Jump Trading’s Crypto Waterloo: Forced to Exit US Crypto Trading Market, Facing Terra Class Action Lawsuit

Jump Trading exits US crypto trading market and faces Terra class action lawsuit.Author: Joy, PANews

For traditional high-frequency trading giant Jump Trading, which entered the cryptocurrency industry with Jump Crypto in 2021, the past year has undoubtedly been a year of setbacks.

From the hack of the cross-chain bridge Wormhole to the death spiral of Terra, the collapse of FTX, and the serious damage to the Solana ecosystem in which it is heavily invested, Jump Crypto has suffered significant losses. Recently, Jump Trading was reported to have withdrawn from the cryptocurrency trading market in the United States due to tightening regulations. In addition, it has been hit with a class action lawsuit by Terra investors and has been confirmed by the SEC to have made nearly $1.3 billion in profits from trading on Terra.

Class action lawsuit alleges Jump helped Terra return to anchor

After the collapse of FTX, US policymakers and regulators have increased their scrutiny of the cryptocurrency industry. According to Bloomberg, as regulatory agencies intensify their crackdown on the cryptocurrency industry, market makers Jump Trading and Jane Street are exiting the cryptocurrency trading market in the United States. It is reported that both companies continue to provide market-making services and have not completely abandoned the cryptocurrency industry. However, Jump Trading’s digital asset trading department, Jump Crypto, is withdrawing from the US market, but it still plans to expand internationally.

- With a massive user base in the world of cryptocurrency, could MetaMask become the Google of Web3?

- Inventory of the current situation of top NFT fragmentation protocols: the overall market has turned cold, with both trading volume and user activity plummeting.

- Is the BRC-20 that cuts through the night sky a nova or a meteor?

At the same time, a class action lawsuit against Jump Trading has also pushed it into the spotlight.

A New Jersey resident named Taewoo Kim filed a lawsuit on behalf of affected investors on May 9, claiming that Jump Trading was an early partner and financial supporter of the failed stablecoin project Terraform Labs, and that it played a role in a fraudulent scheme involving Terra, causing investors who invested in related cryptocurrencies to lose at least $40 billion.

The lawsuit alleges that negotiations between former Terraform CEO Do Kwon and Jump began around November 2019 and included a series of agreements, including Terraform lending Jump 30 million LUNA tokens, enabling them to provide market-making services for LUNA and UST. Jump reportedly had the right to receive compensation, including LUNA tokens at a significantly discounted price, in return.

In fact, in the year before Terra’s collapse in May 2022, there was a UST anchor break on May 19, 2021, which caused a 10% drop. The lawsuit alleges that on May 23 of that year, Kwon and Jump conspired to boost the price of UST and aUST (the token used on the Terra lending platform Anchor). Between May 23 and May 27, 2021, Jump Trading bought more than 62 million UST tokens. These transactions were conducted on multiple cryptocurrency trading platforms to conceal Jump’s manipulation. Therefore, investors believe that Jump’s actions helped Terra temporarily restore the illusion of UST being pegged to $1.

Kwon later said that the UST’s rebound after the incident demonstrated its mechanism’s self-repairing ability and its ability to remain stable and pegged to the US dollar. This incident also led many people to believe that it was a validation and proof of strength for the UST mechanism, misleading many investors to trust Terra. However, it was unexpected that the so-called self-repairing mechanism was actually manipulated by institutions.

SEC accuses Jump of profiting nearly $1.3 billion in Terra transactions

The US Securities and Exchange Commission (SEC) filed a civil lawsuit against Terraform Labs and Do Kwon in February of this year, alleging that they used a “US trading firm” to support the price of UST in May 2021 to mislead investors. The Block reported that Jump Trading was the trading firm accused by the SEC.

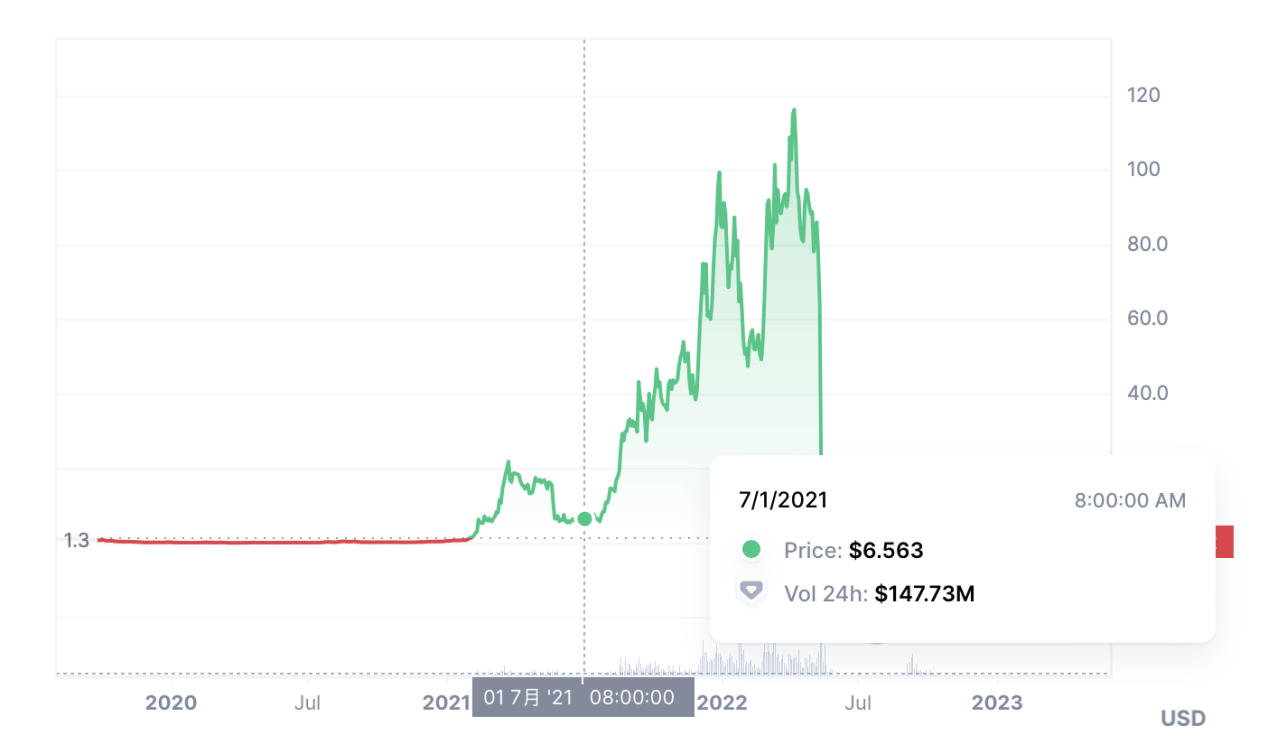

Recently, in a class-action lawsuit, SEC court documents revealed that Terraform had been working with this trading firm since around November 2019. The firm provided market-making services for Luna and UST in exchange for compensation and was usually able to acquire Luna at a cost lower than the current market price. After the trading firm intervened to help support UST in May 2021, Terraform and Jump signed an agreement in July 2021 to transfer 61.4 million LUNA tokens to Jump at a fixed price of $0.4 per token. This arrangement will remain in effect for the next four years, regardless of the actual market value of LUNA, which reached a high of $116 on the secondary market. The SEC stated that this arrangement enabled Jump to earn a net profit of $1.28 billion. Looking back at LUNA’s historical trends, it was precisely after July 2021 that LUNA began to skyrocket.

It was precisely such a deep interest relationship that allowed Jump to continue to increase its position in Terra. Jump seemed to have realized early on that it was difficult to maintain the anchoring of UST with just LUNA, so it led a $1 billion financing round for Terra’s ecology LUNA Foundation Guard (LFG) in February 2022 and suggested creating a Bitcoin reserve pool to defend the value anchoring of Terra’s stablecoin UST. However, everything was too late, and Terra quickly collapsed three months later. Even at the critical moment of Terra, Jump still promised to provide funding support for LFG, but this financing may not have been in place yet, and Terra quickly died in the spiral stampede.

It is worth mentioning that in the FTX insider trading incident, insiders pointed out that Alameda and Jump were colluding to raise the fully diluted valuation (FDV) of Serum to a price beyond its actual value, in order to facilitate the use of Serum for collateral and obtain more liquidity funds.

Currently, Do Kwon is on bail in Montenegro, waiting for trial, and he has been accused of attempting to use a forged Costa Rican passport. The United States and South Korea are both seeking his extradition. Jump has not responded to media requests for comment. According to Bloomberg, due to increasing regulatory pressure, Jump Crypto, the digital asset trading department of Jump Trading, is planning to expand internationally and exit the US market.

Jump and Terra’s Waterloo is also the Waterloo of the entire cryptocurrency market. The crypto world advocates transparency and decentralization, but insider trading and the manipulation of large institutions maintain superficial prosperity, although it will eventually backfire, it also makes more ordinary investors pay the bill or even accompany the funeral.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Deep observation of the NFT market in 2023

- Opinion | When Bitcoin prices plummet in the next few years, gold will "land on the moon"

- Institutional investors boost Bitcoin to $ 7,000

- Babbitt column | How to predict the extreme price of cryptocurrency? Here are a few data to help you

- QKL123 market analysis | It is obviously related to dark web activities, and the demand for Bitcoin has dropped sharply? (0402)

- Over 30% of mined BTC is inactive, and the exchange becomes the largest HODLer

- For a story after a thousand years-Github bitcoin source code freezes Norway