Market Weekly | Daily average market value fell by nearly 10%, Shenzhen launched digital currency research

Weekly summary

- Last week, the average daily market value of global digital currency assets was 276.673 billion US dollars, down 8.53%, and the average daily trading volume was 54.77 billion US dollars, down 10.22%.

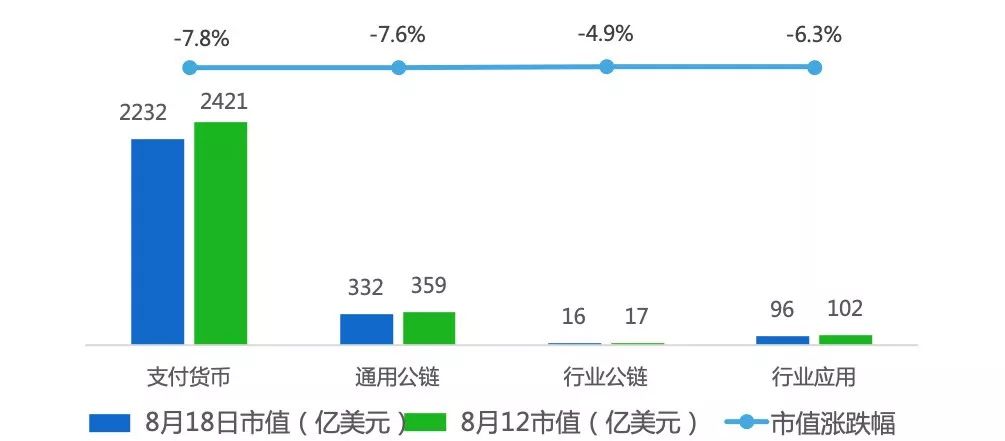

- Last week's market value TOP200 assets fell 7.71% overall, all four major areas fell. Among them, the payment currency sector fell the most, reaching 7.8%.

- There are 11 new listings this week.

- A total of seven projects were closed last week, and the total soft top of the project exceeded $100 million.

- The six blockchain projects received equity financing with a financing amount of more than $21 million.

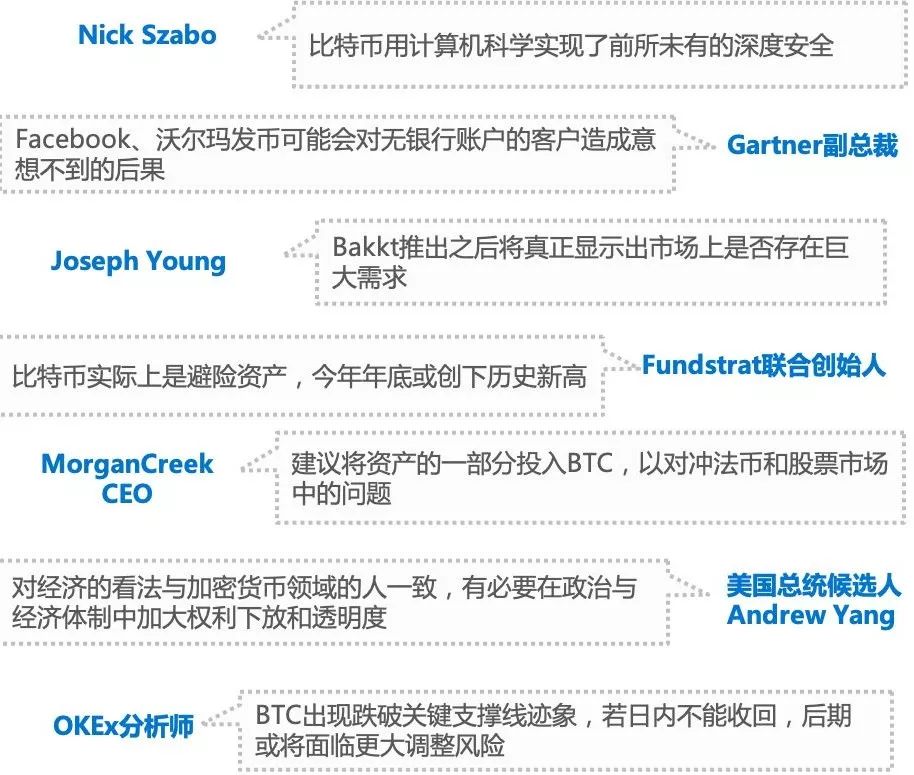

- OKEx analysts : BTC has shown signs of falling below the key support line. If it cannot be recovered within the day, it may face greater adjustment risks later.

Market overview

Last week, the average daily market value of global digital currency assets was 276.873 billion US dollars, down 8.53%, and the average daily trading volume was 54.77 billion US dollars, down 10.22%.

- Is it enough for me to take 100 bitcoins to fry shoes?

- Detonating "under the chain", Celer Network will attend the 2019 than the original global developer conference

- State Grid E-commerce Company established blockchain subsidiary to develop "blockchain + power"

Market value TOP5 (BTC, ETH, XRP, BCH and LTC) , the average daily market value decreased by 10.18% compared with the previous week; the average daily trading volume decreased by 24.59% from the previous week. BCH's biggest drop in the middle of the week was the highest, reaching 20.26%.

Market value TOP5 (BTC, ETH, XRP, BCH and LTC) , the average daily market value decreased by 10.18% compared with the previous week; the average daily trading volume decreased by 24.59% from the previous week. BCH's biggest drop in the middle of the week was the highest, reaching 20.26%.

TOP200 market analysis

Last week's market value TOP200 assets fell 7.71% overall, all four areas fell, of which, the payment currency sector fell the most, reaching 7.8% .

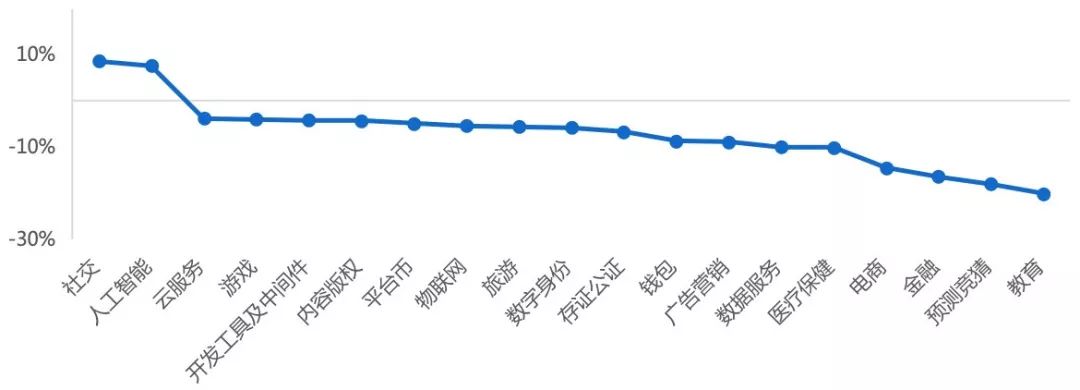

In the industry's public chain and application, according to the industry's further subdivision, except for social and artificial intelligence, other areas fell, with the education sector falling the most, reaching 20.19%.

From the perspective of individual currency gains, among the assets of TOP200 last week, KIN rose the most, reaching 49.56%.

New listing assets analysis

OKEx, Binance, HuobiGlobal, Bitfinex, Bitmumb, ZB.com, Upbit, HitBTC, Bittrex, Poloniex and other 30 trading platforms, 11 new listings.

Primary market financing

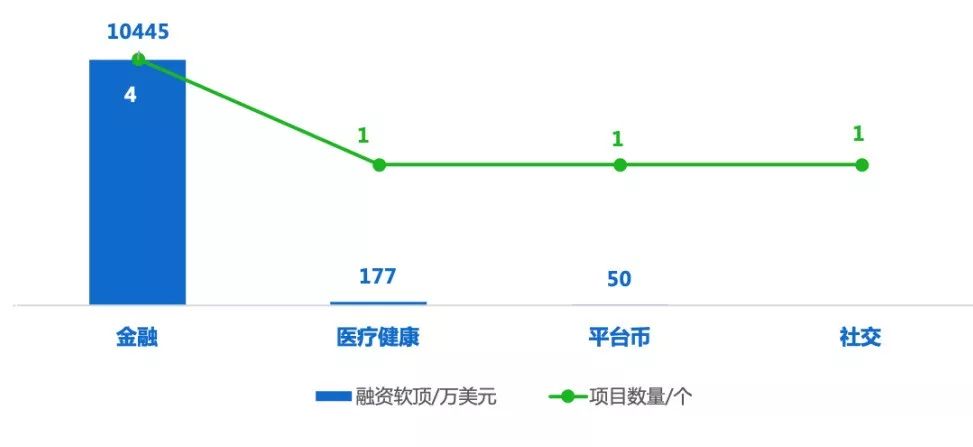

A total of seven projects were closed last week, and the total soft top of the project exceeded $100 million.

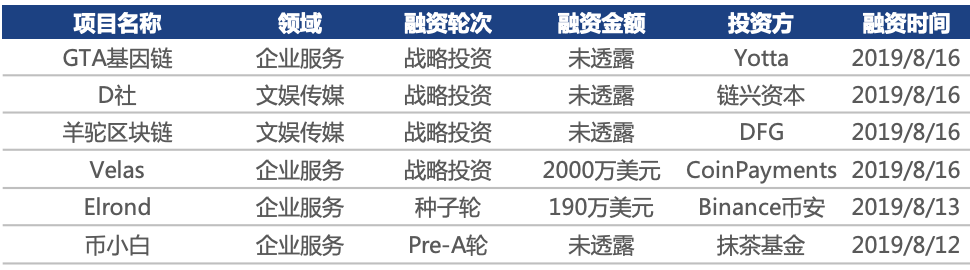

Last week, there were 6 blockchain projects that completed the completion of equity financing, and the financing amount exceeded US$21 million.

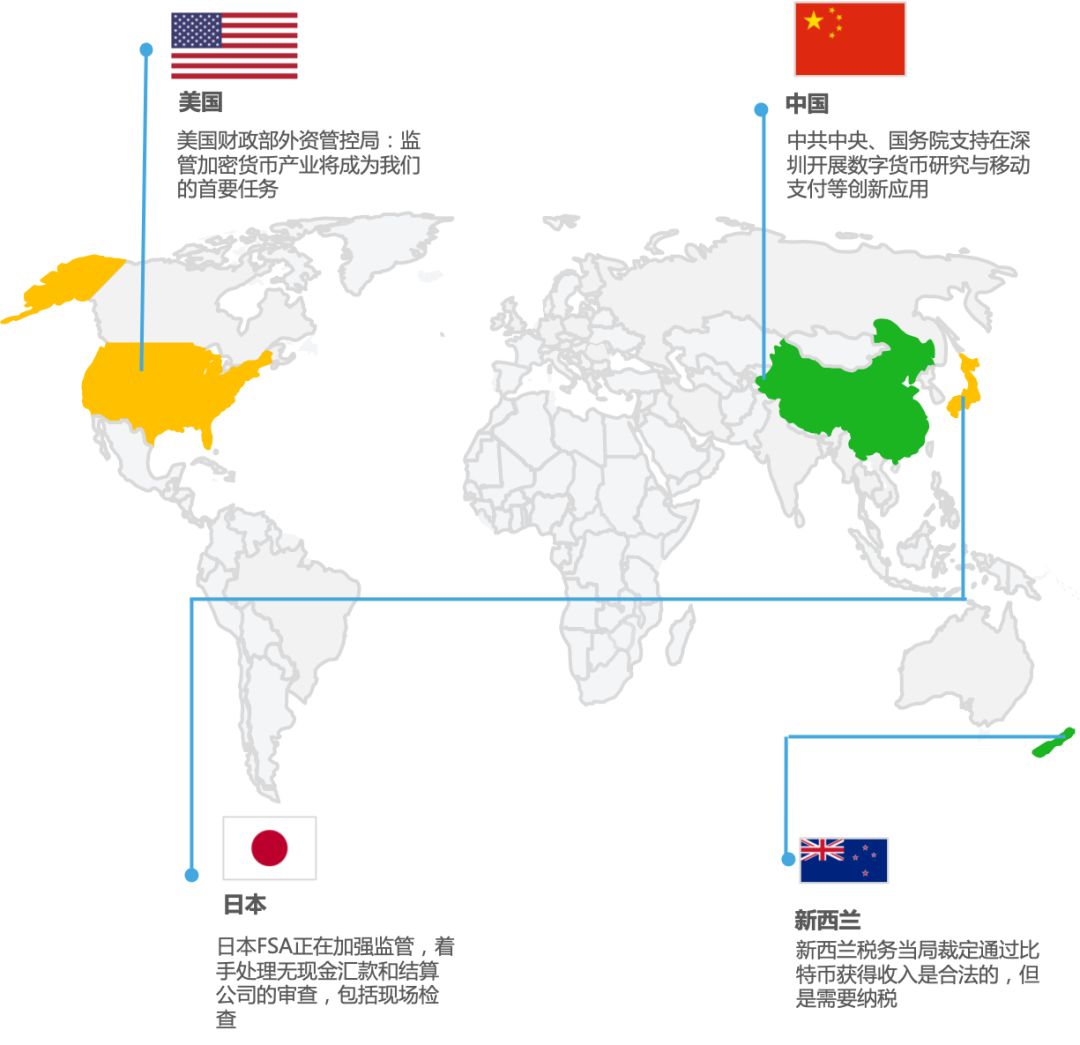

List of regulatory policies

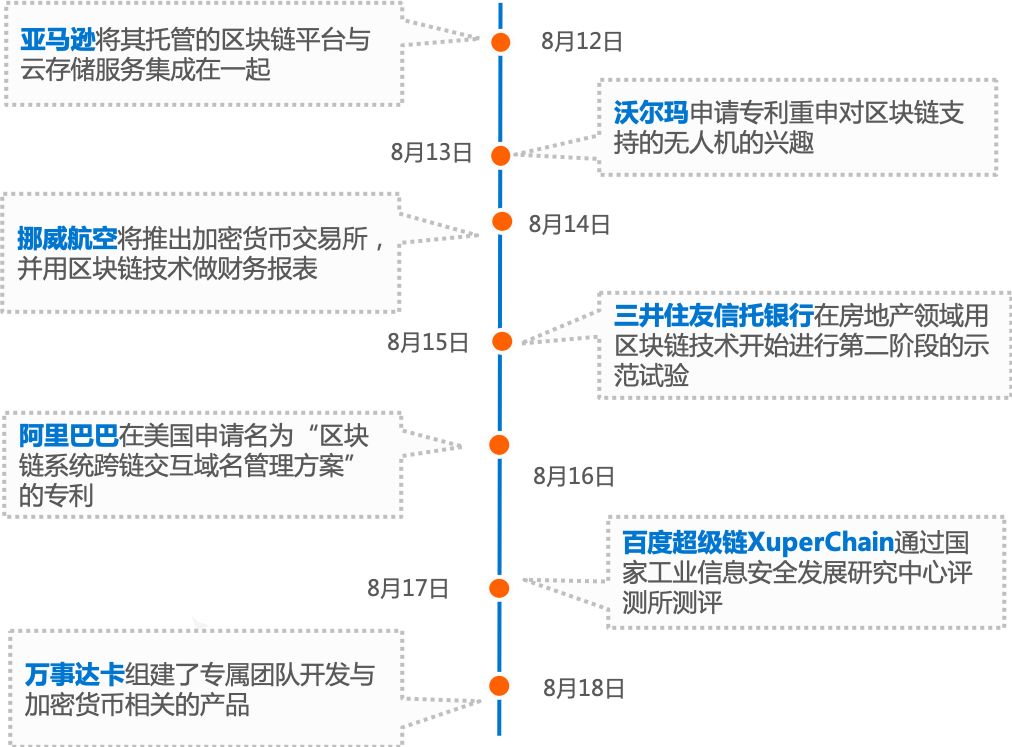

Giant layout

Big coffee said

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain welcomes "the first year of landing" Supply chain finance into the mainstream scene

- Opinion: DeFi brings Ethereum to the bottom of the financial market, but as a service provider, it is going backwards.

- Cocos-BCX first launched on the first day of the currency "A wave of violent"? The reason may be here

- Cycle observation | market, economy and cycle (on)

- How to scientifically measure the distribution of blockchain assets such as Bitcoin?

- The four families of the Italian Mafia have made a "criminal chain", which clearly divides the rights of the family…

- Comprehensive interpretation of central bank digital currency: from operating system, management model to technical route