Perspective | DeFi's Pillar: Decentralized Liquidity

One of the most interesting recent developments in cryptocurrencies is the emergence of a decentralized liquidity pool . Algorithm-based smart contract liquidity pools such as Ethereum's Uniswap are examples of this trend.

Inflow / outflow liquidity is critical to the creation and growth of financial markets . If the encryption technology is to reach maturity, the ability to find prices and flow in / out of trading positions (whether it is the positions of large institutional companies or small traders) is still critical, in which case it is possible to maintain its total daily trading volume at A level comparable to the traditional financial system.

It is no secret that the blockchain and cryptocurrency industries have liquidity problems. With the exception of the most popular crypto assets, all block trades have pushed the market to a worrying level (Translator's Note: The author's meaning is that block transactions of these crypto assets tend to cause price fluctuations). Such fluctuations can cause a series of problems.

- Re-understanding Bitcoin: 8 answers to Satoshi Nakamoto's wisdom

- Small mining companies help themselves: use financial derivatives to hedge hash rate fluctuations

- People's Daily Observation: How Manufacturing Plants Blockchain

First, it reduces the credibility of the market because there are or appear to be problems with price manipulation.

Second, it makes people nervous about holding assets, which means that applications that rely on low volatility are difficult to take off.

Third, it harms the viability of decentralized exchanges and other decentralized token economies, because when they rely on a slow-moving mainnet, they lag far behind faster and more efficient centralization Exchange price information.

Decentralized payment is just one aspect of what decentralization really means, because if you want to build and extend additional functional financial layers on blockchain-related protocols / applications, then you also need decentralized Help with liquidity!

Mobility is king! If you can't gather enough liquidity to help your project grow and make the use cases you are looking for available to your end users, then liquidity will determine the success or failure of your agreement.

With the proliferation and popularity of decentralized lending, the current decentralized landscape seems to have grasped the basic elements of financial instruments that we are already familiar with in traditional markets (the decentralized lending platform Compound is an example). To better understand what we are in, let's first dive deeper into what solutions the industry has found so far.

Liquidity pool

First, liquidity pools can help solve a key problem faced by new token projects: Before the project has practical utility, it needs to laboriously launch a network that provides liquidity.

For those tokens that do not yet have a large user base, the liquidity pool can alleviate the liquidity problem by providing a unique, less speculative reason for people to hold these tokens (i.e. in a fee To provide liquidity).

At the same time, the existence of a decentralized liquidity pool provides additional protection for large investors who invest in new projects, and they do not want to be forced to sell tokens in a market with insufficient liquidity. Therefore, the liquidity pool acts a bit like insurance for token holders (we will discuss this concept in detail below).

In addition, decentralized liquidity is being provided through a mechanism that does not exist in traditional financial markets- automated smart contracts . This is a brand new carrier that provides liquidity, creating the possibility for broader and more competitive participation in market making. Therefore, the liquidity pool is a weathervane for the decentralized cryptocurrency market to mature .

Although the total liquidity of these decentralized liquidity pools is still small by traditional market standards (the daily trading volume can exceed hundreds of billions of dollars), it is growing at an alarming rate.

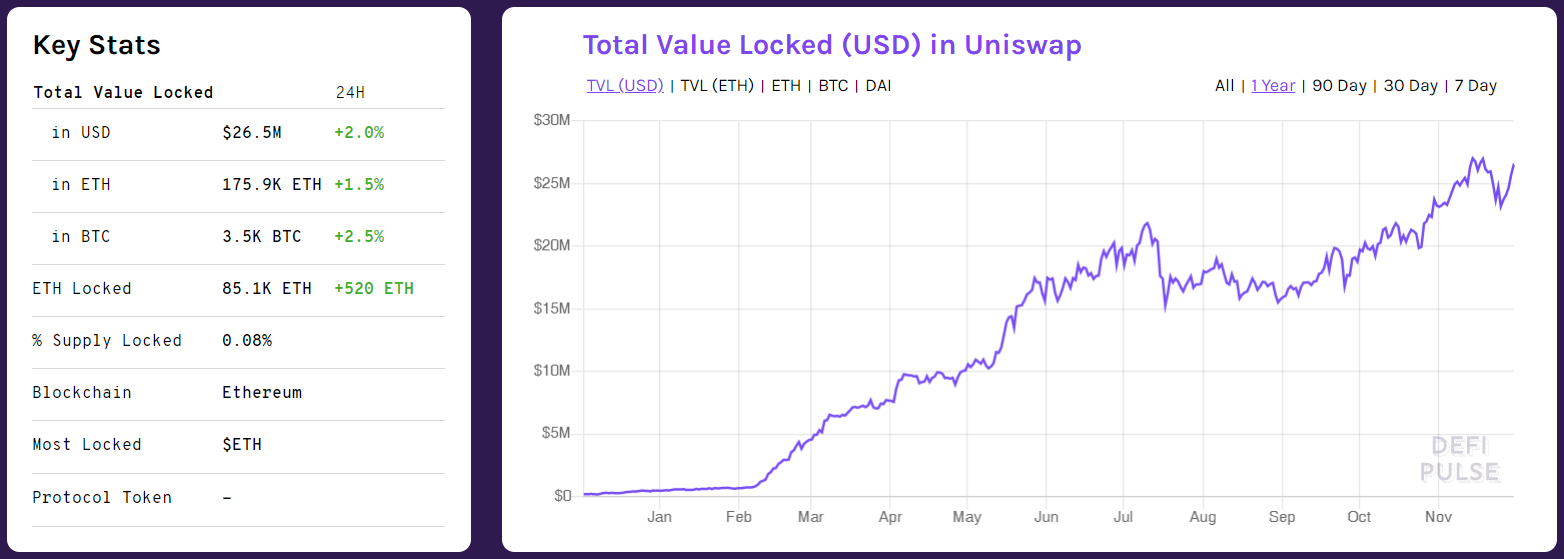

We take the decentralized exchange Uniswap as an example. The following is the growth trend of the total value of the US dollar locked in the Uniswap contract in the past year:

The total value of the US dollar locked in the Uniswap contract, source: defipulse.com/uniswap

Uniswap has become a leader in the field of decentralized liquidity . Each Uniswap exchange contract is a liquidity pool composed of 50% ETH assets and 50% target ERC20 token assets. Traders can directly purchase ETH or specific ERC20 tokens from the contract. It will bring the price of the asset (that is, the exchange rate between the ETH in the contract and the specific ERC20 token) to fluctuate in an algorithmic manner .

When there is a difference between this algorithmically determined price and the market price, the arbitrageur will narrow the gap by buying and selling token assets in the contract. Anyone can add liquidity to the contract by providing equivalent ETH and target ERC20 assets. Doing so gives them (i.e. liquidity providers) the right to a pro-rata transaction fee (0.3% per transaction), which is accumulated in the contract.

This article is a good starting point for understanding the basics behind the liquidity provided by Uniswap contracts. You can also get a deeper understanding here.

In addition, some other projects, such as the Kyber Network and 0x projects, focus on cross-chain liquidity and have their own ERC20 assets.

In a sense, the decentralized nature of any financial system depends on the source of its liquidity. After all, if there is no central bank, but a handful of "whales" serve as the central bank, what more can be said about the improvement of the traditional financial system?

When a large number of unrelated parties provide liquidity, liquidity is fundamentally stronger, which will make liquidity less likely to evaporate in a crisis and better reflect the market's health.

Therefore, the health of DeFi is largely related to the health of the decentralized liquidity platform. We are glad to see a lot of great teams to solve this key issue, and strive to start a new stage of maturity and innovation in this field, and provide important opportunities for investors. If they continue to grow, it may change the calculations of large investors interested in the cryptocurrency market but worried about liquidity risks.

[The copyright of the article belongs to the original author, and its content and opinions do not represent the position of Unitimes, nor does it constitute any investment opinions or suggestions. Posting articles is only for disseminating more valuable information. For cooperation or authorized contact, please send an email to [email protected] or add WeChat unitimes2018]

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can the founders easily take half of the "decentralized scam" that raised 30 million?

- Amun AG receives regulatory approval again to provide cryptocurrency ETP products in EU countries

- Popular science | Amazing, how can digital currency pay offline

- CCTV News: To build a new engine for high-quality development, General Secretary Xi Jinping has "numbers" in mind

- The technical route of the central bank's digital currency may have been confirmed, and ICBC shoulders the heavy technical burden

- Babbitt College × Weizhong Bank Open Course 丨 Talents become the bottleneck of blockchain landing, multi-field exploration technology integration

- Read the Defi popular project Synthetix in one article