Popular Science | DeFi Beginner's Guide

Source: nakamoko

Translation: First Class (First.VIP)

The author of this article is Linda Xie, a former product manager of Coinbase. She is now the co-founder of blockchain venture capital fund Scalar Capital. Her famous work is her currency guide series. She has written more than ten articles such as Bitcoin and Ethereum. Excellent beginner's guide.

- Former CFTC chairman intends to promote "digital dollars" through non-profit foundations

- 2020 Winter Davos Forum Blockchain Preview: Digital Currency Becomes Core Issue but Has No Chinese Role

- The blockchain market raised 4.7 billion U.S. dollars a year, accounting for 40% of the total financing of 129 exchanges

Decentralized finance, also known as "DeFi" or open finance, its role is to use automated methods to replace middlemen and rebuild traditional financial systems (such as lending, derivatives and exchanges). Once fully automated, DeFi's financial components can generate more complex functions. Today, the main application of decentralized finance is on Ethereum, but in principle, DeFi can be applied to all smart contract platforms.

In this DeFi novice guide, we will review the following:

· Stablecoin is the foundation of decentralized finance. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are famous for price fluctuations, stablecoins are carefully designed to remain "stable" on 1.00 units of fiat currency. Most stablecoins are pegged to the US dollar, but some stablecoins are pegged to other fiat currencies, such as the RMB.

· Decentralized lending, programmatically lending on the blockchain. No need to register a bank account.

Decentralized exchanges that buy and sell cryptocurrencies through the blockchain rather than centralized exchanges like Coinbase. In principle, computers can trade on the blockchain!

· Mortgage, using digital assets as collateral, lending out a centralized loan, and providing some recourse to the lender in the event of a default.

· Decentralized identity. Identity is used in the context of smart contracts to evaluate the creditworthiness of decentralized loans.

Composability, which bundles DeFi functions that perform different functions, like a software library. For example, if one contract acquires cryptocurrency and generates interest, the second contract can automatically reinvest that interest.

· Risk management. The high returns of DeFi are usually accompanied by high risks. Fortunately, there are new tools to hedge these risks.

Stablecoin

If we are to recreate traditional financial products on the blockchain, we will face an urgent problem: price volatility. Specifically, the daily volatility of the USD / ETH exchange rate of Ethereum's native cryptocurrency (ie, ETH) is large, and sometimes it fluctuates by more than 10% within a day.

This instrument of price volatility is not perfect for many traditional financial products. For example, if you make a loan, you definitely don't want the loan to fluctuate by 10% before it is paid. This level of volatility can make it difficult to plan for the future.

Stablecoins can solve this problem. It is a specially designed cryptocurrency that maintains "stability" at an exchange rate of approximately 1.00 legal currency per token. A list of the top stablecoins is listed on the Stablecoin Index and Stablecoin Stats.

Stablecoins are divided into three categories: centralized fiat currency collateral, decentralized cryptocurrency collateral, and decentralized algorithms.

1. The stable currency pledged by fiat currency is deposited into the fiat currency at a ratio of 1: 1 in the bank account. For example, the stablecoin USD Coin (USDC) issued by Coinbase has 1: 1 USD support in bank accounts. As long as you trust the issuing company and their base fiat currency, the risk of holding or using tokens is minimal. Another advantage is that there is a centralized company behind it. If there is a problem with the stablecoin, the company is responsible. Many users and enterprises are optimistic about this.

In the United States, the deposit insurance coverage of the Federal Deposit Insurance Corporation is at least $ 250,000, and other countries have their own deposit insurance provisions. These may sound wonderful, and not everyone can use a centralized stablecoin. For example, USDC's user agreement states that it is only available in supported jurisdictions and prohibits users from trading USDC in certain activities.

2. Decentralized cryptocurrencies are stablecoins with no central operator or user agreement. This means that anyone can use the stablecoin without company or government permission. However, under the balance, there is no legal currency to support stablecoins and it is difficult to maintain stability. Unlike the simple USDC model, its USD 1,000 USD has a bank endorsement of USD 1,000, and the stablecoin for crypto collateral is endorsed with at least USD 1,000 cryptocurrency (high volatility).

For example, Maker is a system built on Ethereum that manages a decentralized stablecoin called DAI. The DAI is anchored at US $ 1, and the way of pegging is that everyone in the Maker system can lock the tokens as collateral (mainly ETH) and lend out DAI loans. The amount of collateral should be greater than the amount lent. The loan is therefore over-collateralized.

For example, if you lock $ 200 of ETH as collateral, you can borrow $ 100 worth of DAI and use these DAI to trade on the exchange. The main thing is to do leverage. If you believe that the price of ETH will not drop significantly, you will get "free" $ 100 to trade on crypto exchanges. If the ETH price drops, and your ETH worth 200 USD is lower than the collateral amount requirement, the Maker algorithm will seize your collateral and clear it, returning you 100 USD. In this mode, the Maker algorithm will prevent the loan from losing the principal.

Although the Maker system is much more complicated than systems such as USDC, in theory, DAI does not have coins, and end users do not need to understand the complicated procedures, just like ordinary dollar users do not need to understand the complexity of monetary policy.

Having said that, DAI does have its risks, such as the risk of smart contracts and the risk of DAI breaking the anchor, and the transaction is higher or lower than the level of 1USD / DAI.

3. The third type of stablecoin is a decentralized algorithm stablecoin. This kind of stablecoin does not have any collateral for endorsement, and only relies on algorithms to stabilize prices.

For example, Basis, closed before it was released. There is a concern in this model of stablecoins that well-funded and motivated companies will attack the system, causing people to lose confidence in the pegged exchange rate. This led to a death vortex, and the stablecoin collapsed.

In short, the first two stablecoins are the most popular. Whether it's fiat or cryptocurrency collateral, people seem to want prices to remain stable. The third type of stablecoin is undergoing related experiments, hoping to combine cryptocurrency collateral with algorithms.

Decentralized lending

With stable coins such as USDC and DAI, it is possible to proceed to rebuild each part of the traditional financial system into automated smart contracts. One of the most basic concepts of finance is borrowing.

Many DeFi platforms can borrow Ethereum tokens directly through smart contracts such as Compound, dYdX, and Dharma. These smart contracts have a key feature that borrowers don't have to look for lenders and vice versa. Smart contracts replace middlemen and calculate interest rates based on supply and demand calculations.

Centralized Lending Order Book

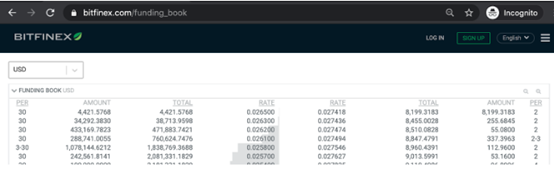

Before explaining how a centralized lending order book works, let's review how a centralized exchange implements lending. The following figure is a screenshot of Bitfinex's fund order book:

Reading the data in the above figure from the left, the first line represents the borrowers in the market. They are willing to borrow a 30-day loan at a daily interest rate of 0.0265%. The loan amount is $ 4,421.58. Directly below the borrower is another borrower who is willing to obtain a 30-day loan at a slightly lower interest rate of 0.0263%, with a borrowing amount of $ 34,292.38. On the right is the lender. The first line indicates a willingness to lend $ 8,199.32 for two days at a daily interest rate of 0.027418%. The second line is someone willing to lend $ 255.68 for two days at a higher interest rate of 0.027436%.

In a similar way, this is how a centralized loan order book works. In the example above, the highest interest rate that the borrower is willing to accept is 0.0265% per day, while the lowest rate that the lender is willing to give is 0.027418% per day. Either of the two parties raises or lowers the price of the currency and concludes the transaction. Bitfinex provides services for setting up order books and matching users, reducing the tedious steps of each loan.

Decentralized Lending Order Book

Some decentralized lending services have taken lending to a new level. Allows users to borrow directly from smart contracts without having to build an order book and facilitate matching, dynamically increasing or decreasing matching interest rates.

For example, if a large amount of cryptocurrency is borrowed from a smart contract, the borrower is charged a higher interest rate. In addition, in order to borrow funds, users need to provide collateral to the smart contract, the amount provided must be greater than the amount borrowed, so that the loan is over-collateralized.

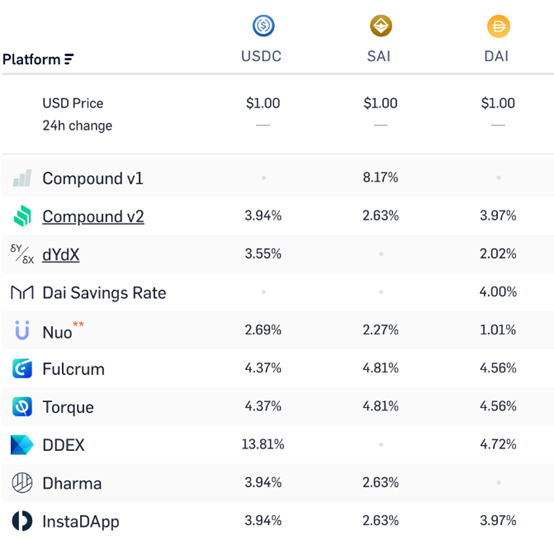

The former is an extensible application. In theory, a crypto service with higher interest and lower risk than traditional bank accounts can attract billions of dollars in deposits. Compound's deposits have reached $ 120 million and other services are growing rapidly. The main risks come from smart contract errors and cryptocurrency volatility, but interest rates are also significantly higher than traditional bank rates of 2% or lower. The following figure is the interest rate that LoanScan can earn from lending stablecoin on major platforms.

Decentralized exchange

Decentralized exchanges are trying to put services like Coinbase Pro on the blockchain. That is, their role is to facilitate transactions between two parties with different cryptocurrencies.

To understand a decentralized exchange, you must first understand a centralized cryptocurrency exchange. These exchanges, like Coinbase Pro, act as intermediaries and custodians, and both parties deposit assets on Coinbase Pro for trading. Although centralized exchanges can facilitate billion-dollar transactions, centralized exchanges do have a single failure that can lead to hacking, reviewing transactions, or preventing someone from trading.

Decentralized exchanges replace intermediaries through smart contracts, solving a single failure. Make all assets fully peer-to-peer.

Many projects are implementing decentralized transactions in various methods based on Ethereum-based tokens (e.g. Uniswap, 0x and Kyber). For example, Uniswap uses so-called automatic market makers (AMM) to provide liquidity through algorithms. Buyers and sellers directly obtain liquidity from smart contracts, and receive quotes based on the number of required tokens and available liquidity. Regardless of the order size, Uniswap always increases the price gradually as the order size increases.

Decentralized exchanges currently only handle a small number of centralized transactions, so they cannot truly exchange large amounts of funds back and forth. In addition, many decentralized exchange projects are limited to trading Ethereum-based tokens on Ethereum, limiting their opportunities to use their own chains to access large tokens. But there are still some promising technologies such as atomic swap and zk-STARK that can solve this problem.

Decentralized identity

One problem with decentralized lending services is that they require a lot of collateral. This excess mortgage requirement may be a very inefficient use of capital, and many people do not have extra funds to provide mortgages from the start.

However, people are working on decentralized identity and reputation systems to reduce mortgage requirements. The earliest batch of applications will be to build blockchain-based fiat currency-based credit agencies, such as bank institutions like Expatian, TransUnion, and Equifax based on credit scores.

Now, to avoid objections, it is certain that credit bureaus put certain groups, such as international organizations or youth, at a disadvantage. However, new services such as Lending Club have addressed the issue of over-reliance on financial management scores by providing additional data points such as home ownership, income and hours of employment.

Decentralized identity and reputation services can provide services such as social media reputation, historical loan repayment records, guarantees for other reputable users, and more. To make a real impact on actual financial decisions, we need to do a lot of repeated experiments on the specific data points used and the corresponding mortgage requirements, and we are just getting started.

In the long run, DeFi with a decentralized identity system may become another option for people who are blocked from the traditional financial system. For example, one billion people do not have official ID cards, and 50% of women in low-income countries or regions do not have ID cards, but most of them have smartphones. Therefore, once decentralized identity IDs are used in developed countries, they are likely to be quickly exported to developing countries as a leapfrog technology, just like the smartphone itself.

Composability

After introducing the decentralized stablecoin, lending, exchanges and identity. However, to build a decentralized financial component on a smart contract platform like Ethereum, the most important thing is composability. Just like software libraries, smart contracts for different financial applications can be plug-and-play like Lego bricks.

For example, if you want to add the function of trading tokenized assets on the platform, you can easily make the assets tradable by integrating a decentralized exchange protocol. These LEGO brick-like smart contracts can even create entirely new concepts that have never been explored in the traditional world.

Take a project that combines DeFi and social media, called 2100, which allows users to use Twitter accounts to mine new tokens, essentially generating digital dollars from social assets. Well-known accounts can deliver premium content that only certain token holders can access, so that they can monetize their fans. There are also interesting things that can be done, such as betting on certain Twitter accounts, which is becoming popular.

Another project, called PoolTogether, combines DeFi and lottery to create a "zero loss" lottery. Users purchase lottery tickets on the chain, and all funds for ticket purchases will earn interest on Compound. At the end of the draw, everyone can get back their own funds, but only one person can get the full interest on the funds raised. In essence, this is a way to use the lottery mechanism to stimulate savings and wealth creation!

As DeFi matures, we hope that these composable libraries can be used outside the crypto community. Eventually, one line of code can be added to add the complete decentralized market to video games, or another line of code to allow e-commerce stores Of merchants earn balance interest.

risk

Although DeFi is fascinating, it is important to recognize the risks it brings. Some of the following risk categories:

· Smart contract risks, many of which are new systems that require more time for combat testing. When protocols interact with each other, smart contracts pose risks. If a protocol has serious smart contract errors, the entire system may be attacked. It is wise to avoid investing too much money early in the system.

· Mortgage and volatility risks. The type of collateral endorsed on a loan may also be risky. Excess collateral can reduce volatility, but if the price of the mortgage asset falls too quickly, there can be no guarantee that the additional margin can be equivalent to the entire borrowing. However, with reasonable mortgage ratios and vetted mortgage types, this risk should be small. Another potential problem is that interest rate fluctuations on many DeFi platforms have prevented some people from participating. There may be interest rate swaps or other methods to lock in premium rates, but this also adds complexity.

· Regarding regulatory risks, the DeFi platform has different degrees of decentralization. No court case that has tested all the terms has been seen and remains to be seen.

Decentralized insurance such as Nexus Mutual and Convexity is an area of DeFi applications that can hedge some of the risks of DeFi. Prediction markets such as Augur are betting on the possibility of smart contract vulnerabilities in the protocols they use to hedge risk.

These hedging methods are still in their infancy, and their own smart contracts are still at risk. But I think these methods will gradually mature, and if the field of DeFi is large enough, traditional insurance companies may also provide hedging products.

to sum up

The field of DeFi covers a wide range and is constantly expanding. DeFi has deployed hundreds of millions of dollars in cryptocurrencies, with great potential.

The article comes from nakamoko, the translation is provided by First Class (First.VIP ), please retain the information at the end of the reprint!

original:

https://nakamoto.com/beginners-guide-to-defi/ manuscript source (translation): https://first.vip/shareNews?id=2723&uid=1

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin option fever skyrocketed, trading volume approaching historical highs or becoming price booster

- Behind 106 market cases, we discovered the impact of the BTC spot market structure on price discovery

- Crypto crime reports: billions of dollars of money laundered, more than half flow into exchanges

- Blockchain distributed storage: a new storage model for ecological big data

- The post-C-end era of blockchain: not the B-end market

- "National Mining Pool" Admission! Miners no longer "underground" in Uzbekistan, government approves exchange to go online next week

- 2020, Bitcoin has something to say to you