New blockchain financial development accelerates: Hong Kong plans to oversee virtual currency service providers, Deutsche Börse launches reverse Bitcoin ETP

Author: Song Jiaji, Renhe Yi

Source: Guosheng Blockchain Research

Editor's Note: The original title was "Hong Kong intends to supervise virtual currency service providers, Deutsche Börse launches reverse Bitcoin ETP"

Summary

- Short market exhausted, BTC rebounded to $ 8,800

- "Black Horse" Exchange FTX Receives Liquid Value to Participate in Round B Investment, The Next Crypto Unicorn Is Coming Soon

- A picture tells you what the central bank's digital currency (CBDC) can meet consumer needs

Event: Hong Kong plans to include virtual currency service providers and other regulatory frameworks. Boerse Stuttgart, Germany's second-largest stock exchange, launches a reverse Bitcoin ETP, which accelerates the development of new blockchain financial services.

Hong Kong plans to include virtual currency service providers and other regulatory frameworks to promote the healthy development of the industry. In response to improving supervision, Hong Kong Financial Secretary Chen Maobo stated in a new Budget that he would further strengthen Hong Kong ’s anti-money laundering and terrorist financing system, including considering the inclusion of virtual currency service providers and the jewelry, jade and precious metals industries. Within the regulatory framework; a public consultation on specific recommendations is planned within this year. Chen Maobo said that the International Supervisory Authority Financial Action Task Force completed a comprehensive assessment of Hong Kong's anti-money laundering and terrorist financing system in the middle of last year. Hong Kong has become the first member region in the Asia-Pacific region to successfully pass the organizational audit. The government will refer to the recommendations of the assessment report. Earlier in November 2019, the Hong Kong Securities Regulatory Commission issued the "Position Letter · Regulatory Virtual Asset Trading Platform" to clarify the licensing conditions for regulatory standards and regulate industry development.

Boerse Stuttgart, Germany's second largest stock exchange, launches a reverse Bitcoin ETP. A new exchange-traded product (ETP) that tracks the reverse value of Bitcoin-SBTC is now available for trading on Boerse Stuttgart, Germany's second largest stock exchange. The exchange is also the ninth largest exchange in Europe. The product is called 21Shares Short Bitcoin ETP (SBTC) and allows traders to short BTC. For example, a trader buying a $ 100 SBTC will have a short position of $ 100. Assuming a 10% drop in the price of Bitcoin, the SBTC ETP will receive a 10% positive return (minus the cost). SBTC charges a 2.5% management fee each year. As early as November 2018, the Swiss authorities approved a license obtained by the Swiss-based startup Amun AG to provide new cryptocurrency exchange-traded products (ETP) and will begin trading on November 21, 2018 local time At present, seven major stock exchanges in Switzerland now list seven cryptocurrency exchange-traded products (ETPs).

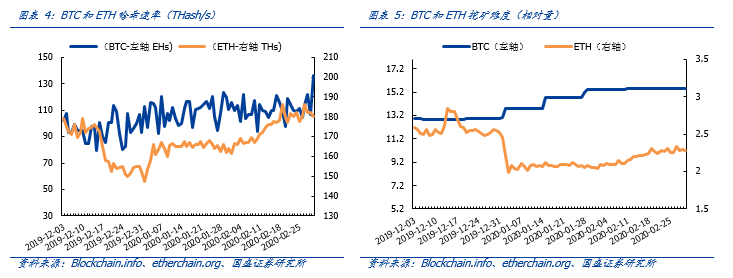

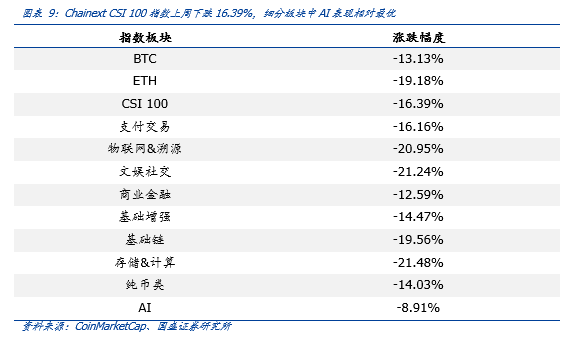

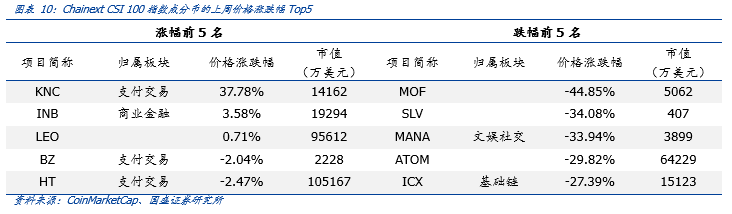

Last week's market review: Chainext CSI 100 fell 16.39%, the AI performance in the segment is the best. From the perspective of subdivisions, the performance of payment transactions, commercial finance, basic enhancements, pure currency and AI were all better than the average level of Chainext CSI 100, which were -16.16%, -12.59%, -14.47%, -14.03%,- 8.91%; IoT & traceability, entertainment social, basic chain and storage & computing performance were all lower than the Chainext CSI 100 average level, which were -20.95%, -21.24%, -19.56%, -21.48%.

Risk Warning: Uncertainty in regulatory policies, and the development of blockchain infrastructure is not up to expectations.

1. Hong Kong intends to supervise virtual currency service providers, Deutsche Börse launches reverse Bitcoin ETP

Event: Hong Kong plans to include virtual currency service providers and other regulatory frameworks. Boerse Stuttgart, Germany's second-largest stock exchange, launches a reverse Bitcoin ETP, which accelerates the development of new blockchain financial services. Hong Kong plans to include virtual currency service providers and other regulatory frameworks to promote the healthy development of the industry. In response to improving supervision, Hong Kong Financial Secretary Chen Maobo stated in a new Budget that he would further strengthen Hong Kong ’s anti-money laundering and terrorist financing system, including considering the inclusion of virtual currency service providers and the jewelry, jade and precious metals industries. Within the regulatory framework; a public consultation on specific recommendations is planned within this year. Chen Maobo said that the International Supervisory Authority Financial Action Task Force completed a comprehensive assessment of Hong Kong's anti-money laundering and terrorist financing system in the middle of last year. Hong Kong has become the first member region in the Asia-Pacific region to successfully pass the organizational audit. The government will refer to the recommendations of the assessment report. Earlier in November 2019, the Hong Kong Securities Regulatory Commission issued the "Position Letter · Regulatory Virtual Asset Trading Platform" to clarify the licensing conditions for regulatory standards and regulate industry development. The third part is the regulatory framework of the virtual asset trading platform, which mentions the licensing conditions of the regulatory standards, clarifies the conceptual regulatory framework of the virtual asset trading platform, and takes an important step in the supervision of virtual asset trading. The consideration of including virtual currency service providers in the regulatory framework will further promote the healthy development of blockchain and virtual asset trading and service markets.

Boerse Stuttgart, Germany's second largest stock exchange, launches a reverse Bitcoin ETP. A new exchange-traded product (ETP) that tracks the reverse value of Bitcoin-SBTC is now available for trading on Boerse Stuttgart, Germany's second-largest stock exchange. The exchange is also the ninth largest exchange in Europe. The product is called 21Shares Short Bitcoin ETP (SBTC) and allows traders to short BTC. For example, a trader buying a $ 100 SBTC will have a short position of $ 100. Assuming a 10% drop in the price of Bitcoin, the SBTC ETP will receive a 10% positive return (minus the cost). SBTC charges a 2.5% management fee each year. As early as November 2018, the Swiss authorities approved a license obtained by the Swiss-based startup Amun AG to provide new cryptocurrency exchange-traded products (ETP) and will begin trading on November 21, 2018 local time . An exchange-traded product (ETP) is a derivative-priced securities that is traded on a domestic stock exchange within a day. ETP is priced to derive its value from other investment vehicles, such as commodities, currencies, stock prices or interest rates. Swiss financial regulator Finma believes that it is important to distinguish between ETP and ETF, because ETP is not subject to the Collective Investment Plan Act (Cisa) and therefore is not subject to Finma's supervision. Generally, ETPs are based on stocks, commodities or indices and can also actively manage funds. ETP includes exchange-traded funds (ETF), exchange-traded instruments (ETV), exchange-traded notes (ETN), and certificates. Like ETFs, they can be traded in a multi-market trading sector, but from a legal perspective, they are not funds. Currently, Switzerland's major stock exchanges now list seven cryptocurrency exchange-traded products (ETPs). They allow investors to invest in individual cryptocurrencies or invest in a portfolio of top cryptocurrencies. Four ETPs track the price of a single cryptocurrency.

2. News from governments of various countries: The Seoul government of South Korea will launch a "blockchain voting system"

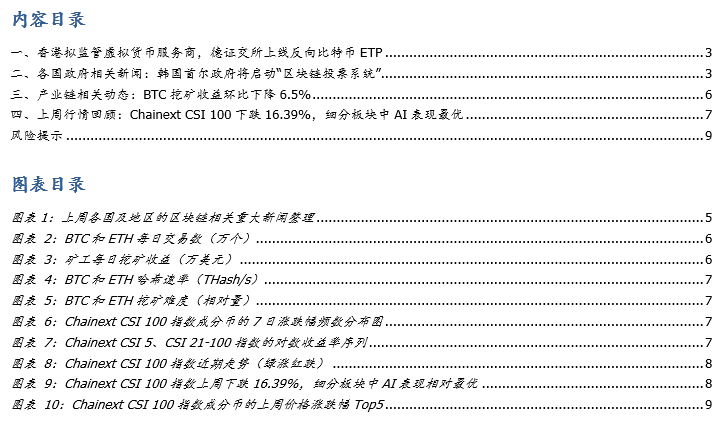

China: Jinan City Public Security Bureau, Jinan City Health and Health Committee and other departments will join Inspur to jointly develop and launch the "Identity Health Code". The "identity health code" is backed by a powerful service platform. The service platform is based on Inspur Blockchain (IBS) and uses digital identity contracts and data certification services to effectively guarantee the security and authorized use of the "identity health code" and personnel data. , Support the application side in the community, office buildings, traffic checkpoints, railway stations and other scenarios of non-contact security code, mobile phone code access services. The Beijing Municipal Financial Supervision and Administration Bureau issued the Opinions on Accelerating the Optimization of the Financial Credit Business Environment. These include actively promoting the electronic application and processing of financial services, establishing a blockchain-based enterprise electronic identity authentication information system, minimizing credit application materials, promoting mutual recognition of customer application materials, and avoiding "duplicate certification". United States: The U.S. Immigration and Customs Enforcement (ICE) recently disclosed that the Cryptocurrency Intelligence Program (CIP) is deployed in every Homeland Security Investigation (HSI) case involving encryption. The U.S. House of Representatives Small Business Committee will hold a hearing on "The Cornerstone of Change: The Benefits of Blockchain Technology for Small Businesses" at 4:30 pm UTC on March 4 (0:30 pm Beijing time) How some startups are using blockchain technology to increase productivity and security. The U.S. Department of Commerce's Bureau of Economic Analysis (BEA) has announced a proposed amendment to the regulation, which proposes to modify the mandatory survey form BE-180 benchmark survey rules issued by BEA every five years, requiring all cross-border cryptocurrencies to be conducted in fiscal 2019 The transaction was reported by a US financial services company. The proposal will enable statisticians from the Ministry of Commerce to more accurately see the prevalence of foreign cryptocurrency activity. The survey will target brokers, private equity funds, custody services, financial advisors, and many other practitioners in BEA's broadly defined "financial services." BEA expects 7,000 respondents to respond to the survey.

South Korea: February 25th. The Seoul government plans to launch a "blockchain voting system" on March 1. The system will allow citizens of Seoul to submit to the government feasibility suggestions or new questions about existing policies. The blockchain technology used in the voting system will be mainly used to verify the identity of everyone on the network and prevent repeated voting.

Third, the industry chain related developments: BTC mining revenue fell 6.5% MoM

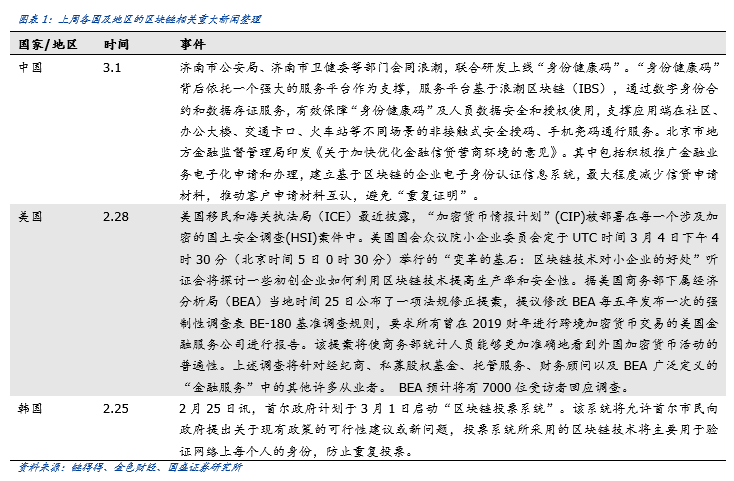

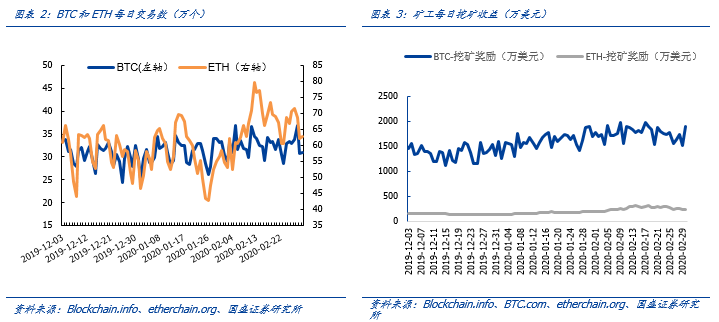

(The following source website data is updated to March 1.) Last week, BTC added 2.32 million transactions, an increase of 2.9% from the previous month; ETH added 4.72 million transactions, an increase of 0.4% from the previous month.

Last week, the average daily income of BTC miners was US $ 17 million, a decrease of 6.5% from the previous month; the average daily income of ETH miners was US $ 2.55 million, a decrease of 13.0% from the previous month.

Fourth, the market review last week: Chainext CSI 100 fell 16.39%, the best performance of AI in the segment

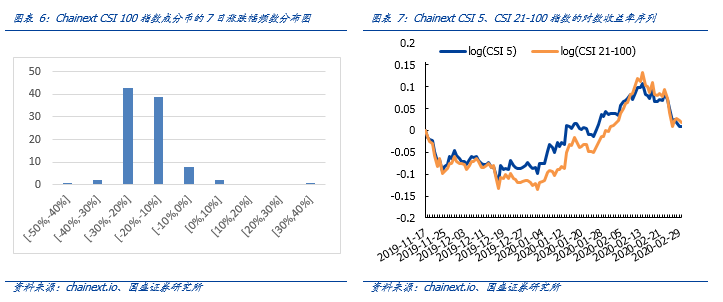

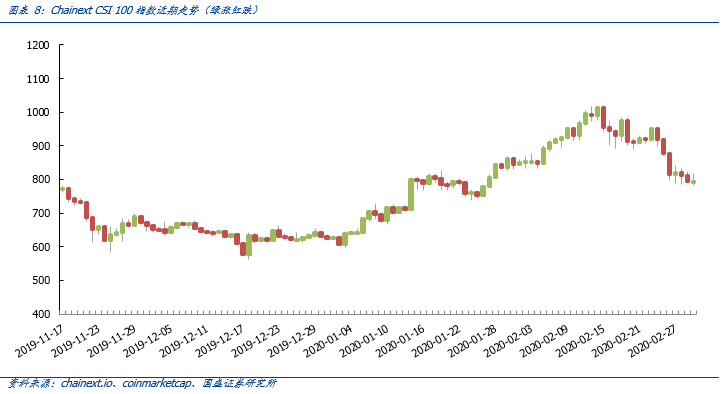

We introduced the professional index product of the token market——Chainext CSI series index, where the CSI 100 index [1] represents the overall market trend; the CSI 5 index [2] represents the market's large-cap currency trend; CSI 21-100 index [3] On behalf of the market in the small cap. The market continued to adjust this week. As of last Sunday (March 1), the Chainext CSI 100 index was 795.27, a decrease of 16.39% from last week, and the total 24-hour trading volume on Sunday was US $ 79.316 billion; of which, the global average price of BTC was US $ 856.45, which was a month-on-month decrease 13.13%; the average global price of ETH is US $ 218.97, a month-on-month decrease of 19.18%

risk warning

Regulatory policy uncertainty. At present, the blockchain is in the early stage of development. There is a certain degree of uncertainty in the global countries' supervision of blockchain technology, project financing and tokens, so there is uncertainty in the development of industry company projects. The development of blockchain infrastructure failed to meet expectations. Blockchain is the core technology for solving supply chain finance and digital identity. At present, the blockchain infrastructure cannot support high-performance network deployment. The degree of decentralization and security will have a certain restriction on high performance. The blockchain infrastructure exists The risk of developing less than expected.

This article is an excerpt from the report "Guo Sheng Blockchain | Hong Kong intends to supervise virtual currency service providers, and the German Stock Exchange to launch reverse Bitcoin ETP" released by Guo Sheng Securities Research Institute on March 2, 2020. For details, please refer to related report.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Blockchain Electronic Invoice Extreme Edition is launched on WeChat.The fastest time to open the invoice is 30 minutes.

- British insurance giant Lloyd's to provide insurance services for cryptocurrency holders

- Blockchain Industry Development Monthly Report: Blockchain Financing Market Meets Cold Again in February, Fiat Digital Currency Track Is Hot

- Observation | OKEx triggers "destruction war", why is absolute deflation worth learning in the currency circle?

- Industry Blockchain Weekly 丨 Baidu's financial report mentions blockchain again

- Research | How Does Blockchain Technology Promote the Transformation of Charities?

- deal! Germany officially classifies digital assets as financial instruments and does not have monetary legal status