QKL123 market analysis | Halving and destruction, a bull market catalyst? (0303)

Summary: Since yesterday, the broader market has rebounded, and the performance of altcoins has been slightly stronger, but the inflow of OTC funds has slowed down, mainly in short-term fluctuations. Compared with the K line of mainstream platform coins, it can be found that the positive impact of the destruction on the project itself is more obvious in the context of the market's rise, and the greater the intensity of the destruction, the stronger the market's short-term response. In addition, in order to cope with the economic downturn, countries will take stimulus measures, which is good for the capital market in the short term, and it is also true for Bitcoin.

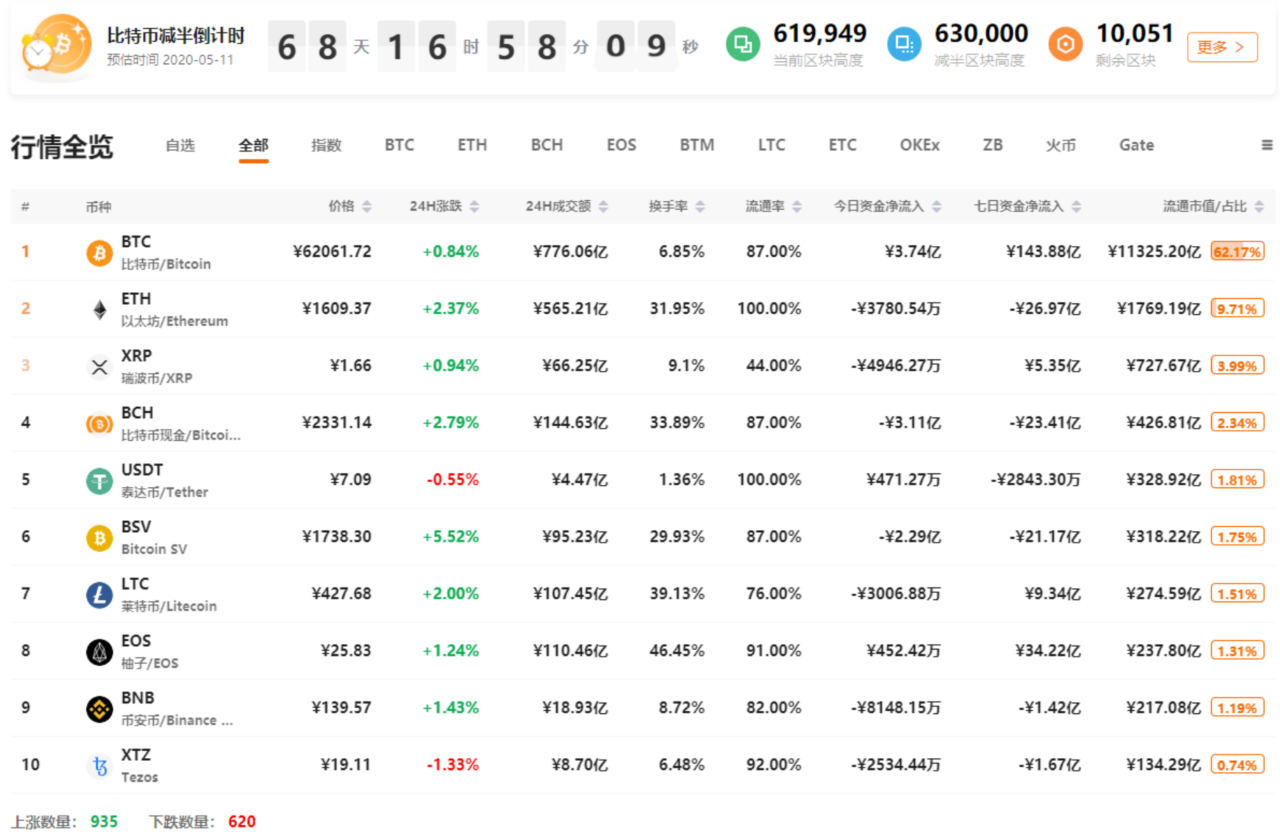

At 16:30 on March 03, 2020, the 8BTCCI broad market index was reported at 13256.50 points, with a 24-hour rise or fall of + 2.19%, reflecting an upward trend in the broad market; total turnover was 1,247.116 billion yuan, a 24-hour change of + 35.20%, and market activity Significantly increased. The Bitcoin strength index is reported at 85.63 points, with a 24-hour rise or fall of -0.99%. The relative performance of altcoin in the entire market has become stronger; the Alternative sentiment index is 38 (previous value 38), and the market sentiment is expressed as fear; ChaiNext USDT field The external discount premium index was reported at 101.25, with a 24-hour price fluctuation of -0.96%, and the strength of short-term over-the-counter fund inflows weakened.

Analyst perspective:

- How does the most secret medical data flow through the blockchain?

- Breaking through the impossible triangle of the blockchain (5): Lightning Network, off-chain technology, and their limitations

- The halving market disappeared and the risk aversion property became empty, and there was only one Bitcoin price support

Halving and destroying both bring supply-side benefits, but they do not necessarily lead to price increases, because favorable backgrounds are also important.

Compared with the recently paid attention to platform currencies, we can find that OKB and HT, etc., have ushered in a sharp rise after the announcement of a large number of platform currency destruction: On February 10, OKB rose 36% on the day, while HT and BNB rose 19% respectively. And 8%; on February 29, HT rose continuously for three days before and after, the total increase reached 20%, while the performance of the platform coin leader BNB was flat, rising only 3%. It can be seen that the platform currency is mainly affected by its own news, and the greater the destruction, the more amazing the increase.

However, when BNB was destroyed in large quantities, it did not catch up with the continuous rise of the market like OKB and HT this time, but when the entire market continued to fall. On July 12, 2019, Binance announced that it would abandon 80 million BNB team shares. It increased by more than 10% on the same day. OKB and HT also had a significant linkage. However, with the rapid decline of the broader market, the positive trend did not reverse the decline.

The favorable release of the platform currency itself is obviously different when the market continues to fall or continue to rise. The continued rise of the broader market has more obvious and stronger effects on the favorable release of platform currency, which is likely to be the role of the market's continued rise in expectations.

In addition, yesterday's news, risk assets such as U.S. stocks and A-shares have rebounded sharply. This is a favorable release of the Fed's interest rate cut expectations and the domestic 25 trillion infrastructure plan in the context of the global economic downturn. And once the global economic downside risks further increase, countries will take more fiscal or monetary stimulus measures, which is a good thing for Bitcoin, especially after halving Bitcoin.

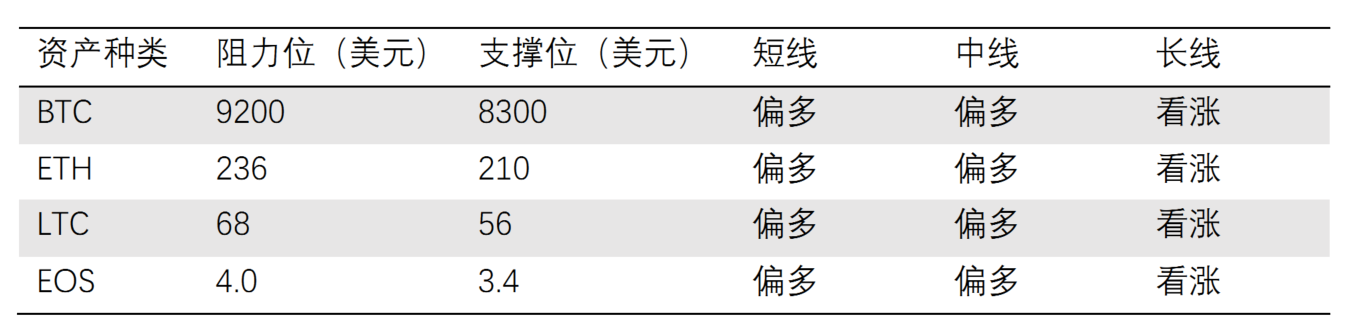

First, the spot BTC market

Yesterday, BTC rebounded rapidly from around $ 8,400. The short power was almost consumed, but the bulls were also slightly weak, and did not stand above $ 9,000. Currently returning to the 200-day moving average, or it will repeatedly confirm the trend, it is expected to go up a wave after it is determined.

Second, the spot ETH market

Relative to BTC, ETH has a stronger trend, but it is also linked to the downward trend, and the amount of shocks can shrink. It will continue to wait for Bitcoin to stabilize its 200-day moving average.

Third, the spot LTC market

The amount of LTC upwards is average, long and short are deadlocked, and short-term linkage is mainly based on Bitcoin.

Fourth, the spot EOS market

Affected by the large decline in the previous period, EOS rebounded strongly, and the signs of multiple counterattacks in the short term were more obvious, which played a certain supporting role in the stabilization of the broader market.

Five, analyst strategy

1. Long line (1-3 years)

The long-term trend of BTC has improved, and it is expected to usher in the crazy bull market in the next one to two years. Smart contract platform leader ETH, altcoin leader LTC, DPoS leader EOS can be configured at dips.

2. Midline (January to March)

BTC is hovering at the 200-day moving average, which is expected to increase by halving. There is still a certain amount of upside. Those who do not have heavy positions will increase their positions on dips.

3. Short-term (1-3 days)

The shock stabilized and the small position was ambush low.

Appendix: Interpretation of Indicators

1. 8BTCCI broad market index

The 8BTCCI broad market index is composed of the most representative tokens with large scale and good liquidity in the existing global market of the blockchain to comprehensively reflect the price performance of the entire blockchain token market.

2.Bitcoin Strength Index

The Bitcoin Strength Index (BTCX) reflects the exchange rate of Bitcoin in the entire Token market, and then reflects the strength of Bitcoin in the market. The larger the BTCX index, the stronger the performance of Bitcoin in the Token market.

3.Alternative mood index

The Fear & Greed Index reflects changes in market sentiment. 0 means "extremely fearful" and 100 means "extremely greedy." The components of this indicator include: volatility (25%), transaction volume (25%), social media (15%), online questionnaire (15%), market share (10%), and trend (10%).

4.USDT OTC Premium Index

The ChaiNext USDT OTC INDEX index is obtained by dividing the USDT / CNY OTC price by the offshore RMB exchange rate and multiplying by 100. When the index is 100, it means the USDT parity, when the index is greater than 100, it means the USDT premium, and when it is less than 100, it means the USDT discount.

5.Net Funds Inflow (Out)

This indicator reflects the inflow and outflow of funds in the secondary market. By calculating the difference between the inflow and outflow of funds from global trading platforms (excluding false transactions), a positive value indicates a net inflow of funds, and a negative value indicates a net outflow of funds. Among them, the turnover is counted as inflow capital when rising, and the turnover is counted as outflow capital when falling.

6.BTC-coin hoarding indicator

The coin hoarding indicator was created by Weibo user ahr999 to assist bitcoin scheduled investment users to make investment decisions in conjunction with the opportunity selection strategy. This indicator consists of the product of two parts. The former is the ratio of Bitcoin price to the 200-day fixed investment cost of Bitcoin; the latter is the ratio of Bitcoin price to Bitcoin fitting price. In general, when the indicator is less than 0.45, it is more suitable to increase the investment amount (bottom-sweeping), and the time interval accounts for about 21%; when the indicator is between 0.45 and 1.2, the fixed investment strategy is suitable, and the time interval accounts for about 39. %.

Note: Crypto assets are high-risk assets. This article is for decision-making reference only and does not constitute investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to understand ETH2.0: start with understanding terminology

- Will Bitcoin become a value storage tool, and how much global demand is there for Bitcoin in the future?

- Featured | Bitcoin Surviving Across Cyberspace, Material World, and Finspace

- Research Report | The full-featured Polkadot mainnet is expected to be online in June, with a DOT target price of $ 135

- Zhejiang Provincial Department of Finance took the lead in donating electronic bills on the blockchain, and Ant Financial provided technical services

- Miners continue to invest funds, Bitcoin's entire network computing power hits a record high

- Report: 26 crypto exchanges and escrow providers such as Coinbase have been targeted by new Trojan viruses