Announcement on the implementation of blockchain electronic ordinary invoices by the State Administration of Taxation

Source: Beijing Municipal Taxation Bureau

On March 2, the Beijing Municipal Taxation Bureau of the State Administration of Taxation issued an announcement on the implementation of blockchain electronic ordinary invoices. The full text is as follows:

In order to reduce the taxpayer's operating costs, save social resources, facilitate consumers to save and use invoices, and create a healthy and fair tax environment, according to the "People's Republic of China Invoice Management Measures" (Order No. 6 of the Ministry of Finance, according to Order No. 587 of the State Council of the People's Republic of China) No.), “Implementation Rules for the Administration of Invoices of the People ’s Republic of China” (Promulgated by Order No. 25 of the State Administration of Taxation, and amended in accordance with No. 37 of the State Administration of Taxation), “Administrative Measures for Online Invoices” (Order No. 30 of the State Administration of Taxation) According to other regulations, the State Administration of Taxation, Beijing Municipal Taxation Bureau decided to launch a pilot application of blockchain electronic ordinary invoices (hereinafter referred to as "electronic ordinary invoices") in Beijing. The related matters are announced as follows:

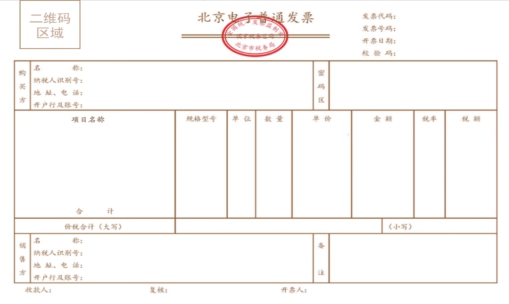

I. The scope of invoicing of electronic ordinary invoices (see attachment for sample samples) is mainly in addition to the scope of issuance of VAT special invoices, ordinary VAT invoices (including unified invoices for motor vehicle sales and unified invoices for used vehicle sales), and electronic ordinary invoices for VAT. Taxes on goods, services, services.

- Bitcoin Secret History: Who Was The First Time To Contact Satoshi Nakamoto?

- Uncovering the secrets of the Coinbase gangster in the cryptocurrency world

- After the epidemic, blockchain will usher in great development. How to find a breakthrough? Babbitt Industry Welcome Class

2. The invoice code is 12 digits, and the coding rules are: the first digit 1 represents taxation, the second to fifth digits represent the Beijing Municipality Code 1100, and the sixth to seventh digits represent the year (for example, 2020 is represented by 20), and the eighth Bit 0 represents the general industry category, 9th place represents the exclusive category of Beijing Electronic Ordinary Invoice, 10th place represents the batch, 11th place represents Lianci, and 12th place represents the unlimited amount version.

3. The invoice number is 8 digits, and is automatically prepared according to the invoicing order of the city's electronic ordinary invoice.

4. If the issuer and receiver of an electronic ordinary invoice require a paper invoice, they can print the formatted document of the electronic ordinary invoice by themselves. Its legal effect, basic purpose, and basic use regulations are the same as ordinary invoices produced by the tax authority.

5. Consumers should take the initiative to check electronic ordinary invoices. Electronic ordinary invoices can be found on the website of the Beijing Municipal Taxation Bureau of the State Administration of Taxation (http://beijing.chinatax.gov.cn) or the authorized Ruihong website (http: // www. .e-inv.cn) Query and verify the invoice information. The information recorded in the electronic ordinary invoice should be consistent with the results of querying the invoice information on the website of the State Administration of Taxation, Beijing Taxation Bureau or the authorized Ruihong website. Consumers have the right to refuse electronic ordinary invoices whose inspection results are inconsistent, and can call the taxation service hotline 12366 of the Beijing Municipal Taxation Bureau of the State Administration of Taxation to report.

6. The Beijing Municipal Taxation Bureau of the State Administration of Taxation is responsible for the interpretation of this announcement.

7. This announcement will be implemented as of the date of its release.

Special announcement.

annex

Electronic ordinary invoice ticket sample

The ticket size (displayed as a 100% ratio) is 210 * 140mm, the size is fixed, and it is longitudinally divided into five parts: the ticket head, the buyer, the taxable details and the total, the seller and the ticket stub. When printing, all content in the layout can be enlarged or reduced year-on-year. When printing is reduced, ensure that the contents of the invoice page are clear and readable.

Interpretation of the Policy on the Announcement of the State Administration of Taxation, Beijing Municipal Taxation Bureau on Issues Related to the Implementation of Blockchain Electronic Ordinary Invoices

I. Background of the announcement

Since October 24, 2019, General Secretary Xi Jinping presided over the 18th collective study on the development status and trends of blockchain technology by the Political Bureau of the Central Committee of the CPC.Blockchain technology has had very good applications in all walks of life. The State Administration of Taxation, Beijing Municipal Bureau of Taxation, in combination with the State Administration of Taxation's series of work on the "decentralization of service" reforms, has decided to organize a pilot project for the application of electronic ordinary invoices based on blockchain technology when technical and policy conditions are in place.

Second, the role and significance of blockchain electronic ordinary invoices

Blockchain electronic invoices use blockchain distributed ledgers, smart contracts, consensus mechanisms, encryption algorithms and other technologies to ensure the issuance, storage, transmission, anti-counterfeiting and information security of electronic invoices. It has the characteristics of complete traceability of the entire process, and information cannot be tampered with. It uses a private chain or alliance chain to build a new ecosystem of electronic invoices in the “Trinity” of the tax department, the issuer, and the receiver. The issuer realizes on-chain invoice application, issuance, inspection, and accounting; the acceptor implements on-chain storage, circulation, and reimbursement; the tax bureau's entire process supervision, and realize paperless intelligent tax management. The taxpayer does not need to go through the tax reporting process or purchase any special hardware equipment and professional equipment, and only needs to use a mobile phone or a computer connected to the Internet to issue the invoice. Technology updates, higher efficiency and lower costs.

Third, the pilot scope of blockchain electronic ordinary invoices

The State Administration of Taxation, Beijing Municipal Bureau of Taxation will gradually carry out the pilot promotion of blockchain electronic ordinary invoices throughout the city. At present, some taxpayers' parking general invoices and attractions park tickets have been selected for promotion, and taxpayers from other industries will be included in the pilot scope of blockchain electronic ordinary invoices in due course.

Fourth, the blockchain electronic ordinary invoice activation time

The Beijing Blockchain Electronic Ordinary Invoice will be activated from the date of announcement.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- "Palace Fight" triggered by an acquisition: Steemit team declares war on the community

- Inventory HyperPlotter, Lava's efficient P disk

- BIS: No central bank digital currency focused on cross-border payments

- PwC analysts: 98% of Bitcoin miners have never generated blocks

- Overview of the global blockchain policy in February: most of the domestic efforts to help prevent and control the epidemic, Guangdong and Shandong are supporting

- New blockchain financial development accelerates: Hong Kong plans to oversee virtual currency service providers, Deutsche Börse launches reverse Bitcoin ETP

- Short market exhausted, BTC rebounded to $ 8,800