Perspectives | Two Sides of Ethereum

"We always imagine that in science fiction movies, there will be something that looks like humans, and will reveal the mask to confirm that it is a robot … In reality, it is exactly the other way round. We removed the robot's mask and confirmed that it was actually A person……"

-Eric Weinstein 's metaphor when explaining The DAO fork

A controversy

It is often argued that cryptoeconomic systems (blockchain; or Bitcoin and Ethereum) are functions of social contracts or functions of automated / unattended code.

What drives it all? Is it a person or a computer? The hypothesis on the Bitcoin side is that we should eliminate human intervention wherever possible. The idea is that interpersonal trust systems can not be as scalable as human-machine trust systems . Therefore, any human participation in the blockchain protocol cannot be easily trusted and should be treated with caution. Humans always mess things up; computers always run according to programmed programs.

- Mining mystery: when halving prices encounter epidemics

- Blockchain under the epidemic: inefficient and predictable future

- Weekly development of listed companies' blockchain business: In the first week of market opening, 5 companies invested in blockchain business

In my opinion, the view of the Ethereum ecosystem is not enough. This is also related to people's ultimate concern about the DeFi ecosystem, that is, DeFi is not completely decentralized , or humans are involved.

Two angles

Elimination of human intervention

One of the core assumptions of blockchain and cryptocurrency is that we can delegate financial tasks and transactions to fully automated code. We no longer need humans to manage the value we have, and computers can do the job. And it can actually do more beautifully.

But which active participation can be stripped from such a system? Can we be 100% free from people to participate?

Hasufl doesn't think so . Bitcoin is a fully automated system, and it seems that all human intervention has been completely eliminated. But according to Hasu, this does not mean that the social contract is not important in this system.

The Thestics may argue that the social contract itself is something that needs to be eliminated. PoW's incentive structure and fixed-supply assets can strongly transform humans into brainless zombies for Satoshi Nakamoto, serving this chain forever.

Complete human control

This model is a bit like my company RealT. We tokenize real estate and calculate rents on a daily basis, it only takes a few minutes to register! Buy RealToken today and receive rent tomorrow! That's right, for non-US citizens! We can also take back your token. Long live centralized!

The cool thing about Ethereum is that it allows companies like RealT to exist. We don't need blockchain to provide our products, but we do need Ethereum and its DeFi ecosystem to give us a competitive advantage over our peers who use paper and ink to work.

This leads to the core point of this article:

There is a spectrum that corresponds to all possible human-machine trust protocols, and Bitcoin and RealT are the two ends of this spectrum.

MakerDAO

MakerDAO is often criticized for their MAK tokens being concentrated in the hands of large households. MKR represents the governance authority for the MakerDAO system, so it needs to be widely distributed in order to "decentralize" governance. However, three points need to be pointed out :

- MakerDAO itself is not a blockchain, it does not require the highest degree of decentralization.

- There are now 16,351 addresses holding MAKs. Compared to the number of shareholders voting in a company, this degree of decentralization is already several orders of magnitude larger (more importantly, the permission to hold MKR is not required).

- Like all tokens, MKR will also increase entropy. Time brings decentralization.

99% of activities on MakerDAO do not require human supervision and intervention. MakerDAO is a protocol . From the perspective of "no one is required to process all transaction requests from consumers", it is automated (like Bitcoin, unlike RealT). The only scenario that requires human involvement is protocol change / upgrade. If you like, it can also be called software upgrade.

Bitcoin has created an incentive system that turns humans into brainless zombies for Satoshi Nakamoto. The Maker system is also the same: a rational economic person will make a rational decision and choose a result that is beneficial to the system. Here is an article explaining how MakerDAO turned everyone into an MKR zombie .

But there are differences between the two: Bitcoin is a plug-and-play system that does not require humans to make choices (as of the moment the plug-and-play is decided). Maker needs the subjective opinions of economic agents, and hopes that the public psychology, which is the basis of the efficient market hypothesis , can also create a secure MakerDAO system .

After all, the reason is the same: the more distributed the MKR and the more voting activities, the more brainless MKR zombies working hard to maintain MakerDAO. The distribution and voting activities of MKR, as well as the engineering security of the MakerDAO protocol, will enable MakerDAO to obtain the same supporting power as Bitcoin: automated anti-fragile software with minimal human involvement (for discussion, see "On the MakerDAO's Anti-Vulnerability ") .

However, the human involvement required to maintain MakerDAO is always higher than Bitcoin, because it requires human initiative .

Big problem

- Has MakerDAO fully deprived human participation and made itself socially expandable?

- Would it be better if the more human involvement was stripped away? Or is it too late?

- How does human participation affect long tail risk? What is the probability that MakerDAO will encounter the Black Swan incident because of human governance than Bitcoin? What benefits does MakerDAO get from human participation compared to the cost of the Black Swan incident?

Uniswap

Uniswap (decentralized exchange) is another good example. Vitalik Buterin often says that Uniswap is his favorite Ethereum application because it is simple and completely eliminates all human involvement. You see, Vitalik is also a bitcoin pie in this regard!

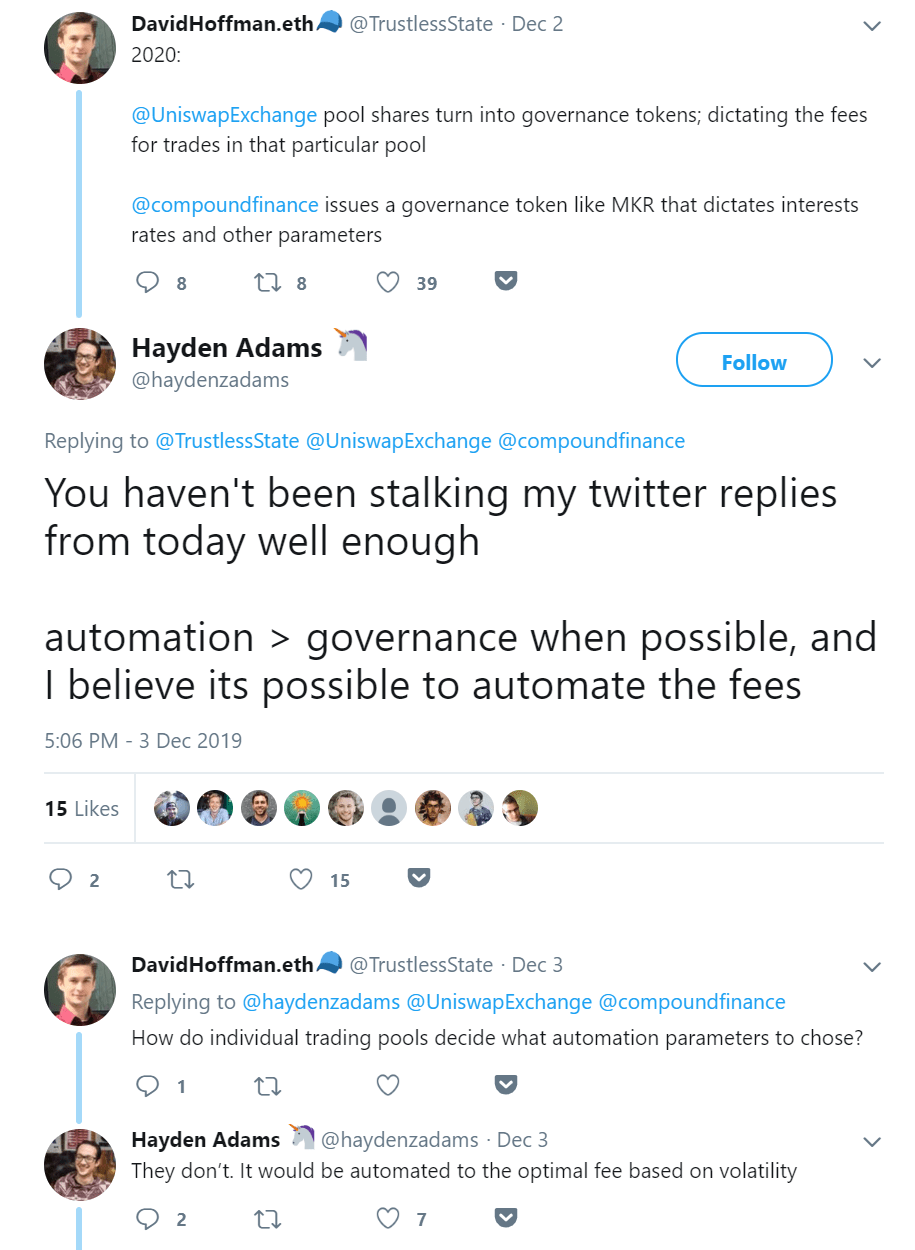

I recently wrote a tweet suggesting that Uniswap could turn their liquidity provider token (a token representing the liquidity provider's right to claim assets in the Uniswap fund pool) into a governance token. In this way, they can adjust the fees they charge. We can let Uniswap LP token holders manage their pool of funds, just like MKR governs MakerDAO.

Uniswap founder Hayden Adams responded to me why Uniswap takes the path of full automation and deprivation of human participation:

-Hyden: "As long as it is possible, automation is better than governance. I believe the fee standard can also be automated."-

My theory is: LP token holders will choose the most appropriate fee standard for the transaction pool in which they are located to ensure that it best matches the market's supply / demand situation.

Hayden's theory is that if a protocol can perform a complete function with fully automated code, it should do so.

You see, this is the one I mentioned above, the core assumptions of blockchain and cryptocurrency.

Hayden asserted that if a token has governance functions, you are actually creating two different sets of incentives. The two sets of incentive mechanisms are not necessarily compatible .

For MakerDAO, the risk of the Black Swan incident is determined by the degree of incompatibility between the interests of MKR holders and DAI holders . If you think this risk is too great, you are a Bitcoin pie. If you think this risk is manageable, you are an Ethereum.

If you are a developer developing an application on Ethereum, please keep in mind that the application requires human participation is not a problem. The Bitcoin pie will definitely yell at you and talk harshly, but you can ignore them. Something on Ethereum is your world. However, if your application can run without human intervention, you should probably adopt this model by default , because Bitcoinists have reasons to say this.

The world of automated code

The Ethereum white paper can stimulate everyone's imagination because it combines non-stop code with Turing's complete programming language . When early investors imagined the future of Ethereum, they did not imagine the emergence of RealT. What they imagine is Uniswap .

But Ethereum has many futures. One of them is a world of completely automated, non-stop applications. Uniswap is part of this world (maybe Augur too).

Other applications, although close, are not as thorough as Uniswap. Again, this is the power of Ethereum : It requires no human involvement to be a big deal. There are so many applications on Ethereum, distributed throughout the "Human-Machine Protocol Spectrum" shown above, most of which have worked well so far. Most are still standing, and new sprouts emerge every day.

The Ethereum applications that are covered in human skin have not been damaged by the storm. Although, as some bitcoinists worry, winter is coming. But who knows? Maybe Ethereum will experience frictions among some nation-states, some regulatory resistance, and then move to the future. Maybe Ethereum will be welcomed by those who have power. Maybe Yang Anze will win the election and set up a working group to support cryptocurrency. Or, maybe Joe Biden will win the election, and he believes that Bitcoin is used to buy drugs.

I really don't think we can accurately predict how power will treat these systems.

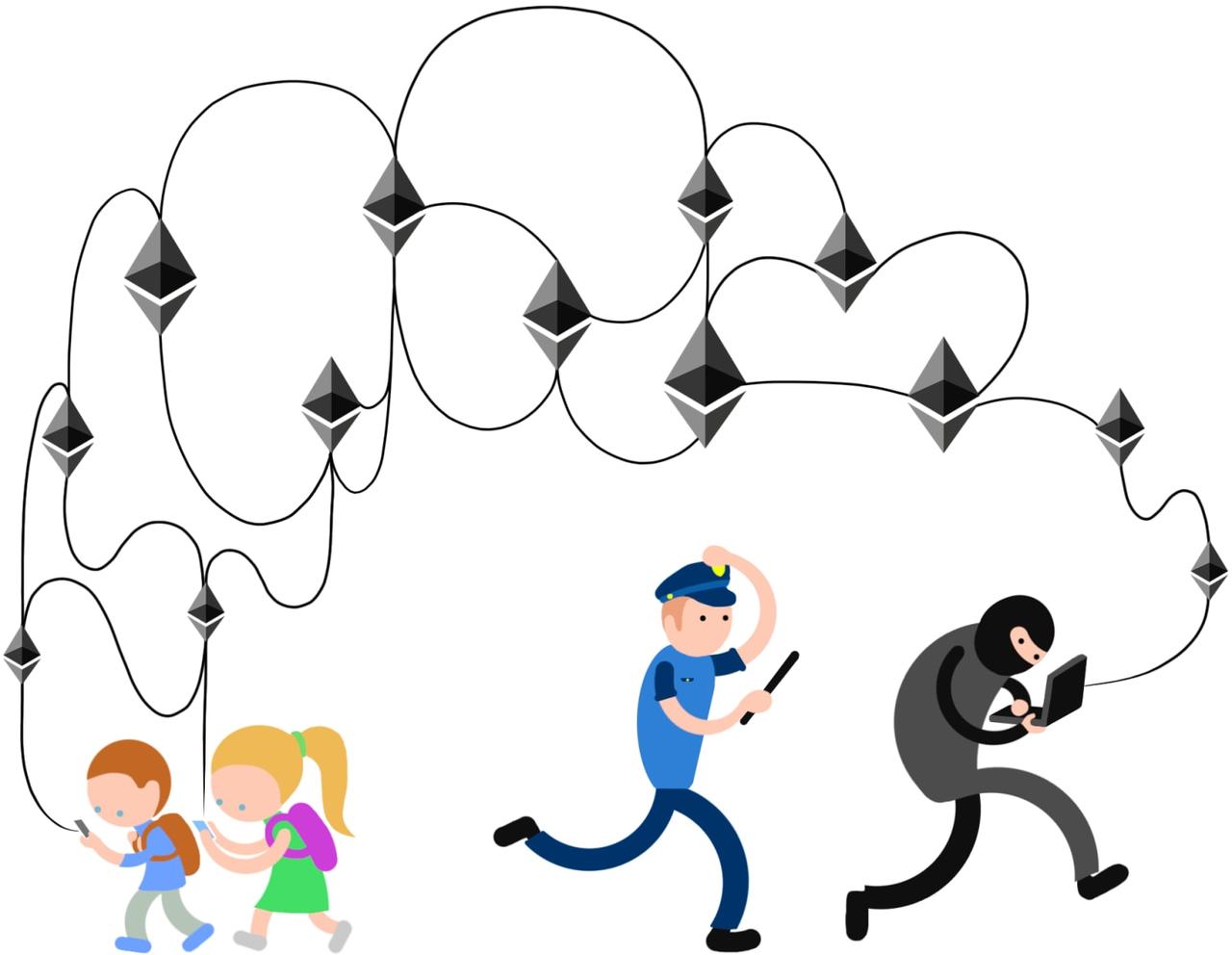

Hydra Ethereum

Ethereum is a Hydra with many faces.

EtherDelta was killed by the SEC because it was too manual and too easy to be targeted.

Ironically, this fallen Ethereum application was quickly completely replaced by its fully automated counterpart Uniswap. Token exchange on Uniswap requires only one transaction, and 8 transactions on EtherDelta, so Uniswap is much more user-friendly and easier to combine with other applications.

After the head of EtherDelta was cut off, Ethereum soon developed a new head, Uniswap, which does not require human intervention and is also a better product objectively.

Although I have said that it is pointless to guess how national authorities would view activity on Ethereum, there is one more point.

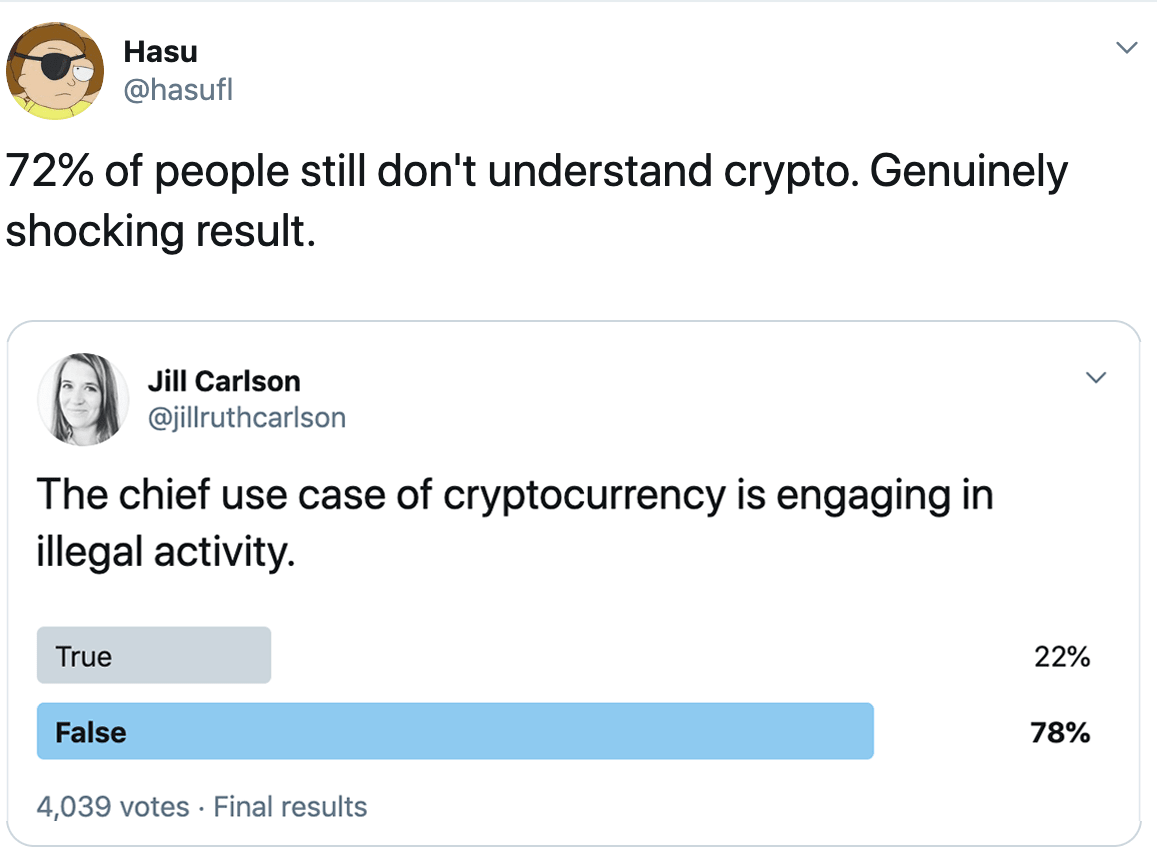

Imagine that from the perspective of various countries, there are many Ethereum applications doing illegal things. But according to Hasu, this is the main use of cryptocurrency.

My opinion is: Hasu is right, for now. The future development of the chain will join many compliant businesses. But for now, non-compliant, illegal applications will appear first because they will not face external competition.

A thought experiment

Suppose that more than half of the Ethereum applications are doing illegal things, and countries are ready to join forces to stop these illegal activities.

Who will they start with in this case? Is it for Ethereum, or for applications that engage in illegal activities?

I don't think they will target "Ethereum" because Ethereum is not doing those things.

-Ethereum will become the air we breathe. Picture from ultraviol.eth-

Attacking Ethereum requires money. This is the biggest deterrent.

Attacking Ethereum applications:

- Or the same cost as attacking Ethereum (eg Uniswap, Augur)

- Either the cost is lower, because some groups manage applications (such as MakerDAO, Compound)

It is worth mentioning that applications like PoolTogether have artificial parts, but it can be easily removed by patching. Writing a PoolTogether without human involvement is too easy. These applications don't do this now because manual entry makes it easier to maintain, iterate, and scale their products. (Translator's Note: PoolTogether is a lottery application. The funds invested by users will be pooled into the Compound lending market to lend and collect interest. Interest is used to win prizes. Users who have not won can get back all their own funds (only no income ).)

Darwin's battlefield

The core function of Ethereum is Turing completeness. Without Turing's complete code, Ethereum would not be able to host applications controlled by people.

This freedom gave Ethereum a Cambrian explosion of interoperable applications in 2018/19. This freedom is that all possible applications, products and services can be developed on Ethereum.

But this freedom is also a double-edged sword, which can bring great risks. We've seen things like hacking (The DAO), being shut down by regulators (EtherDelta), and seeing the growth rates that Silicon Valley startups dream of.

Applications like MakerDAO and Uniswap are clearly "adapted" to Ethereum.

I often say that Ethereum is a "landscape", but I rarely say that EVM of Ethereum is a 3D world of digital value applications . The infinite space of Ethereum is the space of all applications that may be developed on Ethereum. Applications can fill all the gaps in the world of Ethereum, forming an infinitely diverse spectrum. The "human-machine trust" spectrum is one of the most important spectrums on Ethereum.

Code = DNA

Every one on Ethereum should have its own DNA. Each application is unique and fills a gap in the Ethereum world. Each application has its own nutritional base (user, value), and some applications are more useful than others . Although the space of Ethereum allows all possible applications to grow, there is not necessarily room for them to grow at the same time. Therefore, Ethereum applications are also in the struggle for survival of the fittest.

Ethereum means two things:

- The space where all applications are located

- A collection of all applications growing in this space

This space is the battlefield where Ethereum applications are located. Apps compete for users, value, and mobility. Applications and competitors outside Ethereum also have to compete for users, value, and liquidity. They are indispensable .

EtherDELTA is not suitable for survival. It took advantage of a very prosperous market uptime and had no competitors, but quickly died out. Even if the SEC didn't kill EtherDELTA, Uniswap's great user experience would kill it.

Ethereum development will fill gaps

Products that can adapt to Ethereum will naturally fill the gap.

The blank range is determined by both :

- User needs / wishes-how fertile this world is

- The ability / motivation of external forces to intervene-how sinister this world is

The next 10 years of application growth will follow this pattern :

- Provide products that meet user needs

- See if it can survive the harsh environment

Over time, applications will continue to be downgraded and tied to Ethereum. The struggle for survival of the fittest will tune up Ethereum applications and let them fill the most fertile part of the Ethereum world.

Naturally, the Ethereum application will consider the following factors to find a balance:

- Cake size

- Number of competitors eating cake

- Risks of application when eating cake

-Thanks to idecentralized for presenting this metaphor. Picture from ultraviol.eth-

Hydra Ethereum

As Ethereum survives longer and longer, it will eventually become the space where a group of applications that can pass the Darwin test reside.

One of my favorite metaphors comes from Kenny Rowe , who calls these cryptoeconomic blockchain protocols, such as Bitcoin and Ethereum, the young organisms that are growing.

Kenny likens Bitcoin to being a street teenager who can survive on his own; Ethereum may be too young to survive on its own.

As Ethereum goes through the test of natural selection, we will also see weak applications being killed, eaten, or starved, replaced by more powerful and efficient applications.

Naturally, Ethereum will also become stronger and stronger. Every application on Ethereum that can adapt to the environment will become the infrastructure for subsequent applications . Composability not only helps to increase the number of applications, but also helps applications to pass the test of the fittest.

Every automated, non-stop application will lay the foundation for subsequent automated, non-stop applications, and make Ethereum a bit more powerful.

(Finish)

Original link: https://bankless.substack.com/p/the-two-faces-of-ethereum Author: David Hoffman Translation: A Sword

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Morgan Creek founder Pomp: Limited supply and increased demand will bring Bitcoin to $ 100,000 by the end of 2021

- "Secret History of Bitcoin" (7): What is the Bitcoin Alert System?

- The biggest public enemy of the "epidemic"-trust, to overcome its most effective weapon-blockchain

- Observation | Fed: Central Bank's Digital Currency Research and Policy Development Leading the Way

- Nearly halved, Wechsler Ratings raises Bitcoin rating to A-

- Coinbase: Bitcoin will highlight scarcity after halving, digital gold is worthy of the name

- Blockchain empowers community-based epidemic prevention