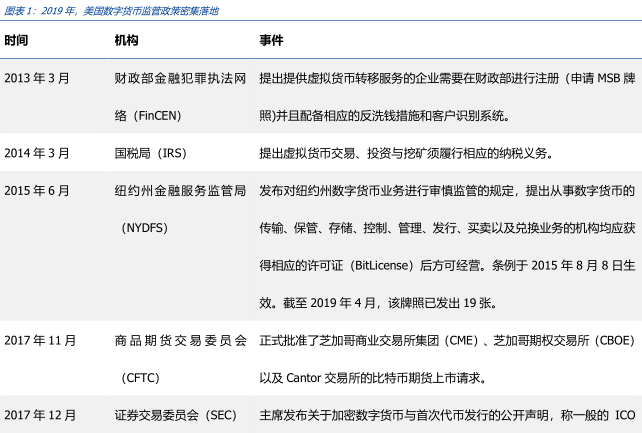

Policy intensive, US digital currency regulation enters a new era

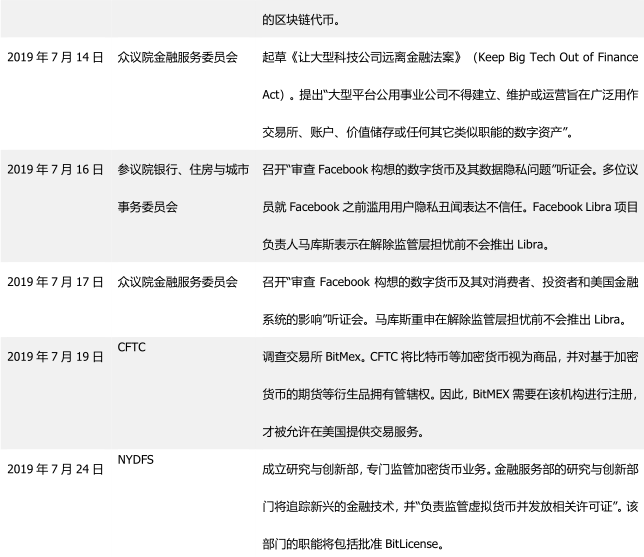

Congress is worried about missing the leadership of the blockchain wave and is also concerned about blockchain risks. It can be seen from the testimony of the hearing and the questions of the members of the Senate. (1) As the US legislature, it is still unclear about the practical application of blockchain and digital assets, but it is increasingly affected by the blockchain of Facebook layout. Chains may become a wave in the future and must be highly valued so as not to miss leadership. (2) Congress has serious concerns about the possible negative impacts of the blockchain, such as whether it can truly protect individuals' control over data, whether they can effectively anti-money laundering, and whether they can effectively counter terrorist financing. (3) Congress is unclear whether the current US regulatory framework for digital currencies is necessary, for example, whether it is necessary to further clarify the definition of blockchain or digital currency to define its nature; whether it is necessary to establish a single digital currency regulator To end the current long-term regulatory status. The current testimony of the witnesses of the hearing did not provide a definitive response to these questions.

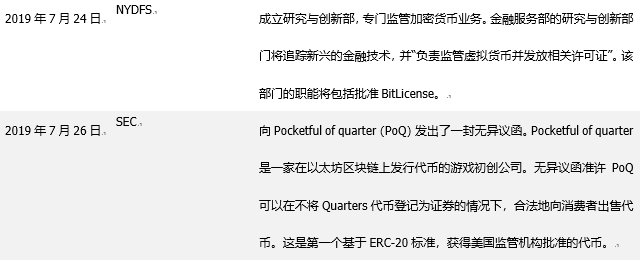

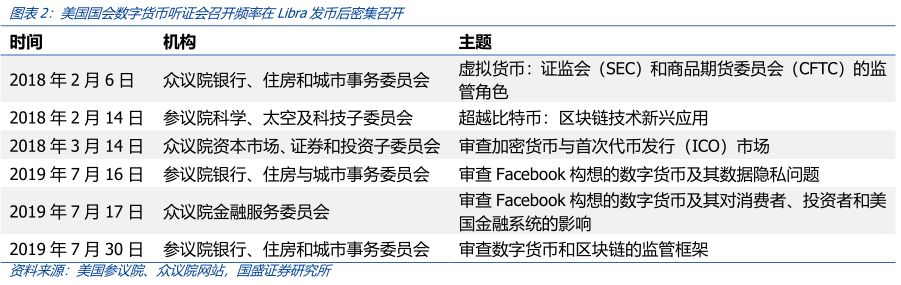

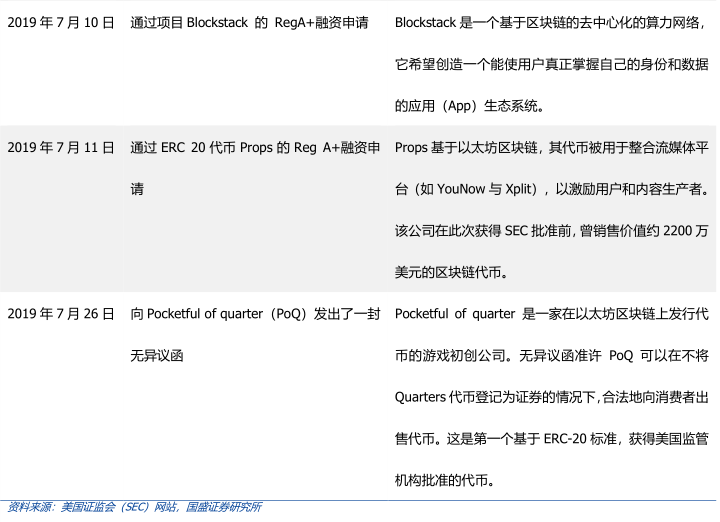

After the door was closed, the main entrance was opened and the Securities and Futures Commission (SEC) began to release. Since 2017, the US Securities and Exchange Commission (SEC) has issued a statement on the digital currency industry's regulatory policies, such as statements, prosecutions, and investigations. It clarifies that it believes that most of the project's token financing activities are issued securities, and relevant formats must be The SEC registered and sued some of the projects. In July 2019, the SEC finally released the compliance program, exempted the listing of some projects (through the Reg A+ regulations), and issued a letter of inaction for some projects.

Digital states are regulated differently in the US states, with New York being the most radical. This is mainly reflected in three points: (1) New York State has set up a new license for digital currency regulation – Bitlicense, and has issued nearly 20, which is different from all federal agencies and states, and other agencies have The digital currency ecology is integrated into the existing regulatory system. (2) The State of New York has set up a special, new department for research and innovation in digital currency regulation, which will be responsible for issuing Bitlicense. (3) According to the state's commercial law Martin Act, suing the USDT issuer Tether to protect the interests of residents.

- The miners' giants are listed: the road to transformation is long and long

- In line with the Swiss Encrypted Valley, Busan became a “unregulated” area for the development of the Korean blockchain

- Hot money has not flowed into the cryptocurrency market, and it will take time for the runaway

More digital currency projects will be approved and the new lead department will not appear for the time being. Since the US Securities and Exchange Commission (SEC) has waived listing applications for multiple projects or issued a no-objection letter, we judge that this has a great demonstration effect on current digital currency projects, and projects with similar nature to the above projects will be faster. Obtaining similar compliance approvals; in addition, based on our judgment on Congress's understanding of the digital currency's ecology, the United States will not have a new digital currency regulatory lead.

Risk warning: Blockchain technology development is not up to expectations, and regulatory policies are becoming stricter.

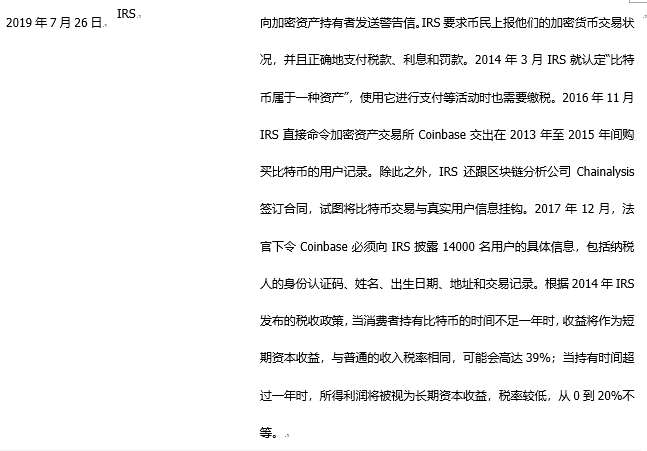

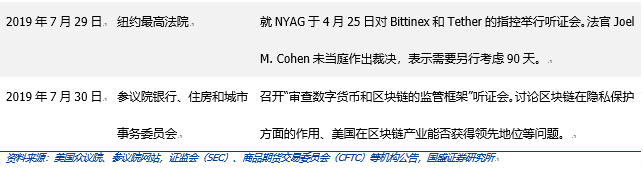

On July 30th, the Senate Bank, Housing and Urban Affairs Committee of the US Legislature (hereinafter referred to as "the Congress") held a hearing to review the regulatory framework for digital currency and blockchain. Discuss the role of blockchain in privacy protection and whether the US can gain a leading position in the blockchain industry. This is the third digital currency special hearing held by the US Congress in half a month. The first two sessions were held on July 14th by the Senate Bank, Housing and Urban Affairs Committee, "Reviewing Facebook's Digital Money and Data Privacy Issues" Hearing and the July 17th House Financial Services Committee's "Review of Facebook Ideas" Hearing of money and its impact on consumers, investors and the US financial system.

Considering that the US Securities and Exchange Commission (SEC), the Internal Revenue Service (IRS), and the Commodity Futures Commission (CFTC) have recently adopted a number of regulatory initiatives such as exemption registration applications, issuing no-objection letters, and issuing licenses to the blockchain and digital currency industries. We have reason to believe that the importance attached by the United States to this industry has entered a new era. In the early stage, the US federal regulatory agencies mainly focused on prosecution, fines, investigations, and research on the blockchain industry. At this stage, the US government finally Released to a compliant blockchain project – “open the door”; these policies also show that the United States wants to increase its understanding of the industry and is determined to gain industry leadership.

From the testimony of the hearing and the questions of the members, it can be seen that

(1) As a US legislature, Congress is still unclear about the practical application of blockchain and digital assets. However, due to the influence of Facebook's layout blockchain, it is increasingly recognized that blockchain may become a wave in the future and must be Highly concerned, so as not to miss the leadership.

(2) Congress has serious concerns about the possible negative impacts of the blockchain, such as whether it can truly protect individuals' control over data, whether they can effectively anti-money laundering, and whether they can effectively counter terrorist financing.

(3) Congress is unclear whether the current US regulatory framework for digital currencies is necessary, for example, whether it is necessary to further clarify the definition of blockchain or digital currency to define its nature; whether it is necessary to establish a single digital currency regulator To end the current state of bullish supervision of digital currencies by institutions such as the Securities and Futures Commission (SEC), the Commodity Futures Commission (CFTC), and the Internal Revenue Service (IRS).

The current testimony of the witnesses did not respond to these questions. It can only be said that “the current industry cannot be supervised by the law 100 years ago.” “Some cryptocurrencies are neither commodities nor securities, nor are they The currency, etc., but does not give further changes to its desired regulation. In other words, whether it is a regulatory agency or the industry, the US's perception of digital currency is still in a relatively vague state.

In 2016, 2017, and 2018, there were $5.96 million (43 projects), $15.86 million (343 projects), and $25.72 million (650 projects) for the first token issue (ICO). It has a great demonstration effect on many ICO projects.

(1) The State of New York has set up a new license for digital currency regulation , Bitlicense, and has issued nearly 20 copies. This is different from all federal agencies and states. Other institutions have incorporated the digital currency ecology into existing ones. Regulatory system.

(2) The State of New York has set up a special, new department for research and innovation in digital currency regulation , which will be responsible for issuing Bitlicense.

(3) According to the state's commercial law Martin Act, suing the USDT issuer Tether to protect the interests of residents. The USDT is the stable currency with the largest share of the digital currency eco-market, with a market capitalization of US$4 billion, ranking the top 10. The New York State Attorney General's Office (NYAG) filed suit against Tether, the digital currency exchange Bitfinex, and their parent company, iFinex, which is more radical across the United States. All of the above initiatives show that the State of New York strives to gain a “bridgehead” status in the digital currency ecology.

2. The regulatory policy is tightened;

Author: Song Jiaji

Source: Guosheng District Block Chain Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Count all bitcoin blockchain movies before 2020! Which classics accompany you through the cold winter?

- Interpretation of the market | LTC production price rules can be applied to the BTC?

- What is the beacon chain in Ethereum 2.0?

- Africa has become a hotbed of bitcoin fraud: these few scam companies can bitter the African people…

- The market's gains narrowed, and the resistance above the short-term remains.

- In the face of regulation, should the blockchain embrace or escape?

- Coinbase receives a large single, gray scale 2.7 billion knives encryption assets handed over to it