Analysis: Why is Asia-Pacific only China's nearly 100% bitcoin transactions using USDT?

Author: Chainalysis

Compile: Interlink pulse

“In China, almost 100% of bitcoin transactions use USDT.”

It is no secret that password currency is popular in China. China has been leading Bitcoin mining anywhere in the world (and of course the Asia Pacific region). And China has a large number of cryptocurrency exchanges.

- The digital currency of Chinese listed companies (I)

- The three social platforms are blocked by the currency: Why is US regulation so strict?

- Research Report | EU Blockchain Observatory: An Overview of the Legal and Regulatory Framework for Blockchains and Smart Contracts

But the Chinese government has been cracking down on cryptocurrency activities since 2017. This year, the National Development and Reform Commission of China has increased the restrictions on bitcoin mining, which is considered a waste of resources. But these all indicate that the government does not like cryptocurrency. Paradoxically, China still has the world's most active cryptocurrency trading participants, and the largest use of USDT linked to the US dollar, rather than the renminbi.

USDT obtains pricing power for Chinese cryptocurrency transactions

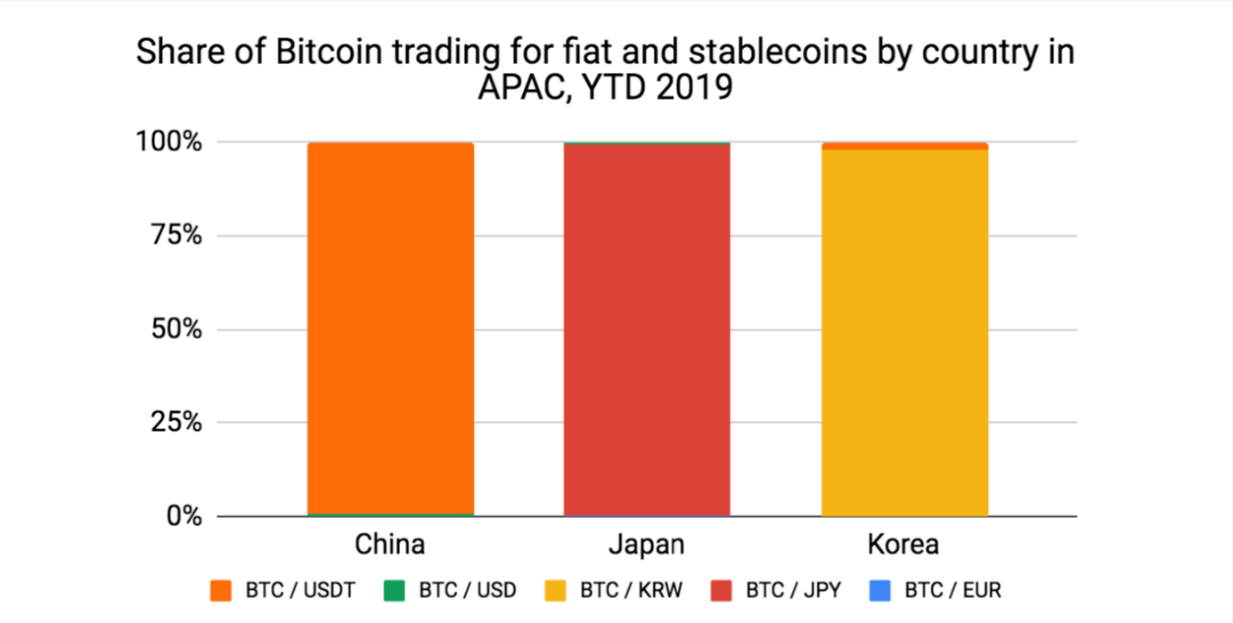

An interesting phenomenon was noted when studying the most common currency trading pairs in the Asia Pacific market. The chart below compares the most common exchange user pairs in China, Japan, and Korea.

Source: Chainalysis and Kaiko

Almost 100% of the bitcoin transactions in the Japanese and Korean markets use the official currency of the country, the Japanese Yen, and the Korean Won. But when we looked at the China Exchange, almost no one used the yuan when trading Bitcoin. And these transactions were previously in mainland China and continue to serve Chinese customers today. Almost 100% of transactions involve converting bitcoin to USDT and vice versa. In other words, for foreign exchange users in China, USDT has replaced the RMB as the legal currency for cross-border transactions.

Why is this happening? This is because at the end of 2017, China officially forbids citizens to exchange renminbi for cryptocurrency.

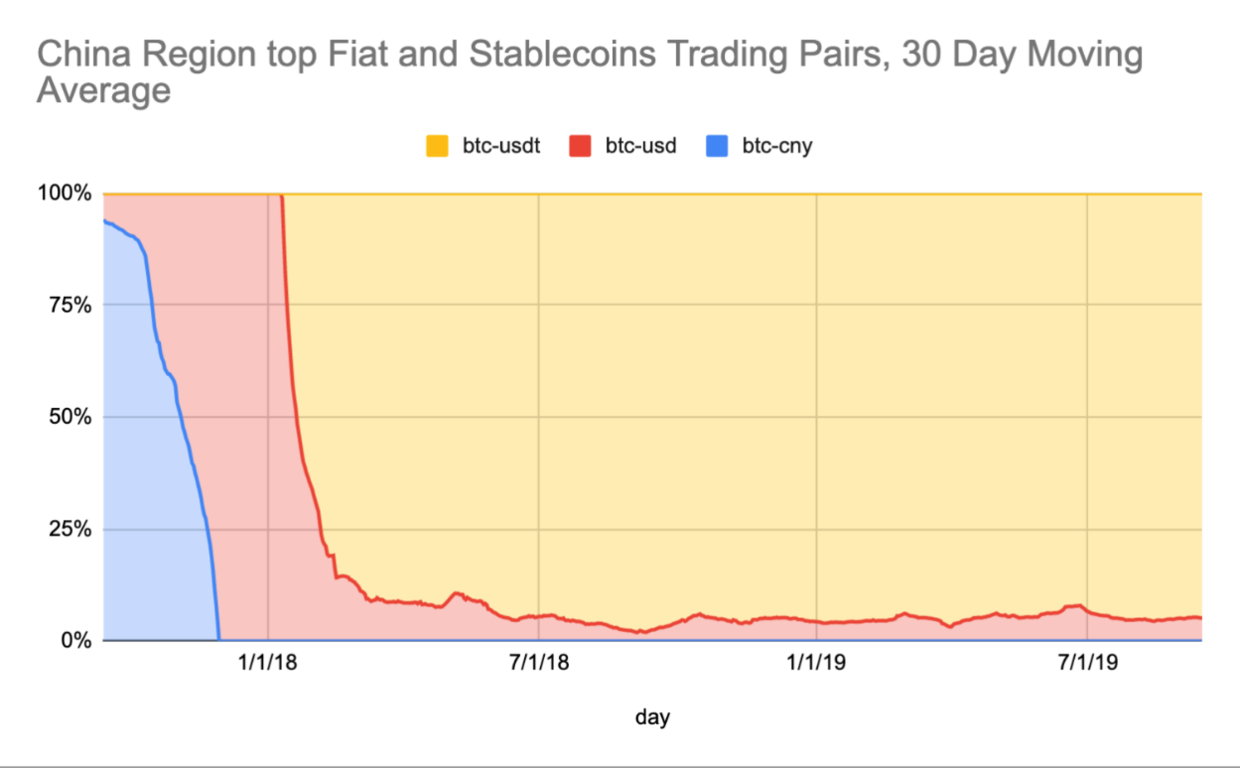

The chart below shows how the trading of the fire coin and OKcoin (the exchange that the Chinese usually use) changes over time:

Source: Kaiko

The data is almost identical to the government's decision. Before the introduction of the trading ban, we saw a very high ratio of transactions between the RMB and Bitcoin, and all transactions in the RMB and Bitcoin fell sharply. In 2018, when global bitcoin transactions rebounded, they did not see the recovery of direct transactions between the RMB and Bitcoin.

For cross-border traders, the USDT as a substitute for legal tender money makes sense. It is relatively stable linked to the US dollar and can be easily exchanged into different types of cryptocurrencies.

Is this the whole story?

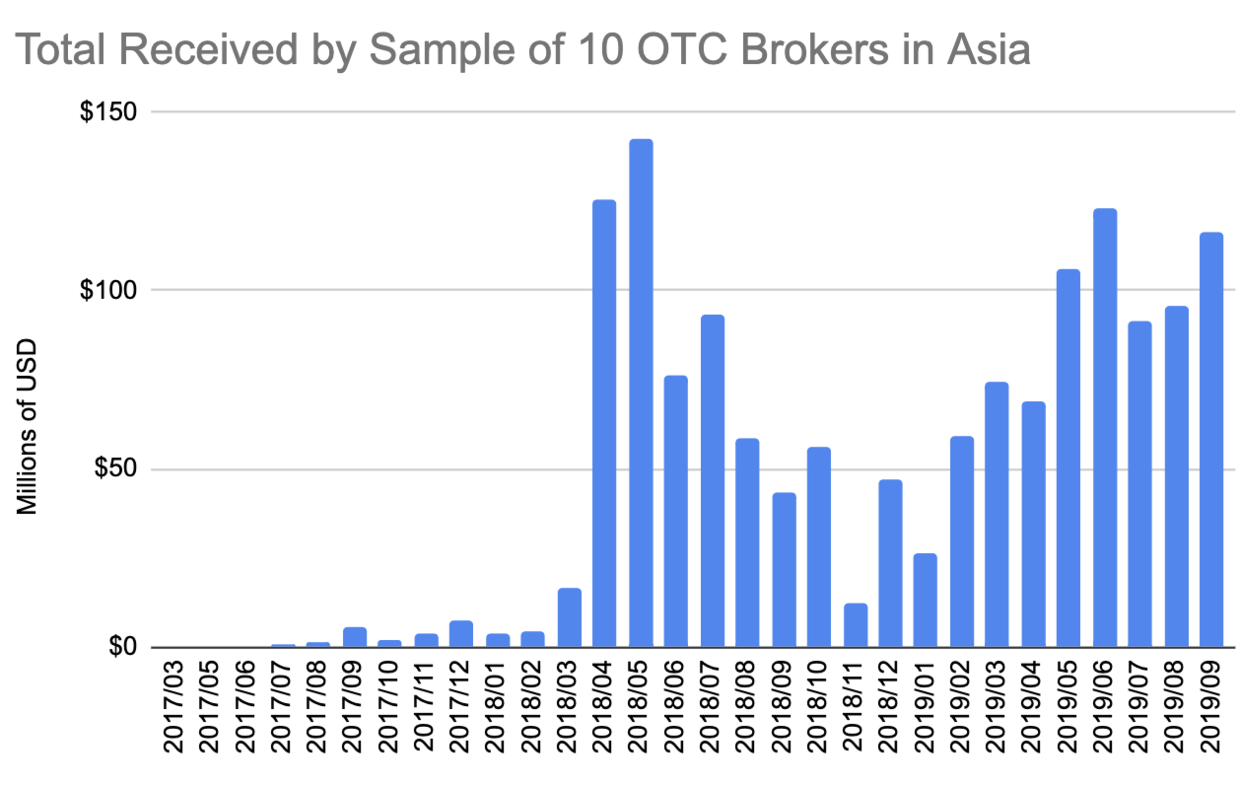

It is worth noting that the above statistics are all exchange transactions, and Chinese traders are likely to use RMB to exchange cryptocurrency elsewhere. Dovey Wan (Editor's Note: Managing Director of the former Danhua Capital) explained this phenomenon, and her article stated that although the direct transaction of the RMB to the special currency has almost fallen to zero since the ban, the over-the-counter transaction ( OTC and peer-to-peer (P2p) exchanges provide a channel for Chinese traders. Exchanges such as Firecoin provide over-the-counter trading services, while other P2P networks are managed on WeChat.

Our statistics show that since the promulgation of the Chinese ban, a large amount of funds have flowed into such services, as shown in the following figure:

Source: Chainalysis

From September 2018 to September 2019, we measured the trading volume of 10 OTC brokers and traded $877 million to $577 million in the past 12 months.

These data, as well as all the anecdotal evidence we have, show that in China, RMB and Bitcoin transactions are far from dying. However, for ordinary exchange users, USDT seems to be the current king.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- OKEx Mine Pool officially launched CRO lock service

- QKL123 market analysis | Fed interest rate cuts expected to strengthen; Britain's hard Brexit is uncertain (1017)

- National team admission blockchain! The only internal measurement of the global infrastructure that controls China’s access rights

- Internet of Things + Blockchain Series: The Challenges of the Internet of Things

- Speed reading | Chain governance and DAO must read articles recommended

- Finance, passwords, communication, science fiction circles gathered, the world blockchain conference • Wuzhen second batch of guests exposed!

- Chinese government's blockchain “shopping list”: 57 purchasing units, 12 provinces and cities, Tsinghua University bought the first order