Interpretation of the market | LTC production price rules can be applied to the BTC?

Interpretation today

Interpretation today

Litecoin (License LTC) production cut soon. According to litecoinblockhalf.com, the halving will be carried out at 10:17 on August 5, 2019, and the mining award for each block will be reduced from 25 LTCs to 12.5.

LTC sold at $30 on January 1 this year, and closed at $61 in the first quarter, a 100% increase. Prices continued to rise in June, hitting a high of $145, then fell back to a minimum of $75, and the current price is $95.

- What is the beacon chain in Ethereum 2.0?

- Africa has become a hotbed of bitcoin fraud: these few scam companies can bitter the African people…

- The market's gains narrowed, and the resistance above the short-term remains.

The price performance of LTC is reminiscent of the price movement of LTC when it was halved for the first time on August 25, 2015. At that time, the price bottomed out to $1.12 in January, and it surged to $8.72 in July, then fell back to $2.55 on August 25.

If the historical data is used as a reference, the price of LTC should be mainly horizontal. "Buy expectations, sell facts" is the best comment on the LTC's halving.

Can the same law apply to BTC?

The time span of the first round of BTC price cycle is from March 2010 to November 2011; the time span of the second round of price cycles is from November 2011 to August 2015.

The full BTC price cycle lasts approximately four years, and the price up cycle begins each halving of the previous year. At the end of November 2012, the first production of BTC was halved, and in November 2011, the price of BTC has bottomed out; in July 2016, the second production of BTC was halved, and in August 2015, BTC has bottomed out; the upcoming The halving of the three productions will occur in May 2020. At present, the bottom of the price appears to be about $3,200 in December 2018, and it is impossible to continue to fall below this price.

Therefore, the time span of the third round of the BTC price cycle is from August 2015 to December 2018. The BTC is currently opening the fourth round of price cycles.

Although it is not the BTC halving to bring the price up cycle, the halving of BTC's output has greatly reduced the growth of BTC supply, accelerating the rise of BTC prices and the price up cycle. From November 2011 to November 2012, before the halving of BTC production, the BTC increased by 6.74 times in one year; the BTC increased by 99.57 times in the year from November 2012 to November 2013. In the third price up cycle, BTC rose by a maximum of 2.87 times in about 11 months before the production cut. After halving, BTC rose by a maximum of 29.73 times in about 11 months.

Different from the price law of LTC production reduction, BTC halved the horn of each price up cycle attack, and the price began to accelerate!

Market research

Market research

Overall view

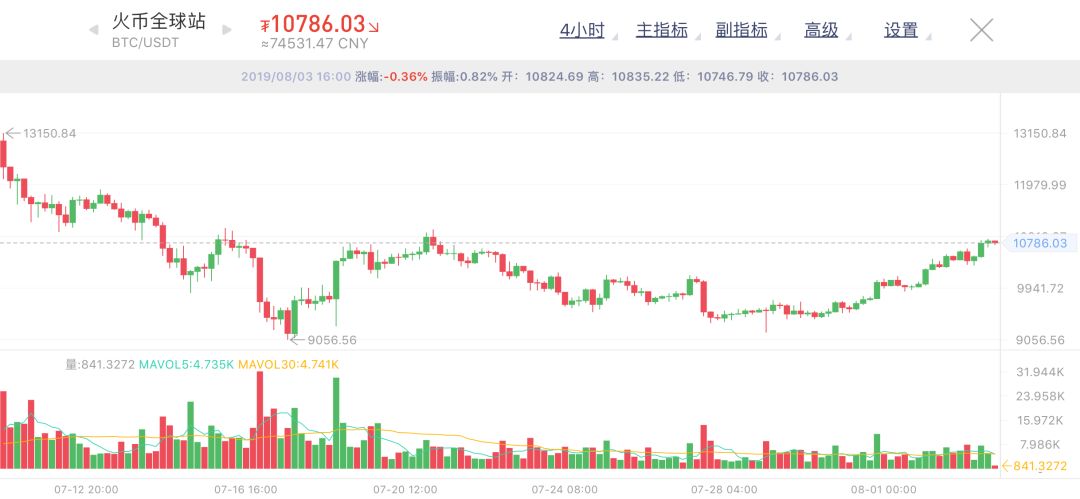

Today, BTC continued to rise, once attacked to 10868USDT, but has not touched the key position of 11050USDT, which cannot be considered a trend reversal. At present, BTC is consolidating around 10,800, temporarily breaking through the short-term downtrend line, still in the consolidation period. In the short term, the possibility of a BTC consolidation is increasing. For a long time, we are optimistic about the investment value of BTC. At present, we are still in the early stage of the bull market.

In December 2018, we clearly pointed out BNB's investment opportunities in the bear market, and the first to propose that the BNB in the bull market will enjoy Davis double-click (hedging: the platform pass the bear market profit key – the certificate valuation series) 2) In October 2018, we will point out the price cycle of BTC and predict the bottoming time to be around May 2019 ([Classic update reappears] three laws and applications of BTC Bulls and Bears cycle – Freezing Point Outlook A); In April 2018, when the remaining temperature of the bull market had not been exhausted, we indicated that it was a rebound rather than a bull market (whether the bull market is coming? It is the four reasons for the rebound rather than the bull market).

From the perspective of the daily line, BTC has emerged from the five consecutive years, and formed the MACD gold fork form, the rising signal is obvious. BTC continues to rise slightly, and its quantity is gradually enlarged, which is expected to form an accelerated upward trend. From a short-term perspective, breaking through the pressure of $10,200, the rise has become the main theme, and it is necessary to focus on the change in volume and energy. Support level is 10400USDT and pressure is 10900USDT.

ETH weakly follows the BTC and oscillates around 220USDT, with support at 214USDT and pressure at 225USDT.

EOS and ETH maintained a weak linkage, oscillating around 4.2USDT, support at 4.04USDT, pressure at 4.36USDT.

risk warning

The price of digital pass is fluctuating violently. Investment digital pass is a high-risk investment behavior. Investors should reasonably assess their investment ability and risk tolerance, use leverage carefully, strictly control risks, and invest carefully. Investors are advised to keep in mind that investments are risky and require caution when entering the market.

Disclaimer

Personal opinions are for reference only. The analysis in the text does not constitute a recommendation for trading, and the profit and loss is self-sufficient. Welcome to reprint, but need to indicate the source.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- In the face of regulation, should the blockchain embrace or escape?

- Coinbase receives a large single, gray scale 2.7 billion knives encryption assets handed over to it

- The “first airdrop in the currency circle” project is suspected of being degenerate. Is it the founder who left or the community split?

- In the chaos of the world, bitcoin "three steps" or will create a new record high?

- Bitcoin is a self-test prophecy? Is the air currency also?

- MIT AI Lab: After analyzing 200,000 bitcoin transactions, only 2% were "illegal"

- The adjustment posture of BTC has intensified, and the mainstream currency differentiation still needs to be improved.