Ping An and Zhong An lead: The Silver Insurance Regulatory Commission encourages the application of blockchain and the entry of nine insurance companies

Blockchain + insurance industry may usher in major development opportunities.

On July 16, the China Insurance Regulatory Commission issued the "Guiding Opinions of the General Office of the China Banking Regulatory Commission on Promoting the Entity Economy of Supply Chain Financial Services" to the major banks and insurance companies (hereinafter referred to as "Opinions").

The "Opinions" require that banking financial institutions should conduct due diligence and professional judgment on the authenticity and rationality of transactions when conducting supply chain financing business. Bank insurance institutions are encouraged to embed new technologies such as the Internet of Things and blockchain into the trading session, using mobile sensing video, electronic fences, satellite positioning, and radio frequency identification to remotely monitor logistics and inventory goods to improve the level of intelligent risk control.

For the “blockchain+insurance industry”, this is undoubtedly a major policy benefit.

- JP Morgan Chase CEO dilutes the effect of Libra coins: we will talk again after at least three years

- The top 5 “fraud coins” in the first half of the year, the lowest increase of 1400%

- In the second game of the Libra hearing, Marcus broke the 7 materials.

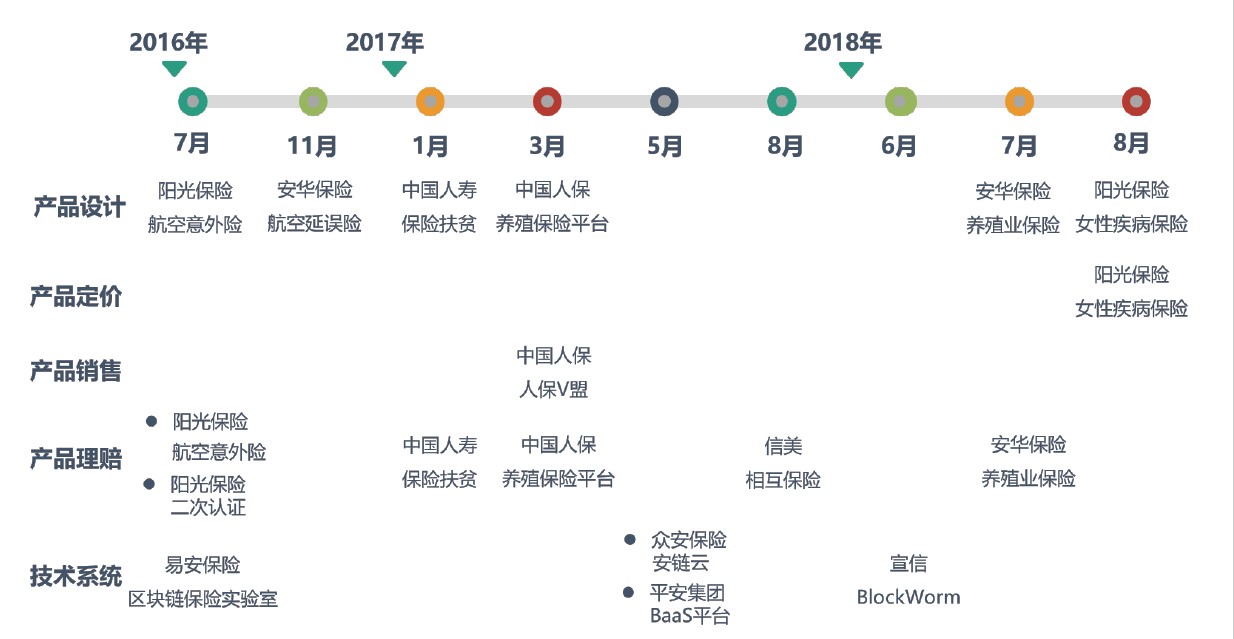

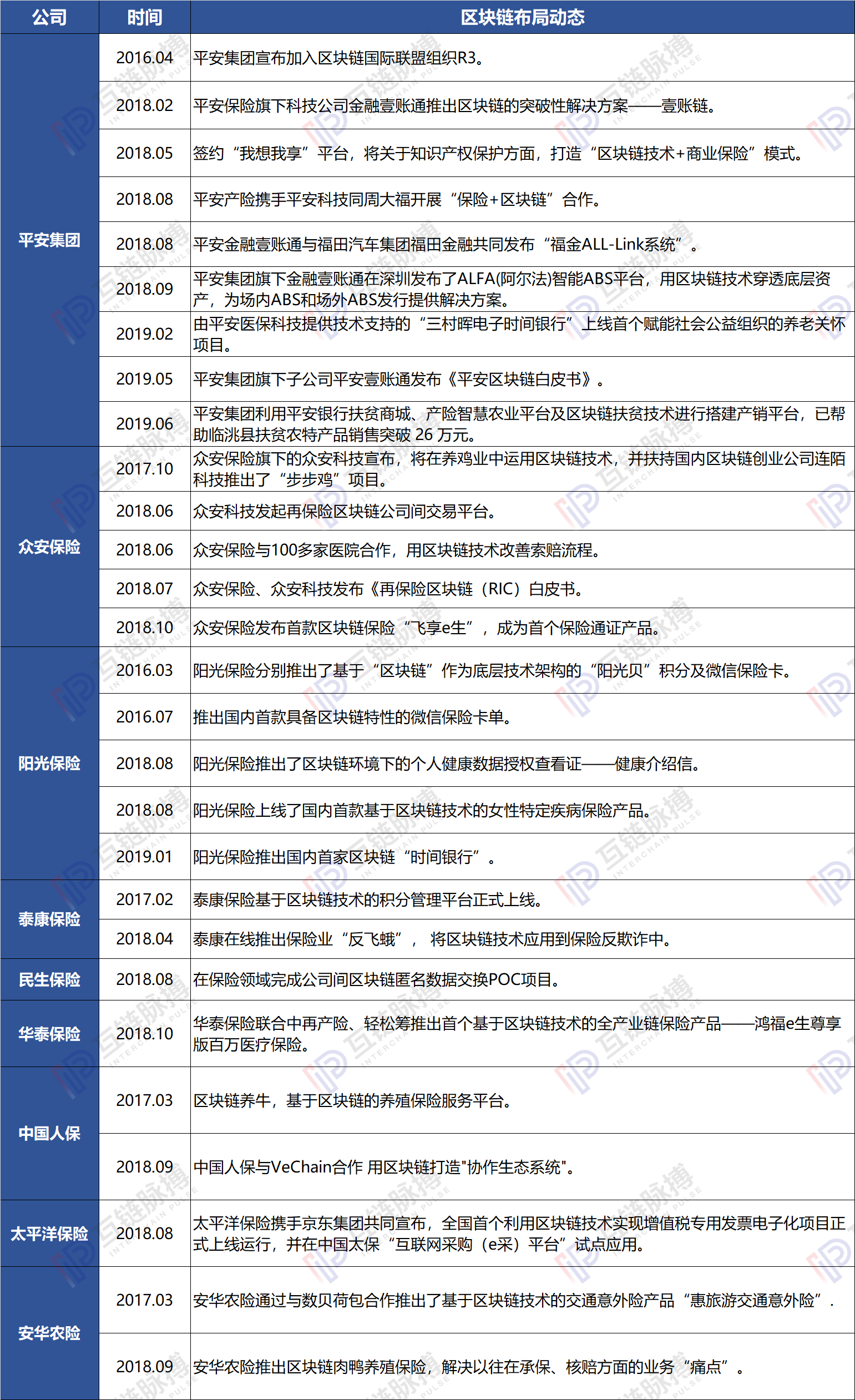

Mutual chain pulse inspection found that as early as 2016, Ping An Group and Sunshine Insurance had quietly launched their layouts and launched a series of blockchain insurance application projects. In 2017, more insurance giants joined the blockchain layout camp.

Up to now, according to the statistics of the inter-chain, according to public statistics, nine insurance companies including Ping An, Zhong An, Taikang, Sunshine, Minsheng and Huatai have entered the blockchain field.

Mutual chain pulse statistics on the layout of the blockchain-related business of the nine insurance companies for reference by industry colleagues.

Nine major insurance companies layout blockchain: the earliest sunshine, peace, public security

At present, although there are nine major insurance companies in China that have successively carried out blockchain-related businesses, the layout strengths are quite different, especially Ping An Group, Zhongan Insurance and Sunshine Insurance.

In terms of layout time, Sunshine Insurance and Ping An Group were the first two. In March 2016, Sunshine Insurance took the lead in launching the “Sunshine Bay” score based on the blockchain as the underlying technology; the following month, Ping An Group announced its participation in the R3 of the Blockchain International Alliance. Then, in July of the same year, Sunshine Insurance launched the first WeChat insurance card “Fei Chang Hui” aviation accident insurance with blockchain characteristics.

In 2017, Zhongan Insurance, Taikang Insurance, PICC and Anwar Agricultural Insurance entered the company one after another. In addition to the application of traffic accident insurance, there was also a platform for breeding insurance services such as blockchain raising cattle.

By 2018, the insurance company's layout blockchain business has entered a peak period. According to the incomplete statistics of inter-chain pulse, in 2018, the nine insurance companies carried out more than 17 operations related to blockchain-related businesses, especially Ping An Group and Zhong An Insurance.

It is worth noting that although more and more insurance companies are entering the market, most companies' layout actions are limited to the application of insurance products, and the insurance companies with the strongest layout are Ping An Group and Zhong An Insurance.

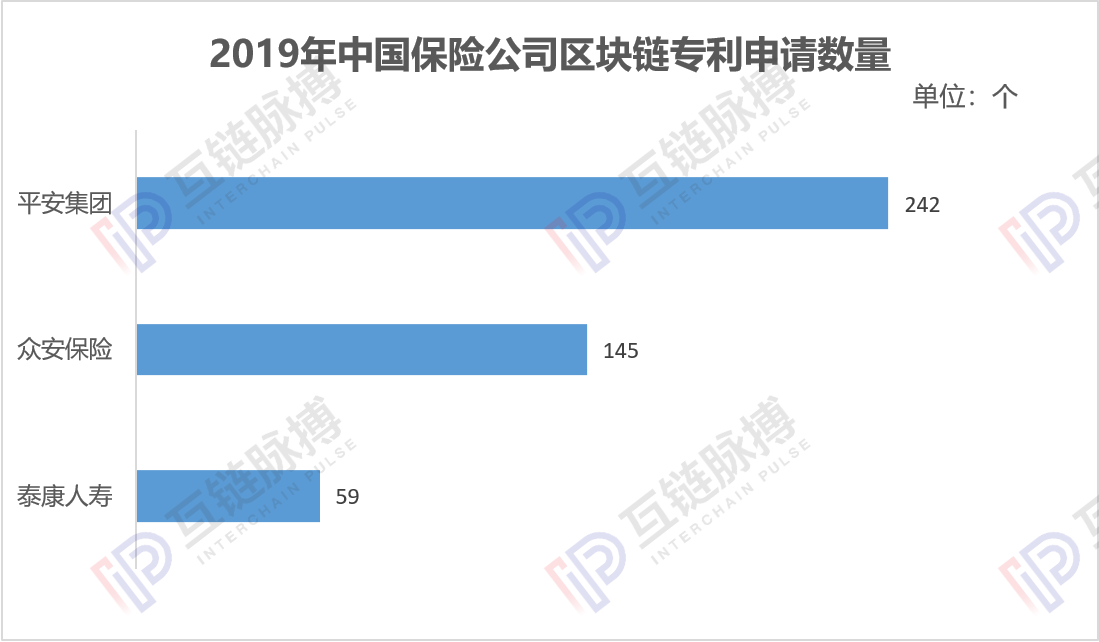

This is evident from the number of blockchain patents applied by insurance giants in recent years.

According to the inter-chain pulse combing, among the insurance companies, Ping An Group and Zhong An Insurance have the largest number of patent blocks in the blockchain, ranking 242 and 145 respectively. Other insurance companies except Taikang Insurance are in the district. There are very few layouts for blockchain patents.

More importantly, Ping An Group and Zhong An Insurance have also released independently developed BaaS platforms dedicated to the underlying technology.

In February 2018, Ping An’s technology company, Finance and Accounting, officially launched the blockchain solution credit chain. In September of the same year, Zhongan Technology, a subsidiary of Zhong An Insurance, also released the Zhongan Chain, which provides BaaS services.

The introduction of the insurance industry blockchain BaaS platform means that insurance giants are competing for standardized interfaces for industrial applications, but it also means that large-scale application and rapid deployment of blockchain technology in insurance and other related industries is possible.

Blockchain + insurance bank applications usher in major development opportunities

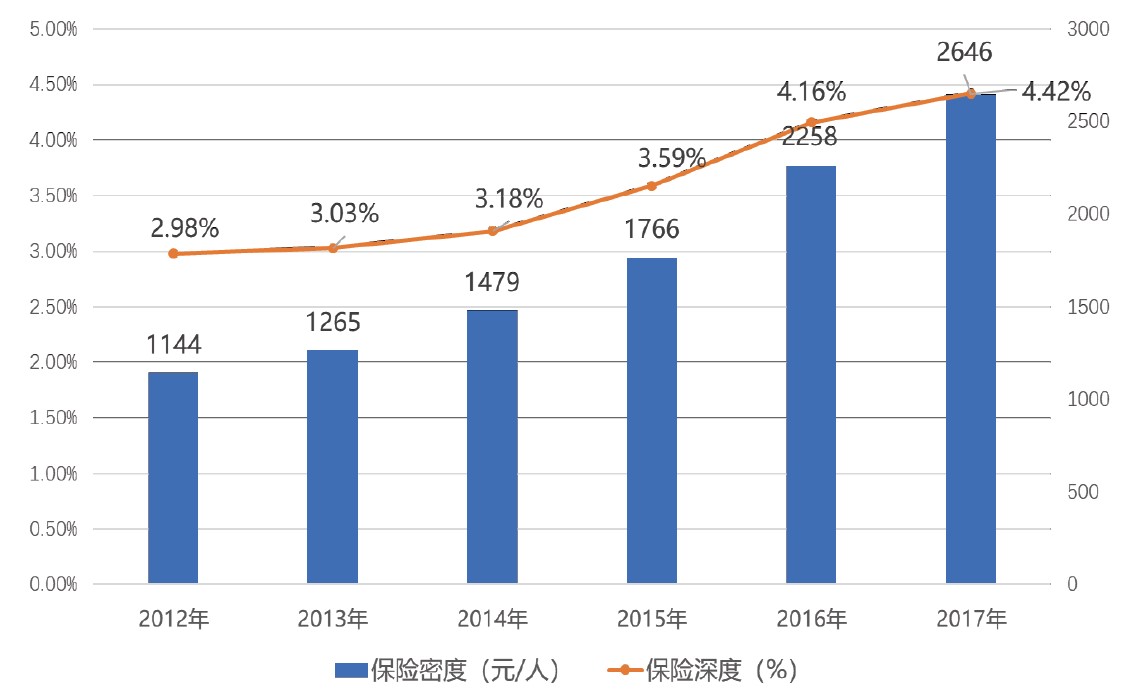

So far, although the development of the domestic insurance industry has entered the fast lane, the application of blockchain technology will still bring huge opportunities.

On the one hand, the current domestic insurance industry is still in the incremental market, and the existing insurance industry still has a large market space. In the insurance industry, under the premise of compliance, it is necessary to strengthen data sharing, help insurance companies understand the insurance needs of ordinary people, and develop products that solve the problems of ordinary people and meet the needs of society. In these respects, blockchain technology is based on features such as distributed data storage and anonymous disclosure, which can further expand the application scenarios of the insurance industry.

On the other hand, due to the complexity of insurance itself, the insurance industry still has many problems, such as low claims efficiency, misreading of policy content, and inability to share industry information. In addition, the insurance industry also has long-term troubles such as fraudulent claims, distrust of insurance, etc., but it is difficult to crack. The advantages of blockchain technology are expected to transform the original process of the traditional insurance industry, improve the overall operating efficiency of the industry, and stimulate the vitality of the industry.

The Bank's Insurance Regulatory Commission issued a document encouraging all insurance companies and banking institutions to adopt new technologies such as blockchains to embed trading links and improve the level of intelligent risk control, which will undoubtedly inject new kinetic energy into the blockchain insurance industry.

Development trend of blockchain business of 9 insurance companies

Author: Mutual chain pulse · Liangshan Huarong

This article is [inter-chain pulse] original, reproduced please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- French Finance Minister: Will maintain a digital service tax on Internet giants cannot accept the emergence of new currencies

- The Digital Currency in the Eyes of Economists – Supervision: Keeping up with the times

- Encrypted market sentiment index: from greed to extreme panic! What happened this week?

- International Monetary Fund (IMF) report: Electronic money may replace traditional currency

- The G7 summit will be in unison against libra, and the BTC will usher in a critical bottom.

- Regardless of Libra's fate, Facebook is a big winner.

- US House 怼 Facebook: The currency is not "not you can't"