Project Ubin: Singapore's central bank's attempt to apply DLT in clearing settlements (Part 2)

With the rise of the market value of crypto assets and the increasing attention of global capital, governments have not only introduced relevant policies to regulate the encryption market, but also explored and practiced the underlying technologies in cryptographic assets. Since 2016, the Monetary Authority of Singapore (MAS), the Singapore Central Bank, and the Singapore Exchange, 10 commercial banks, 8 technology companies and 6 academic institutions have jointly launched Project Ubin to explore the distribution. The practical application of Distributed Ledger Technology (DLT) in clearing and settlement.

From 2016 to the present, Project Ubin has released a total of four reports, namely Project Ubin based on distributed ledger-based SGD , Project Ubin: Refactoring RTGS , Project Ubin: DLTP-based payment for DLT. Cross-border Interbank Payments and Settlement: New Opportunities for Digital Transformation . Each report includes, but is not limited to, an introduction to the problem that the project needs to address, the rule design of the prototype, the impact of the prototype on the real world, and the issues that need to be considered in the future when the project is further refined. Project Ubin's overall research level is progressive, and its overall planning is six stages, namely SGD Singapore Singapore legal currency digital exploration, domestic interbank settlement exploration, DLT-based DvP exploration, cross-border interbank payment settlement exploration, target operation mode and DvP exploration for cross-border payment settlement. Project Ubin is currently in the fourth phase, which is cross-border interbank payment and settlement.

Figure 1: Project Ubin overall planning

- Data Analysis: Bitcoin's short-term return to a reasonable valuation, the next round of bull market capitalization peak value of at least 860 billion US dollars

- Whose universe

- Can Bitcoin ATM machines also use lightning networks? Anyway, this developer has done it.

This article was compiled and adapted from the contents of the above four reports published by Project Ubin. Try to summarize the contents and results of the first four stages of Project Ubin. Stage 1 and Stage 2, see Project Ubin: The Singapore Central Bank's Attempt to Apply DLT in Clearing Settlement ( Part 1 ) .

Phase 3: DLV based on DLT

On August 24, 2018, MAS and SGX announced plans to implement DvP settlement of two types of certified assets across different blockchain platforms (distributed ledgers), exploring the final confirmation of DvP settlement, interoperability between books and accounts. Investor protection and propose future considerations for DvP on the DLT and its impact on the capital market. The two types of certified assets are the Central Digital Currency issued by MAS issued by Singapore Government Securities (SGS) and MAS, namely the SGD in digital form.

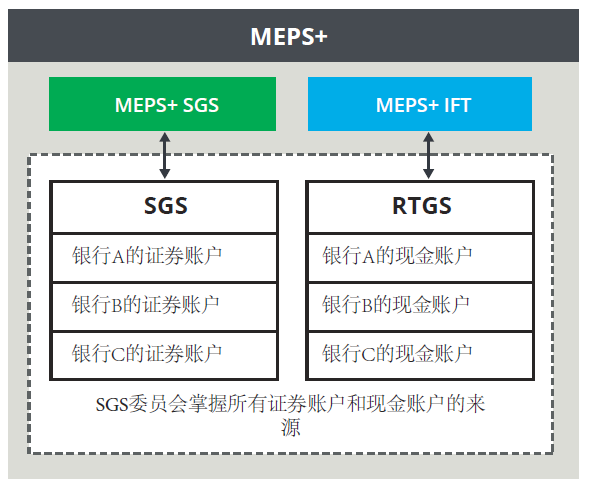

The current MEPS+ is an RTGS system implemented and operated by MAS and consists of two systems: MEPS+-SGS system and MEPS+-IFT system (MEPS+ interbank transfer system). The MEPS+-SGS system handles the paperless settlement of SGS issued by MAS on the basis of DvP. The MEPS+-IFT system supports large interbank fund transfers denominated in SGD. Market participants must register separately in the MAS's two systems to trade. The MAS-SGS Committee acts as an arbitration party to resolve disputes.

Figure 5: Current MEPS+ system architecture

There are several problems with the existing DvP MEPS+ system. In terms of system risk, there is a single point of failure risk in the traditional settlement system. All participating banks that need settlement services must connect to the central operator (RMO, including clearing house and central bank) to settle their transactions; In time, MEPS + runs in a fixed running time. According to current industry practice, the clearing and settlement cycle is T+2 or T+3; in terms of supervision, additional processes, manpower and financial resources are required to ensure clearing settlement compliance, supervision It takes years for an organization to adjust the rules of the financial services industry, especially regulatory changes, compliance standards changes, and system upgrades.

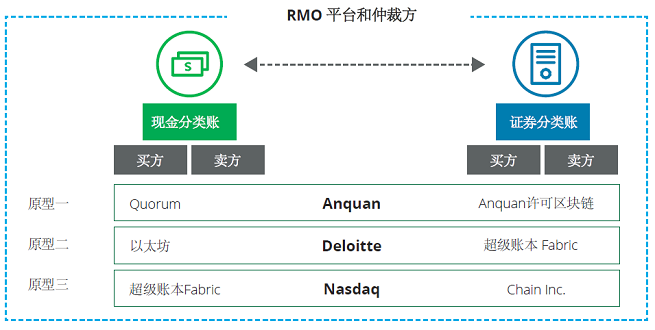

Phase 3 designs a DLT-based DvP settlement process and takes into account the abnormal state in the settlement. This settlement process can be summarized as the following steps: the transaction two-way system submits the order, the system matches the two parties to the order, the system generates a key and hash for the transaction parties for the private transaction, and the two parties negotiate the securities and cash in the distributed ledger. , complete the delivery. Throughout the settlement process, the RMO acts as an arbitrator to supervise.

Figure 6: Prototype scheme proposed by the three companies

The above picture shows a prototype of an application-free blockchain system proposed by Anquan, Deloitte and Nasdaq. The prototype implements functions such as expanding the time window, locking the cash/securities contract on the ledger, controlling the account by the arbitrator, encrypting and transmitting information under the chain to ensure privacy.

Phase 3 explores the rules of embedding compliance requirements in smart contracts to achieve compression of the settlement cycle from T+3 to T+1 or even full-time settlement. Due to the diversity of regulatory review and compliance standards, smart contracts embedded with compliance rules may affect multi-regional enforcement of financial regulatory authorities. In addition, the contract locks the assets to be traded in the cash ledger and the securities ledger, which may reduce liquidity during the settlement period.

For future considerations, Stage 3 proposes whether the arbitrator can maintain fairness and neutrality; full-time settlement needs to consider issues such as foreign exchange rates, transaction fee pricing, and different banking hours. In the future, consider expanding DLT's application asset classes and markets, such as securities, corporate bonds, commodities and derivatives, to improve existing primary and secondary markets.

Phase 4: Cross-border interbank payment and settlement

Bank of Canada (BoC), Bank of England (BoE) and the Monetary Authority of Singapore jointly released the report “Cross-border Interbank Payments and Settlement: New Opportunities for Digital Transformation” on November 15, 2018. The report looks at large payments, such as personal payments to individuals for overseas payments and other low payments.

The project brings together commercial bank participants in the cross-border payment process to discuss three main topics: the current pain points for cross-border payment settlement, the potential for cross-border payment settlement in the future, and examples of cross-border payment settlement in the industry. The report analyzes the challenges faced by the three main players, central banks, commercial banks and end users, in cross-border payment settlement, and analyzes the underlying causes and evaluates the existing innovations proposed to address these challenges. More importantly, the report proposes five possible future cross-border payment settlement models, and analyzes its possible impacts, exploring the pain points from both technical and policy aspects.

The five models are derived from the current two models of cross-border payment settlement and three potential future models that use central infrastructure to drive change for cross-border payment settlement.

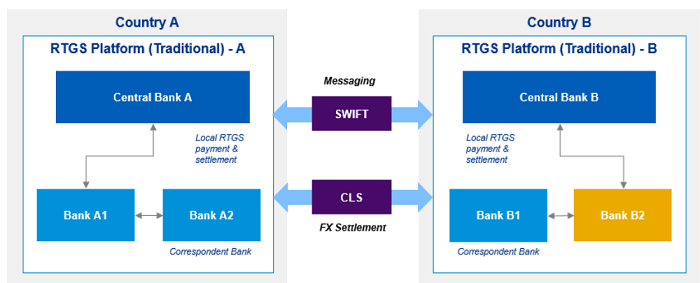

Model 1 is a collection of current industry innovations based on innovations in existing payment and settlement systems and infrastructure across jurisdictions and across jurisdictions. Such as increased business hours, enhanced payment status notifications, adoption of universal messaging standards (ISO20022), payment tracking and status visibility (SWIFT gpi), initiatives to connect domestic payment infrastructure, establishment of the International Payments Framework Association (IPFA) and SWIFT Payment by amount (HVPS +), etc.

Figure 7: Schematic diagram of cross-border payment settlement model 1

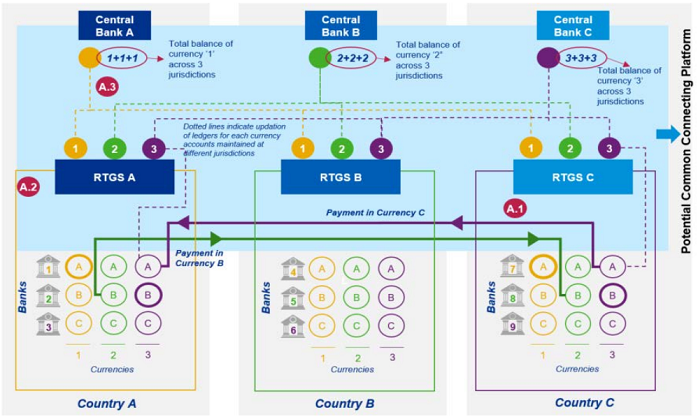

Model 2 expands the role of national RTGS operators who act as “super counterparties” to resolve cross-border payments rather than relying on intermediate banks as proxy banks. The central bank allows RTGS operators in different jurisdictions to open accounts in their (central bank) books in the currency of a given RTGS operator. This allows RTGS operators to effectively hold multi-currency clearing accounts for their member banks, and various RTGS operators may link through a common shared platform.

Figure 8: Schematic diagram of cross-border payment settlement model 2

Models 3a, 3b, and 3c are based on cross-border payment settlement between banks using W-CBDC (Wholesale – Central Bank Digital Currency), depending on the holding and trading range of W-CBDC. There are a few differences between the three modes.

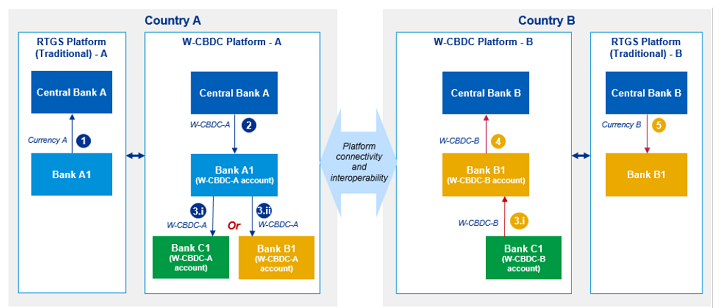

In Model 3a, the issue can only hold and trade W-CBDCs in its own jurisdiction. Each central bank issues its own W-CBDC for the national legal currency. These W-CBDCs are issued to participating banks in their respective jurisdictions. Central Bank A and Central Bank B enter into an agreement to allow participating banks from one jurisdiction to maintain a W-CBDC account (wallet), while the central bank in another jurisdiction is denominated in the currency of that jurisdiction. Other intermediate banks (eg, Bank C1) can also maintain W-CBDC wallets in each jurisdiction. This is similar to the generalized version of the agency banking, which allows the central bank to better control the money supply in its respective jurisdiction.

Figure 9: Schematic diagram of cross-border payment settlement model 3a

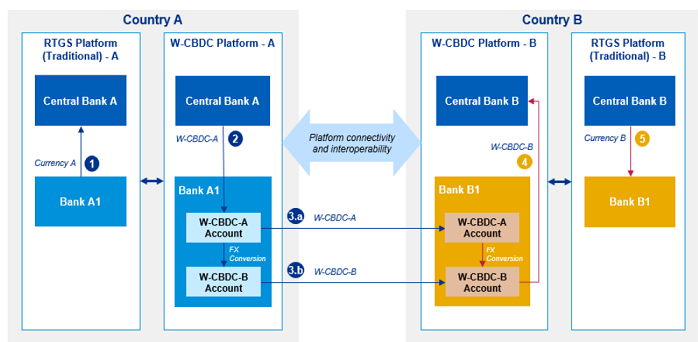

In Model 3b, the issue can hold and trade W-CBDC outside its national jurisdiction. Central Bank A and Central Bank B signed an agreement to allow participating banks in both countries to hold and trade W-CBDCs issued by the two central banks. (ie, the W-CBDC issued by the Central Bank A (W-CBDC-A) may be held by the bank of the B country; the W-CBDC issued by the Central Bank B (W-CBDC-B) may be held by the bank of the country A). Each participating bank maintains a different currency W-CBDC account (or wallet) with its own central bank to allow payment and receipt of different W-CBDCs as part of cross-border transactions with other banks.

Figure 10: Schematic diagram of cross-border payment settlement model 3b

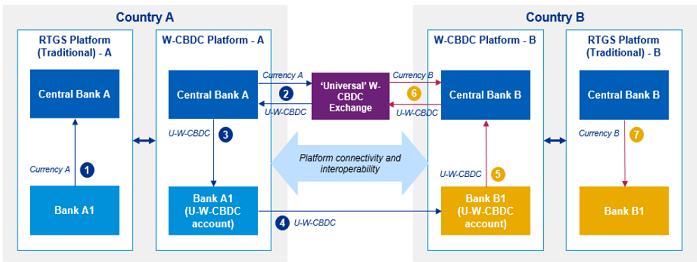

In model 3c, a single generic W-CBDC supported by a series of currencies is issued. Several participating jurisdictions have established a “universal” wholesale CBDC (Universal – Wholesale – CBDC, UW-CBDC) through their respective central banks or globally diverse institutions. The UW-CBDC will be supported by a range of currencies issued by participating central banks. The UW-CBDC will be issued through a specially established exchange to allow the issuance and redemption of such UW-CBDCs. Converting a jurisdictional currency to UW-CBDC will generate an exchange rate between that currency and UW-CBDC. The framework for how to manage needs to be determined jointly by the participating central banks.

Figure 11: Schematic diagram of cross-border payment settlement model 3c

Phase 4 provides a reference for further analysis of these potential future models. In the future, it is also necessary to consider legal and regulatory requirements and risks, the cross-jurisdictional governance structure required under the unified standards, the impact on monetary policy and central bank-led monetary policy, the legislative needs of W-CBDC, and the formulation of eligibility criteria for direct participants.

Summary of this article

The Monetary Authority of Singapore is at the forefront of the World Central Bank's exploration in exploring the application of DLT in clearing and settlement, especially in landing trials. In the next phase five and phase six, MAS will also explore the RMO operation mode and the DvP implementation of cross-border payment settlement, thus achieving the closed loop of the national digital currency in the field of large-value payment settlement. Project Ubin provides important experimental references for the issuance, clearing, settlement and other research of national digital currency, and proposes many issues to be resolved about the financial system impact, policy impact and social impact of the national digital currency, such as national digital currency pair currency transmission. The impact of the policy, etc. From project trials to global system implementations, Project Ubin leaves a huge research space for future exploration of national digital currencies.

The Blockchain Research Center of the Institute of Financial Science and Technology of Tsinghua University will continue to track and study the progress of central bank CBDC.

Source: Weiyang.com

Author: Financial Technology Research Center, Tsinghua University Block Chaining

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The gospel of Bitcoin! The natural gas produced by oil exploitation can be used for mining. This oil field is a step forward.

- How to create an Ethereum address with a bitcoin private key

- Dr. Beijing Normal University: Penetrating stable currency from the perspective of monetary economics

- QKL123 Blockchain Leaderboard (March 2019)

- Switzerland: Existing legislation will be adjusted to accommodate cryptocurrency regulation

- The Uncle Block of the Ethereum Reward Mechanism (on)

- On behalf of the hot discussion, the blockchain policy in each region is more powerful – the blockchain policy of all regions of the country is summarized (below)