The digital currency of Chinese listed companies (I)

Author: The number of chain team rating

Source: Number Chain Rating ShulianRatings

Investing in digital currency concept stocks, with a monthly income of 16%, is it going crazy? Still starting the wind?

Straight Flush was launched on September 18, 2019, in the digital currency sector (885866). Currently, there are 20 concept stocks. In the past January, trading was 17 days, which was nearly 16% higher than the benchmark index. The Shanghai Composite Index (000001) declined slightly during the same period. -0.03%. The "super market" of many concept stocks has stopped trading. The Keda shares have achieved 4 consecutive boards, the Golden Crown shares have 5 days and 4 boards, and the Zhidu shares have 3 boards. The hot market of the popular sector is coveted.

- The three social platforms are blocked by the currency: Why is US regulation so strict?

- Research Report | EU Blockchain Observatory: An Overview of the Legal and Regulatory Framework for Blockchains and Smart Contracts

- OKEx Mine Pool officially launched CRO lock service

The rise of the sector benefited from the continuous airing of the sovereign digital currency by the central bank, the establishment of the super-sovereign currency Libra Association, the launch of the CCB “BCTrade 2.0 blockchain trade finance platform”, the establishment of the cryptocurrency fund by UNICEF and the Swiss R&D central bank. The promotion of market news such as digital currency, but the signal of intentional or intentional release by listed companies is a powerful catalyst for capital speculation.

Straight Flush Digital Currency Sector, October 17, 2019

Straight Flush Digital Currency Sector, October 17, 2019

Blockchain companies are bent on landing in traditional financial markets in order to gain recognition. For example, the OK Group in the exchange field acquired the Hong Kong stocks forward holding, the Huoquan Group acquired the Hong Kong stocks Tongcheng Holdings, and the bite mainland in the mining machine field, Jia Nan Zhizhi and other companies in the A shares, Hong Kong stocks and US stocks experienced a wave of listings.

However, whether it is an exchange or a mining machine, it is not fully compliant in China and around the world. It is difficult to borrow, easy to apply, and difficult to market. For example, Bitland's net profit for the first half of 2018 was 743 million US dollars, an increase of nearly 8 times compared with the same period of last year. It has surpassed Xiaomi and Jingdong in the same period, second only to Baidu, and the same group that was listed in 2018, and many more. The car is still in huge losses. The failure of listing, the collapse of the currency price and internal differences allowed Wu Jihan and the Jenke group to cry at the Beijing annual meeting.

Li Xiaojia, president of the Hong Kong Stock Exchange, once said that

"You used to make billions of dollars through the A business, but suddenly said that you want to do B business in the future, but there is no performance, can you make money in the future?"

This sentence can be applied not only to Bitcoin (mine machine sales VS AI chip), but also to the recent skyrocketing digital currency concept stocks (formerly the main business VS digital currency business).

The people around the city want to escape, and the people standing outside the city want to rush in. Traditional listed companies are always staring at the market trend and speculation space of blockchain/digital currency. There are 20 stocks of the same type of digital currency in the flush, and there are chaos and chaos. For example, Zhidu shares invested in the miners giant Bitland, Kodak shares invested 8 million yuan into the Biger exchange, Meisheng culture multi-level participation in the blockchain media, but did not find a point in the announcement and interactive platform information. There are revolutionary heroes, and there are also robbers of bandits; there are tigers and horses pulling the flag, hanging sheep's heads to sell dog meat, high-level reduction and killing more goods; there is a real knife and a gun to open the arms, close to the red line knife mouth blood. All this is like a real version of Liangshan Water Park.

The forty-third back of the classical masterpiece "Water Margin" tells that some people used the "black whirlwind" and Li Wei’s name was robbed on the road. "Although the villain is surnamed Li, it is not really a black whirlwind. For the grandfather and the river, there is a famous name, mentioning the name of a good man, The gods are also afraid, so the villain steals the name of the grandfather, and cuts the path indiscriminately… The villain’s own name is Li Gui. In the digital currency rivers and lakes, who is Li Wei and Li Gui, investors must polish their eyes. Regrettably, whether it is true Li Wei or fake Li Gui, Shi Naijun gave them a bad ending. Li Gui was cut by his waist knife and Li Wei was stabbed to death by medicinal liquor.

The digital currency rivers and lakes are like the Liangshan water mooring. Some were murdered and pleaded guilty, some were surrendered to Diane, some were wandering around the sea, a story came up, and a story ended, eventually falling to calm. Different people, the same story. For thousands of years, historical stories have always been the case, because of human nature. Whether it is in the Song Dynasty or now, for ordinary investors, they must know how to distinguish between Li Wei and Li Gui, protect themselves and avoid being harvested.

The digital currency of Chinese listed companies is divided into three parts: upper, middle and lower. This article is the first part, which is about Zhidu, Keda, Meisheng Culture and Hengbao.

Zhidu shares

In the previous period, it was changed by ST, major shareholders, and then invested in Bitland, and obtained the Matrixport subscription right. The existing business has not directly involved the blockchain and digital currency, and is still in the research stage.

Layout areas: mining machines; over-the-counter trading, lending and hosting platforms

Companies involved: Bittland ; Matrixport

Concept Ranking: 7

Interval increase: 23% , won 3 boards

Introduction:

Zhidu Shares (000676) is called Zhidu Technology Co., Ltd., located in Henan Province, the information service-media industry, mainly engaged in digital marketing (currently contributing nearly 80% of revenue) and Internet media business. Formerly known as Sida High-Tech, the company was changed by ST due to unsatisfactory business conditions. The major shareholders changed several times, and the net profit in the last three years was positive.

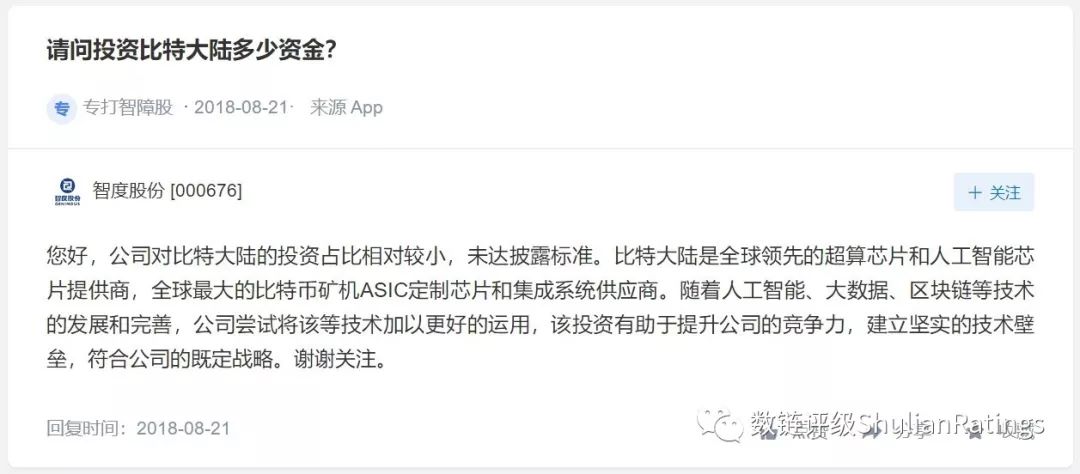

Viewpoint :

On October 15, Zhidu shares announced that in 2018, the company invested in Bitland, but did not disclose the specific investment amount. The reason for the investment is because the company tries to make better use of artificial intelligence, big data, blockchain and other technologies to enhance the company's competitiveness and establish solid technical barriers. At the same time, the company acquired the shareholding of Matrixport established by Wu Jihan, the co-founder of Bitland, in 2019. The company's existing business has not directly involved the blockchain and digital currency business.

Shenzhen Stock Exchange Interactive, October 17, 2019

Shenzhen Stock Exchange Interactive, October 17, 2019

Bitcoin is huge in energy and is going to the US market, and subsequent related listed companies may be hot. The global market for cryptocurrency mines is highly competitive, with most of the leading players being Chinese companies. According to the IPO prospectus, Bitland's revenue increased from US$137 million in 2015 to US$2.517 billion in 2017, and US$2.846 billion in the first half of 2018. The revenue growth rate is comparable to that of the Rockets. Net profit increased from US$83 million in the first half of 2017 to US$743 million in the first half of 2018, an increase of nearly 8 times year-on-year. Its net profit has exceeded that of Xiaomi and Jingdong in the same period, while the US group, Pinduo and Weilai Automobile, which were also listed in 2018, are still in huge losses.

According to the global consulting firm Frost & Sullivan, as of December 31, 2017, Bitcoin's market share accounted for 74.50%. At present, it has about 1,800 employees, ranking first in the digital asset industry, with a valuation of about $15 billion, and is the leader of the miners. On October 10th, the second largest miner, Jia Nan Zhizhi, will go to the US for listing in mid-November. The listing valuation is tentatively set at US$2 billion to US$3 billion. If the news is true, it will be the first among the global digital money industry miners. Shares, when the miners related listed companies will be hot.

The investment layout of Zhidu shares in the blockchain field is forward-looking. Matrixport is a digital asset over-the-counter, lending and hosting platform that aims to develop financial services for professional cryptocurrency dealers and investors, and has a complementary relationship with Bitland. We believe that the company is equivalent to getting tickets for the digital age of the future.

In addition to investing in Bitland, other related businesses are still in the research stage. Since 2018, the company has been paying attention to the development of big data, blockchain, digital currency and other technologies. The company has also set up a dedicated technical research group and business research group, the application of blockchain technology in various industries, and digital currency. In the field of payment, wallet, asset management, trading system and other fields, the previous direction research was carried out. With the acceleration of the central bank's digital currency, the company is also actively researching the application of the central bank's digital currency in the global cross-border payment system and the application of the central bank's digital currency in the digital currency wallet business to explore the possibility of the implementation of related technologies and industries. .

Kodak shares

The layout is comprehensive and frequently shot, which is an authentic blockchain. Research and exploration are still in the early stage and have not been profitable so far, and it is not expected to achieve profitability in the short term.

Layout area: digital currency exchange; blockchain media; rating / evaluation; asset management; security; wallet; mining machine

Companies involved: Biger Exchange; Nuclear Finance; Ear Finance; TokenGazer ; TokenOnly ; Beijing Chain Security; Master Wallet;

Introduction: Keda Co., Ltd. (600986) is a full name of Keda Group Co., Ltd., located in Shandong Province, the information service-media industry, mainly engaged in digital marketing business. In June 2019, the average daily investment in Tencent exceeded 35 million yuan. Tencent's advertising partners ranked first in the daily average, and the net profit in the last three years was positive. Opinion: On October 15, Kodak announced that the company's main business is digital marketing. It is a traffic operation company that builds an intelligent marketing platform through data + technology to provide customers with intelligent marketing solutions. The company has conducted preliminary research and exploration in the blockchain field, but the research and exploration is still in the early stage, and it has not been profitable so far, and it is expected that it will not achieve profit in the short term, and will not have a major impact on the company in the short term.

On the evening of October 15, Zhidu shares said that the company is investigating the application of the central bank's digital currency in the global cross-border payment system and digital currency wallet business, and explores the possibility of related technologies and industries.

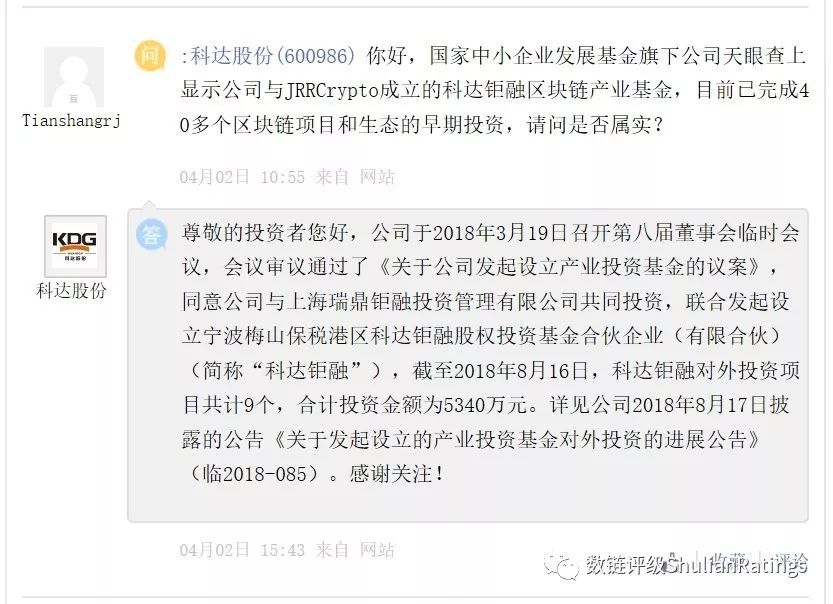

The company and JRR Capital established Keda Rongrong Fund, covering a total of 9 blockchain projects covering exchanges, media, evaluation, asset management, community, security and other fields, with an investment amount of 53.4 million yuan. In March 2018, Keda Co., Ltd. announced that the company and Shanghai Ruiding Rongrong Investment Management Co., Ltd. (JRR Capital) jointly initiated the establishment of a 60 million yuan blockchain industry fund, Keda Rongrong, namely "Ningbo Meishan Bonded Hong Kong District Keda Rongrong Equity Investment Fund Partnership (Limited Partnership), Keda shares invested 50 million yuan. According to the SSE e-interaction, as of August 16, 2018, there were 9 foreign investment projects of Keda Rongrong, with a total investment amount of 53.4 million yuan.

Keda shares participate in the digital currency exchange. According to the “Announcement on Preventing the Risk of Subsidy Issuance Financing” issued by the Central Committee of the Seventh Central Committee on September 4 , 2017 , it faces domestic policy risks.

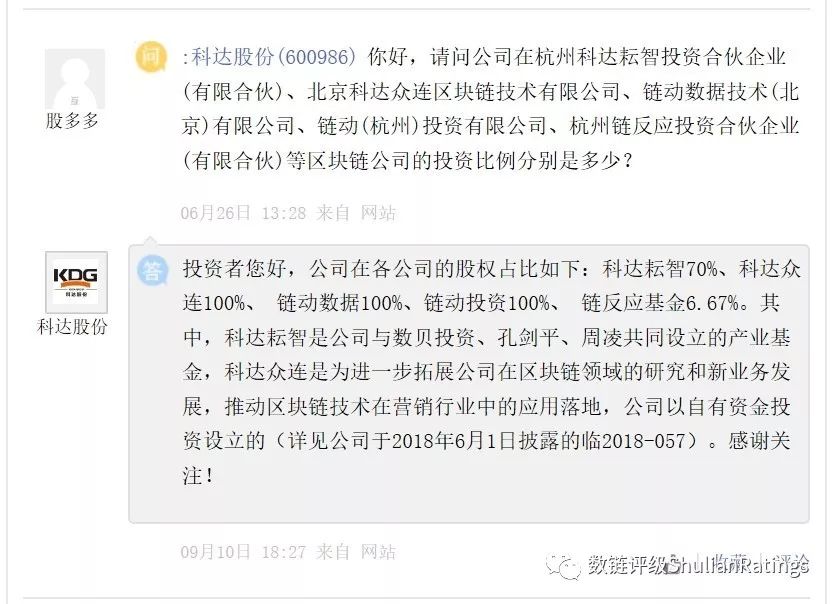

SSE e-Interaction, on October 17, 2019, jointly established a blockchain investment company with the second largest miner of the mining machine, Jianan Yuzhi, to invest in content ecological platforms such as mustard circle and coin wisdom, and the wholly-owned subsidiary has launched the blockchain media quickly. Chain planet. If Jia Nan is listed in the US stocks in mid- November , as a related company, Keda shares may be speculated. In April of this year, Keda shares said on the SSE Interactive e platform that the company's share of each blockchain company Keda Zhizhi, Keda Zhonglian, Linkage Data, Chain Investment and Chain Reaction Fund is 70% and 100 respectively. %, 100%, 100%, 6.67%.

On June 5, 2018, Keda Co., Ltd. announced that the company has invested 35 million yuan with Jianan Yuzhi (Kong Jianping and Zhou Ling respectively invested RMB 7.25 million) and Zhejiang Digital Investment Management Co., Ltd. (referred to as “Shanbei Investment”). (Investment of 500,000 yuan) jointly established Keda Zhizhi, namely Hangzhou Keda Zhizhi Investment Partnership (Limited Partnership). According to Sky Eye, at present, Keda Zhizhi has three projects for foreign investment: Shenzhen Yunjie Information Technology Co., Ltd. (ie, mustard circle), Guangzhou Chuxing Technology Co., Ltd. (coin wisdom) and Shenzhen Amoy Chain Technology Co., Ltd. Among them, Kong Jianping is the executive director of Digital Investment and the joint chairman of Jianan Yuzhi, and jointly invested in several investment projects with Keda. The registered capital of Digital Investment is 10 million yuan, of which Kong Jianping has recognized the amount of funds to be 3.5 million yuan.

The company once said in the SSE Interactive e platform that the wholly-owned subsidiary Keda Zhonglian, Beijing Keda Zhonglian Blockchain Technology Co., Ltd., launched the blockchain media platform in 2018, the fast-chain planet. Keda shares 2019 semi-annual report shows that the company increased investment of 4.95 million yuan in the first half of the year, with an accumulated investment of 20 million yuan.

In addition, the chain data, namely Link Data Technology (Beijing) Co., Ltd., is a data analysis company. The 2019 semi-annual report shows that the company invested 10 million yuan. Chain Investment is Link (Hangzhou) Investment Co., Ltd., which has two funds, namely Hangzhou Chain Dynamic No.1 Investment Partnership (limited partnership) (deregistered) and Hangzhou Chain Reaction Investment Partnership (Limited Partnership), which were established in 2016 respectively. Year and 2015. The Chain Reaction Fund, Hangzhou Chain Reaction Investment Partnership (Limited Partnership), was established in 2015 and is managed by Hangzhou Good Hope Investment Management Co., Ltd.

SSE e-Interaction, October 17, 2019

Meisheng Culture

Multi-level participation in multiple blockchain media, and did not find any information on the company's direct investment blockchain/digital currency in the announcement and interactive platform.

Layout area: blockchain media

Introduction:

Meisheng Culture (002699) is called Meisheng Culture Creative Co., Ltd., located in Zhejiang Province, the information service-media industry. The products mainly include IP derivatives, animation, games, film and other cultural products, as well as light game services. In the last three years, due to the increase in asset impairment losses and income reduction, the net profit attributable to owners of the parent company in 2018 was -230 million yuan, a decrease of 220% over the previous year. Opinion: On December 29, 2015, Meisheng Culture participated in the A round of financing of Beijing Micromedia Interactive Technology Co., Ltd. (referred to as “Micro Media Interactive”/New Media “WeMedia”) listed on the New Third Board, with an investment of 60 million yuan. Holding 14.25%. The first half of 2019 reported that the profit and loss of micro-media interactive investment confirmed by Meisheng Culture under the equity method was 217,500 yuan, and the ending balance (book value) was 68.706 million. Meisheng Culture invests in micro-media interaction, micro-media interactive investment chain tower and micro-chain era, micro-chain era investment in a number of blockchain media, is a multi-level participation, and has not been listed in the company announcement and interactive investor exchange platform Inquire about the information of the Meisheng Culture Direct Investment Blockchain Enterprise. Micro-media interactive share block data service provider Beijing Chain Tower Technology Co., Ltd. ("chain tower"), holding 25%, and in 2014 established a wholly-owned subsidiary Beijing Micro-Chain Times Technology Co., Ltd. (referred to as "micro-chain era"). According to Sky Eye, up to now, the micro-chain era has invested in 10 companies, most of which are blockchain media, such as 31 District, Sanyan Finance, Ear Finance, Big Cat Finance, 31 latitude and block rhythm, and technology. The service company voted for Ken Technology.

Hengbao shares: continue to invest in technology research and development, in the information security, data transactions and other aspects of the layout, is currently in the technical reserve stage.

Layout area: wallet; payment system

Involved in the company: Hengbao Intelligent

Concept Ranking: 1

Interval increase: 12%

Introduction:

Hengbao Co., Ltd. (002104) is called Hengbao Co., Ltd., located in Jiangsu Province, the information equipment-communication equipment industry, mainly engaged in magnetic stripe cards, password cards and IC cards and other related operating systems (COS) and tickets. Product development, production and sales. The company released its semi-annual report on August 29th. The report shows that the operating income in the first half of this year decreased by 27.18% compared with the same period of the first half of the year. Five of the six subsidiaries incurred losses. The vigorous development of the Internet of Things business in the first half of this year was higher. The year-on-year decline was 79.47%.

View:

In October 2005, Hengbao Co., Ltd. established a wholly-owned subsidiary, Jiangsu Hengbao Intelligent System Technology Co., Ltd. (“Hengbao Intelligent”). According to the announcement issued by Hengbao in February 2018, Hengbao Intelligent is mainly engaged in Development, production and sales of electronic labels, reading and writing equipment, and terminal products.

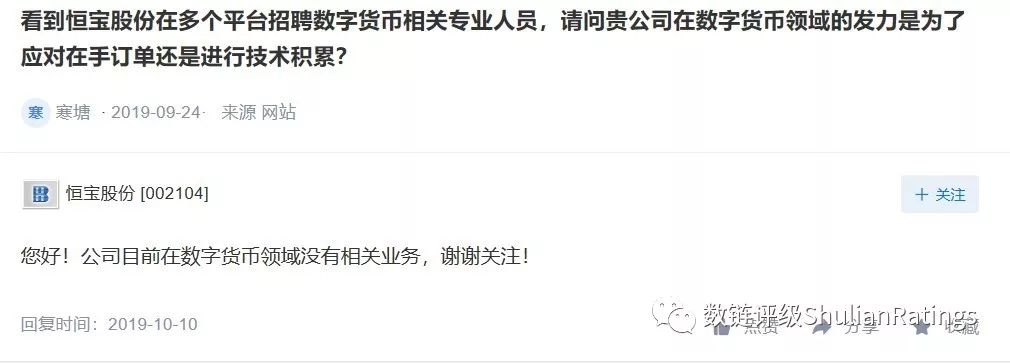

In terms of blockchain, the company has mainly laid out its layout in information security and data trading, and has continued to invest in R&D in blockchain technology. It is still in the technical reserve stage.

According to Sky Eye, Hengbao Intelligent applied for 14 blockchain related patents in 2019. They are: a password reset method and system for a digital currency wallet; a hardware wallet; a natural gas life payment management system based on a blockchain; a hard wallet and a hard wallet based verification method; and a cryptocurrency payment method And system; a blockchain hard wallet supporting a chain transaction method and a hard wallet; a blockchain cold wallet address management method; a blockchain account key backup and recovery method and system; a blockchain account Key backup and recovery method, device, terminal and system; a blockchain-based e-commerce platform evaluation management system; a blockchain-based highway payment system; and a blockchain-based urban transportation payment system A blockchain-based IoT cost management method and system; an information management and authentication system using a blockchain.

In 2018, 12 patents related to blockchain were applied. They are: a blockchain-based ETC payment system; a blockchain-based bank account management method and system; a blockchain-based natural gas life payment management system; and a blockchain-based electronic Contract management method and system; a node data synchronization method in blockchain; a blockchain-based electronic voucher management method and system; a blockchain-based online banking security transaction method and system; Chain payment account security transaction method and system; a blockchain-based tax management method and system; a method and device for setting bank account management personnel based on blockchain and iris recognition; An authentication method and device for combining chain and iris recognition; a method and system for tax return management based on blockchain.

According to the interaction of the Shenzhen Stock Exchange, many investors have been curious about the recruitment of cryptocurrency practitioners and applications for blockchain-related patents on multiple platforms in recent years. The staff clearly stated that the company is currently not relevant in the digital currency field. business

Shenzhen Stock Exchange Interactive, October 17, 2019

Shenzhen Stock Exchange Interactive, October 17, 2019

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | Fed interest rate cuts expected to strengthen; Britain's hard Brexit is uncertain (1017)

- National team admission blockchain! The only internal measurement of the global infrastructure that controls China’s access rights

- Internet of Things + Blockchain Series: The Challenges of the Internet of Things

- Speed reading | Chain governance and DAO must read articles recommended

- Finance, passwords, communication, science fiction circles gathered, the world blockchain conference • Wuzhen second batch of guests exposed!

- Chinese government's blockchain “shopping list”: 57 purchasing units, 12 provinces and cities, Tsinghua University bought the first order

- Telegram plans to postpone the TON for half a year, if investors refuse to lose about 200 million US dollars