Cycle observation | market, economy and cycle (on)

In this sharing, we proceed from a more fundamental market interaction to dismantle the essence of a free market economy and to understand the cyclicality of the economy from a different perspective from Western economics.

In the following sections, we will share our analysis of the economic cycle and the fundamentals of the Bitcoin market.

The general way we study things is to first analyze the problem, find out the main contradictions, and then strip off the non-critical factors as much as possible to restore things to the most general state.

- How to scientifically measure the distribution of blockchain assets such as Bitcoin?

- The four families of the Italian Mafia have made a "criminal chain", which clearly divides the rights of the family…

- Comprehensive interpretation of central bank digital currency: from operating system, management model to technical route

Starting from the study of the most basic things, gradually from simple to complex, from concrete to abstract, and constantly improve the understanding of things .

For example, we now have quantum mechanics and relativity, but when we study the motion of cars, we don't need relativity and quantum mechanics. We only need simple Newtonian mechanics, because in this simple case. Our knowledge of Newtonian mechanics is sufficient.

The current economy is basically an economic model based on market economy. Then we must first study the market economy. There are many kinds of market economy, such as monopoly market, free market economy, and our unique socialist market economy.

These market economies have their own characteristics, but their essence stems from free exchange. To study the market economy, we must study the simplest free exchange.

To study the market economy, we have to track the source of the market.

In fact, this is something that every creature can do, otherwise the creature cannot progress, but only humans will actively and consciously produce more products.

Before the earlier society, humans may be single-handed, and everyone will produce the products he needs. But this situation is very difficult in the early days because the natural environment is very bad.

This creates a problem: one cannot guarantee his own survival.

But the social division of labor has led to new problems: everyone's products must be exchanged with other people's products to meet the needs of everyone. This slowly makes the exchange the main purpose or even the sole purpose of producing the product.

At this time, human beings have entered the commodity society. The commodity society is characterized by its social production for the purpose of pure exchange.

A commodity that can be used to exchange any commodity, we call it currency . The currency used to be a shell on the sea. Because shells are very rare for people in the Central Plains.

Since ancient times, the production cost has remained basically the same. So far, the production cost of gold mines in Europe and America is about 1300 US dollars an ounce. Before the gold surge in July, all gold production was actually close to losing money.

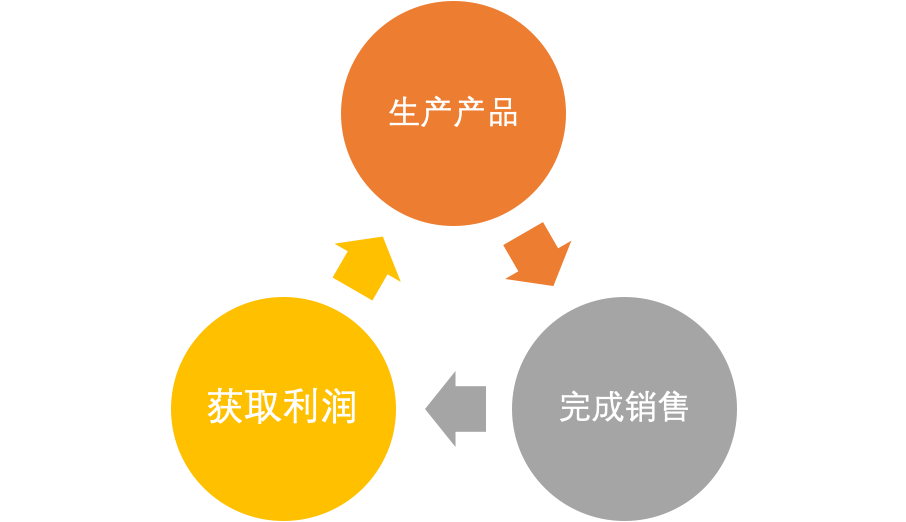

After the currency was produced, the production model changed further, and the original exchange for the purpose of obtaining money for the purpose of production . Such a production model becomes a production and sales into a currency, and then purchases new production materials and re-produces them. Producers make profits through this process.

The second step: selling the products produced. After the product is sold out. Will be converted into profit. This step is called a thrilling jump. Its thrill is that capitalists are responsible for the risk of not selling in the production process;

The third step: capital sells to obtain capital. Then continue to add value.

This is because there is a risk in the production model in capitalism. Especially when a single company faces the market, there are many risks, such as “thrilling jump” and risks in all aspects of the supply chain. But banks are different, and because they hold mainly cash (to simplify discussions, not distinguish between currency and credit currency), the risk is very small. Therefore, banks can provide capital support to other companies. As long as social production exists, capital can earn interest.

Since banks are the center of cashiers and settlements, and the risks inherent in capitalist production models, banks have a higher risk tolerance for interest-bearing capital and become the basis for controlling all production. Modern large-scale consortia, all of which are banks. For the core. All economic activities start from the bank to the end of the bank, which is the financial system of the entire modern society. Banks have become the core of society as a whole and have assumed responsibility for society.

This creates a problem: products are consumed by all groups in society and workers are required to purchase. If workers do not have enough money to buy, it will lead to a total output of the entire society greater than the total income available for consumption. Most of the money of the capitalists needs to be added, and not all of the money is spent on consumption.

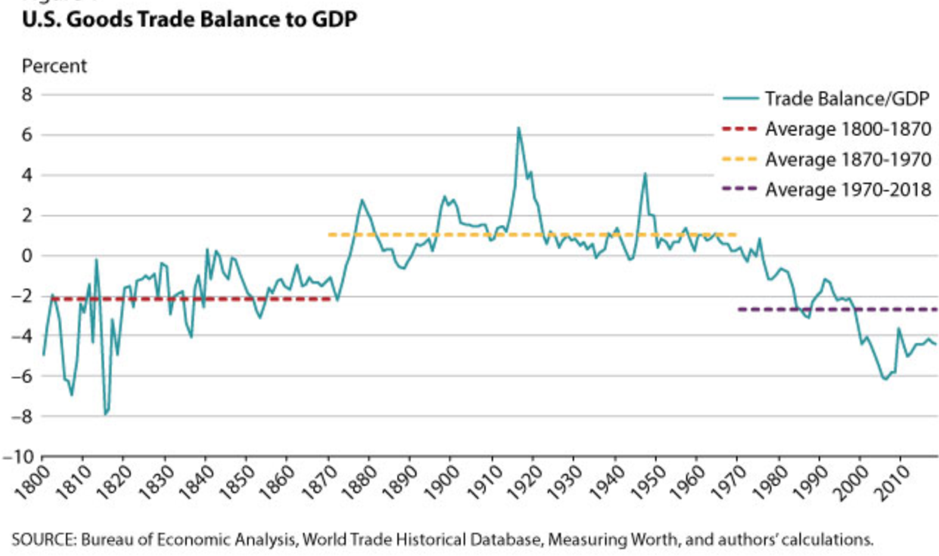

Therefore, some products will never be converted into profits, products cannot be sold, and capitalists cannot recover capital for reproduction. According to the general production efficiency and capitalist profit rate, generally 20% (the average growth rate of all industries is about 20%).

Then in this case, after deducting the cost, the remaining product for one year is 10%. After all, the remaining products in 10 years are close to 100%, and almost all products cannot be sold. This is why the economic crisis has been basically a decade since the mid-19th century and the 1930s.

They do not recognize the existence of the economic crisis and believe that the economic "crisis" can be self-healing.

To put it simply, the government expands its credit, releases liquidity, and disguised inflation to ease the economic crisis.

When the economic cycle comes, the government expands its credit to release liquidity and then builds large-scale infrastructure projects. The government absorbed debt by changing inflation.

At the same time, we will further analyze the nature of Bitcoin and digital currency to reveal where the future of the digital currency market is.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin calendar: Grasp these few time nodes, you may be able to put the "pulse" of the market

- Market Analysis: Doomsday ETC is soaring, the market is still far away

- "Japan Amazon" Lotte launches cryptocurrency transaction service

- QKL123 market analysis | long and short glue $ 10,000, the main force will continue to wash (0822)

- Viewpoint | On the safety budget of Bitcoin

- 70% is inaccurate, the researchers said that the actual market share of Bitcoin has exceeded 90%

- Bitcoin node distribution at a glance: the largest in the United States, the fifth in China