Featured | Messari Founder: Recent Frustrations and Hopes in the Industry; Innovations in the Bitcoin Technology Stack

Today's content includes:

1. Founder of Messari: the recent frustration and hope of the industry;

2.Innovation in the Bitcoin technology stack;

3. The suppression of cryptocurrency exchanges within China;

- Bakkt CEO secures U.S. Senate seat, may help cryptocurrency promotion

- Science | An article to understand the innovation in the Bitcoin technology stack over the years

- Babbitt live 丨 Zhang Laiwu: In the era of digital economy, digital currency and the sixth industry are the main battlefields of blockchain applications

4. New asset release: Decomposing the on-line strategy of Kadena and Nervos Network;

5. Status of stablecoins in 2019.

Messari founder: The industry's recent frustration and hope.

This is an essay by Messari's founder, describing some of the recent industry frustrations, and then (pretentiously) sad after a while to point out some of the industry's hopes and insights. I almost translated the whole essay, and it wasn't very long or worth seeing. Well, he milked Zcash, milked stablecoin, milked Web3 and Defi, but I think he was caught by Zcash.

This article is actually not so pessimistic, and the contradiction is only because of love.

Cryptocurrencies face some major challenges, and the frustration and disappointment that I have felt in recent days has been increasing.

Where is cryptocurrency going?

Most of the recent overwhelming news happens to fall into areas where my outlook for the industry is even more bearish: US regulation and tax systems; Libra's feasibility of issuance in developed countries (given that FB is a political pariah in all Western countries, and In China, it is 404); ICO / IEO is chronically dying, there is no real industry catalyst or sticky use case, and persistent negative headlines.

But there are still many areas that still excite me and give me hope!

Bitcoin has been repositioned as "speculative value store" by some of the best marketers in the industry-any gold investor should supplement it as part of an asset basket, as it may be the perfect digital analog gold. Bitcoin also has a story "Swiss bank account in your pocket", but this is scary as a marketing story, and I hope more people choose to forgive short-term volatility and use it for medium and long-term asset protection, Rather than calling BTC a "cryptocurrency", this has led to double fears ("black dollars").

Zcash tells me that it is the second most important project in the industry because it is the only one with near-perfect privacy embedded in the core protocol … We need to balance both homogeneity (for dissidents) and corporate adoption ( For customer privacy)). Zcash is also the canary in coal mines (coal miners use canaries to detect the crisis ahead), and it is also the front line on how cryptocurrency regulation can be implemented globally. If Zcash's route is severely blocked, then I think upgrading privacy to BTC is almost impossible. I'm glad Coin Center has been the main supporter of Zcash and there are some smart institutions and well-connected investors to support the project.

The Web 3.0 investment theme has quickly become interesting, and I thought it would take some time to make these applications exciting, but perhaps earlier than we thought. I don't really like the token-first model, but it is more interesting to apply the token model to already running applications. Moreover, from a functional point of view, the value of the token is not traded through Binance IEO, but is gradually being paid attention to and slowly gaining liquidity. If so, such a change would be welcome, wouldn't it?

I really like decentralized exchanges, synthetic assets (about how foreigners own S & P's shadow shares?), Live payments, cryptocurrencies for games and virtual goods, and Web 3.0 wallets; I'm also the “Defi A strong supporter of the “Lego Model” approach, because it is much easier to build a reliable audited mini contract library than a complete smart contract tower that trusts more complex systems. I'm cautiously optimistic that the ETH 2.0 team will avoid breaking the combo.

I am also a super bullish on non-Libra stablecoins: USDT, Dai, USDC, etc. should provide power for the biggest killer applications in the next cycle. Dai stands for DeFi? USDT for Emerging Market Payments? USDC is used for corporate settlement? Dare to dare to do it.

As now two years ago, I think the industry can reach transparency and consensus on basic practices (including governance, contributors, token economics, and issuance, etc.) to avoid causing self-harm in the industry. We are happy to work with an excellent team to find a solution to our transparency registry. I hope it will help us move in the right direction, both in the United States and globally.

Should you be bullish too? Don't trust me!

I highly recommend that you repeat what Andreas Antonopoulos said on the Defiance podcast . Andreas Antonopoulos has always been the clearest and most inspiring teacher in the cryptocurrency space. If you like text content, it also provides text drafts, very valuable works. My favorite excerpt is as follows:

"So why is privacy and financial affairs so important? The reason is that if you understand that money is a language that society can not only coordinate but also express value, and cash is the last mechanism that allows people to coordinate and process before cryptocurrencies. In the absence of In the case of intermediaries, there is no mutual expression between each other, and it is clear that if you lose the ability to have privacy on these issues, it will violate many of our other fundamental freedoms. "

This podcast is 55 minutes long, but I listened to it three times this weekend.

Full text link: https://messari.io/article/tell-me-something-good

Innovation in the Bitcoin technology stack

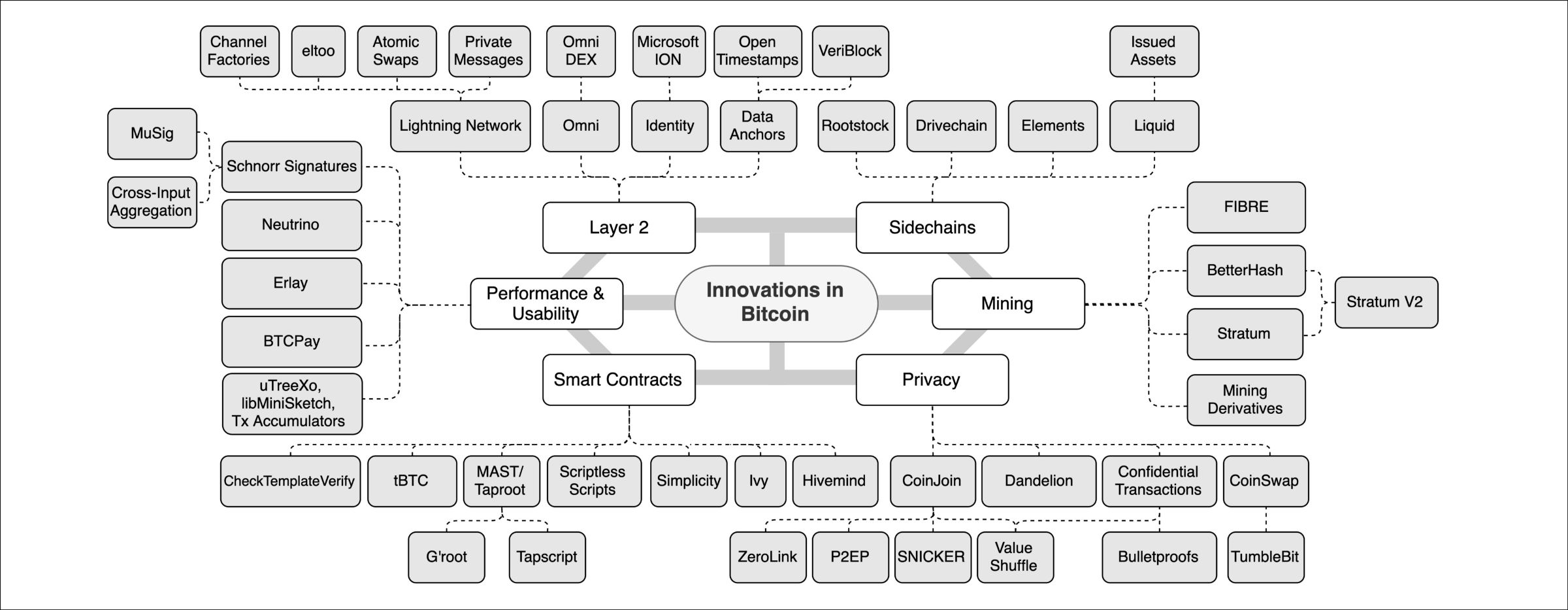

This is a bitcoin technology stack written by Digital Asset Research. Someone wrote it before, this one is a bit more updated, and the picture he compiled is quite comprehensive. Yes, it is the following picture:

Some of the main points of the article are as follows:

Second floor:

One of the most underrated advantages of Lightning Network is its direct privacy properties. Since Lightning Network does not rely on global verification of all state changes (ie its own blockchain), users can use other technologies and network overlays (such as Tor) to conduct transactions privately.

Smart contracts It is important to note that Schnorr signatures are the technical primitives that make all these new smart contract methods possible. These new methods allow novel smart contract applications to be built on top of Bitcoin, with Schnorr as the foundation.

Mining Another interesting development in mining that helps improve stability is renewed interest in hash rate and difficulty derivatives. These are especially useful for hedging transactions that want to hedge against fluctuations in the hash rate and difficulty adjustments. Although these derivatives have not yet become widespread, they represent an interesting development in the industrialization of the Bitcoin mining industry.

Privacy Before we study specific privacy innovations, it's important to emphasize that the biggest obstacle to privacy transactions for digital assets is the fact that most solutions are immature, lacking maturity and usage.

Full text link https://medium.com/digitalassetresearch/a-look-at-innovation-in-bitcoins-technology-stack-7edf877eab14

Crackdown on cryptocurrency exchanges in China

This is a more fascinating story to share with western audiences about China ’s recent news of some suppressed exchanges. The Chinese and Western countries often have some gaps in the understanding of many cryptocurrency news. This article is more knowledgeable. It may be related to the author's oriental background, and what is shared to western audiences is more grounded and authentic. One of the points that caught my attention was that "the project parties that did not have matcha tea were embarrassed to say that they were doing MLM."

The article is divided into two parts, the upstart exchange and the red exchange. The upstart exchange part is the rise story of matcha and some recent negative stories. I believe everyone has read a lot. As for the red exchange part, that is, some speculation stories related to Huobi and OKex recently related to some government departments or policies, I believe that everyone has read a lot of Chinese content. It will not be provided here anymore. The author gave a very interesting list at the end, as follows:

do you know?

Most Chinese exchanges make money through the following fee structures:

- Transaction Fees.

- Listing fees-Influential exchanges have increased listing fees as they become more and more famous.

- May be up to $ 2 million in "margin." This is the money reserved for the exchange to use after the tokens are listed. The recent dispute between Biki and CWT suggests that there is an ugly deal between the exchange and the project. CWT delayed its margin, so BiKi's community manager publicly discouraged investors from buying tokens because huge amounts of funds have not been received.

- The MXC platform coin MXC's platform coin MX achieved a 100-fold return in its heyday.

- Other service fees such as membership fees, villa purchase discounts (yes, some exchanges offer real estate transactions!) And "pretty girl services", which means that attractive sales representatives will provide personal services (?????, author The original text is indeed written like this).

Original link https://decrypt.co/12669/inside-chinas-crackdown-on-crypto-exchanges

New asset release: Breaking up the launch strategy of Kadena and Nervos Network

Messari writes an analysis of the different approaches used by Kadena and Nervos Network to guide their mining communities. All Proof-of-Work (PoW) blockchains rely on a strong set of miners to ensure network security. But PoW networks need to provide a clear competitive advantage (usually a financial advantage) to attract miners to join first.

How to do it

Nervos chose to host a mining competition on its test network, and when the mainnet launches (November 15th), the top participants will receive real rewards from Nervos local token CKB. This approach helps familiarize miners with the nuances of the Nervos blockchain and mining client design, while facilitating token distribution.

Kadena quietly launched its mainnet only for CPU mining activities (tokens cannot be unlocked until December 6th, and smart contract functions cannot be launched until January 2020). This version enables early miners to earn KDA tokens with minimal fees. Kadena also launched a public token sale, priced KDA at $ 1 per unit. The distinct cost difference between mining and purchasing creates attractive arbitrage opportunities for miners.

Comparative Results

Kadena's efforts have had a profound impact on the adoption of miners. Early access to substantial financial gains (think of it as a pre-sale for miners) helps to expand the base of miners. It is worth noting that even if arbitrage opportunities have long been closed, miners continue to dedicate resources to the network.

The growth of Nervos Network is more gradual, but the hash rate and difficulty level of Nervos are several orders of magnitude higher than Kadena's security indicators. Nervos is a prime example of how the testnet competition recruits an active community of miners to launch the mainnet.

Full text link

https://messari.io/article/new-asset-launches-breaking-down-the-launch-strategies-of-kadena-vs-nervos-network

Status of stablecoins in 2019

Tether has 40,742 wallet addresses leading the way here. DAI ranked second with 2752, followed by USDC and Paxos.

In the past year, more than 237 billion USD of stablecoins have been traded on the chain. USDT occupies most of the market. Quantitatively-this number is about 80%. Centralization (and branding) still plays a role here. DAI's transaction volume has increased by 300% since January 2019. The introduction of multi-collateral DAI is likely to further this number.

2019 is the year when USDT-ERC20 established its leading position.

Big players still dominate DeFi and dApps. And, if an application or utility is unlikely to capture large households early in its growth cycle, they may not see much appeal because today's cryptocurrency market is small.

The question I've been asking myself is what it takes to build a unicorn based on DeFi and stablecoins. If the regulators catch up and provide a stable framework for space growth, many buildings still need to be built. All hope can happen only if the penetration rate of the retail industry does increase. Some of the markets I have been tracking (in combination with stablecoins) include remittances, gig economy, digital asset insurance, revenue sharing agreements and DAOs. But when I researched B2C applications and last-mile solutions built on blockchain-based products, I felt that there was still plenty of room for growth.

Full text link https://www.decentralised.co/what-is-going-on-with-stable-coins/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt live | I heard these "different" views at a conference attended by more than 100 blockchain investors

- Kelly Loeffler steps down from Senate seat, Bakkt welcomes new CEO

- Regarding the Ethereum Istanbul hard fork, we need to understand these (with user guide)

- Holding money or using DeFi to manage money, who is more profitable?

- Babbitt site 丨 Li Lin: Upgrade Huobi Cloud to provide digital financial solutions based on blockchain digital currency issuance and payment

- Bitcoin Mining 60 Days Visit: Recording the Mysterious Nugget Paradise

- The funds were cheated under the name of the public chain. Where is the way out for the public chain?