Bitcoin for $0.32, they dreamed back to 2009 today

On August 23, 2019, the history of cryptocurrencies may remember this day.

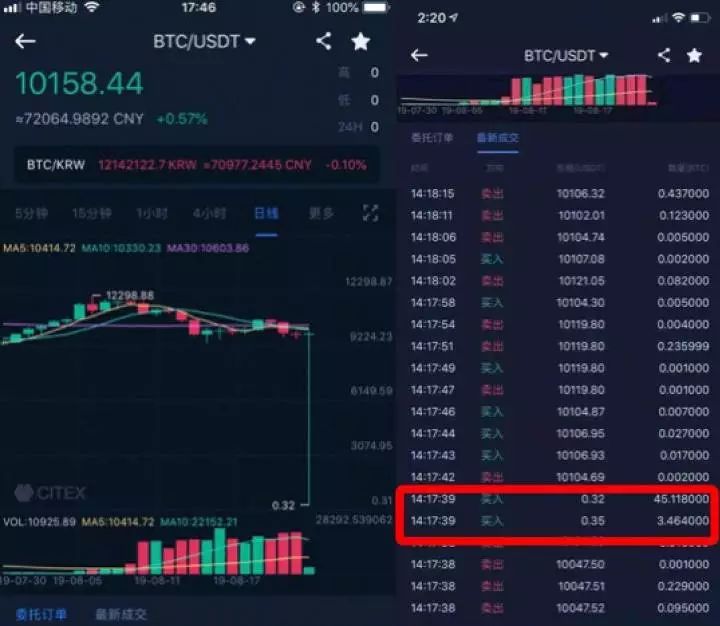

In the normal market price of Bitcoin was $10,200, someone sold 45 bitcoins at a price of $0.32/bitcoin, that is, with 100 yuan, bought bitcoin worth 3.15 million yuan. Some people also sold the ADA, which should have a value of 0.35 yuan, at a price of 163 Ethereum, which is 221,000 yuan.

There are still many people who have gained hundreds of thousands or even millions in just 5 minutes.

There is no problem with blockchain technology. The main reason for this happening is that a cloud room in Amazon Cloud Server (AWS) has failed.

- Why do Morgan, Facebook, Wal-Mart and other giants tend to use the alliance chain to release stable coins instead of public chains?

- Introduction | Market Development Model and Ethereum 2.0 Development Process

- Accounted for up to 64%, this report says cryptocurrency transactions are concentrated on low-quality platforms

AWS's computer room

The earliest problem was the currency security, the world's largest cryptocurrency exchange.

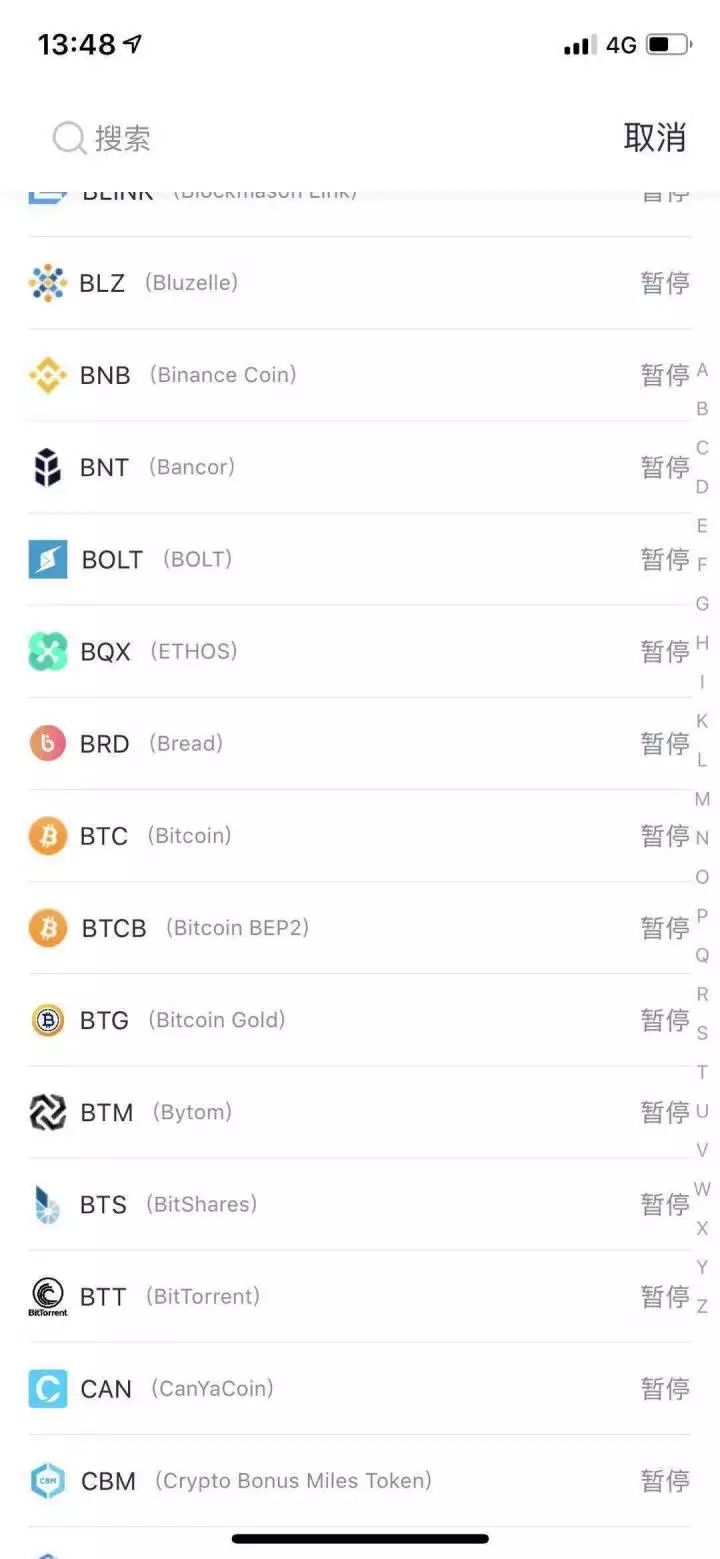

Users who traded on the currency exchange exchange found that all the currencies of the currency security exchange were suspended, and all users could only trade, not to refill the currency, nor to withdraw coins.

Before the announcement of the currency security, Zhao Changpeng, CEO of the Onan Exchange, explained on Twitter first, he said, "Because the Amazon server AWS has encountered some problems, mainly in the cache service, it has affected some users around the world. It is in the API. This caused an error 500 error message and affected some of the withdrawal process."

AWS does have a problem.

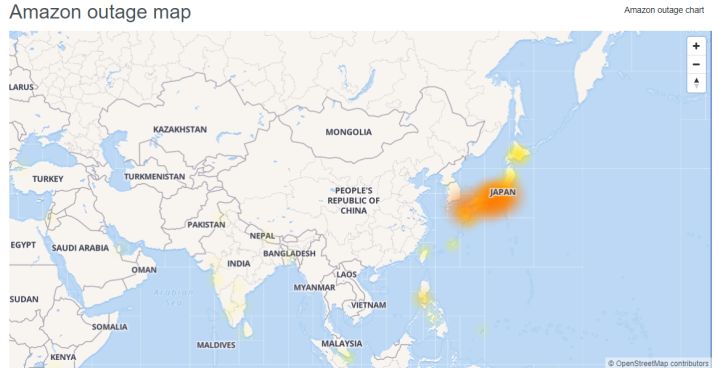

Purple Night told the block to block BlockBeats, and at noon he found the problem, earlier than AWS himself. As the founder of the chase network, he communicated with AWS and found that the hardware of the computer room was faulty, and there was a problem with the connectivity of an available area in Amazon. Even the AWS other districts are not connected to this computer room in Tokyo, Japan.

This problem caused the services in this Availability Zone to be disconnected. The impact has gradually expanded in a short period of time, and AWS Tokyo's redis machines, creations, and other services have been affected.

The AWS official dashboard also shows the problem with the Tokyo machine room, and neither the cloud service nor the database is available.

Amazon Cloud Server data tracked by the DownDetector.com website shows that there is a major failure in Japan.

As a result, all users who use AWS Tokyo servers are confused, including cryptocurrency exchanges.

$0.32 bitcoin

Everything happens only in less than 5 minutes.

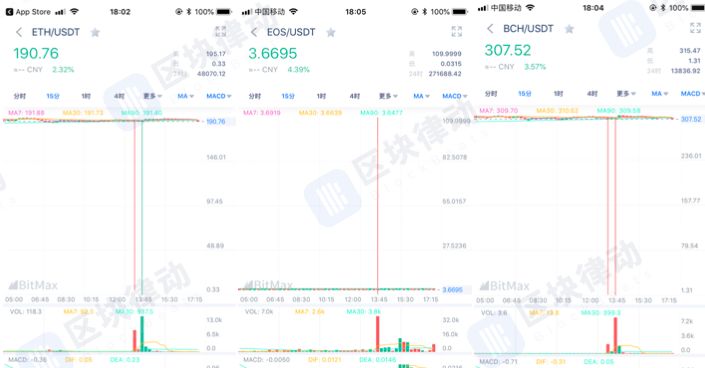

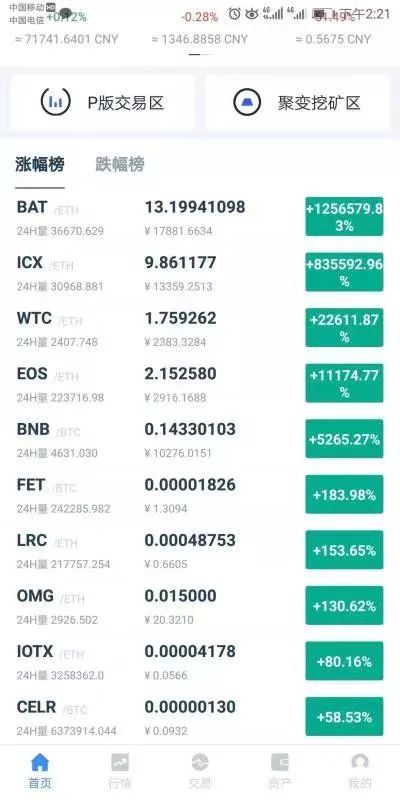

Not long after the currency limit was replenished, the currency prices of multiple exchanges began to fluctuate drastically. The prices of mainstream cryptocurrencies on BitMax, Citex and other exchanges are instantly turbulent. At 14:15, Bitcoin has a minimum price of $9.43 on BitMax, less than 70 RMB.

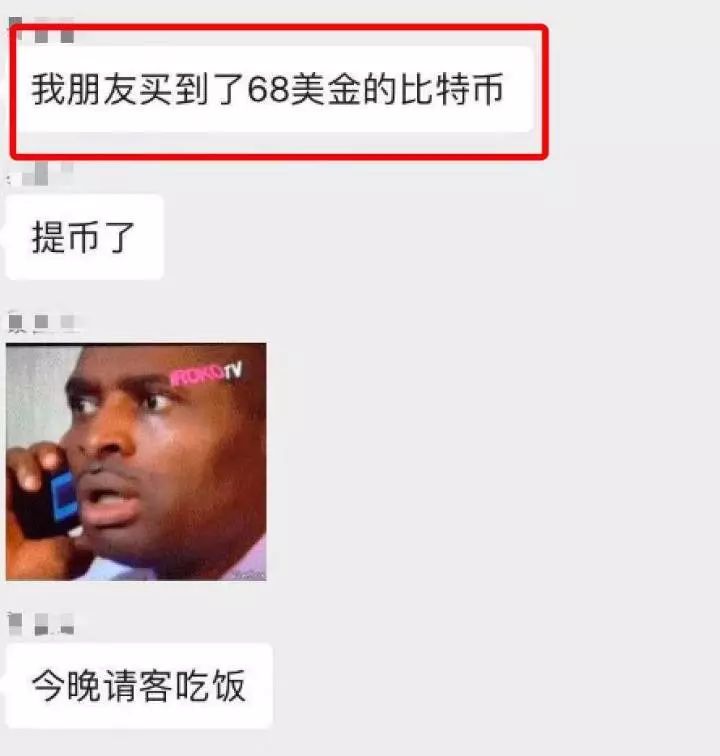

Bitcoin on Citex is cheaper, at 14:18, and bitcoin costs only $0.32. Some users have sold 45 for $0.32, and only used 100 yuan, they bought the bitcoin worth 3.15 million, if he now sells the 45 bitcoins, 31,500 times the proceeds.

More than just bitcoin, the price of mainstream currencies on BitMax is completely chaotic. Originally 190 US dollars, go to ETH that can be bought for 0.33 US dollars; the original 3.6 US dollars, but can sell EOS for 109 US dollars; the original 307 US dollars, but can buy BCH with 1.31 US dollars…

The price stability of Citex's currency has also completely collapsed, and the volatility of multiple currencies has exceeded 100 times.

According to incomplete statistics, the currencies of BitMax, Citex, Hopex and BKEX have fluctuated drastically. Obviously, in these few minutes, some people have successfully speculated on these exchanges. Be aware that the crowdfunding price of ETH is $0.30.

Crash market maker

The block rhythm BlockBeats contacted Dr. Cao Jing, the founder of the BitMax exchange, for the first time. He said that it was not a problem with BitMax, it was a problem with the currency exchange and the market maker.

It turned out that some of the big market makers on the BitMax exchange anchored the price of the currency exchange. However, due to the failure of the AWS server used by the Currency Exchange, the market makers made mistakes in reading the price data. The market maker's trading procedures were not perfect at the code level, which caused the program to shift the price judgment.

In the extreme case of the market, the program did not judge that the price of $0.32/bitcoin was unreasonable, so it was directly sold. In exchange for 100 pieces with 3.15 million, the loss was serious.

On Weibo, some people have confirmed that this "coin price of the currency has caused problems in the quantification process", but the Weibo user who claims to be the employee of the quantification company believes that the data submitted by the coin to the quantification program is wrong. It caused the loss to happen.

When discussing with the founder of security company PeckShield, Professor Jiang Xuxian, how to solve this problem, he told the block to block BlockBeats, to solve this problem, the exchange should choose to roll back.

Rollback is the abnormal situation of the exchange, all the transactions within a certain period of time are invalidated, and the assets of all accounts are returned to a certain point in time to solve the various losses caused by the problems of the exchange.

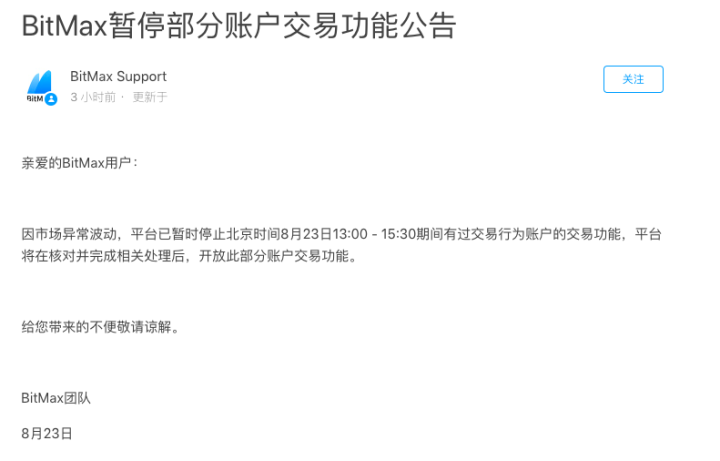

Sure enough, BitMax subsequently issued a notice, first prohibiting the platform's coin-sending function, and then indicating that due to market anomalies, users who generated trading behavior between 13:00 and 15:30 temporarily closed the trading function.

However, the rollback is only valid for users who have not yet withdrawn the currency from the exchange. Once the user withdraws the currency, the exchange cannot roll back the user's assets. If the user who bought 45 bitcoins raised the coin immediately after the transaction was successful, even if the Citex exchange rolled back, his 45 bitcoin would still be his, with no effect.

The cryptocurrency transaction is a zero-sum game. Someone earned 3.15 million and some people lost 3.15 million. BlockBeats will follow the follow-up block of this matter, but now we can know that AWS's Tokyo server has not been repaired, some market makers have a huge loss, and the exchange rollback may lead to a crisis of trust…

And we can still be sure that there must be a dinner table tonight and a bottle of champagne.

* Block Rhythm BlockBeats prompts investors to guard against high risk.

Author: 0x29

Source: block rhythm

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- I sold the mining machine and I went to the shoes.

- Is there an internal contradiction in the Libra Association? Foreign media: At least 3 members are considering launching

- The central bank released the 2018 annual report: four times mentioned the digital currency, saying that "the stage has progressed" (PDF full text)

- QKL123 market analysis | Bitcoin is multi-empty, the altcoin is relatively strong (0823)

- The sky is really a pie! Many exchanges traded abnormally, and more than 40 bitcoins were sold for 0.3 dollars.

- Babbitt column | Cai Weide: How do foreign countries see China's response to Libra, how is it laid out abroad?

- Opinions | Whether it is PoW or PoS, it will eventually become centralized