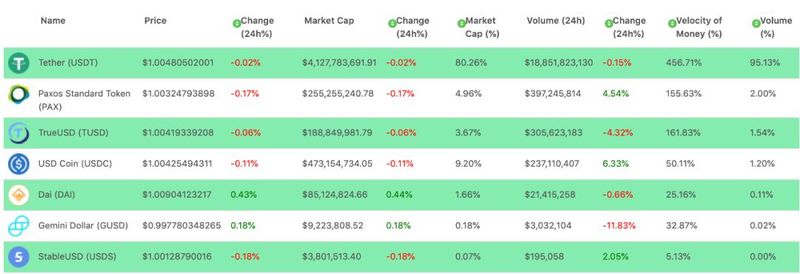

Among all current stable currency projects, Tether has the most obvious head effect, and the total market capitalization ranks fourth among cryptocurrency items. According to the data of Stablecoinswar, in the stable currency project of website statistics, the market value of UDST reached 80.26%, the currency circulation speed was as high as 45.71%, the transaction volume accounted for 95.13%, and the far-net supermarket value was the second USDC. Most of the stable currencies are mainly circulated on the exchange. Although there is a phenomenon of exchanges, we can intuitively feel that the acceptance of USDT is far more than other stable currency projects.

Source: https://www.stablecoinswar.com/ | Interception time: 2019/10/16

In addition, in 2017, 134 stable currency-related projects have been released but not yet online. We believe that 2019 and 2020 will be two years of large-scale stable currency projects. The competition between stable currencies has become a hot trend, and the requirements for the project's operating system, management methods, reward mechanism, overall design and other factors will also be improved. Therefore, we have selected several hot stable coins projects on the market for analysis. I hope to draw some conclusions and inspiration from it.

-1- Under-chain asset-backed stable currency – US dollar mortgage (in USDT as an example)

The USDT is a Tether USD (hereinafter referred to as USDT) based on the stable value currency US dollar introduced by Tether, 1 USDT = 1 USD. At the beginning of its establishment, Tether claimed to strictly abide by the 1:1 reserve guarantee, that is, for every USDT issued, its bank account will have a one-dollar guarantee.

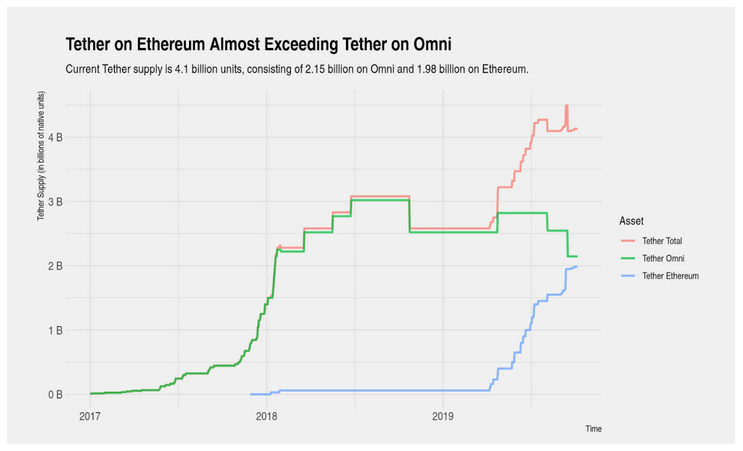

The USDT was launched in 2015 and was originally released on Bitcoin's Omni Layer, hence the name Omni USDT. In 2018, Tether issued the ERC-20 USDT on the Ethereum, and then released the corresponding version of the USDT on Tron and EOS. According to the data of tether.to, the supply of Omni network is 2.145 billion in the supply of USDT, the supply of Ethereum network is 2.024 billion, and the number of USDT issued in other blockchains is very small. Observing the chain transaction volume of USDT in the past seven days, 11,522 transfers were made in the wave field chain, 570,298 transfers were made on the Ethereum chain, and 181,181 transactions were transferred on the Omni chain. It can be seen that most of the USDT transactions are located in Ethereum.

source:

https://etherscan.io/topstat#OverviewDay7 | Time: 2019/10/16

Https://tronscan.org/#/ | Time: 2019/10/16

Https://usdt.tokenview.com/ | Time: 2019/10/16

Https://wallet.tether.to/transparency | Time: 2019/10/16

Source: https://coinmetrics.substack.com/ | Interception time: 2019/10/09

However, the stable currency of the asset under the chain will have both the chain part and the lower part of the chain. The part of the chain is mainly because the issuer does not have enough ability to pay, which will create a crisis of trust. Tether suffered a crisis of confidence in October 2018 and April 2019, causing the USDT price to drop to 0.85 in a short time. In April 2019, the New York Attorney General's Office (NYAG) said that the cryptocurrency exchange Bitfinex had misappropriated Tether 850 million. The US dollar's reserve funds to fill the frozen funding gap began the tug-of-war between NYAG and Tether and Bitfinex parent company iFinex. Recently, New York judges rejected NYAG's request for Bitfinex and Tether to collect documents covering $850 million in lost funds and $900 million in credit lines, but NYAG can continue to investigate Bitfinex and Tether, which means that the tug-of-war may have to wait until 2020. Years can only be eye-catching.

As for the chain part, Omni is a bitcoin-based upper layer protocol. With the protection of the Bitcoin blockchain, Omni USDT has sufficient security, but is it safe in Ethereum's ERC 20 USDT and TRC USDT, EOS USDT? The security of the stable currency and the prevention of double-flower attacks are still in doubt.

-1.1- USDT Impact on Ethereum

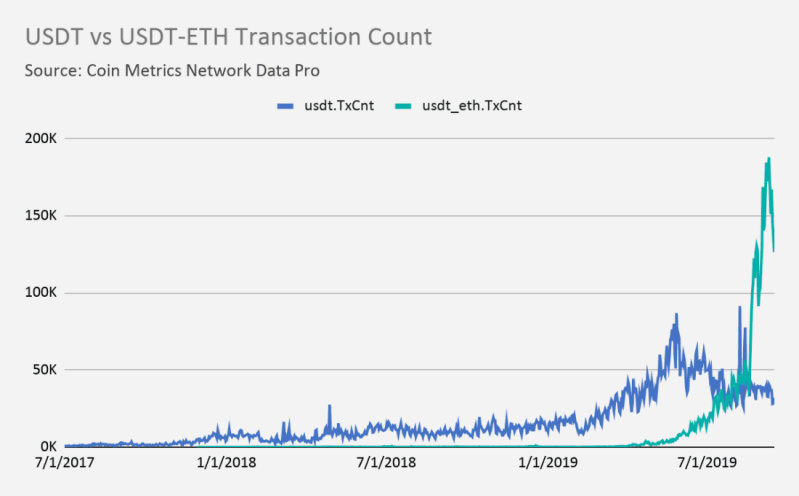

Although the USDT was only released in Ethereum in 2018, its performance was quite impressive. According to Coin Metrics Network Data Pro, the volume of ERC 20 USDT's chain transactions has risen rapidly in recent months, surpassing and replacing the original Omni USDT trading volume. The number of transactions of USDT on the Ethereum in the past seven days was 570,298, accounting for 12.12% of the total transaction volume of Ethereum in the past seven days (2019/10/9 – 2019/10/16), and the ERC 20 USDT accounted for 25% of the highest. (2019/09/08).

Source: Coin Metrics Network Data Pro | Interception time: 2019/09

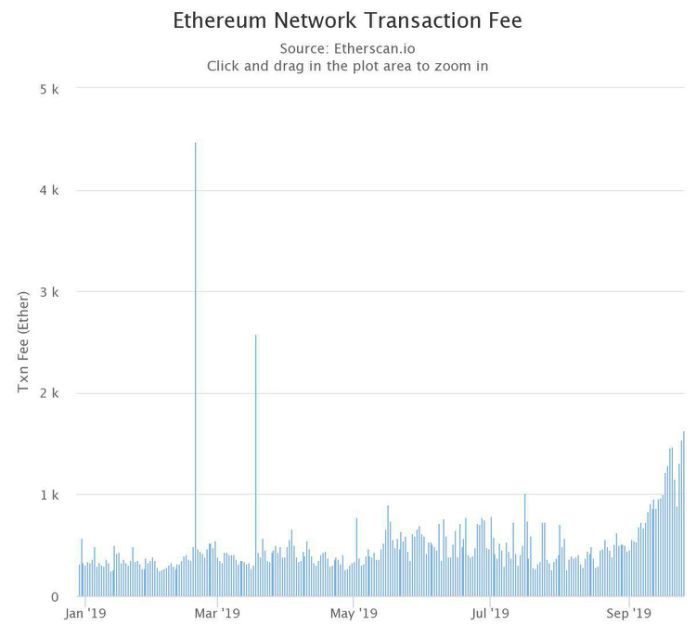

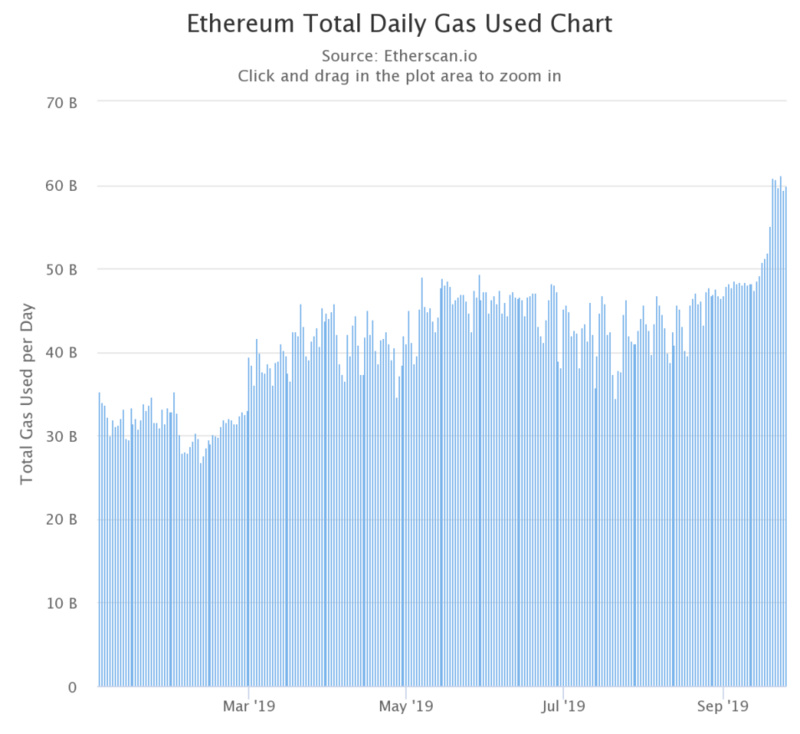

With the active trading of the ERC 20 USDT chain, the daily usage and handling fees of Gas are soaring.

Source: Etherscan.io | Interception time: 2019/09

Source: Etherscan.io | Interception time: 2019/09

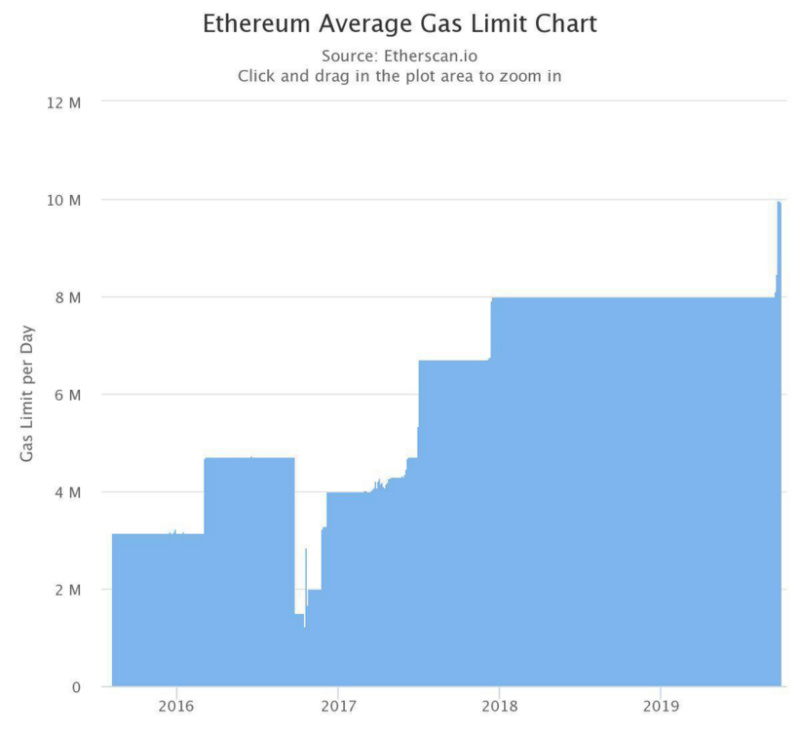

In response to the increasing congestion of the network, the Ethereum miners and mines voted on the Gas Limit of the Ethereum block, raising the upper limit of the Gas Limit for each block.

Source: Etherscan.io | Interception time: 2019/09

The current cryptocurrency market has obvious speculative nature. The purpose of investors buying USDT is not to store value, but to use it as an exchange intermediary, so users will pursue lower transaction fees and faster transaction speeds. The future does not rule out that USDT will migrate more circulation to the EOS or Tron blockchain. At present, the USDT premium to the US dollar is obvious. The main reason is that cryptocurrency is a better cross-border payment method, which makes the USDT have a wider demand. The USDT also meets the market demand through continuous issuance.

-2- Under-chain asset-backed stable currency – gold mortgage (take Paxos Gold and Digix Gold as examples)

Compared to the stable currency that anchors the US dollar or other national currency, the stable currency project that anchors gold is less. Paxos, following PAX, was approved by the New York Financial Services Department (NYDFS) to launch the PAX Gold, which is anchored with gold. Paxos has three compliance stable currency projects, Paxos Standard (PAX), PAX Gold (PAXG), and Binance USD (BUSD).

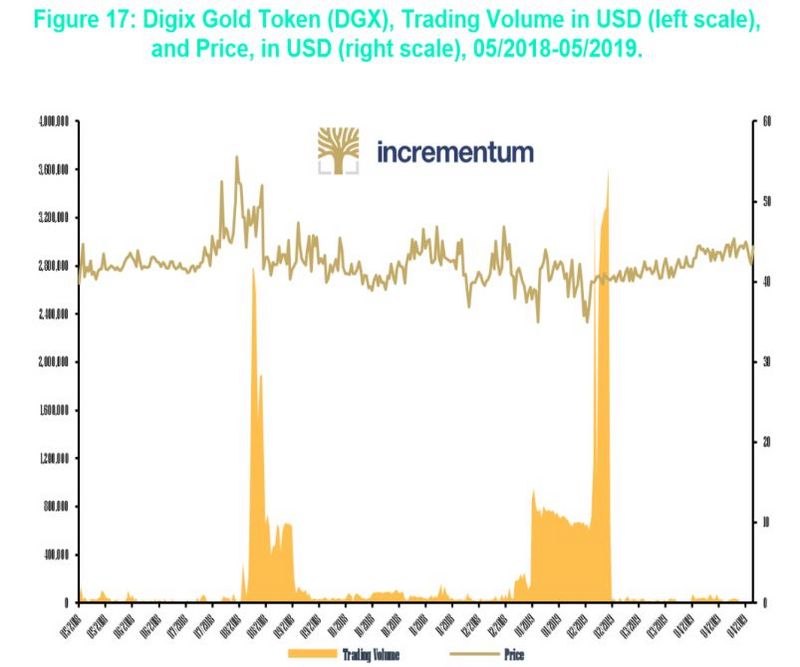

Digix Gold is another stable currency project based on the Ethereum blockchain, anchoring gold. Digix has two types of tokens: DGD and DGX. DGD is the securities token of DigixDAO, its value depends on the stability of the system, while DGX is used to represent the commodity token of gold physical storage. The supply of DGX is directly proportional to the gold reserve in the physical warehouse. However, by analyzing the market performance of Digix Gold tokens, the price does not remain stable with gold, and the float is large, usually trading at a price lower than gold.

Source: Coinmarketcap, Gold.org, Incrementum AG. | Interception time: 2019/05

However, it is worth mentioning that if this mechanism can be established, it means re-creating the "golden summary standard" in the world of cryptocurrency, which will enable the future encryption economy to circumvent the existing legal currency system due to over-issue, The global economic crisis caused by the bubble has a reference role. In other words, the gold-backed stable currency can be anchored to all other cryptocurrencies, just as the dollar anchored gold under the Bretton Woods system, and other sovereign currencies anchored the dollar.

At present, the traditional economy pursues a "no anchor" legal currency system. Unless the economy collapses completely, the chances of overthrowing reconstruction are minimal. But in the new world of encryption, it is possible to build a more stable primary economic system on the flat. In addition, in the special period, when the centralized credit endorsement becomes unreliable, the value system still needs hard currency such as gold as the value storage and measurement scale, and the cryptocurrency of the benchmark gold can play a high liquidity through the gold standard. The use of digital gold. Tokens linked to precious metals such as gold can not only divide the difficult-to-divide precious metals into smaller denominations, but also facilitate portability and transportation, and greatly increase the speed and efficiency of asset transfer.

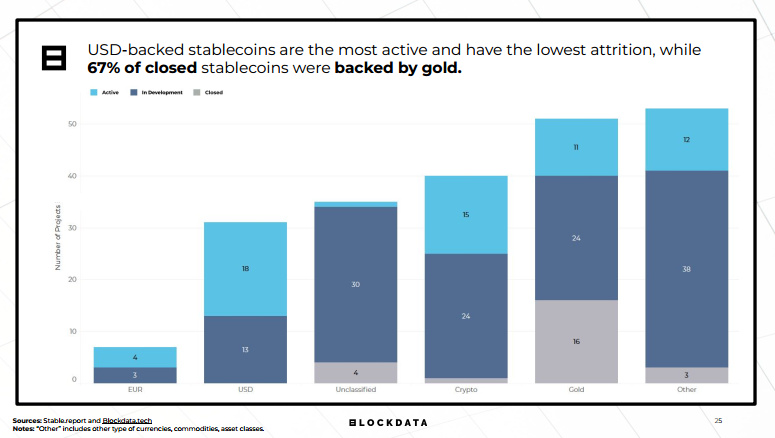

But it's worth noting that in the BLOCKDATA research project, the US dollar-backed stable currency is the most active and least worn, while 67% of the dead stable currency projects are supported by gold. Perhaps the current stable currency project anchoring gold is still in urgent need of finding a breakthrough.

Source: BLOCKDATA "An overview of the current state of stablecoins" report

-3- Chain-backed asset-backed stable currency – between mortgage and algorithm (see Reserve as an example)

Reserve's design approach is between mortgage and algorithmic stable coins, aiming to create a stable, distributed stable currency and digital payment system. The system mainly has three tokens to interact with, namely Reserve Secure Currency (RSV), Reserve Rights Token (RSR), and collateral tokens.

RSV was initially a stable dollar anchored to the US dollar and maintained a 1:1 relationship with the US dollar; RSR is an expedient within the Reserve ecosystem that can participate in governance proposal voting to maintain RSV price stability; collateral tokens are for The package of tokens held in smart contracts that guarantee the value of RSV acts as a collateral, primarily for all types of assets. In addition, the Reserve White Paper does not mention Reserve Dollar (RSD), but the project party said that in the early stage of Reserve, the project is in the centralized stage, RSD will be issued instead of RSV as the stable currency.

The idea of Reserve is divided into three steps. The first step is to establish a dollar-backed centralized stabilization currency. The second step is to become a decentralized stable currency that anchors a basket of assets (similar to SDR), but the value is still stable relative to the US dollar. The third step is its Stabilizing coins are no longer pegged to the US dollar, no longer considering the value of the dollar, but still maintain a stable independent phase. Currently, Reserve only progresses to the first step, and the second step is expected to begin at 2020-2021.

Reserve conducted IEO on Firecoin on May 22 this year. The total amount of RSR tokens was 100 billion. In the initial period, only 3% of the total amount was released, and 97% of the tokens were in the hands of the project parties and other investors. In the short-term, the private placement of the token will unlock most of the money within 3 months, of which the foundation has 58.6% of the token, the token is stored in the hot wallet, which can be decided by the team and is ready to be sold. may. In the long run, seed round tokens, partner tokens, teams and consultant tokens will be unlocked after the main online line. It is expected that the main network will be officially launched in 2020.

From the Route map of Reserve, it has completed the initial centralization in 2019, 1:1 is guaranteed by the US dollar, and the trust company holds the technical implementation of RSD. There is no data on the pledge assets and stable currency issued on the Reserve network. It will release RSV and start the main network in Q3 and 2020 in 2019. Considering its development difficulty, balance and design details, the current progress is slower than other stable currency competing products.

-4- Chain-backed asset-backed stable currency – cryptocurrency mortgage (take Dai as MakerDAO as an example)

Among the stable currency projects collateralized by chain-encrypted assets, the most well-known item currently is Dai of MakerDAO. Dai is a 1:1 stable currency issued by MakerDAO and has a market capitalization of 57 in CoinmarketCap. MakerDAO users can obtain a stable currency Dai at a 150% pledge rate by mortgage ETH.

Dai is the most active part of the DeFi ecosystem, with a variety of derivatives based on Dai:

1. xDai, running on the PoA (authoritative proof) sidechain, allows seamless transfer of xDai in a short time. Today xDai runs on the DPoS blockchain using the PoSDAO consensus algorithm.

2. iDai, the first time the loan pool is tokenized. It has two salient features: compound interest calculations per second; if the underlying asset pool suffers losses, its exchange rate will fall. It is therefore ideal for building risk management derivatives on iDai.

3. cDai, real-time Dai savings account. The compound's protocol is upgraded to v2, and the asset is stored in the Compound to obtain cToken, which represents the amount of funds supplied by the user and the accumulated interest.

4. gDai, using Fulcrum to lend assets, while using GasStateNetwork, Kyber, Uniswap, allows users to pay the Gas fee with Dai, so there is no need to leave ETH as a transfer fee in the wallet. gDai is built by CryptoManiacsZone in ETHBoston Hackathon.

5. zkDai, using ZKSNARKs to protect the privacy of the transaction.

In addition, there are derivatives of idleDai, LSDai, pDai, aDai, etc. Dai. Most of them are still in the development stage.

Dai-based derivatives reflect the decoupling of the DeFi ecosystem, reflecting the staged victory of the asset-backed stable currency on the chain. The MakerDAO Foundation is currently actively promoting the use of Dai in third world countries. Dai has a Pundi X payment platform that will be deployed in Brazil, Argentina, Colombia and Venezuela.

-5- Unsecured PoW Stabilizing Coin on Chain – (Meter First)

Strictly speaking, Meter does not belong to any of the above categories, and its concept is somewhat advanced. The idea is to establish a pure decentralized stable currency. The Meter is unsecured, does not anchor the US dollar, does not pre-dig, and is issued through PoW mining, more like the native currency of the blockchain world.

First, through research on the cryptocurrency economic game model and consensus algorithm, Meter realized that the current mainstream cryptocurrency confuses the economic consensus of currency issuance with the prevention of double-banking, and the two consensuses are in a mature market. It will be more effective to complete separately.

Secondly, starting from the "three-dimensional paradox" of stabilizing the currency, that is, "independent monetary policy, maintaining a fixed exchange rate with other currencies, and the free flow of capital, these three cannot exist at the same time, at most only meet the two goals" principle. Meter proposes that the design of the stable currency issuance mode can also be bound without the legal currency, but by the way of the algorithm, it is strongly bound to the value of the long-term stability of purchasing power in the real world, so that a completely decentralized virtual commodity can be created. As a general equivalent in the world of encryption.

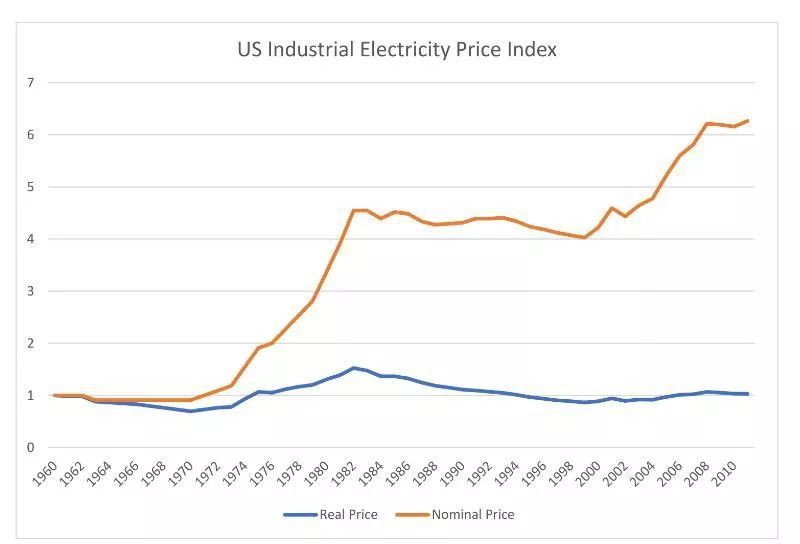

Meter found that the price index of industrial electricity in the history of the United States, from the 1960s to the 2010s, was calculated based on actual purchasing power (removing inflation), which was almost stable at a level and more stable than the French currency.

Source: Meter White Paper | Intercept Time: 2019.10

Meter adopts the economic model of double Token, one is not to mortgage the currency or other assets, but refers to the distribution mechanism of Bitcoin, the stable currency MTR generated by mining; the other is the equity token MTRG of Meter network, used for governance Meter's decentralized community and stable construction of global trading and payment stability currency MTR. Instead of acting as a collateral for issuing stable currencies, MTRG uses its cash flow and scarce cold start to stabilize the demand for coins.

Unlike Bitcoin's fixed circulation, the circulation of Meter's stable currency changes with the change of PoW's computing power, but at the consensus level, the mining cost of each currency is guaranteed to be consistent. The Meter anchors the MTR's mining costs to the electricity consumption of an MTR, fixing its production cost to 1 Meter = 10kWh, allowing miners to agree on the value of the currency in a competitive manner. If the price of MTR rises, the power will increase, which will lead to an increase in the supply of MTR. The increase in supply will lead to a decrease in the price of MTR. The miners will reduce their computational power because of the decrease in income, and the MTR will remain relatively stable through the profit-seeking behavior of miners. In addition, Meter separates the miners who produce tokens from the bookkeepers of the transaction, and the accounting consensus is completed with PoS, which ensures the system is safe and efficient.

Meter's design chose the idea of completely decentralizing the super-sovereign commodity currency, building consensus with mining costs, no need for predictive machines, no physical assets or other crypto assets for collateral, and power supply to ensure that the money supply is flexible enough and The stability of value. Since the PoW process permanently transfers the value of the real world to the chain, Meter proposes that using this native encryption asset stable currency as the base currency to construct a decentralized financial system can be safer and has no physical constraints. Although Meter is facing a lack of liquidity and needs to be patient to witness the liquidity boosted by its rising money supply, this decentralization practice deserves our attention on the eve of the massive outbreak of stable currency.

"The Limitation of Stabilizing Coins"

The status quo of stable currency discusses the innovations of different types of stable coins in order to achieve price stability or solve existing problems. However, due to various factors, there are no stable coins in the market that can simultaneously satisfy safety and practicability. .

1. The current situation of increasing supervision is related to the compliance issue of stable currency.

As the size and influence of the stable currency has grown, governments and even international organizations have begun to make frequent regulatory statements. The Anti-Money Laundering Financial Action Task Force issued a proposal for cryptocurrency regulation, proposing a review of anti-money laundering/anti-terrorist financing in June 2020. The IMF's new article "Digital Currency: The Rise of Stabilizing Coins" mentions that stable currency will bring more illegal activities. In this context, countries such as Canada, the United Kingdom, and Japan have increased their censorship of their cryptocurrency business.

Currently, the main application of stable currency is to provide transaction pricing. In these scenarios, the richness of liquidity and trading pairs is far more important than the existence of sufficient collateral behind the stable currency. USDT is typical. But it is foreseeable that the cake of unlicensed stable currency headed by USDT is increasingly touching the nerves of regulation. The growing situation of iFinex and NYAG reflects the determination to supervise a large-scale entry and compliance becomes a stable currency. One of the appeals.

However, the cost and difficulty of compliance are also increasing. From Facebook's Libra, it can be seen that lobbying regulators are costly, and regulators are not happy to see stable currency formation in the currency independent of the existing banking system. The shadow banking system. In addition, the emergence of a strong stable currency may also trigger a ban on weak currency countries. The Argentine central bank ordered a restriction on the purchase of US dollars in September this year. No company can accumulate dollars, so the current mainstream US dollar-backed stable currency is blocked in Argentina. It is also reasonable.

Second, the balance between "centralization" and "decentralization" is hard to find, and anti-censorship construction is worth looking forward to.

Although the vision of the blockchain is to establish a network that is decentralized, free to enter and exit, and no need to trust third parties, in order to pursue this goal, the performance of the product will be sacrificed to a large extent, resulting in most of the promotion pursuit. The “centralized” project faces the dilemma of landing into a box. For the availability of products, the pursuit of higher TPS or other services is beyond reproach, but it wants to balance the relationship between “centralization” and “decentralization”, and ultimately it is no different from licensed networks. Far less than the Internet's efficient "freak".

As a "third-time application of the blockchain", the stable currency has become a necessity to compromise with "centralization." Whether it is in the form of legal currency, physical assets or crypto assets, it is impossible to escape the centralization spiral. For example, in the case of a stable currency that is collateralized by a legal currency, such a stable currency is equivalent to a centralized entity, which is equivalent to the user handing the trust to the issuer when using it. In order to avoid the opaque audits encountered by USDT, the doubts about actual assets, and the market share of USDT, the current issuer's improvement direction is to rely on third-party audit companies and obtain compliance licenses (such as BitLicense) to win users. trust.

In addition, there will be a problem with the chain transfer, and the user will transfer the physical value to the stable issuer, but it does not mean that the value is completely transferred to the chain. In the process, the user transfers the ownership of the physical assets and obtains a credit certificate that is in exchange for the physical world currency. Aside from its completion in the monetary function, the most important guarantee promised by the “decentralization” of the blockchain is the security of the user's assets, and the above process clearly deviates from this purpose.

In addition, the cryptocurrency-type stable currency requires a oracle to provide data. The core problem of the prophecy machine is twofold: First, the data source is still generated by the centralized transaction. The API data provided by these exchanges can only guarantee the accuracy as much as possible, but the user needs to bear the risk; the second is the asset that the predictor can pay. It cannot match the assets carried. If the data of the predictor is wrong, it may cause the collapse of the entire financial system.

The revolutionary nature of cryptocurrency lies in empowering a single node, protecting the node—the individual's assets are protected from infringement. If the perpetrator is the decision-making center, the cryptocurrency is inherently anti-censorship that other things do not have. That is to protect assets from the important protection of these perpetrators. However, with the development of the first point of compliance mentioned in the limitations, the construction of stable coins in the anti-censorship has become a more worthwhile direction.

3. The price of stable currency collateralized by commodities and cryptocurrency is subject to volatility, and there is a hidden market collapse risk.

For example, in the case of stable currencies collateralized by cryptocurrencies, cryptographic assets such as BTC and ETH are not high-quality collateral assets due to their price fluctuations. There is currently no widely recognized valuation system. In the case of large price fluctuations, stable currency projects that use crypto assets as collateral are vulnerable to confidence risks. In order to ensure full collateral for liquidity on the chain, “over-collateralization” was introduced as a risk hedging program.

For example, if the mortgage value is $200 for ETH, but only 100 stable dollar coins are generated, then the stable currency has twice the collateral. When the ETH price drops by 25%, the mortgage rate is 1:1.5, and the stable currency can still maintain the price of $1. However, if there is a large depreciation of the cryptocurrency, there is a risk that the stable currency will be liquidated. The ETH price plummeted on September 24, 2019, resulting in a total of $3.8 million in loan settlements in DeFi as a collateralized asset. In order to deal with this situation is to pledge as much as possible, and this will also make capital use rate low. In theory, multi-asset collateral can be relatively dispersed risk, but at present, crypto assets such as BTC and ETH have higher price correlation and cannot effectively spread risk.

Fourth, the collateral on the chain or under the chain, it is difficult to avoid systemic risks

The stable currency of the legal currency mortgage is the risk of passing the risk to the bank and the account, and there is a risk of the asset being detained. The stable currency collateralized by the cryptocurrency, such as the Maker user, is converted to Dai by mortgage ETH, then ETH is purchased by Dai, and ETH is acquired again to obtain Dai, which forms a positive feedback function. However, if ETH appears to be depreciated significantly and is lower than the liquidation value, the mortgaged ETH will be forced to close the position and used to repurchase Dai. If the collateral is too large in the circulation of the corresponding collateral, there will be insufficient buying at the auction of the collateral, which will cause systemic risks.

So MakerDao set a $100 million cap for DAI for ETH as a mortgage. Such stable coins also have problems on the demand side. At the beginning of this year, Dai's price was lower than US$1 for a long time. MakerDAO reduced Dai's supply by continuously increasing the stable rate to bring Dai's price back to US$1. It can be seen that the whole stable system will be very complicated to operate.

Some people have imagined whether it is possible to issue an unsecured, stable price stable currency? This view was born out of Hayek’s private currency theory in the 1970s. Hayek believes that allowing private money to be issued and free to compete, this competitive process will find the best currency. The unsecured algorithm-based stable currency, that is, the stable currency that controls the coinage right itself, was born in this context.

Haaseb Qureshi, managing partner of Dragonfly Capital, explained the unsecured algorithmic stable currency in his name "Stabilized Coin: Designing a Stable Encrypted Currency". The operating mechanism is to use smart contracts to simulate the central bank's issue price. For the $1 currency, the price is stabilized at $1 by controlling the circulation of the currency. If the price of the current currency is 2 US dollars, it means that the price is too high, the circulation is too low, you can mint the new currency through the smart contract, and then go to the market to auction to increase the supply, so that the price will fall back to 1 US dollar, which can also Smart contracts bring extra profits, the so-called coinage tax. The coinage tax can be understood as the proceeds of the issuing currency. A $100 bill can cost only $1 to print, but it can buy $100, of which $99 is a coinage tax and an important source of government finances. If the current stable currency price is $0.50, you need to buy a stable currency to reduce the supply on the market. If the existing coinage tax is not enough to support the purchase of stable currency, you can promise to share the shares by issuing shares. The future coinage tax. As a result, the supply fell and the currency price stabilized at $1.

However, it is worth mentioning that the existence of the coinage tax itself is an extension of the logic of the legal currency, and the collection of the coinage tax of the legal currency system is guaranteed by the state machine through the army and power. Imagine that in one system, if some users can get the stable currency with a coinage tax close to zero, and another user will need to buy the stable currency for $1, in a decentralized environment without state enforcement. It is difficult to reach a systematic consensus on the price of the currency.

It is for this reason that the unsecured algorithmic stable currency is basically not seen on the market. The representative of such projects, Basis, died in the form of a refund to investors at the end of 2018. Fundamentally, the “collateral” of unsecured algorithmic stable currency is the future growth of the system. If the system cannot continue to grow under extreme circumstances, it cannot maintain its linkage mechanism. If the selling pressure lasts too long, it will trigger a death spiral.

"The new battlefield of stable currency"

BLOCKDATA's Stabilized Coin Report states that 134 projects have been announced since 2017 but have not yet been officially launched. 2019-2020 may be the year in which the stable currency debuts the most. The large-scale launch of stable coins means that competition has intensified and stifling has become hot.

The currency-backed stable currency will still occupy the mainstream position in the next 2-3 years, and the degree of regulatory intervention will increase significantly.

If we look at the majority of the existing stable currency that is collateralized by French currency, the logic behind it is very similar to the one created under the international monetary system. The current international monetary system is developed on the basis of the gold standard. During the First World War, gold was concentrated in the war-torn countries for the purchase of arms, and the free output and bank notes were stopped, resulting in the collapse of the gold standard. After World War II, the Bretton Woods system was established, and the US government re-linked the US dollar to gold. However, in August 1971, as the United States unilaterally announced the decoupling of the US dollar from gold, the Bretton Woods system existed in name only. The complete end of the gold standard marks the beginning of the free floating phase of the French currency.

The author of The Brief History of the Future, Yuval Hulari, once said: “Money is the most common and effective system of mutual trust in history. Even those who do not believe in the same god or disobey the same king are willing to use the same The money has been well understood. After all, "gold and silver are not money, but the currency is naturally gold and silver", but after the abolition of the gold standard, we still believe that the French currency can buy what we need? That is because the legal currency is the currency that the state gives to its compulsory circulation in legal form. It is endorsed by the state credit, and its value comes from the stability of the government and the relationship between supply and demand. Behind the legal currency is “full trust and credit” to the government.

Therefore, the clear advantage of the French currency-backed stable currency compared to other types of stable currency is the use of centralized hosting to bring the greatest price stability. In the next 2-3 years, the stable currency pledged in French currency will still be the mainstream. Although the USDT is currently the number one stable currency of this type, it is mainly due to its first-mover advantage. The USDT, which lacks supervision and audit opacity, walks in the gray area and plays the role of “the thief”. As the market value of Tether grows, the big cake of stable currency has attracted more and more eateries, such as USDC, PAX, GUSD, etc., which anchor the US dollar. These stable coins are aimed at the shortcomings of USDT. Through regulatory intervention and audit transparency, the stability of the currency to the value of the French currency has been increased, and the market share of USDT has begun to be eroded. In the future, the stable currency of the legal currency mortgage will certainly flourish, but it needs a more reliable issuer, a better audit system and a more mature regulatory framework.

Libra's attempt as a new financial infrastructure heralds a strong global currency in the future.

In addition to the booming of the currency-backed stable currency, Facebook Libra's proposal has brought the encryption world to a subtle fork. Libra says its goal is to issue “a stable currency built on a secure, stable open source blockchain that is backed by tangible assets of reserves and managed by an independent association.” The opening slogan aims to create a simple global The monetary and financial infrastructure benefits billions of people around the world. It is true that once Libra is launched, it can significantly reduce the time and cost of cross-border transactions, including international payments and settlements, as well as foreign exchange, and may also trigger a restructuring of the global financial system. For an introduction to the innovations that Libra brings, refer to NPC's previously published "Libra: A New Financial Infrastructure Attempt" , which is not repeated here.

The birth of Libra is not only an attempt to introduce an innovative financial infrastructure, but the more significant impact it has is to give countries a sense of crisis in sovereign currencies. Libra claims to be a 100% legal currency reserve, but due to the diversity of reserves, Libra's currency value and any legal currency will fluctuate, and may even be a large fluctuation, due to Libra members providing Libra and various currency exchanges, the actual mortgage The amount of positions and targets will be different. When the Libra Committee adjusted the reserve currency and reserve ratio, its essence was to adjust monetary policy. If people generally use tangible assets and trade directly with Libra, Libra is likely to pose a huge threat to sovereign currencies. By then, the Libra Association will become the de facto currency issuer with the currency of issuing currency for 2.7 billion people around the world, which will make it difficult for countries to implement monetary policy, leaving the Fed and even other central banks in a redundant situation. Libra's concept does indicate that there may be a stronger, more global currency in the future.

The failure of traditional financial means, the idea of the beginning of the encryption world is thought-provoking, the design of super-sovereign free competition currency or the ultimate direction of stable currency.

Zeng Youwen pointed out that at the end of the short-term and long-term debt cycles of the world's three major reserve currencies, a large amount of debt maturity expenditures, as well as non-debt expenditures such as pension and medical care, far exceed the income affordability. Within the country, the gap between the rich and the poor has widened, and conflicts between various interest groups have become frequent; friction between countries has increased, and there are indications that the balance of the global economy has been broken. In terms of monetary policy, major central banks kept cutting interest rates. Japan and the European Central Bank have already implemented negative interest rates, but when interest rates are already low enough, they are tantamount to quenching thirst. The Bank of England governor has previously admitted that extremely low interest rates usually coincide with high-risk events such as wars, financial crises and the collapse of the monetary system. The 2008 financial crisis has shaken our confidence in these financial institutions.

On the whole, stable currency as an infrastructure for the encryption world will usher in a large-scale outbreak. Bitcoin's vision is to build decentralized, new electronic money. The imagining of the encrypted world is to free people from the old, centrally-based trust-based financial order, from mandated to permissionless, from trust to trustless. But unfortunately, the current stable currency is at the center.

As we mentioned above, the ideal base currency for the cryptocurrency world is the need to attract everyone to abandon the real world value, permanently transfer the corresponding value to the chain, and thus continue to promote the growth of the encrypted world economy. The idea of competing for money will also lead this trend. But in any case, the basic design of super-sovereign free-competitive currency is still inseparable from the problem of balancing the stable currency "three yuan paradox". The new mechanism is still like a newborn baby, and there is no test, and the future is really expected.

Click to read: Blockdata full version of the stable currency report

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Telegram delays TON launch, investors can recover "about 77%" funds

- Analysis: Why is Asia-Pacific only China's nearly 100% bitcoin transactions using USDT?

- The digital currency of Chinese listed companies (I)

- The three social platforms are blocked by the currency: Why is US regulation so strict?

- Research Report | EU Blockchain Observatory: An Overview of the Legal and Regulatory Framework for Blockchains and Smart Contracts

- OKEx Mine Pool officially launched CRO lock service

- QKL123 market analysis | Fed interest rate cuts expected to strengthen; Britain's hard Brexit is uncertain (1017)