The adjustment posture of BTC has intensified, and the mainstream currency differentiation still needs to be improved.

On the BTC daily chart, the trend is again adjusted back below the 30-day moving average, while the 5-day moving average has crossed the 60-day moving average, further establishing effective support in the bottom area. The 30-day moving average runs downwards and the 5-day moving average forms a volatility range. There are signs of volatility in the interval. If the short-term fails to break above the 30-day moving average, the volatility will continue and will go to the stalemate. The MAZD indicator continues the Jinchao upward movement and will enter the multi-party market through the 0-axis. STOCH fast line elbow down, if the trend continues to break down the key support, the dead fork is formed, the downward adjustment will be further deepened, the RSI runs down the 50 horizontal line, overall, it is a downward trend, the Bollinger Bands remain parallel The trend will also be biased towards shocks. Then Chen Chuchu suggested that the short position be the main one, with more than one single supplement. You can follow the 30-day moving average and follow the empty order. Follow the empty order at 10600-10700 and see the area of 10200-10400. You can follow up to 10600 in the vicinity of the bottom 10200-10300 area, maintain good operating habits during operation, bring a good stop loss, control risk in the safe operation; Potential once again to break the 30 day moving average, the trend will shift upward trend formation; spot friends in the near future may hold follow 10000-10200 region;

ETH continued to fluctuate for nearly a month, and now it is running around the middle of the Bollinger Band. The MACD indicator continues to run upwards, the SOTCH indicators intersect and the Bollinger Band is in a closed position, and the volatility trend will continue. Continue to shrink, RSI is running near the 50 horizontal line, there is a flat posture, and the long and short battle will be further expanded into white heat, then it can stand firm in the region and break through the upswing 220 line, the upward trend is formed; the operation suggestion is low and low. Support 210, resistance 230;

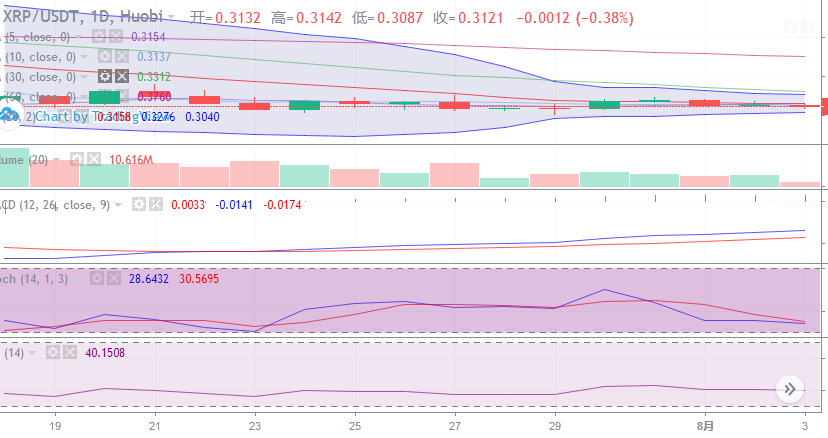

XRP still failed to stand firm in the middle and upper rail zone of Bollinger Bands, and the trend entered a downward trend. The STOCH indicator was down near the 20 horizontal line, the downtrend continued, and the RSI remained parallel. The follow-up will be a downward trend. Resistance 0.32, support 0.30;

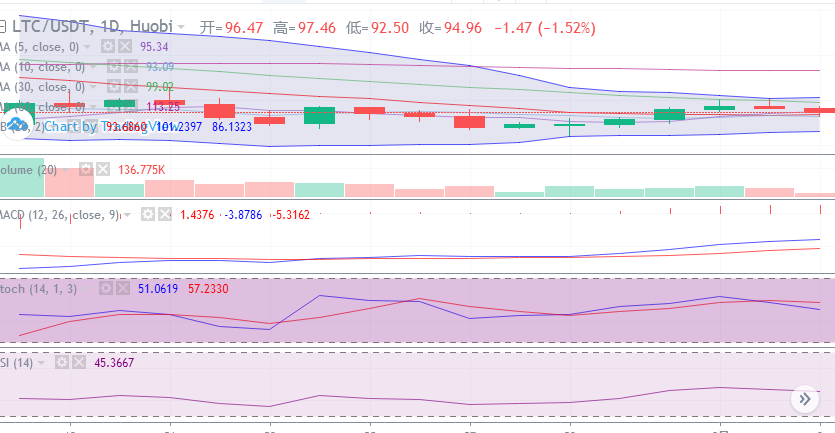

LTC is also affected by the pancakes and enters the trend of the callback. The upward touch of 100 is still not broken. The author has repeatedly mentioned that the profit is put to 100. Currently, the short-term gain of 5 to 10% in LTC is enough. The current trend also broke the middle of the Bollinger Band. If you return to the lower limit of the target again, you will see the 80-85 support bottom follow-up;

- Heavy! Central Bank's deployment in the second half of the year: Accelerating the development of legal digital currency (full text)

- Bitfinex said NYAG's investigation was too demanding, and the latter insisted that it submit relevant documents.

- Getting started with blockchain | What is Bitcoin Futures?

BCH's upside posture continued to maintain, and yesterday successfully broke through the resistance of 330. Currently adjusted around the 5-day moving average, retaining the upside posture, then after the trend stabilizes above 320, it will maintain the offensive against the upper high, RSI indicator There is a flat posture, the Bollinger band is parallel, and the BCH will keep running in a oscillating trend, supporting 310;

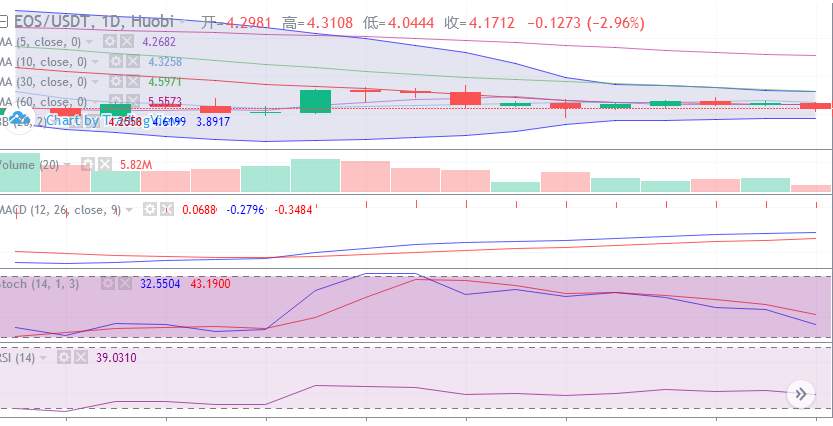

EOS also failed to stabilize to the upper part of the Bollinger Band. Currently running in the middle and lower rail areas, the 5-day moving average and the 10-day moving average will form a dead fork, so the short-term trend cannot return to the 4.3 direction, then the downtrend will continue to remain. The adjustment will continue, the operation proposal is mainly empty, and the short list is followed by 4.3;

The callback of BTC has made the differentiation of mainstream currencies intensify and evolved. Some currencies still exist in the down channel, and the callback still has great possibility. In this situation, the market still needs to be adjusted, and the shock adjustment period will be pulled. Long, so at present, it will give some better admission opportunities. If there is no patient friend to follow up in the area suggested by the author, short-term friends still need to do risk control, grasp the income in time, and profit as soon as possible to leave. Keep safe and effective operating habits; friends who can't grasp the opportunity to take the anti-single in the near future can pay attention to Chen Chuchu's timely change of strategy and follow up the profit-making ideas;

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- On the importance of trusteeship, any exchange may issue 15% of assets, but you can’t find it.

- The legal status of Bitcoin virtual property was first recognized, what is the significance?

- BTC chain data perspective: 78% of the whale address has no expenditure, the daily address increases 40% in half a year

- Institutional Strategy Research | People still want to miss the altcoin for a while

- The quilt cover for 40 days, the Algorand photographed by investors can finally be solved in advance.

- Capital events black swan frequently, the marginal effect on BTC is weakening

- QKL123 market analysis | Risk aversion surge, Bitcoin strong Hengqiang (0802)