Read the Defi popular project Synthetix in one article

Editor's Note: The original title was "Understanding Synthetix"

Blue Fox Note started focusing on Synthetix in May 2019. It was not well known at the time, but its data has developed rapidly.

Blue Fox Note mentioned earlier that one of the three DeFi giants (" Why DeFi is the second breakthrough in crypto history? " Before Blue Fox Note) is Synthetix, which is based on the total value of its locked assets. At the time of writing, the total value of its locked assets reached $ 167 million, second only to MakerDao's $ 338 million, surpassing Compound.

- Babbitt Column | The main driver of the evolution of consensus algorithms: humanity

- Babbitt Observation | Two Districts in Beijing rush to land in "sandbox supervision", more than 100 banks have entered the field

- A scam worth hundreds of millions of dollars: Why did HEX cause public outrage?

As one of the three giants, Synthetix is one of the most interesting and complex projects in the current DeFi project. So, what exactly is Synthetix? Many readers of Blue Fox Notes have been feedback that Synthetix is difficult to understand, why did it come up later?

Today's Blue Fox Notes briefly explain Synthetix. Synthetix is essentially a distribution agreement for synthetic assets (Synths), built on Ethereum. To understand Synthetix, we must first understand what synthetic assets are.

Simple understanding of synthetic assets

Synthetic assets are mainly simulations of certain assets. There are many simulated behaviors in our lives. This is very common in games. For example, in football simulation games, you can combine your favorite players. You can form a team including Messi, Mane, Debrauner, Van Dyke, Sun Xingyi, Aza Seoul and other players' teams. The data of all players comes from the actual performance. Based on these data, determine the final result of your dream team.

A more intuitive example of a synthetic asset is a simulation of some asset with a price. For example, a simulation of Tesla stock. You can simulate Tesla's stock to build synthetic assets, and even synthesize all the assets of the entire NASDAQ and NYSE.

Not only stocks, but also assets such as fiat currency, gold, and BTC. A synthetic asset is a simulated expression of the original asset, but it is not the original asset itself. It is equivalent to a “parallel world” of existing assets. At the same time, it is an alternative expression through the simulated expression of real assets Way of real assets on the chain.

Why is there a demand for synthetic assets? The demand for synthetic assets is mainly derived from transactions. The risk exposure of the asset is obtained by simulating an asset, thereby obtaining a possible opportunity to earn income. For example, Apple stock is not available for purchase in all countries. However, if the method of synthesizing assets is used, users can purchase the synthetic assets of Apple's stocks and obtain the gains of Apple's stocks. Of course, they will also bear the risk of falling.

Sythetix is a distribution agreement for synthetic assets

Synthetix is a synthetic asset distribution agreement based on Ethereum. Synthetix currently supports the issuance of synthetic assets including fiat currencies, cryptocurrencies, and commodities. Among them, the fiat currency mainly includes the US dollar (sUSD), the euro (sEUR), and the Japanese yen (sJPY), but currently it is mainly sUSD. In terms of cryptocurrencies, there are Bitcoin (sBTC) and Ethereum (sETH) .In addition, there are reverse crypto assets, such as iBTC. When the BTC price falls, the iBTC price rises, thereby making a profit. Commodities are currently dominated by gold (sXAU) and silver (sXAG).

Why do people use Synthetix?

Synthetix is not only an agreement to issue synthetic assets, it is also a trading platform for synthetic assets. The main purpose people use it for is trading. For example, suppose that a user expects a certain crypto asset (such as BTC) to rise, then you can obtain an opportunity to earn income by purchasing a synthetic asset (sBTC) of the asset, whose price is the same as the price of the asset in reality, which means Once the user purchases, the ups and downs of the asset are also accepted.

Can these needs be met directly through the exchange? Why is it done on Synthetix? Here are a few user needs: Transactions on Synthetix are conducted in a decentralized model, without the need for counterparties, and without worrying about liquidity and slippage issues. The transactions on its exchanges are all performed through smart contracts, which are transactions on smart contracts, not order book transactions. These have their unique trading experience and some advantages. The exchange rate of synthetic assets comes from the oracle.

In addition, through synthetic asset transactions, you can achieve transactions in the asset without actually holding the asset, such as without holding btc or holding Apple's stock. This type of transaction can reduce the friction of asset exchange, and can be quickly exchanged between different types of assets, such as Tesla stocks, gold, soybeans, bitcoin and other different assets, so synthetic assets can help investors Reaching a wider range of assets.

Finally, arbitrage can also be achieved. sUDS is pegged to USD, but sUSD is traded on the open market and may be less than 1 USD. SNX mortgagors generate synthetic assets by collateralizing SNX, and also create debt. After they sell synthetic assets, when sUSD is less than 1USD, they repurchase and use them to destroy and reduce debt, thereby arbitrage.

How Synthetix Works

Synthetix, like other asset issuance agreements, also requires asset collateral to be issued. For example, the MakerDAO protocol needs to mortgage ETH to generate dai. Synthetix is similar, but it is staking its native token, SNX. As long as users lock a certain amount of SNX in their smart contracts, they can issue synthetic assets. Among them, the pledge rate is very high, which is 750% of its issued assets. Only when it reaches the target threshold of 750% can it have the opportunity to receive transaction fees and SNX new token rewards.

Similar to MakerDAO, when SNX mortgagors create synthetic assets, they generate "debt." And this "debt" is variable.

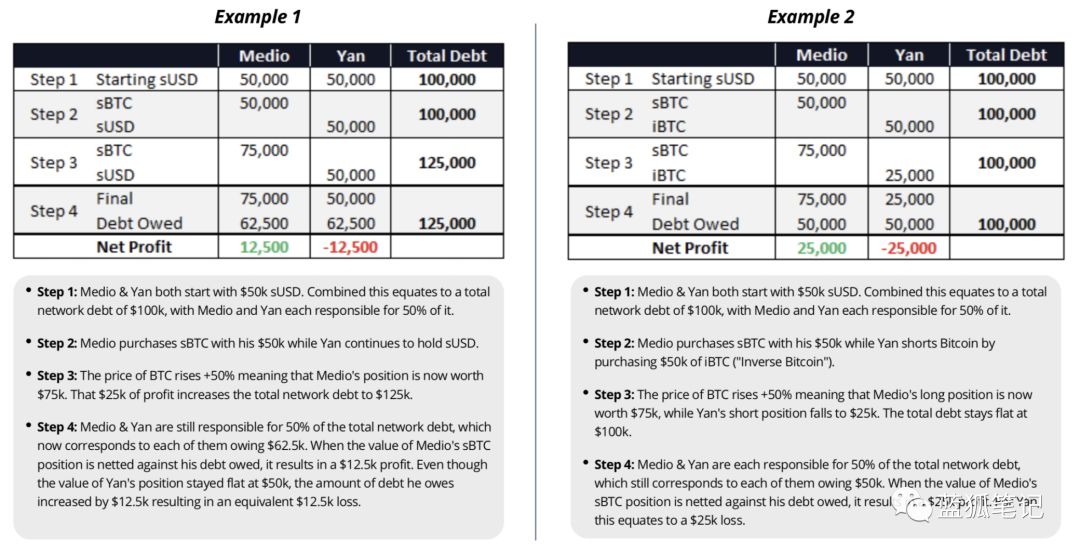

For example, if 100% of the system is sBTC, assuming that the sBTC price is halved, the total debt in the system is also halved, and the debt of each mortgagor is also halved. Conversely, if the sBTC price doubles, the total debt in the system will also double, and the debt of each mortgagor will also double. If sBTC takes up half, if sBTC's relative price increases by 50%, then in the end, all people's debt will increase by 25%. As sBTC synthetic assets grow by 50%, then, relative to the increase in debt, there is still a 25% gain. The other half of the synthetic assets increased debt by 25%, but its price did not increase, which resulted in a loss of 25%. In other words, this mechanism has caused SNX mortgagors to become counterparties to all synthetic asset exchanges. The mortgagor needs to bear the entire debt risk in the system.

(Picture from Synthetix white paper)

The Synthetix system is essentially a system for generating, trading, and destroying synthetic assets. For the operation of the system, the most important participant is the equity pledger who mortgages SNX assets to issue synthetic assets. It is different from MakerDAO in that users who issue synthetic assets not only do not have to pay a stable fee, but also can get the transaction fees of Synthetix exchange. As a result of this mechanism, SNX holders are encouraged to lock SNX and synthesize assets. This also means that SNX can capture the transaction costs of its synthetic assets.

The main purpose of users using synthetic assets is to trade. To synthesize assets, we must first mortgage the assets.

Issue synthetic assets

In order to issue synthetic assets, the premise is to mortgage sufficient native assets SNX (currently requires a 750% mortgage rate to get rewards). When users hold SNX, they can use Mintr to mortgage their SNX tokens to generate synthetic assets.

After mortgage, a mortgage rate and debt record are generated, and a corresponding proportion of rewards can be obtained according to the contribution. This ultra-high mortgage rate incentive mechanism is mainly to ensure that the mortgage assets supporting synthetic assets can cope with large price fluctuations.

In order to encourage mortgagors to maintain a sufficiently high mortgage rate, as mentioned above, currently Synthetix stipulates that in order to receive transaction fee rewards, its mortgage assets must be 750% of the issued assets. If it is below this threshold, the pledger cannot get a reward for transaction fees. This will prompt mortgagors to increase their mortgage rates, deposit more SNX, or destroy synthetic assets.

Mortgage debt is the amount of synthetic assets generated. They are stored in Synthetix Drawing Rights (XDR), and the price of these synthetic assets fluctuates according to the price of the oracle, that is, their debt is variable.

When the debt is distributed to the mortgagor, the Synthetix smart contract will issue new synthetic assets and add them to the total supply, and the new synthetic assets will also be distributed to the user's wallet. Since synthetic assets are over-collateralized with SNX, it has a target threshold of 750%. If the value of SNX increases, then SNX can be unlocked accordingly, and of course, it can also issue more synthetic assets.

2. Trading synthetic assets

The process of trading synthetic assets is essentially the process of destroying the original synthetic assets and generating new synthetic assets. Suppose sUSD is exchanged for sBTC. First, the corresponding amount of sUSD in the user's wallet address is destroyed, and the total supply of sUSD is updated. After determining the exchange rate according to the price of the oracle, a part of the transaction amount (such as 0.3%) is sent as the transaction fee and sent To the fee pool (applied by all SNX mortgagors in proportion), and the remaining portion is issued by the smart contract of the target synthetic asset, and at the same time the user's wallet balance is updated, and the total supply of sBTC is updated.

From the above process, it can be seen that the transaction of synthetic assets mainly interacts with smart contracts. There is no order book and no counterparty. For its system, its asset trading is just a matter of swapping debt from one synthetic asset to another. This way users don't have to worry about liquidity issues.

3. Destruction of debt

When a SNX asset mortgagor wants to reduce debt or exit the system, it needs to destroy the synthetic assets first. For example, the mortgagor generates 1000 sUSD through the SNX mortgage. In order to unlock the SNX mortgaged, the user needs to destroy the 1000 sUSD first. If the debt pool changes during the mortgage period (and personal debt also changes), this may result in users needing to destroy more or less sUSD to destroy their debt. The operation process is completed through smart contracts. Synthetix smart contracts will determine the user's sUSD debt balance, then delete it from the "debt register", destroy the corresponding sUSD, and update the sUSD balance of the user's wallet and the total supply of sUSD. After that, SNX unlocked successfully.

4.Synthetix's Debt Pool

In general, SNX holders always generate or destroy synthetic assets, which means that the system's debt pool will change. The system will determine the debt of each SNX mortgagor at any future point in time based on the generation and destruction of synthetic assets, and it is not necessary to actually record the debt changes of each mortgagor. Because it updates the Cumulative Debt Increment Ratio on the Debt Register, this keeps track of the percentage of each mortgager's debt. Each time a synthetic asset is generated or destroyed, the system multiplies the number of tokens in all synthetic asset smart contracts by the current exchange rate to calculate the total issued debt.

SNX value capture

First, SNX is the only mortgage asset currently issuing synthetic assets. SNX is equivalent to working tokens entering the Synthetix system.

Second, capture transaction costs. For transactions that occur on Synthetix, for example, if the user exchanges sBTC for sETH, then 0.3% of the transaction fee will be generated, and this fee will be deposited into the fee pool as XDR. SNX mortgagors can claim expenses in the fee pool each week according to the corresponding proportion of their staking (distributed according to the proportion of each lender's issued debt). From December 2018 to the time of writing, a total of $ 3.2 million was incurred. If a mortgagor issues 10,000sUSD of debt, assuming the total debt is 20,000,000 sUSD, then its debt ratio is 1/2000, assuming the total cost of the period is $ 3,200,000, then the mortgagor can get a cost reward of $ 1600.

Finally, SNX's new token rewards. SNX is an inflation token, and its total supply will increase from 100,000,000 tokens in March 2019 to 245,312,500 tokens in March 2024. The newly added tokens will be proportionally rewarded to SNX mortgagors whose mortgage rate is not lower than the target threshold (currently 750%, which may change in the future).

Possible risks of Synthetix and areas for improvement

Synthetix's history is only about a year, and the overall system is still in the experimental stage, and its risks include the volatility risk of crypto assets. The issue of synthetic assets itself is subject to exchange rate fluctuation risks. Sometimes when exiting the system to unlock SNX tokens, the mortgagor may need to consume more synthetic assets than when it first started generating synthetic assets.

Synthetix uses native token collateral instead of ETH as MakerDao. If the price of SNX drops sharply, the value of the mortgage asset will plummet, which may cause system problems. Since Synthetix also lacks a corresponding mechanism (for the time being there is no global clearing mechanism similar to MakerDAO) to protect the interests of synthetic asset holders, there may be extreme cases where synthetic assets cannot be paid. In order to cope with the problem of excessive price fluctuations of SNX, it uses an ultra-high mortgage rate, which can be rewarded more than 750%. This also limits its scalability.

The oracle is also a key issue. Currently, it adopts a partially centralized model. In the future, there are plans to integrate decentralized oracles such as chainlink.

Currently Synthetix's collateral is only SNX, no ETH or anything else. For most people, there are some barriers to buying SNX and pledge. Synthetix needs to be expanded and more people are required to participate. If users are allowed to exchange Dai with sUSD, it will be easier for users to enter and expand the system's liquidity. In addition, synthetic assets can also introduce borrowing and derivatives transactions, and there will be more exploration. Finally, the interface, transaction type, and speed of the current Synthetix exchange need to be improved.

Conclusion

Synthetix is a synthetic asset distribution agreement based on Ethereum. It is convenient for traders to access more types of assets and to trade with less friction. It has no counterparty and does not need to worry about insufficient liquidity and slippage. By gaining exposure to different assets, traders get a better trading experience.

Synthetix uses the native token SNX as collateral assets to generate synthetic assets, and its ultra-high mortgage rate locks more than 80% of SNX. Of course, the security of the Synthetix system depends on the value support of SNX itself. Possible risks such as cryptocurrency price fluctuations, oracles, and system vulnerabilities need to be further tested in actual combat. In general, Synthetix has completed a cold start in just one year and formed a certain scale, which is rare in DeFi.

Risk warning: All articles of Blue Fox Note can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Beijing's "regulation sandbox" experiment is about to begin, and the road to blockchain compliance begins?

- Article predicts five major impacts of secure multiparty computing (MPC) on the blockchain industry in 2020

- Featured | Some secrets about DAO that you can't see at the developer conference

- Opinion | The open source of hardware wallets does not represent a wallet upgrade, but a major security compromise

- Bakkt plans to launch a set of digital currency products in 2020, similar to Brent crude oil futures contracts

- Gospel for institutional investors, SEC approves first Bitcoin futures investment fund

- Li Lihui: China leads the way in the development of fiat digital currencies