Paying wages in cryptocurrency? In fact, many people have already done this.

For most people who are accustomed to legal tender, it is somewhat unacceptable to use a highly volatile cryptocurrency as a wage for labor.

However, more and more blockchain industry practitioners are now more willing to accept digital currency such as Bitcoin as a fixed income they receive each month. With the changes in the form of various types of production collaboration organizations, the fixed payment of fiat currency per cycle may no longer be the only option for future companies or organizations to pay wages.

A human resources startup called Chronobank surveyed 445 cryptocurrency enthusiasts from around the world, including the US, Russia and Australia, and 66% of respondents said they would like their employers to embrace cryptocurrencies. In order to pay salaries, 72% of respondents indicated that they would prefer to work for employers who listed cryptocurrency as a payroll option when considering the next move.

01About salary payment

- Panic Index burst: When Bitcoin is $3,000, everyone is not so confused.

- Bollinger Band Creator: The Bitcoin market is like the early stock market and is still bottoming out.

- PoS replaces the PoW tide, but some domestic mine pools have heard the sound of boycott

Ancient Rome used "salt" to pay "military" to soldiers. For example, the English words Salary (salary) and Salt (salt) are exactly the same. In fact, the word Salary comes from the Latin word Salarium, which means to buy salt money, which refers to the subsidies and military squads used by soldiers to buy salt.

In ancient Rome, only a few places produced salt, and the salt-making technology was very backward. In addition, transportation was inconvenient, so salt was especially precious. The salt at that time had the title of "white gold." The Roman army will provide subsidies for soldiers to buy salt or direct salt. This part of the allowance is an important part of the military and will be distributed regularly. Therefore, the word Salary, originally used to mean “buy salt allowance”, was later used to indicate that it received a steady and reliable income, that is, wages.

▲Source: Salarium

The salt that the army distributes to soldiers is a kind of in-kind wage, and the physical wages of modern society are rarely seen. Most companies choose a monetary wage that is relative to the wages in kind, that is, wages paid in monetary terms. When we enter a company, the personnel department will let you fill out a bank account to pay you a monthly salary.

Perhaps what you didn't think is that when you still lament that payday is the repayment date, and another opportunity to get rid of poverty and get rich, the girls in Afghanistan don't even have the right to own a bank account. If they have a little money, they must be transferred to their father's or brother's account.

Pariza Ahmadi is an exception to the Afghan girl. She is a blogger who loves movies and often expresses her opinions online. The film company (Film Annex) is learning about it. After the plight of the Afghan girls, the founder of the company chose to use Bitcoin to pay the salary of the bloggers.

In addition to the Afghan girls, the dancers from the Las Vegas Strip Club are also the first to accept Bitcoin as a payroll. Individual dancers will place a bitcoin-receipt QR code on their prominent position for tipping. Compared to the traditional means of payment, accepting bitcoin payments, you can avoid the payment of fees to the credit card company.

Over the past few years, users of cryptocurrencies have gradually become less restricted to these marginalized groups. As more and more people accept cryptocurrency as a means of payroll, cryptocurrencies are being used more and more quickly, moving from the edge of the stage to the center.

CoinCorner employees of the cryptocurrency trading platform and wallet service provider can choose to receive some or all of their wages in pounds sterling, Ethereum, Litecoin or Ripple. All employees choose to receive part of their salary in bitcoin. An employee collects all his salary in cryptocurrency.

In recent years, many athletes in the sports industry have also taken the initiative to pay their own salary with cryptocurrencies such as bitcoin. Matt Barkley of the American Football League Buffalo Bills, the offensive tackle of the Los Angeles Lightning team Russell Ocon, and the Danish hockey player Rosenthal, etc., all require the team to be in the form of bitcoin. Pay your own salary. In view of the general situation of the cryptocurrency roller coaster, Rosenthal also specifically bought an insurance for his bitcoin salary.

▲Left: Matt Barkley; Right: Russell Ocon

If you think about it, it's easy to understand that because cryptocurrencies don't have the legal limits of legal currency, they can be used globally and converted into almost any national currency, which makes multinational companies that need to pay wages to employees in multiple countries and regions. The wage problem becomes very easy. All transfer information is recorded on the blockchain and the data cannot be tampered with, so using cryptocurrency to pay employees is actually more secure than traditional methods.

Of course, there are some problems in this. For example, the price instability of cryptocurrencies means that the wages you receive on this day may shrink rapidly in a few hours. If an employee sells the cryptocurrency quickly, there is no loss; but if they choose to be a Holder, then its value will fluctuate in the following days, whether it is a day, a week or a year. A salary of $1,000 may be worth $5,000 or $500.

The shrinking wages are certainly ridiculous, and the tax that does not accompany the wages shrinking is really enough to make people "slap the thighs."

02 tax

Xiaopin, a small actor, once said: "The most painful thing in life is that people are dead and money is not spent." His master Zhao Benshan said: "The greatest pain in life is that people are alive and the money is gone."

In fact, there is still a pain in life, that is, your encrypted assets are shrinking because of the cold winter market, and the taxes to be paid are “not moving”.

Adrian Forza of the Australian accounting firm said that one of his clients would have to pay $100,000 in taxes for the current $20,000 worth of crypto assets, which would pay five times the value of these crypto assets.

In January 2018, during the peak of the previous bull market, Adrian Forza's client filed a $250,000 crypto asset, which was paid by an overseas company. According to the provisions of the Australian Tax Office, the value of virtual assets is calculated and paid according to the receipt of virtual assets, so even if he is now due to market problems, assets are shrinking, the tax to be paid is “everything from north to south” Wind, I am not moving."

▲Source: altcoinbuzz

In early August of this year, the New Zealand Revenue Agency issued an announcement stipulating that the wages for receiving cryptocurrencies were legal and taxed accordingly. The new regulations will come into effect on September 1, and New Zealand will become the first country in the world to legalize the payment of cryptocurrency wages. Many encryption enthusiasts believe that this is the official recognition of the cryptocurrency system by the state, and it is also an important step for the cryptocurrency to mature as an asset class, and will enter the daily payment field of the people.

However, most people's interpretation of this regulation issued by the New Zealand Taxation Office is not correct. The New Zealand authorities did not support encryption or legalize them for wages. They simply provide guidance on how to deal with such corporate bodies that use cryptocurrencies to pay salaries from the perspective of tax liabilities.

In most Western countries, citizens are free to choose the payment method that suits them, whether it is in-kind payments, stocks, options, or a combination of the above. Now, they have another option to consider – cryptocurrency. From the point of view of the tax authorities, when cryptocurrency becomes the first choice for more and more employees to receive salary payments, how to tax this new thing must be put on the agenda. Many cryptocurrency enthusiasts believe that there are many advantages to cryptocurrencies, including the exemption from taxes paid to the state. However, in fact, the United States, the United Kingdom, Japan, Australia and other countries have already introduced cryptocurrency tax policies.

Take a closer look at the New Zealand Inland Revenue Department's announcement, which clearly states that in the current environment, you are not ready to use cryptocurrency as a means of payment for daily purchases of goods and services. It cannot be treated as wages or salaries like money, and employees receive it. The wages in the form of cryptocurrencies must also be converted into mainstream currencies such as Bitcoin and Ethereum, and then converted into fiat currencies.

The cryptocurrency helps you to pass the bank account without having to pay the fee to the intermediary, but you still have not escaped the “Five Fingers Mountain” of the tax authorities.

New Zealand's new regulation is more to avoid tax evasion and tax evasion caused by cryptocurrency as a means of payment. This type of non-monetary payment is not exempt from the employee's “Pay As You Earn”. In addition, only employees who have signed a contract with the company can receive a fixed amount of money each month to choose the cryptocurrency to receive the salary, and all freelancers still cannot receive the payment in the form of cryptocurrency.

03 Is it a gimmick or a progress with a cryptocurrency?

On July 29, 2018, according to the British "Guardian" report, the European team Gibraltar United became the first team in the world to use the encrypted digital currency to pay players' salaries. The team's owner, Pablo Dana, said that all players' contracts will include a cryptocurrency payment agreement next season. This model can help athletes avoid some of the problems encountered when setting up a local bank account.

However, the thunder and rain were small, and the boss of this team did not honor their promise. According to Hard Fork, the team is still using legal tender rather than cryptocurrency to pay players' salaries.

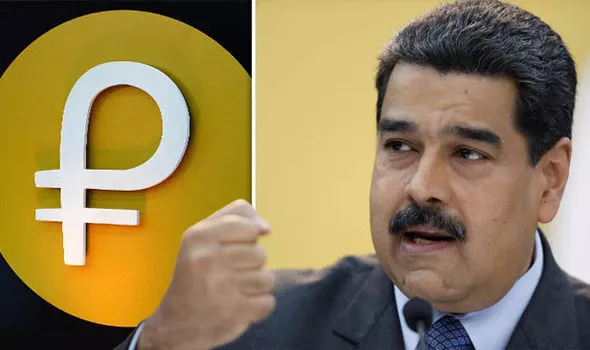

Also in 2018, due to domestic hyperinflation and foreign economic sanctions, Venezuela’s President Maduro officially announced that Petro-Petro will become the first state-sponsored legal system in the world. Digital currency. In addition, the government will introduce a new salary system and a pricing system for goods and services on the basis of petroleum coins. President Maduro believes that the implementation of the new oil-based wage and pricing system will significantly increase workers' income.

From 2013 to 2017, Venezuela's inflation rates for the five years were as high as 41%, 63%, 121%, 254% and 626% respectively. In June 2018, the IMF (International Monetary Fund) speculated that by the end of 2018, the country's inflation rate would reach 1,000,000%, and the country's monetary system almost collapsed.

According to United Nations estimates, 4 million Venezuelans have fled the country since 2015, accounting for about 12.5% of Venezuela's current total population. The economic sanctions imposed by the United States on Venezuela have intensified the brokering crisis in this country.

In order to circumvent economic sanctions, the Venezuelan government has introduced Petro (Petro), which has become a dazzling topic in the blockchain industry. (For details, see the tweet before the vernacular blockchain. "The first All In cryptocurrency country is a smashing or a scam. 》). However, one can't help but wonder if a sovereign state, even its own legal currency, can't control it. Is the national legal digital currency it issued just another bigger bubble?

04 Conclusion

At present, at the accounting, auditing level and tax and legal levels, there are still many problems in the company's use of cryptocurrency to pay wages to employees. If all of the employee's salary is paid in some cryptocurrency, the risk may be no less than the conversion of the salary into a lottery.

However, as the popularity of cryptocurrency increases, prices will gradually stabilize. When the speculative space is compressed and stabilized, paying various types of salary in cryptocurrency will become the first choice for many companies, especially multinational companies.

Message Mining No. 309: If you can choose, would you choose a cryptocurrency as a salary? why? Feel free to share your opinion in the message area.

——End——

Original: Jiangnan Dahu Dai boss

Source: vernacular blockchain

『Declaration : This article is the author's independent point of view, does not represent the vernacular blockchain position, and does not constitute any investment advice or advice. You are not allowed to reprint this article by any third party without the authorization of the "Baihua Blockchain" sourced from this article. 』

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Morgan Creek CEO Anthony Pompiano: Bitcoin only takes 10 years to become the protagonist of G7

- The central bank official micro-distributed two articles on the details of digital currency

- Solidity programming language: structure struct

- Market Weekly | Daily average market value fell by nearly 10%, Shenzhen launched digital currency research

- Is it enough for me to take 100 bitcoins to fry shoes?

- Detonating "under the chain", Celer Network will attend the 2019 than the original global developer conference

- State Grid E-commerce Company established blockchain subsidiary to develop "blockchain + power"